U.Michigan consumer sentiment and Conference Board economic confidence rise. But expectations drop.

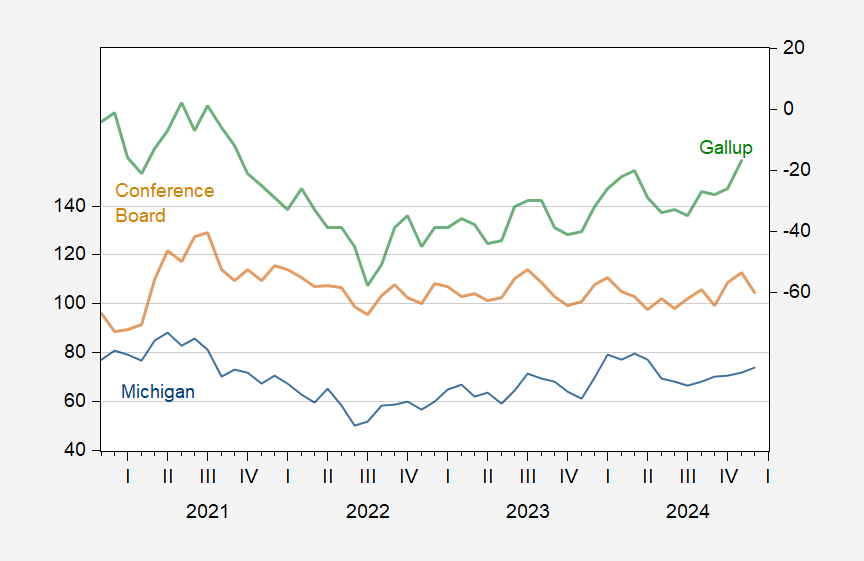

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Economic Confidence (tan, left scale), and Gallup Economic Confidence (green, right scale). Source: U.Michigan via FRED, Conference Board, Gallup.

Current conditions were up partly because of the impetus to buy now to avoid future tariffs.

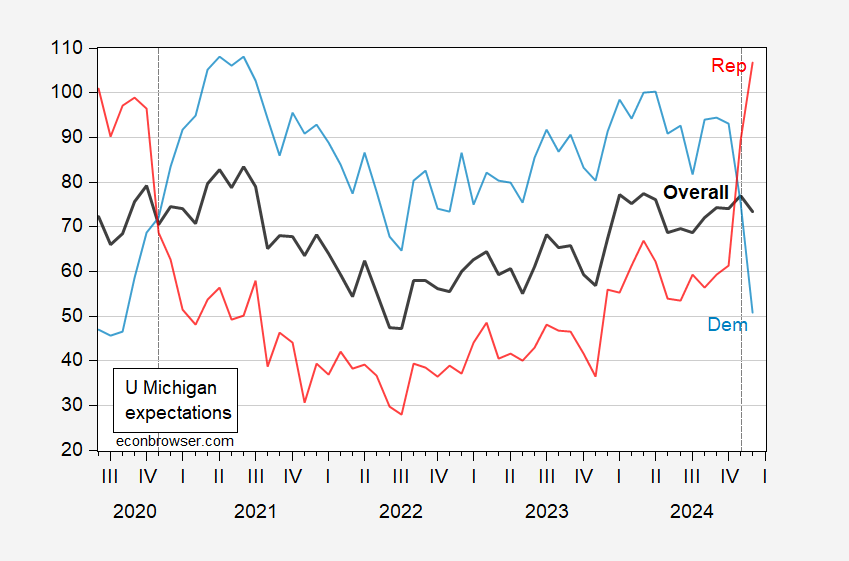

Interestingly, expectations as measured by U. Michigan have dropped, attributed to anxiety regarding the effects of tariffs. Still, Republicans/lean Republican have seen their expectations soar, while Democrats/lean Democrats have seen the reverse (as happened, in reverse, in 2020).

Figure 2: University of Michigan Expectations (bold black), expectations of Democrats/lean Democratic (blue), expectations of Republicans/lean Republican (red). Source: University of Michigan, FRED.

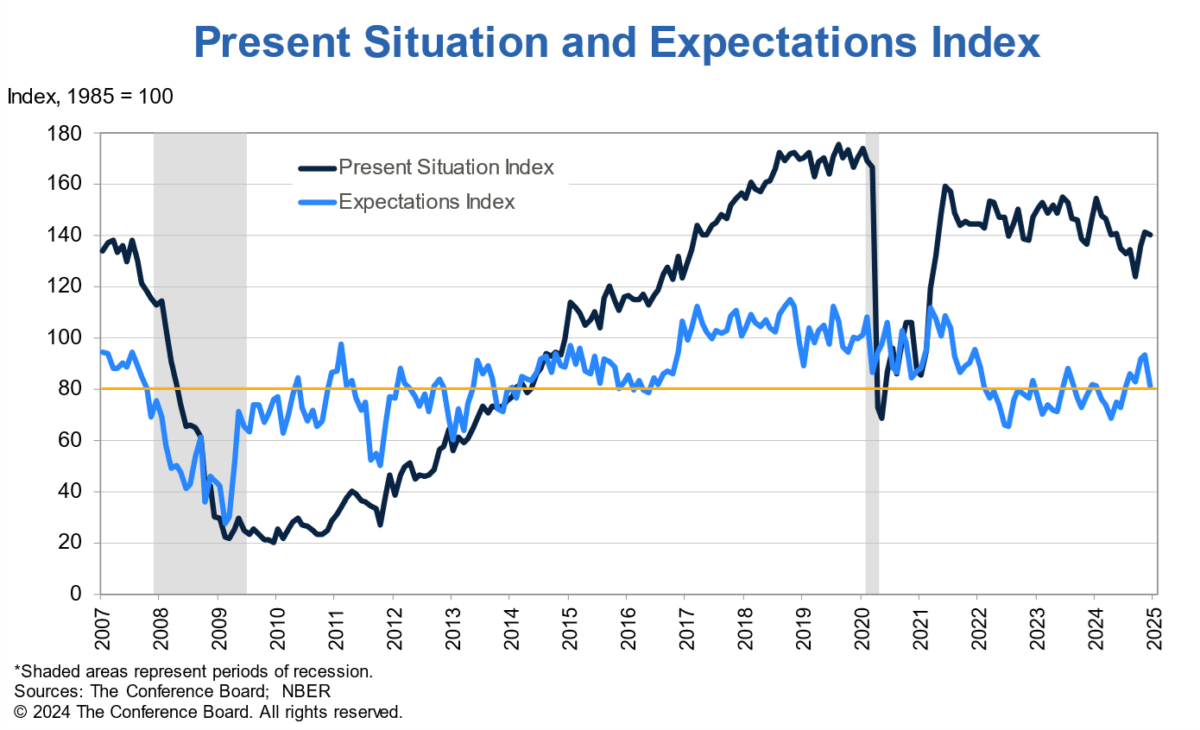

The Conference Board expectations index also evidenced a drop:

Source: Conference Board.

The Conference Board’s note on the December results included:

In write-in responses about factors affecting consumers’ views of the economy, mentions of politics—including the outcome of November’s elections—continued to rise. Mentions of tariffs also increased in December. Notably, a special question this month showed that 46% of US consumers expected tariffs to raise the cost of living while 21% expected tariffs to create more US jobs.

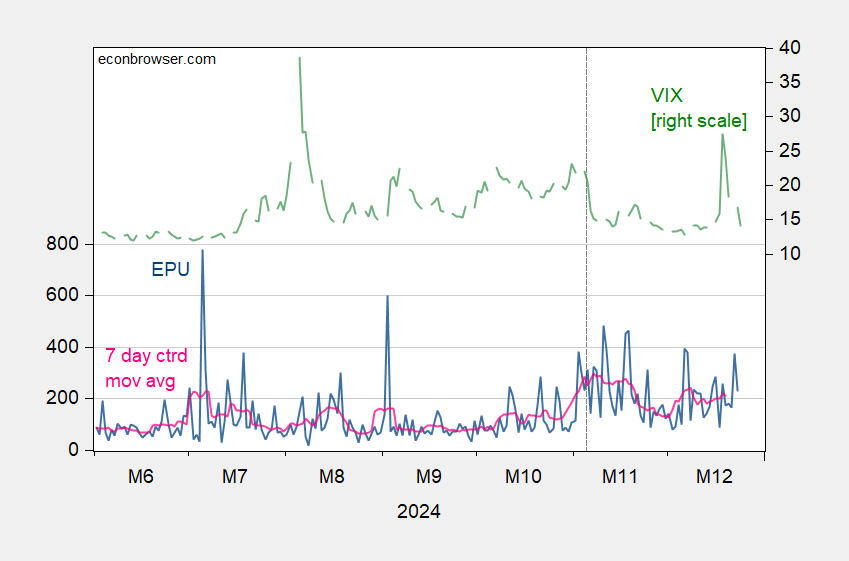

Certainly, uncertainty has increased since the election, relative to the recent past.

Figure 3: EPU (blue, left scale), EPU centered 7-day moving average (pink, left scale), and VIX (green, right scale). Source: EPU, CBOE via FRED, author’s calculations.

People voted for this (well, at least a plurality did), so here we go…

Merry Holidays anyway!

Off topic – the ruble:

The current contract for Russian use of gas pipelines in Ukraine expires at the end of this month. Ukraine is reportedly intent on shutting Russian exports gas to the rest of Europe:

https://www.yahoo.com/news/russia-multi-billion-dollar-revenue-124712426.html

The pipeline earned Russia $5 billion this year, Ukraine $800 million. I don’t know how likely a full shutdown is, but Putin says it’s a done deal – no more gas through Ukraine:

https://www.reuters.com/business/energy/putin-it-is-clear-there-will-be-no-ukraine-gas-transit-deal-2024-12-19/

That could be one reason for the recent weakness of the ruble and the MOEX. As things now stand, Russia is unlikely to gain control of any of the pipelines as a result of war. Bad for Austria, Hungary and Slovakia.

Also off topic – BoJ policy and market volatility:

The BoJ has cut way back in coupon purchases. The government is still running sizable deficits, adding tot the stock of outstanding government debt:

https://www.bloomberg.com/news/articles/2024-12-23/japan-s-bond-market-is-set-to-absorb-biggest-supply-in-a-decade

The BoJ is also expected to raise rates soon. There was one big episode of yen-based carry-trade unwind in August of this year, the result of BoJ policy. The issuance outlook and BoJ rate outlook both suggest a further flow of cash back to Japan, and rising rates elsewhere makes the repatriation math stronger.

All of which is to say, hold in to your hats. Carry-trade unwinding isn’t necessarily a sign of doom for asset values, though is a reliable source of volatility. Enough volatility, and you can run into persistent losses, just no guarantee.

Off topic – the FT previews Xi’s new year:

https://archive.ph/kPogi

Aside from the fact that Grover now writes headlines for the FT, the most interesting point to the article is the suggestion that Trump may drive a wedge between China and Russia. I think that may overestimate Trump’s influence and his foreign policy chops, but that’s just me.

Anyhow, the “Very Bad, No Good” of the title sums up the article’s outlook for Xi, more than for China.