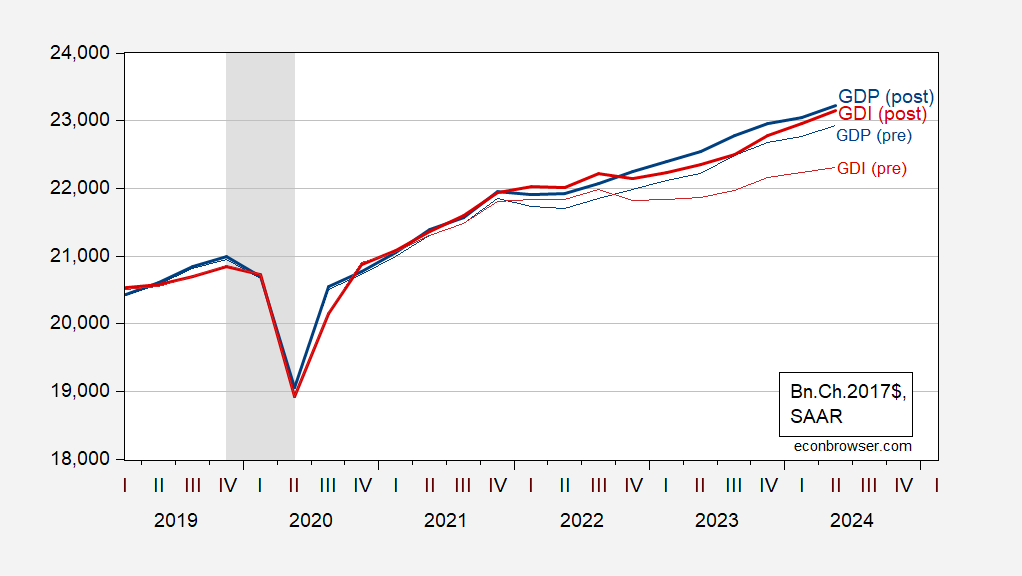

One of the interesting aspects of the annual revision is that, contrary to what happens with typical (non-annual) revisions, GDI moved toward GDP, rather than the reverse.

Figure 1: GDP post-update (bold blue), GDP pre-update (blue), GDI post-update (bold red), GDI pre-update (red), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, 2024Q2 3rd release/annual update, BEA 2024Q2 2nd release, NBER, and author’s calculations.

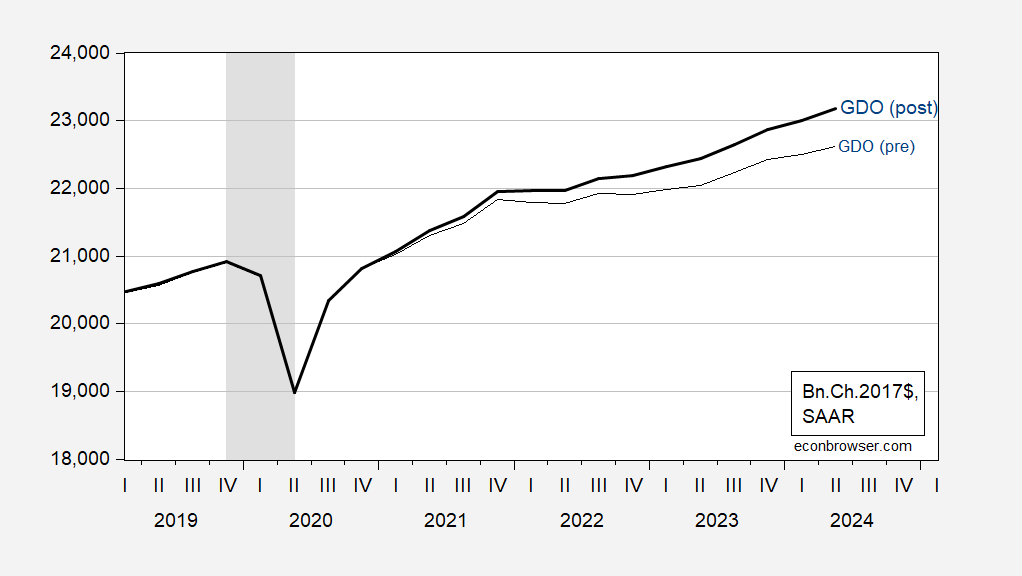

Figure 2: GDO post-update (bold blue), GDO pre-update (blue), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, 2024Q2 3rd release/annual update, BEA 2024Q2 2nd release, NBER, and author’s calculations.

GDP was revised up, but GDO was revised up even more. This is shown in Ch2017$ terms in Figure 3 (where the annual revisions apply to 2019-2023).

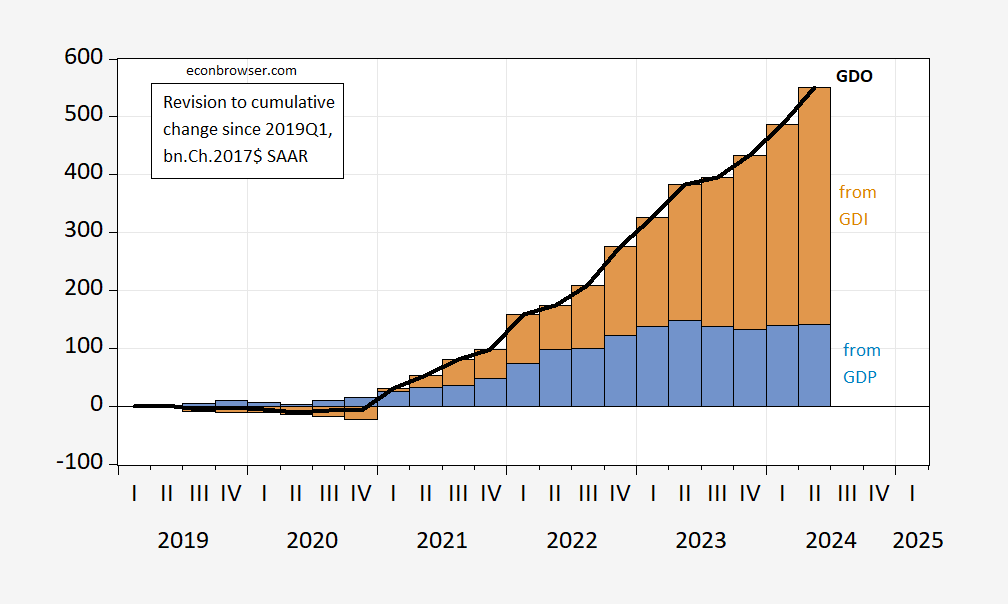

Figure 2: Relative to 2019Q1, change in GDO post-vs-pre update (bold black line), change attributable to GDP (blue bars), change attributable to GDI (tan bars), all in bn.Ch.2017$ SAAR. Source: BEA, 2024Q2 3rd release/annual update, BEA 2024Q2 2nd release, NBER, and author’s calculations.

The lion’s share of the change in GDO vs pre-update is attributable to changes in GDI. This matches up with claims that BEA had been undercounting/estimating non-labor income.

Do I recall correctly that some commenters here insisted that GDI was going to prove more reliable, and that GDP would inevitably be revised lower? I don’t expect they’ll admit being wrong, in part because two of them have been banned for breaking the rules of the blog. In part because the truth was never the point for those guys.

The downward revision to employment and the upward revision to output strongly suggests an upward revision to labor productivity. Even for observers who insist on ignoring the slide in income shares for labor, and insist on ignoring rhe downward divergence of labor compensation growth from productivity growth, this higher trajectory for productivity means labor compensation is less responsible for past inflation than had been thought. A higher trajectory for productivity also means labor should expect a faster pace of compensation gain in future.

If labor compensation doesn’t track labor productivity, that is prima facie evidence of monopsony power in the labor market. Want higher income? Re-elect Lina Khan.*

*Don’t. Don’t correct me. Just don’t.

“Do I recall correctly that some commenters here insisted that GDI was going to prove more reliable”

My 1st thought was that you were referring to Antoni but yea – this clown has never commented here. No Antoni hangs out with his fan base on Faux News.

“The lion’s share of the change in GDO vs pre-update is attributable to changes in GDI. This matches up with claims that BEA had been undercounting/estimating non-labor income.”

Back when some banned troll kept harping on high profits, I started noticed that inflation adjusted profits as reported in the GDI accounts were declining. At one point I wondered if the drop reflected some measurement error. It seems it did.

I sorta kinda recall a similar upward revision in the late teens which was coincident with pretty substantial tax-enforcement efforts. Looked like tax cheating had involved hiding business activity. I have to wonder whether upward revision to non-labor income now is the result if uncovering more tax cheating. If so, should we start anticipating upward revisions to GDI/GDP?

If the party of tax cheats is ever out of power for long, will we then adjust our thinking to assume less cheating and smaller upward revisions?

Antoni did not admit he was wrong about that alleged 2022 “recession” even as he had a Twitter post with graphs and all. He dubbed that revision to real GDP as “massive” as if it were somehow fake. Same old misleading fake Ph.D.!