NPR’s show today has a long segment on recession detection and prediction.

I learned a lot about TikTok, Lady Gaga, wasabi peas in bars, babysitter buns, etc. Some talk about Sahm rule, term spreads and yield curve inversions, as well as the Conference Board LEI.

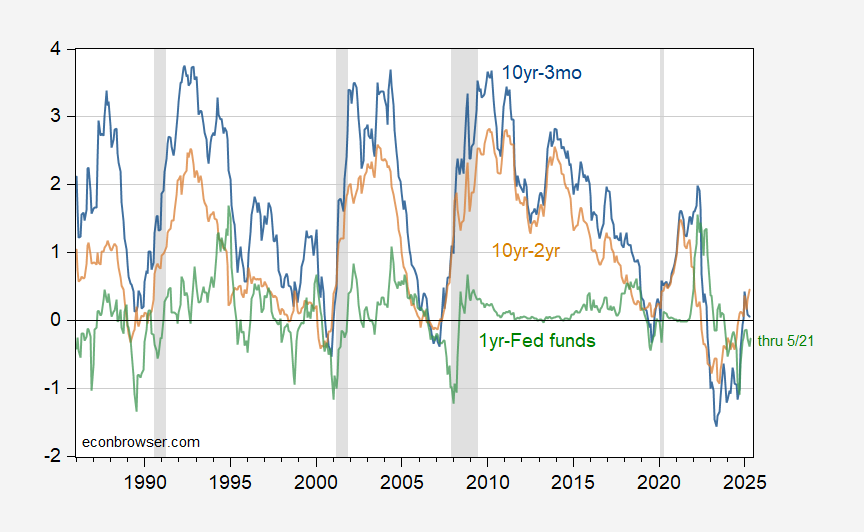

Figure 1: 10yr-3mo spread (blue), 10yr-2yr spread (tan), 1yr-Fed funds spread (green), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, Fed, NBER, and author’s calculators.

It’s a little embarrassing that one of the hosts, Kenny Malone, mentions “my” model; it’s really Cam Harvey’s (1989) model (personally I think “my” model as a term spread augmented with debt-service and foreign term spread, per Chinn and Ferrara and Ahmed and Chinn). In Figure 1, show the 10yr-3mo and 10yr-2yr spreads which are conventionally used, as well as the 1yr-Fed funds spread, which Miller (2019) identifies as the maximal AUROC spread at 2 months lead.

The 1yr-Fed funds spread dove in April (troubling), but was much more negative in September 2024 (comforting).

Anyway, a really entertaining piece which delves into lots of interesting correlations involving recessions.