When consumer sentiment drops as precipitously as it has (see here), then one has to ask if a recession is in the offing in this month. Here’s I’m using the U Michigan consumer sentiment index to determine if we’re in a recession now (i.e., not forecasting).

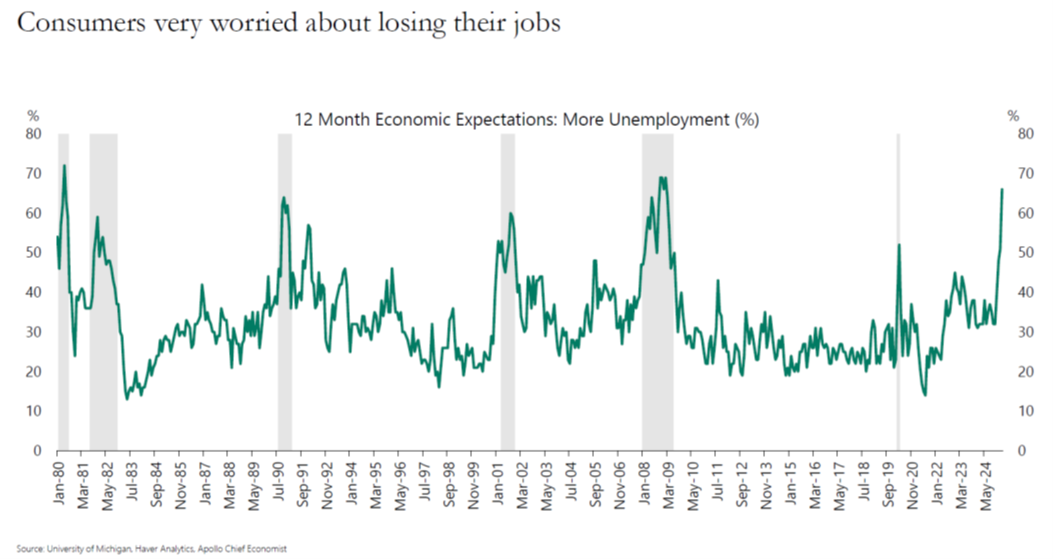

Here’s Torsten Slok’s graph (among several):

Source: Slok/Apollo.

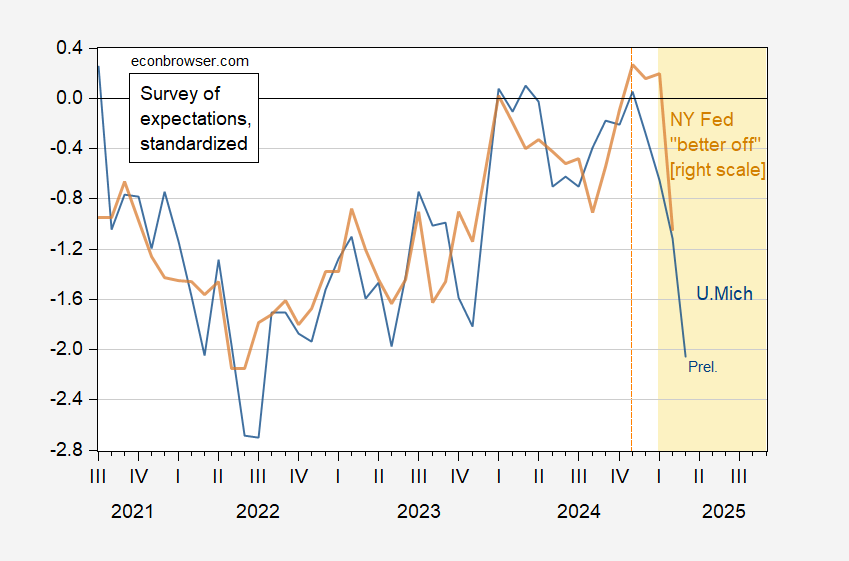

The drop in Michigan sentiment and Conference Board confidence is shown below:

Figure 1: U.Michigan expectations index (blue), and NY “better off” aggregate (tan), both demeaned and standardized (2013M06-2025M02). Source: U.Michigan, NY Fed, and author’s calculations.

Here’s one recent analysis on this subject: [1] Blanchflower and Bryson (2022) argue for predictive power of the Michigan index.

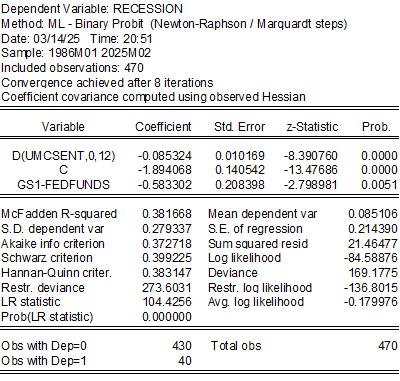

I run a probit regression of a NBER peak-to-trough recession dummy on contemporaneous Michigan sentiment (FRED variable UMCSENT) and the 1yr-Fed funds spread (the last is per Miller (2019) who shows this spread has the highest AUROC of spreads at one month horizon).

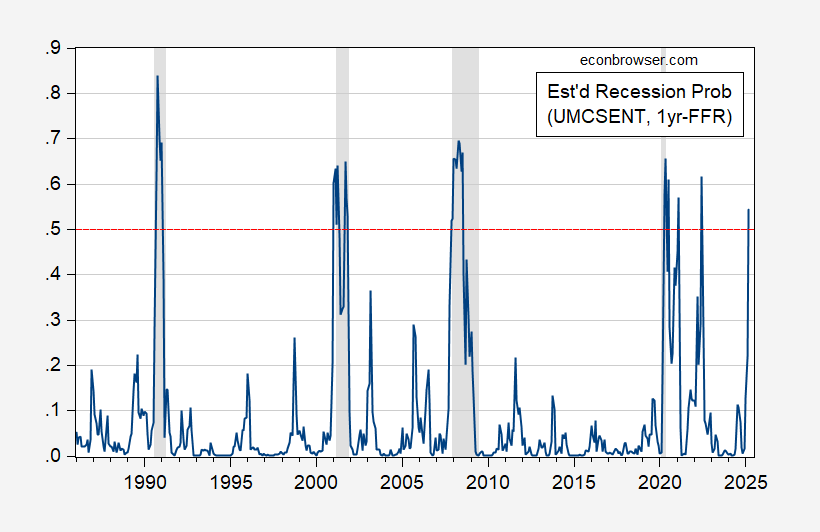

And here’s the estimated recession probability, extended to 2025M03, assuming no recession has occurred as of February 2025.

Figure 2: Estimated recession probability using contemporaneous Michigan consumer sentiment and one year Treasury-Fed Funds spread. March spread based on Michigan preliminary reading and yields/rates through 14 March. NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan, Treasury, Federal Reserve, NBER and author’s calculations.

While these estimated probabilities match the recessions pretty well, they indicate a mid-2022 recession (one month). The likelihood for this month is 53% (using the preliminary U.Michigan reading and interest rates through the 14th).

Still, we don’t have readings for any variable in March. The unemployment rate would have to jump from 4.1% in February to 4.9% in March in order for the Sahm rule to be triggered (as of February, it reads 0.27 ppts, far below 0.5 ppts).

Just to repeat some ideas I’ve offered in the past –

This time may be different. We’ve never had felon as President before never someone so determined to say and do harmful stuff. A guy this bad might trigger a recession, but he might also convince the public that things are worse that they really are. Just like faux news does.

The public is often wrong about economic conditions. Faux news and its fellow travelers has degraded the understanding of a big chunk of the population, so we have to expect poor grasp of reality from that chunk. That said, it isn’t the faux news addicts who are most distressed about the economy right now.

I’m curious to know if Michigan respondents who express no party affiliation have a better forecasting record than partisan types. If so, then how do unaffiliated folks’ current views line up against recessionary periods? All that I find broken down by political affiliation are the headline index, current conditions and expectations indices. The expectations index for politically unaffiliated respondents in early March is the lowest since May, 2023 – not a glowing endorsement, but not recessionary.

The short term is the creator of the long term. Falling stock prices mean no “wealth effect”; consumer worry means less spending; negative talk fosters negative feelings. Above all, when you are at a top “full” employment can’t get fuller and since everybody is working and spending there’s no more potential for much growth. Cruising along at the top is a fine thing, but most corporate hope is for growth, not stasis; most stock investor want growth, not stagnant prices with modest dividends.

And the worst sign is government officials coming out to reassure the public – that means there is a problem they want to talk away.