Has the Fed lost credibility, as some people have argued (e.g., EJ Antoni)?

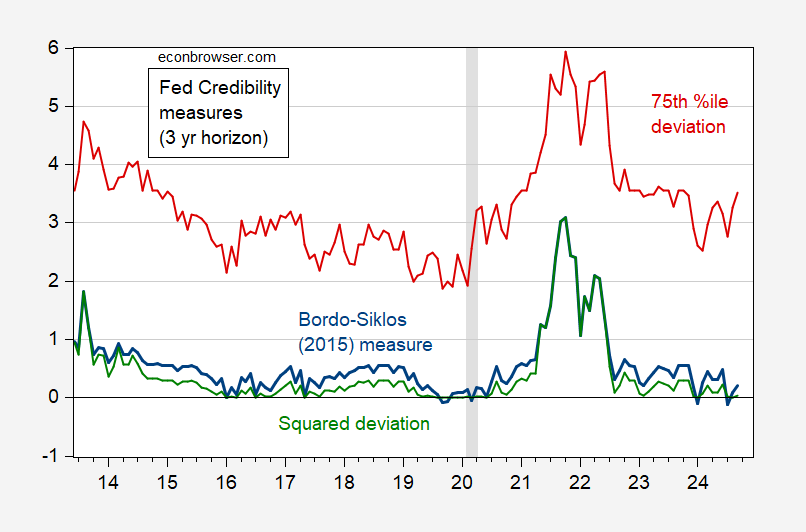

One way to assess credibility is to see whether people’s expectations of inflation at the medium term (say 3 years) comes close to the implicit target. With a PCE y/y inflation target of 2%, this means a 2.45% CPI target. Using this, and the NY Fed’s survey of consumers (not economists), we get the following picture:

Figure 1: Bordo-Siklos (2015) credibility measure using 2.45% target (blue), squared deviation of expectation from 2.45% target (green), 75th percentile deviation from 2.45% target (red). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

My answer: No. At a minimum, Fed credibility with respect to medium term inflation is as high as — if not greater than — it was at the end of the Trump administration.

Antoni of all people should avoid questioning anyone else’s credibility. The man is a lying hack who pretends to be an economist. He’s clearly not.

Speaking of credibility

Harris says violent crime is down. Trump says it’s up. Here’s a fact check.

https://www.msn.com/en-us/news/crime/harris-says-violent-crime-is-down-trump-says-it-s-up-here-s-a-fact-check/ar-AA1soJvt?ocid=msedgntp&pc=U531&cvid=7e7ed57cf94d49e881061e8e68d4f3d8&ei=12

You guessed it – violent crime has fallen under Biden-Harris. But it did rise in 2020. Remind me again – who was the President in 2020?

Was this the Antoni blog post that questioned the FED credibility?

In today’s edition of “no one believes the Fed anymore”…

Sep inflation expectations: 1yr unch at 3.0%, 3yr up at 2.7%, 5yr up at 2.9% – kiss the 2% target goodbye; meanwhile, over 1 in 7 people expect they won’t be able to make their minimum debt payments over next 3 months:

If so, Antoni is being more retarded than usual.

BTW Antoni forget to tell us WTF he meant by ‘inflation expectations: 1yr unch at 3.0%, 3yr up at 2.7%, 5yr up at 2.9%’

I checked this series:

5-Year Breakeven Inflation Rate

https://fred.stlouisfed.org/series/T5YIE/

2.19% is not exactly 2.9%. Not that I am accusing of Antoni (even though he does all the time) but maybe someone could improve on this moron’s writing.

Trump recently said farmers did really well when he was President. I wonder if soybean farmers agree with this given how their prices suffered from Trump’s trade war:

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

Trump on climate change – hey my golf courses are great!

Trump Responds to Climate Question by Rambling Incoherently About Golf Course

https://www.msn.com/en-us/news/politics/trump-responds-to-climate-question-by-rambling-incoherently-about-golf-course/ar-AA1srRiV?ocid=msedgdhp&pc=U531&cvid=806e91a2c2a74774b9fc9929c0cd4238&ei=11

At one point Carlos Aguilera, a construction worker from Florida who was born in Cuba, asked Trump if the recent slew of natural disasters and environmental issues battering the Sunshine State had made him reconsider his claims that climate change is a “hoax.” Trump responded by bragging about his golf courses and lying about his environmental record. “I always feel that with the climate and I have been great,” Trump said at one point in his rambling. “I have been an environmentalist. I built many things. I own Doral right next door and we did that in a very environment – I got awards, environmental awards for the way I built it, for the water, the way I use the water, the sand, the mixing of the sand, and the water,” he added as part of a lengthy, meandering response.

Trump has never produced the names of these alleged awards, and a 2017 investigation by The Washington Post could not find evidence that they exist. Trump never directly answered Aguilera’s question, but he did claim that under his administration he “had the cleanest water, crystal clean. We had the cleanest water, the cleanest air.” (In fact, the Trump administration rolled back critical protections on American freshwater resources, allowing companies producing harmful pollutants to discharge them into waterways with less oversight.) “I hear a lot about climate and they talk about global warming – because they used to call it global warming now they call it climate change because that covers everything – global warming. The real global warming that we have to worry about is nuclear. The water is coming up 1/8 of an inch over three hundred years, the ocean is going to rise and you know – nobody knows if that’s true or not – but they’re worried about the ocean rising an eighth of an inch or a quarter of an inch in three hundred years. What I’m worried about is nuclear weapons tomorrow,” Trump concluded.

And I thought Bruce Hall was the dumbest person God ever created. Trump is worse – much worse.