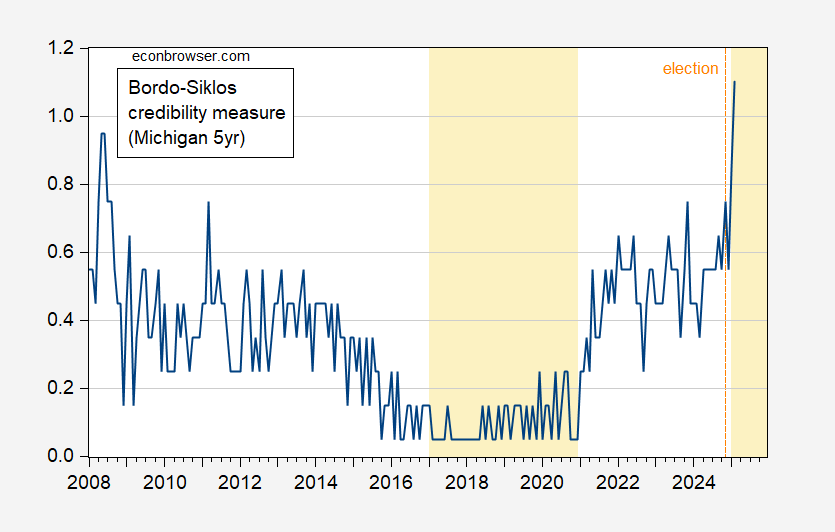

Using 5 year ahead inflation expectations from the Michigan survey, not so much erosion in Trump 1.0. Trump 2.0 so far is another story.

Figure 1: Bordo-Siklos measure of Inflation Credibility (blue). Higher values indicate less credibility; assumes CPI target consistent with 2% PCE deflator target is 2.45%. Light orange highlight indicates Trump Administrations. Source: Michigan Survey and author’s calculations.

In a previous post, I used the NY Fed’s measure to calculate the Bordo-Siklos index; at the moment only the January observation is available for that dataset.

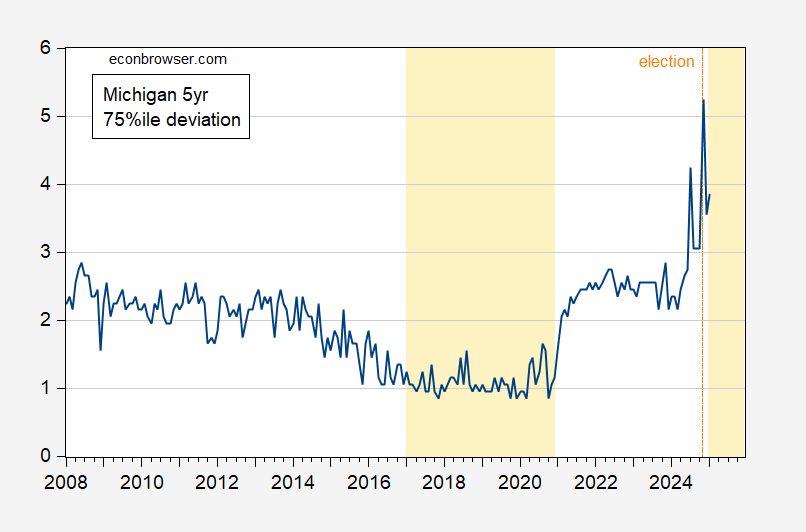

And as an indicator of the tails, here’s the 75 percentile expectation, minus 2.45 percentage points.

Figure 2: 75%ile of expected 5 year inflation minus 2.45% (blue). Higher values indicate less credibility; assumes CPI target consistent with 2% PCE deflator target is 2.45%. Light orange highlight indicates Trump Administrations. Source: Michigan Survey and author’s calculations.

When it comes to the thinking of the general public, Fed credibility is probably not a big deal for the formation of inflation expectations. Market participants and economists track the Fed. The public doesn’t.

Inflation expectations are largely a reflection of past inflation, backward looking. To the extent that confidence is an issue, it’s probably a vague sort of confidence in outcomes, not in particular institutions. That’s why Republicans and Democrats see the inflatio outlook so differently.

We’ve had a long period of low inflation, followed by a couple of years of higher inflation. We have headlines about the inflationary effects of tariffs, deportations and bird flu. We have some food prices that have risen substantially. These, I would think, have a greater influence on the inflation expectations of the general public than the felon-in-chief’s plans for the Fed.

That doesn’t mean the rapist-in-chief’s plans don’t matter. Piling tariffs, deportations, a weak response to bird flu, expansionary fiscal policy and default on Treasury debt* on top of a loss of Fed independence looks like a formula for persistent higher inflation.

* At its core, any Mar-el-Lago plan, whatever the details, amounts to default on Treasury debt.

You are an idiot. I just wonder if your obvious bias is just being reported in your ignorance or were you born an idiot and it just grew as you did.

I keep being amazed at the levels of lies and skewing of data to the level of it being completely devoid of any value from liberals. You would think that

somewhere inside of you, it would be more important to want the best for this country and the people in it instead of letting your political views and

dislike for others lead your actions. I can only guess you really do not care and are typically selfish as most liberals and fake caring people are. You say one thing

and do another. Reality does not matter. Only your perception and ignorance do.

You are a crap flinging baboon… with not a thought in your wee bitty head

Exactly.

Johnny, your allegiance to a convicted felon and sexual assault perpetrator is quite enlightening. perhaps the next time you post, you could include at least one true statement in your rant. you sound a lot like stephen miller when he goes on one of his media rants. douchebag.

John Dixon: Thank you for your deeply reasoned comment. Please be specific regarding instances where I have “skewed” the data. If you are saying there are better measures of consumer inflation expectations, I would welcome your identification of superior measure, and reasons for that choice. If you do not like the Bordo-Siklos measure, I would welcome your preferred indicator.

I don’t know what you mean “say one thing and do another”? Please elaborate, since you are engaging in ad hominem attacks.