As noted earlier, Peter Navarro indicated Jerome Powell would be “gone in a hundred days”. Trump in a Bloomberg interview:

“I would let [Powell] serve [the second term] out,” Trump says, “especially if I thought he was doing the right thing.”

Even so, Trump has thoughts on interest-rate policy, at least in the near term. The Fed, he warns, should abstain from cutting rates before the November election and giving the economy, and Biden, a boost. Wall Street fully expects two interest-rate cuts before the end of the year, including one, crucially, before the election. “It’s something that they know they shouldn’t be doing,” he says.

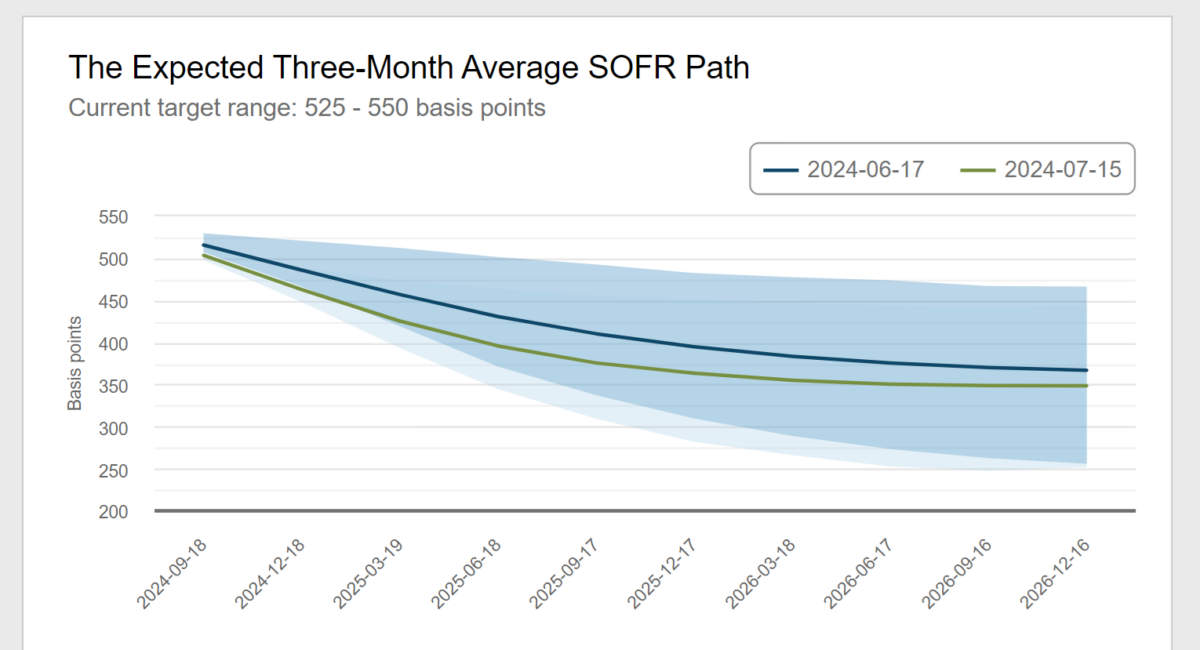

Current probabilities are for multiple cuts by year-end. As of 7/15 and month ago:

Source: Atlanta Fed, accessed 7/16/2024.

Peter Navarro is released from prison today, just in time to make a speaking appearance at the Republican Convention in Milwaukee. I expect an unhinged grievance tirade.

Yea – Trump does not want interest rate cuts until he becomes President as Trump wants a Biden recession. What a guy. Lots of silliness in that interview including a list of real nut cases as Trump’s economic team. Such as

‘Hassett’s name comes up on shortlists to chair the Federal Reserve when Powell’s term ends in 2026.’

Mr. DOW 36000 is not qualified to be FED chair. And Dimon as Treas. Sec.? Give me a break.

Then after he becomes President he wants rates cut to zero just after he has turbo charged inflation with his idiotic tariffs. Whatever happens I am sure that “nobody could have predicted”.

“Third is immigration. He believes harsh restrictions are key to boosting domestic wages and employment. He characterizes immigration restrictions as “the biggest [factor] of all” in how he’d reshape the economy, with particular benefits for the minorities he’s eager to win over. “The Black people are going to be decimated by the millions of people that are coming into the country,” he says. “They’re already feeling it. Their wages have gone way down. Their jobs are being taken by the migrants coming in illegally into the country.” (According to the US Bureau of Labor Statistics, the majority of employment gains since 2018 have been for naturalized US citizens and legal residents—not migrants.)

Nice catch on Trumps lies about migrants allegedly stealing those “black jobs”. But have their wages “gone way done”? Maybe a post presenting the actual data would be nice.

Now restricting immigration may raises wages but only because it will REDUCE labor supply. I guess Trump did not take Econ 101 at Wharton!

Here’s a start on assessing the trajectory of incomes for blacks, adjusted for inflation:

https://fred.stlouisfed.org/graph/?g=1qjD5

Looks like progress has been made over the past decade.

That long Bloomberg discussion linked to another Bloomberg piece entitled:

You Won’t Like Trumponomics 2.0

A couple of related quotes:

“Tariffs, one of Trump’s only consistent enthusiasms, are a sure thing. Starting in 2018, his administration imposed several rounds of duties, prompting predictable retaliation. Combined, these measures eliminated jobs, slashed incomes and cost consumers about $51 billion annually. Now Trump wants to impose tariffs of 60% on Chinese-made products and 10% on other imports. Bloomberg Economics estimates that this would raise consumer prices by 2.5% over two years and reduce growth by 0.5%. Trump has also promised a 100% duty on imported cars. Details TBD — one analyst describes the likely effect as “catastrophic” — but the point is that trade wars of this kind are always prone to raising prices.”

Kudlow the Klown and those jokers at the RNC are denying any tendency for tariffs to raise prices. But most economists would agree with Bloomberg Economics.

“More directly, the former president is toying with devaluing the dollar. Although the hope is to revive domestic manufacturing, exactly how he’d carry out this plan isn’t clear. (Like many products of Trump World, it seems to be premised on a lot of needless belligerence.) On balance, such manipulation is likely to invite retaliation, erode faith in the dollar and do little to actually boost exports. By raising the cost of imported goods and inputs for domestic producers, it would also (perhaps you’ve sensed a pattern) increase prices.”

I seem to recall some paper by the late great Joan Robinson entitled Beggar Thy Neighbor which tackled “competitive devaluations”. Something else Trump never read.

Can you Yanks help an ignorant Aussie please.

Can a President sack the FEd Chair or does he have to wait for his/her term to finish.

Joan Robinson was one of the great writers on economics. Possibly the most readable economist that ever lived

Joan Robinson was great! And sacking a FED chair is not something the President could do legally. But the question is what would mob boss Donald Trump do.