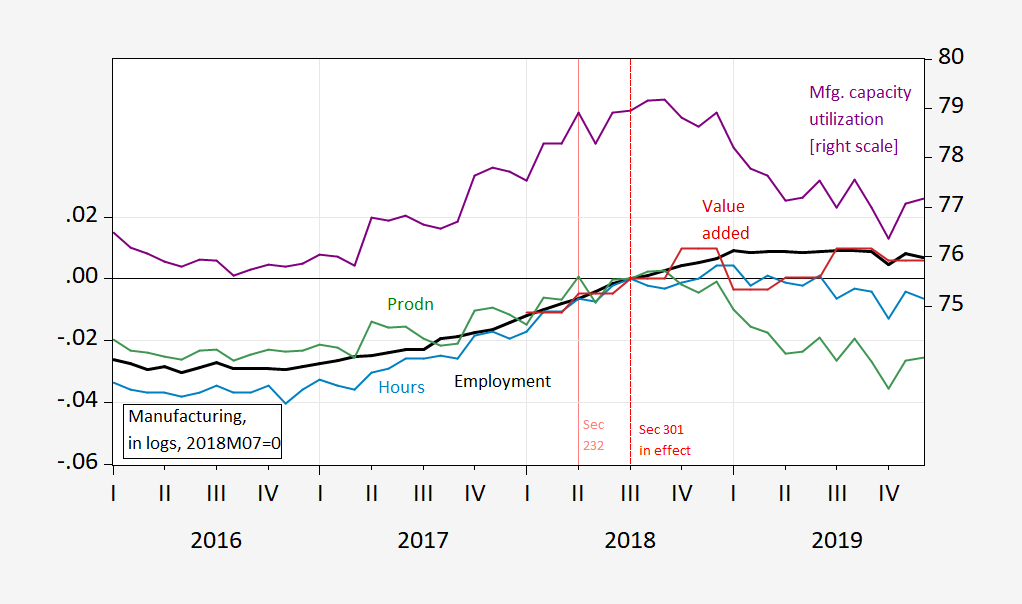

Lest we forget, a visual recap of what exactly happened when Trump started announcing Section 232 and Section 301 measures.

Figure 1: Manufacturing employment (bold black, left scale), hours (light blue, left scale), production (green, left scale), valued added (red, left scale), all in logs 2018M07=0; and capacity utilization (purple, right scale). Source: BLS, Federal Reserve, BEA via FRED, and author’s calculations.

Since exports broke off trend after the imposition of tariffs (for whatever reason), one shouldn’t be too surprised at the plateauing-off of measures of manufacturing activity in the wake of the tariff war’s start (see also formal econometric studies, discussed by Cox and Russ here).

One of the problems with Trumps import taxes were that they were put on import of raw materials like steel and aluminum. So our manufacturers using steel and aluminum had to pay above world market prices, whereas foreign competitors didn’t have to pay that extra tax. Anybody manufacturing with those metals within US became less competitive with anybody manufacturing outside US. Not what you want to do to help US manufacturing.

Trump also put tariffs on washing machines, solar panels and a bunch of products from China. The taxes on imported washing machines, solar panels and other end products made domestic producers more competitive and the products more expensive for consumers. So is it worth it to pay more for your washing machine so someone in a washing machine factory can keep their job. It may be except if retaliatory tariffs leads to guys in the Harley Davidson factory losing their job

Retaliatory tariffs applied by foreign countries were almost exclusively applied to end products, making US producers less competitive.

Biden modified the metal tariffs to a tariff rate quota and got rid of the washing machine tax. The tariffs on China has mostly been retained a part of an industrial policy protecting critical/strategic manufacturing abilities or countering unfair trade practices and dumping.

https://taxfoundation.org/research/all/federal/trump-tariffs-biden-tariffs/

“The Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products valued at approximately $380 billion in 2018 and 2019, amounting to one of the largest tax increases in decades.”

Trump is so proud he had the largest in something!

“Candidate Trump has proposed significant tariff hikes as part of his presidential campaign; we estimate that if imposed, his proposed tariff increases would hike taxes by another $524 billion annually and shrink GDP by at least 0.8 percent, the capital stock by 0.7 percent, and employment by 684,000 full-time equivalent jobs. Our estimates do not capture the effects of retaliation, nor the additional harms that would stem from starting a global trade war.”

And Trump told us that Americans will pay for his tariffs!

Steel and aluminum are swing-state products. Sugar is a once-and-future swing-state product.

Always ask: Cui Banana?