That’s Heritage Foundation economist EJ Antoni yesterday. Dr. Antoni continues:

Increasingly, people are realizing that the 2% target is long gone. We’re looking at 3% basically as the implicit target. Now we’re in for a lot of pain. So the question is just, is this going to be 1920 or is it going to be 1929

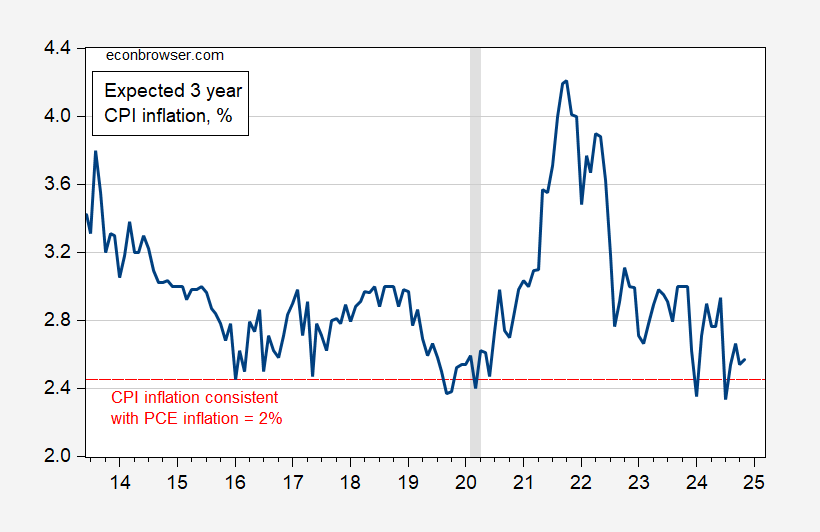

I wondered what the basis for this assertion was. As usual with Dr. Antoni, it’s hard for me to determine. Take a look at 3 year median expected CPI inflation of consumers.

Figure 1: 3 year median expected CPI inflation deviation from 2.45% target (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

Seems to me that the Fed’s coming close to re-establishing credibility, insofar as households are concerned.

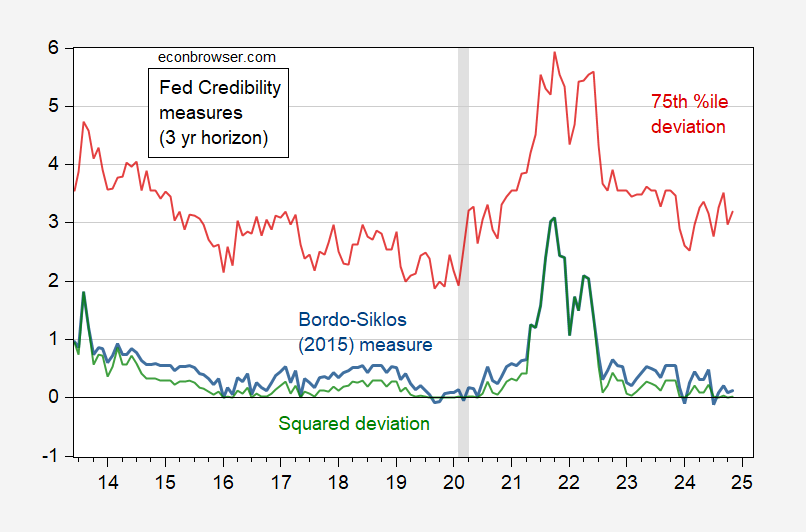

One can measure Fed credibility with respect to its inflation target in a variety of ways. I use plot three measures.

Figure 2: Bordo-Siklos (2015) credibility measure using 2.45% target (blue), squared deviation of expectation from 2.45% target (green), 75th percentile deviation from 2.45% target (red). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

It’s true the folks at the 75th percentile remain skeptical — but no more so than at the end of the Trump 1.0 administration. The Bordo-Siklos measure seems almost dead on.

Heritage boy is playing fast and loose beyond his claims about credibility:

“Now we’re in for a lot of pain. So the question is just, is this going to be 1920 or is it going to be 1929”

We’re in for a lot of pain because of a 3% implicit inflation target (sic)? Based on what evidence, exactly? Inflation in 1920 was 15.6% and had been above 15% in the 3 prior years. In 1929, the inflation rate was zero, had been negative in the prior two years and conti ued negative in the 4 subsequent years:

https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1800-

Inflation is now very close to target, far below the rate in 1920 and well above the deflation associated with the Great Depression. Heritage boy is either ignorant of the facts, or is relying on the ignorance of his readers. So which is Heritage boy warning us about, inflation, or deflation?

Oh, and I’m pretty sure there is nothing in the literature to demonstrate that a 2% inflation target is better in any way than a 3% target.

Mostly off topic – With the latest GDP revision, I decided to take a fresh look at the U.S. output gap. For what it’s worth, the current reading shows the largest positive gap since 1973:

https://fred.stlouisfed.org/graph/?g=1Cmpg

Put another way, we have the largest positive gap since the Great Moderation (1983). Oddly, the industrial capacity utilization rate is down and the unemployment rate up from recent extremes, so the potential GDP series showing a widening output gap may be a bit flakey? Curious.

Anyhow, a positive output gap may not be the direct cause of recession, but there is an unrelenting pattern of recession following positive output gaps. It is certainly reasonable to think that a positive output gap implies slower growth ahead, since there are few unused resources available to put to work.

With that in mind, note that the FOMC’s latest Summary of Economic Projections anticipated real GDP growth in 2025 of 2.1%, same as the growth in potential GPD, 2.0% in 2026 and 1.9% in 2027 – just about enough to close the output gap. A look at the FRED link I’ve provided will show that, since 1950, not only has the output gap never closed without a recession, but that since 1970, the gap has always closed in considerably less than 3 years; when it happens, it happens fast.

I know – this cycle really is different. Big Fed hikes haven’t yet induced a recession. An inverted curve hasn’t presaged recession. So maybe the economy will cool off gradually, unlike any other time on record. But with Trump threatening to slow growth with tariffs and immigrant deportations, the Fed planning to maintain restrictive policy and the output gap signaling trouble, the absence of recession warnings seems odd. For instance:

https://www.gurufocus.com/news/2628601/jp-morgan-forecasts-2025-recession-odds-at-just-15-ai-to-drive-growth?r=caf6fe0e0db70d936033da5461e60141

Incidentally, I find it interesting that negative output gaps have been larger since the Great Moderation than before, positive output gaps smaller. That isn’t the kind of moderation I’d have chosen, if I’d been asked.

Maybe the Heritage Foundation is saying – More and more market participants are believing unelected chaos agent Musk – meanwhile Speaker Johnson is happy he cleared the budget deal with Musk and – oh yeah – Trump.

Also as a preview of the next four years – we get this milquetoast take from the AP: “Some critics” are saying Trump/Musk/MAGA are destroying our economy: https://finance.yahoo.com/news/trump-poised-inherit-strong-economy-120023064.html (who coulda knew?? -given the GOP’s “deficits don’t matter” when they are in charge.)

Remember when the GOP would complain about Obama “uncertainty” when he was putting regulation in place – now it is do away with the debt ceiling and massive tax cuts for billionaires to blow up the U.S. economy.

NYT Pitchbot: Whether it’s the Republicans refusing to recognize the Presidency of Joe Biden or Democrats refusing to recognize the Presidency of Elon Musk, both sides are at fault.

Well done! I had to read that twice before I got it!

In the case of Biden it is less evident who ran the U.S. on his bed days since 2021

Oh, I see that you have swallowed whole the Rupert Murdoch Wall Street Journal codswallop. Did it go down well?