That’s the title of an article by Jasmine Cui for NBC, citing me, Jeffrey Frankel (formerly on the NBER BCDC), and Dennis Hoffman (ASU).

Trade tensions have torn into the markets. With stocks sliding into correction territory in the last week, a question emerges: Is a recession next?

Traders on prediction markets — where people wager on such events as the likelihood of a recession — are increasingly betting on an economic downturn. Polymarket, for example, currently places the odds on a recession in 2025 at 40% — a sharp jump of nearly 20 percentage points in under a month.

…

Consumer behavior

Consumer spending represents approximately 70% of the country’s gross domestic product. Jeffrey Frankel, an economist at the Harvard Kennedy School and one of the experts who called recessions for the National Bureau of Economic Research, emphasized that consumer spending is one of the earliest and most direct indicators of economic downturn.

“Retail sales is like if you’re navigating through a foggy ocean, trying to see where the port is — the first rocks, the promise of the mainland as it comes into view — that’s retail sales,” Frankel said.

So far, data from the Census Bureau shows sales numbers have remained steady.

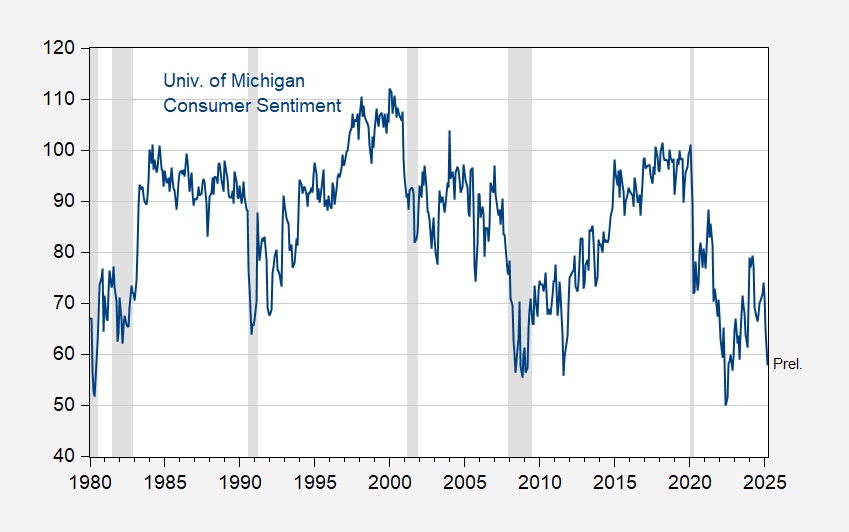

The article contains a graph of the U.Michigan consumer confidence index, up through January. I update with February data, and preliminary March data.

Figure 1: University of Michigan Survey of Consumers Economic Sentiment index. NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan via FRED, TradingEconomics.com, NBER.

As noted in this post, sentiment indicators are suggesting a recession in March (i.e., this month), while we don’t know what the Sahm rule indicator is going to be reported as (as the article notes, it’s far below the 0.5 ppts threshold as of February, and unemployment would have to jump 0.8 ppts in March to trigger a recession call.

El Erian, interviewed on Marketplace, observed that “soft” data like confidence and like the Empire State Survey lead “hard” data by 3 to 6 months. Now, I’m sure a look at the data would show that things are more complex than “soft data lead”, but maybe we’ll be seeing softer hard data ahead.

The earliest high frequency consumer data for March that I know of are from Redbook and OpenTable. The former is well known (in fact I believe it is a component of the Lewis-Mertens-Stock Weekly Economic Index), and the latter measures the YoY change in restaurant reservations, which are one of the first things I would expect consumers to cut back on.

Last week retail spending as measured by Redbook was up 5.2% YoY, and the four week moving average was up 5.9%. Needless to say, this is not recessionary.

Through Sunday, the seven day average of restaurant reservations were up 2% YoY, in the range of readings from the past several months.

I suspect we will need to see the first price “shock” from retaliatory tariffs and/or a big increase in new jobless claims before there is any meaningful deterioration in consumer spending.