Released today by CEA:

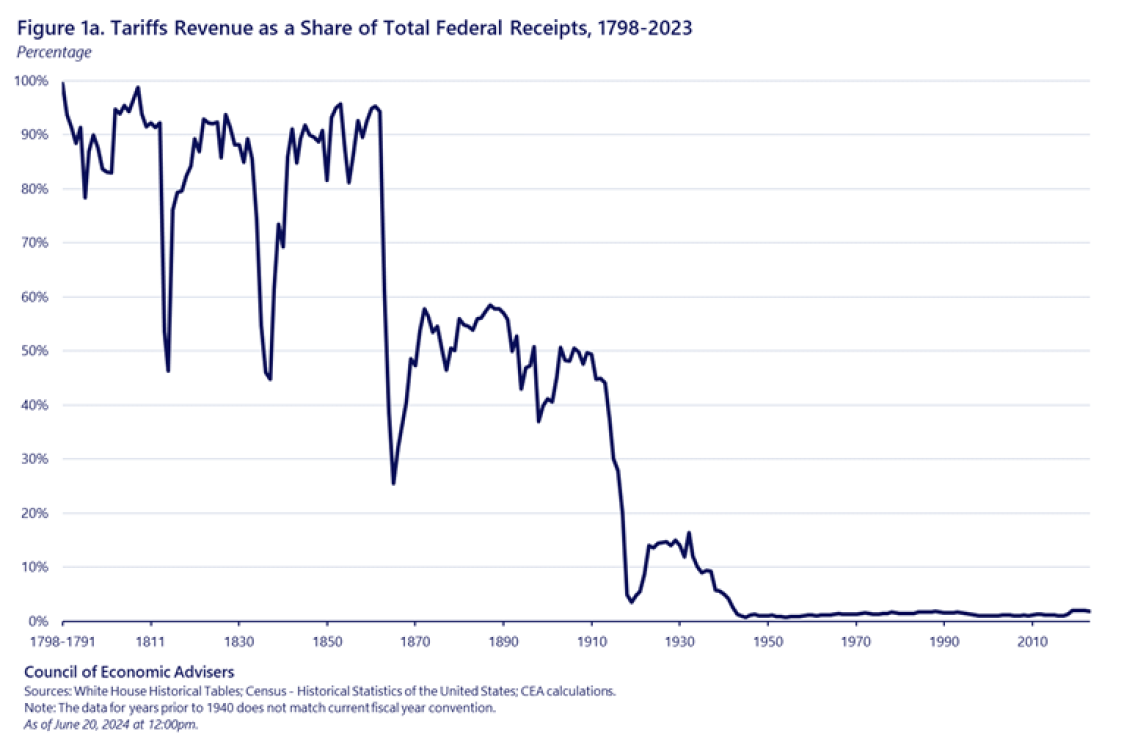

Well first a picture depicting plausibility:

Onto the conclusion:

Strategically targeted tariffs are an important tool to protect economic and international interests of the U.S. However, the potential for a broad tariff to serve as a major revenue raiser in a modern, global economy is limited. Moreover, elevating the reliance of the Federal government on tariff revenue would likely exacerbate long-running trends in income inequality by shifting more of the burden of taxation onto lower-income households. It is also highly like to generate large, negative distortions to the macroeconomy.

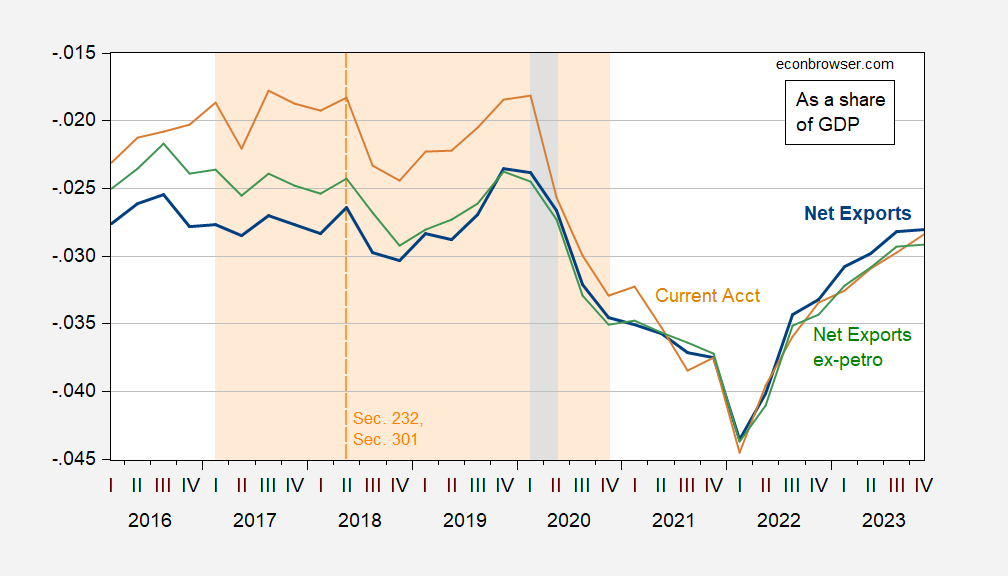

And if you thought tariffs didn’t do anything for the trade deficit back under Trump, wait until a 10% general tariff goes into effect…

Figure 1: Net exports to GDP (bold blue), net exports ex-petroleum (green), and current account (tan), all as share of GDP. Trump administration shaded orange, dashed line at start of Section 232 and Section 301 actions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

“Well first a picture depicting plausibility”

A side note. Federal spending as a share of GDP was quite low before WWII but has been a lot higher since. Tariffs were not even enough to cover spending when Alexander Hamilton was Treas. Sec. but team Trump thinks they are now? Yea – MAGA morons everywhere.

‘Tariffs remain an important and targeted tool, of course, to protect against unfair trade practices. But, as we show in this issue brief, to use them as a revenue source that would significantly or even wholly replace the income tax would increase inflation and invite deep economic distortions that benefit the wealthy and harm low- and middle-income Americans.’

But wait – sticking it to low and middle income Americans is one of the main goals of the Heritage Foundation. MAGA.

“A recent study found that a broad implementation of tariffs would raise the inflation rate by about ¾ percentage point relative to the current baseline”

Tell this to the Faux News crowd. Of course these MAGA morons trust Kudlow the Klown and not Mark Zandi. Yea Kudlow claimed tariffs would be entirely paid by either the Chinese or by companies agreeing to lower their profit margins!

Dude – your ancient version of ChatGPT is broken. Learn to write coherently or just go away.

Analysis by declamation. How enlightening.

Care to lay out the mechanism behind each of your predictions?

I stopped paying attention to his weird rants a while back. Keep up the good work. Maybe he will learn to write a coherent point or better still maybe he will just go away.

Please stop. Your rants are embarrassing your own mother.

Wrong again.

Growth and demographic realities? Let’s consider real GDP per capita – thereby accounting for growth and demographic realities – for a number of G7 countries:

https://fred.stlouisfed.org/graph/?g=1q9oI

Looks like the U.S grew along with the rest of the pack from 2000 until 2018. When the U.S stands out is after the Covid recession – Thanks, Joe. The “exorbitant privilege” of the dollar’s dominant role existed in the 2000-2018 period, just as it does after the Covid recession. In fact, the dollar’s share of official reserves has shrunk in recent years. Looks like your story doesn’t fit the data. You just made it up.

Hand-to-hand? What country do you live in?

I’m willing to grant that Trump doesn’t mean to replace all of federal tax revenue with tariff revenue. But just for giggles, let’s see how that would work out:

https://fred.stlouisfed.org/graph/?g=1q6yh

There’s a problem with magnitudes: federal revenue is higher than total imports. Anything less than a 100% tariff – and demand elasticity of zero – prevents tariffs from replacing all tax revenue. A 10% tariff would supply far less than 10% of total revenues, elasticities in the real world being what they are.

Note also that imports as a share of GDP are on a downward trajectory since the housing bust. If that trend continues, tariffs will provide a shrinking share of federal revenue, so that taxes – or the deficit – would rise over time, even with a 10%, across-the-board tariff rate.

All it took was rubbing two data series together to realize that financing big tax cuts with tariffs is nonsense. Took three minutes. Somehow, Trump thinks it’s a clever idea. But then, he leads the party of self-financing tax cuts.

Maybe Trump’s idea is to print lots of $2 bills with his mug shot in place of Jefferson’s picture. He will have the Treasury charge $20 a piece to those MAGA morons who would be dumb enough to buy them. I hear Bruce Hall can’t wait to spend his life savings on this scheme!