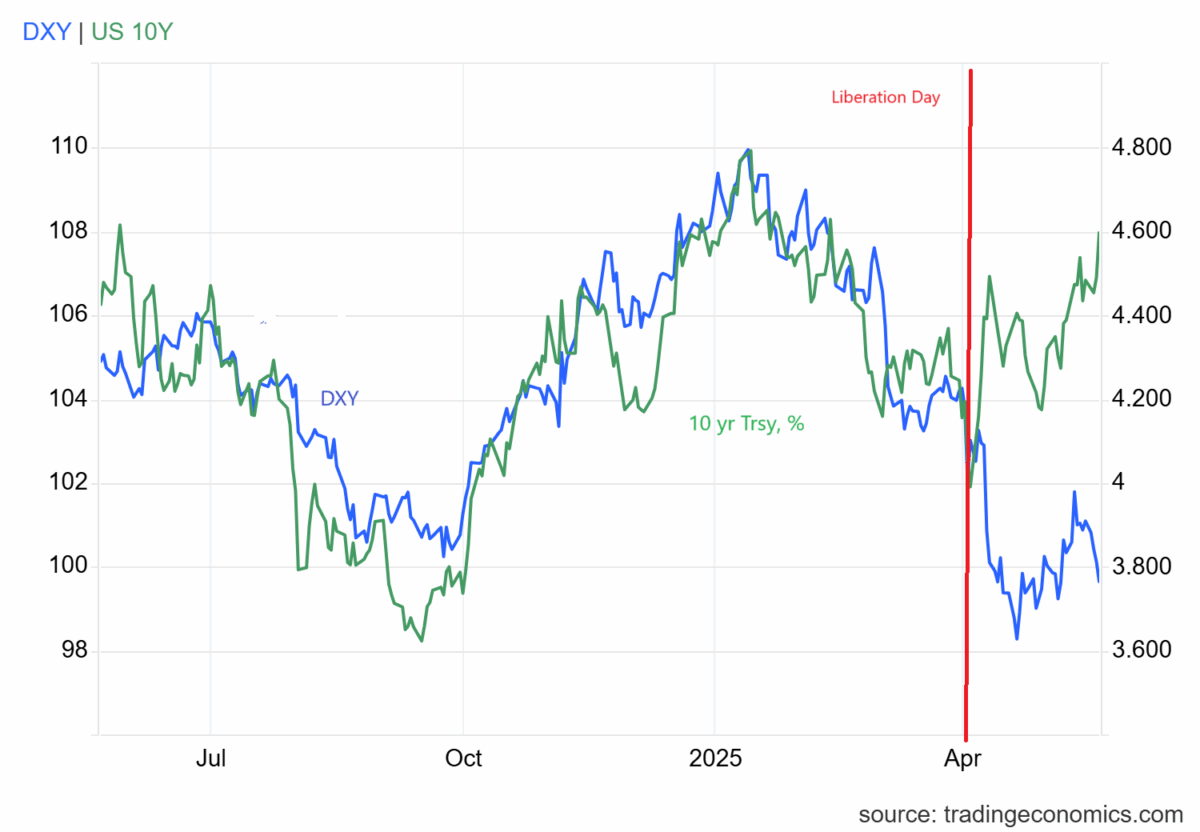

Consider the ten year Treasury yield and the dollar index (DXY) over the past six months:

Figure 1: DXY (blue, left scale), and ten year Treasury yield, % (green, right scale). Red line at “Liberation Day” (April 2). Source: TradingEconomics accessed 21 May 2025 3pm CT.Is th

First obvious episode is in the wake of Liberation Day. The second is … ongoing.

Is there any wonder? Given how the fiscal plans are playing out, it would be surprising if there wasn’t some unrest.

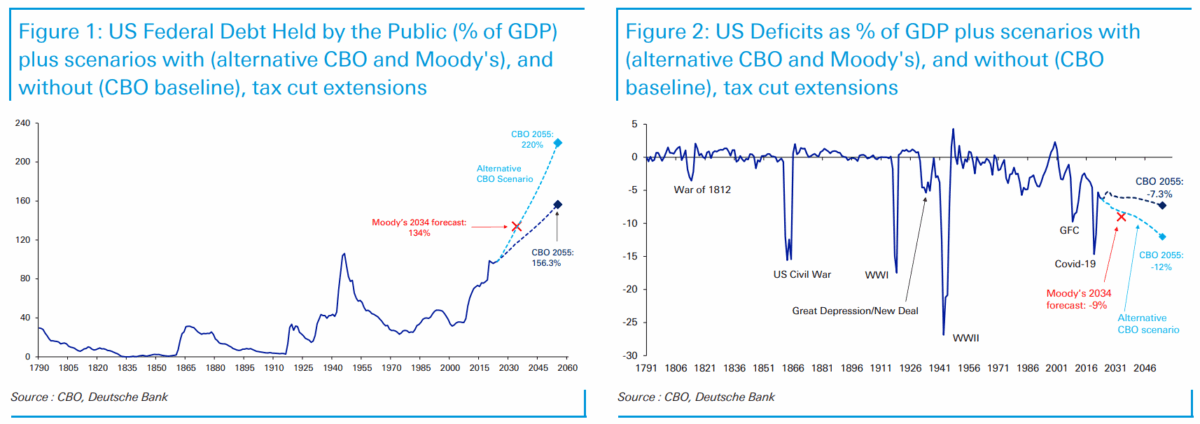

Source: Reid, CoTD, DeutscheBank, May 19, 2025.

Off topic – First this happened:

https://www.cnn.com/2025/05/20/middleeast/israel-gaza-west-bank-international-pressure-intl

The UK and EU are considering reducing trade ties with Israel and perhaps imposing sanctions. (Sure took their time about it.)

Then this happened:

https://www.cnn.com/2025/05/21/middleeast/diplomats-israeli-fire-west-bank-intl

Israeli soldiers fired weapons at European and Middle Eastern diplomats who were attempting to enter Jenin in the West Bank. Israel is giving Jenin a sort of “Gaza-lite” treatment, and doesn’t want anybody showing up to see what’s happening.

The timing is probably a coincidence?

What happens if safe-haven staus is eroded? Safe-haven status is not the only advantage to using the dollar as an international medium of exchange. The “medium of exchange” thingie is, in fact, a separate reason for holding dollars, though the two are closely related.

Having a reliable international medium of exchange – liquid, inexpensive, more or less universally excepted – lowers the cost of doing business. You can hold dollar-denominated assets but trade and borrow in other currencies, as many in the Eurozone do. Alternatively, you can trade and borrow in dollars but invest in non-dollar-denominated assets. That’s what we’re seeing hints of now. The dollar cannot be quickly replaced as a medium of exchange.

Of course, if you don’t hold assets in the same currency as you trade and borrow in, that’s already an additional expense. Also an additional risk, because exchange rates can go against you when you have to be in currency X next month, but you don’t save in currency X today.

Eventually, the expense and risk of convsersion reduces the incentive to trade and borrow in dollars. That’s the big step, the one that takes decades.

There is no other currency as well suited as the dollar to the international medium of exchange role. So instead of the dollar being supplanted by another currency, fragmentation of international finance might be the next step. That seems a more likely oucome if we continue to march toward fragmentation of international trade and – in divesting of dollar-denominated assets – of international investment.

We have long been lectured about how countries that trade with each other don’t go to war with each other. That’s clearly wrong, just on the geography. Nearness fosters trade and conflict.

I want to substitute a different truism, one that may actually be true: Fragmentation is expensive. The felon-in-chief’s tariffs are clearly evidence in favor of this truism. So was the Covid trade shutdown. So has been Brexit for the UK. MAGA and Amerika First are, at root, an urge toward separating “us” from “them”, toward fragmentation.

Don’t care for a neo-liberal system? Neither do I. The felon-in-chief’s alternative, however, seems likely to keep much of what’s wrong with neo-liberalism and shed what’s right. Fragmentation reduces the benefits of trade, adding expense by adding complexity. So smart.

No, its a grift. Them want to isolate “us”. So ” we” stop bothering them. Why can’t you get that???

Not sure:

1) What you mean

2) How what I said contradicts what you mean

3) What evidence you have that I don’t “get” whatever it is that you mean.

And I’m still pretty sure that fragmentation of economic and financial activity is expensive.

Krasnov has his orders. As a asset, his people do.have limitations in their ability to provide benefits. Isolation of the United States while China goes around the world taking over is humiliation.

a foreign treasury holder who used the dxy to hedge against currency swings is getting crushed right now. made that comment in a previous post as well. i see two things occurring right now. asset risk is getting repriced in the bond market-its a currency risk. and currency traders are getting worked up about usa inflation, monetary and fiscal policy. equity markets will need to be repriced if bond yields continue to increase. with tariffs, current p/e ratios are going to increase to unacceptable levels, based on risk compared to higher yielding bonds. probably need to retest those lows from a couple of weeks ago. going to be messy for a while.

the big beautiful bill is looking to lock in a bunch of spending cuts for the poor in order to give the wealthy a nice tax cut. and stick the country with the bill in a few years, when the felon in chief is out of office. seriously, is that the best maga republicans can do? screw themselves, only waiting a few years to actually do so? i think massey is a piece of crap, but he has some valid points in his dispute with trump.