Despite the lack of coincident indicators suggesting a recession’s onset (we’ll see more on Friday), there are plenty of articles now suggesting an imminent recession: “Wall Street Banks Say Markets Are Flashing Rising Recession Risk”, “The Recession Trade Is Back on Wall Street”, “Whisper it and it’s back: Recession risk creeps onto markets’ radar”, “2025 Recession Risk Is Increasing According To Multiple Indicators”. Kalshi’s recession probability for 2025 is now at 42%, after languishing at around 22% for a month. Assuming no recession as of February, what does a conventional term spread (10yr-3mo) model for 12 months ahead indicate?

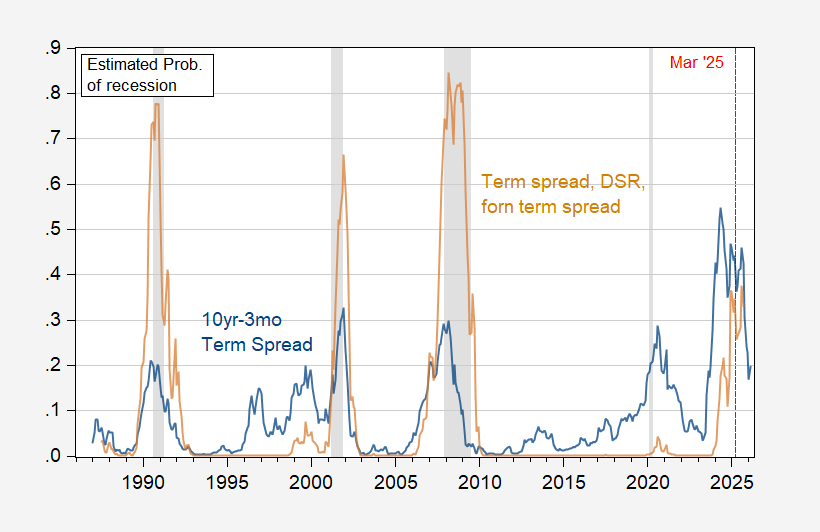

Figure 1: Probability of recession 12 months ahead estimated 1986M01-2025M02 using 10yr-3mo term spread (blue), using 10yr-3mo spread, private nonfinancial debt-service ratio, and foreign term spread (tan). NBER defined peak to trough recession dates shaded gray. Source: NBER and author’s calculations.

As of March, the probability of recession using the spreads last March is 44%.

A model incorporating debt-service ratio as well as the term spread as in Ferrara and Chinn (2024) and — for the foreign term spread — Ahmed and Chinn (2024), better predicts the recessions since 1990 (excepting the 2020 recession). This specification indicates 35% probability in March, 38% in August.