For nonfinancial corporate business sector, using price per unit real gross value added.

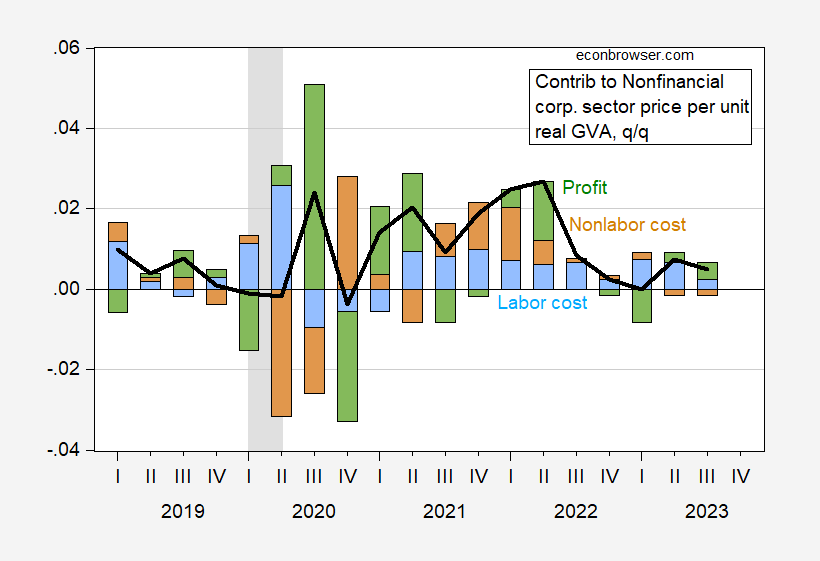

Figure 1: Quarter-on-quarter inflation of price of gross value added (black line), contribution of unit labor costs (blue bar), of non-labor unit costs (brown), and of profits (green). NBER defined recession dates shaded gray. Source: BEA 2023Q3 2nd release, Table 1.15, NBER, and author’s calculations.

Note that profits have added substantially, an accounting sense, to the price level of gross value added, in certain quarters (e.g., 2020Q3, 2021Q1-Q2), and deducted in others (e.g., 2020Q4).

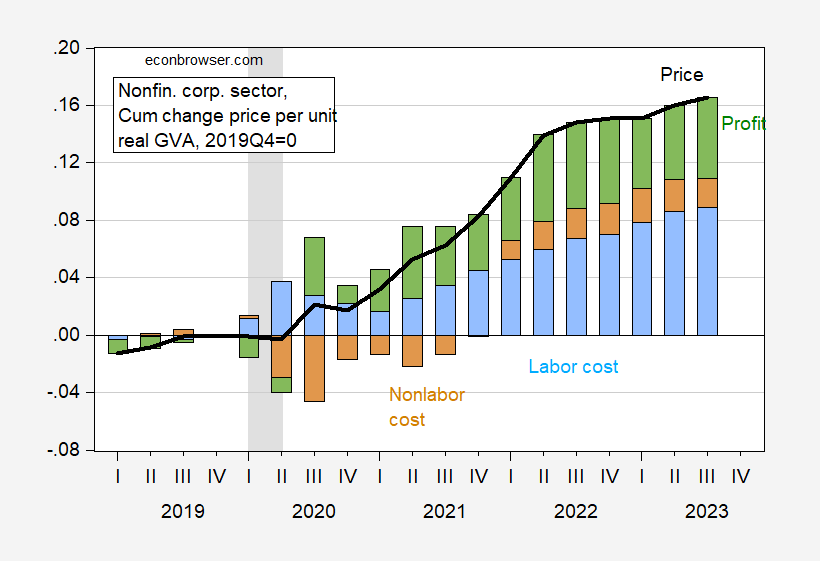

What’s the cumulative impact since the last NBER defined peak? This is shown in Figure 2.

Figure 2: Cumulative increase in price of gross value added (black line), cumulative contribution of unit labor costs (blue bar), of non-labor unit costs (brown), and of profits (green), all relative to 2019Q4. NBER defined recession dates shaded gray. Source: BEA 2023Q3 2nd release, Table 1.15, NBER, and author’s calculations.

Note that labor costs are specifically unit labor costs; hence they incorporate changes in productivity.

The picture shows that while corporate profits are not inconsequential to price level increase, they are actually smaller — in proportion — than labor costs.

Andy Glover noted in this FRBKC analysis that the profit share contribution to the price level is similar to what occurred in previous recoveries, at least through Q1.

If I am reading the charts correctly, they show that profits per unit have barely decreased, if at all, since the surge in 2020-21, despite increased labor costs and higher interest rates. What does the ability to protect high unit profits say about the competitive vs oligopolistic nature of the market?

Furthermore, while labor cost increases are larger than profits’ increases in absolute terms, it is important to factor in the relative importance of labor to profit in overall unit cost.

Since labor makes a large contribution to value added unit costs (.677), it is to be expected that its share of an equally distributed price increase would be proportional to its relative significance. And since profit’s contribution to value added cost is much smaller (.161), its share of a price increase would be expected to be much smaller than labor’s. However, that was not the case. According to the charts, which contain no detailed figures, the unit price increase attributable to labor’s large overall contribution was cumulatively about 9%, while the portion of the price increase attributable to profit was about 6%, disproportionately much higher than its small contribution to total unit cost would warrant if the price increase were equally distributed. https://fred.stlouisfed.org/release/tables?eid=42365&rid=53

This is entirely consistent with the increase in value added profit margins, which rose from about 11% of unit value added in the 2010s to 15% plus during the 2020s.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Finally, did Andy Glover take into account record high profit margins when he noted that profit share contribution to the price level is similar to what occurred in previous recoveries? Since these profit margins are unprecedented, I find it hard to believe that anyone could claim that they are similar to anything happened in the past…unless you think that record profit margins are the norm for recoveries. If so, should we expect that in the next recovery, economists will consider it to be “normal” for value added unit profit margins to reach 20%? 25%?

JohnH: In 2021Q1, profits accounted for 86% of the cumulative price increase. In 2023Q3, profits accounted for 31.2%.

“profits per unit have barely decreased”

They have decreased which undermines your incessant trash. And yet you still chirp away.

You can count on pgl to try and provide cover for outrageous corporate profiteering…his views certainly align well with Trump’s!

Your emotional issues are pathetic. All I do is provide FACTS. I do not cover for anyone or anything unlike Putiin’s pet poodle which would be you. Come on Jonny boy – you are never going be invited to the grown up table so just make up with the other little kiddies in your sand box.

“the unit price increase attributable to labor’s large overall contribution was cumulatively about 9%, while the portion of the price increase attributable to profit was about 6%”

Just wow – you do know how to twist the data. Then again you claimed profits a share of GDI being only 8.5% in 2022 was one of the highest levels ever. Seriously? Your understanding of labor market data is as bad as giving a two your old a gun.

What I said above–“the increase in value added profit margins, which rose from about 11% of unit value added in the 2010s to 15% plus during the 2020s.” pgl lies about as much as Trump!

Whew – little Jonny boy accusing someone else of lying? I’d call you a sad little child but I don’t want to insult children.

“And since profit’s contribution to value added cost is much smaller (.161), its share of a price increase would be expected to be much smaller than labor’s.”

Only someone unfamiliar with the behavior of profits could honestly say such a thing. Profits are far more variable than input costs. I’ve pointed this out to you before. Either you didn’t understand, in which case you have no business pretending to understand, you’re ignoring what I told you because you don’t care about facts. In the latter case, no one should pay any attention to you.

Also not smart:

“If i am reading the charts correctly, they show that profits per unit have barely decreased, if at all, since the surge in 2020-21, despite increased labor costs and higher interest rates.”

Two things. “Barely” is one of those vague, “in the eye of the beholder” kind of words. Any useful discussion (I know, I know – you not here for useful discussion) is going to need something little more falsifiable. And you don’t need to rely on your own ability to make judgement about something not directly represented in a chart when you can just go find the data.

Here’s one way to do it:

https://fred.stlouisfed.org/graph/?g=1c2XO

The rise in profit per unit of value added was unusually large in the first quarter of the current expansion, followed by a fairly large decline. Otherwise, variation in the series has been within historic norms. The series has fallen in five quarters during this expansion.

You see, when discussion facts, one ought to examine the facts. And since FRED makes it so easy, there’s really no excuse to pretend.

If you want to know what Glover did and didn’t account for, read what he wrote. It’s far more likely that Glover has done things right than that you have caught him in an error.

I read what they (more than 1 author) wrote so for reading impaired little Jonny here we go:

Inflation spiked in 2021 alongside a sharp rise in corporate profits, bringing substantial attention to the

role of firms in determining inflation. Previous research has shown that corporate profits contributed

substantially to inflation in the first half of 2021; however, the contribution of profits began to fall in the

second half of 2021, a time when inflation accelerated (Glover, Mustre-del-Río, and von Ende-Becker

2023). This pattern is consistent with anticipatory price-setting, in which firms expect higher costs of

production in the near future and thus raise prices on the goods they produce today. This pattern also appears consistent with previous economic recoveries. The idea that firms are forwardlooking when setting prices is not specific to the post-pandemic recovery. Economic theory predicts that the contribution of corporate profits to inflation should spike whenever costs are temporarily depressed but expected to increase in the near future; as the recovery continues and costs rise, the contribution of profits to inflation should fall. Chart 1 confirms that this pattern appears in U.S. data going back to the late 1940s.

What I have said, what Dr. Chinn has said, what you have said. But you see – little Jonny cannot read. Heck – he didn’t even read the title of this short paper.

https://www.kansascityfed.org/Economic%20Review/documents/9329/EconomicReviewV108N1GloverMustredelRiovonEndeBecker.pdf

How Much Have Record Corporate Profits Contributed to Recent Inflation?

By Andrew Glover, José Mustre-del-Río, and Alice von Ende-Becker

I thought you might be interested in something else they wrote on this topic. Of course we know lttle Jonny boy could not be bothered to read their earlier paper. After all it is 13 pages and Jonny has trouble reading 13 words.

There were 3 authors dumbass not one. Or did you once again fail to even read the heading?

Corporate Profits Contributed a Lot to Inflation in 2021 but Little in 2022—A Pattern Seen in Past Economic Recoveries

By Andrew Glover, José Mustre-del-Río, and Jalen Nichols

“did Andy Glover take into account record high profit margins when he noted that profit share contribution to the price level is similar to what occurred in previous recoveries? Since these profit margins are unprecedented, I find it hard to believe that anyone could claim that they are similar to anything happened in the past”

How dumb can you get? Inflation is not the level of profits but their rate of change. Oh wait – even this is not going to sink into your pathetic excuse for a brain. Never mind.

“Note that profits have added substantially, an accounting sense, to the price level of gross value added, in certain quarters (e.g., 2020Q3, 2021Q1-Q2), and deducted in others (e.g., 2020Q4).”

What we have been telling JohnH for a long time. I see he is still chirping nonsense but may the facts will finally hit this troll accross the face.

” while corporate profits are not inconsequential to price level increase, they are actually smaller — in proportion — than labor costs.”

And yea JohnH claims just the opposite in his comments here. Yea – he is indeed either data incompetent or twists data to suit his tired out narrative.

In other news:

https://www.bea.gov/news/2023/personal-income-and-outlays-october-2023

Personal Income and Outlays, October 2023

The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent (table 5).