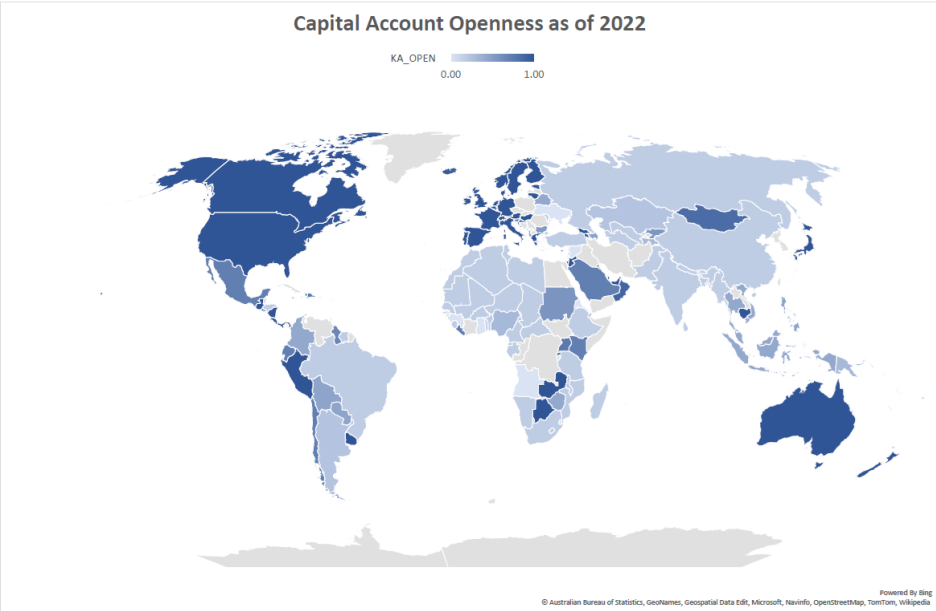

Just published, Chinn-Ito index, available here. Normalized to [0,1], with 1 being most open, here’s the world.

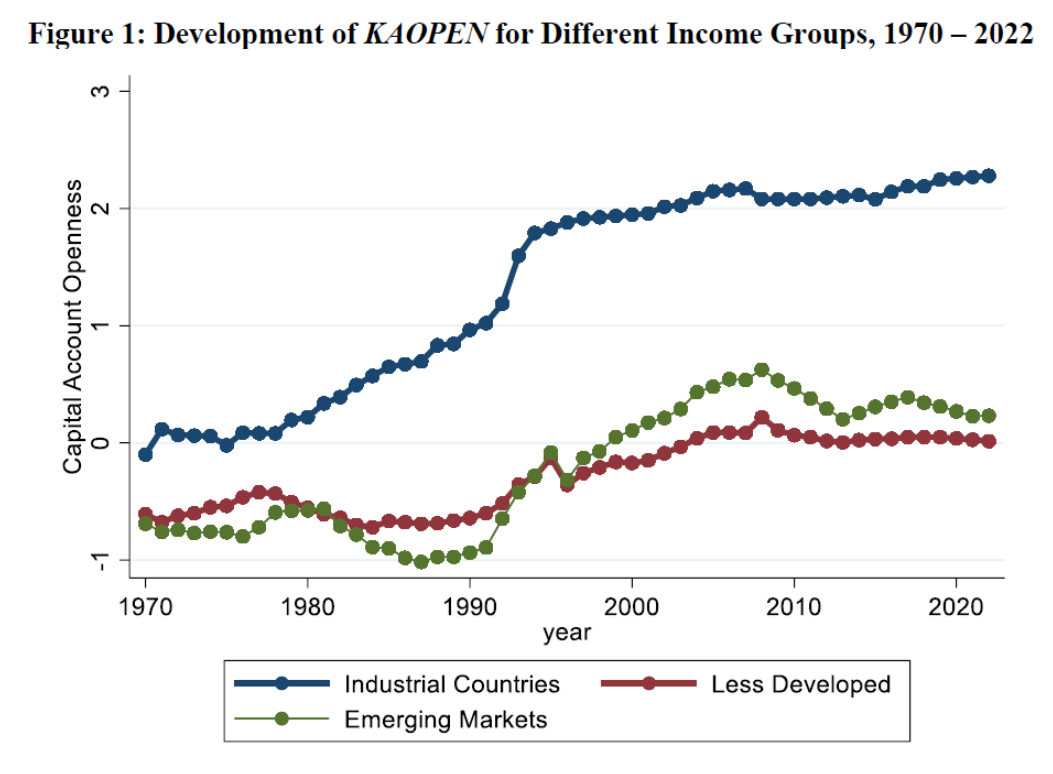

Here’re average values for country groupings.

The description of the current dataset is Ito and Chinn (2025).

Hiro Ito and I constructed the index because there were few, widely available and consistently updated measures of financial openness at the time, with the exception of Quinn’s (APSR, 1997) measure, which at the time was more limited in coverage. Individual dummy variables based on the IMF’s (old) de jure classification of controls (on exchange rates, export proceeds, capital account, current account) didn’t prove informative in one of my early empirical analyses of financial development (Chinn, 2004, ungated version here). The Chinn-Ito index, based on the aforementioned IMF de jure classifications, was converted into a single index using by taking the first principal component (essentially — the capital account component is smoothed), and was developed for a project to assess how financial openness correlates with financial development, published in JDE (2006) (with lots of help from friends, including Ashok Mody, Antu Panini Murshid).

Quinn, Schindler and Toyoda (IMF Econ Rev 2011) provide an early comparison of measures. More recent comparisons are in Graebner et al. (2021) and Erten et al. (2021). In the aggregate, the measures move together.

A bit off topic – On the issue of the loss of the dollar’s loss of status, Treasury International Capital Data can be useful. This is from the May 16 report, covering March data:

“In March, foreign residents increased their holdings of long-term U.S. securities by a net amount of $183.2 billion. Of this total, private foreign investors contributed $146.0 billion, while foreign official institutions accounted for $37.3 billion in net purchases.”

By the way, that increase came despite China shedding roughly $19 billion in dollar holdings. That’s not new for China, probably more reflective of efforts to diversify that to hurt the U.S. When their own exposure is much reduced, they may see themselves as in a better position to take a big, one-time whack.

A table of recent months’ data can be found at the bottom of the report:

https://home.treasury.gov/news/press-releases/sb0144

The next release is due June 18, covering April data. Should be interesting.

Remember that health insurance CEO who was gunned down for withholding medical care? Remind me – which company did he run?

https://www.theguardian.com/us-news/2025/may/21/unitedhealth-nursing-homes-payments-hospital-transfers

UnitedHealthCare paid nursing home staff to reduce costs by avoiding hospital visits for their clients. That included bullying old folk into signing “do not rescucitate” forms when they didn’t want to.

“It’s convenient that you die” as a business plan? Brian Thompson killed a bunch of people and then was killed. UHC remains a muderous organization.

Remember this?:

“Destroying Dollar Safe Haven Status at Breakneck Speed”

https://econbrowser.com/archives/2025/05/destroying-dollar-safe-haven-status-at-breakneck-speed

And this?:

“Macroduck May 21, 2025 at 12:33 pm

“The yield on Treasury bonds (30-year) is currently around 5.08%. That’s the highest on a closing basis since June 2007. Tens, meanwhile, are holding in the same range as in recent weeks – which also means at the highs since 2007…Evidently, holding long-dated Treasuries is seen as riskier now than in the past 15 years or so.”

Well now the folks at Marketplace Radio have caught on:

“The 30-year Treasury yield above 5% signals that investors see the U.S. as riskier proposition”

https://www.marketplace.org/story/2025/05/22/whats-going-on-with-the-30year-treasury-yield

By the time Public Radio catches on to something happening in the bond market, it’s really, really happening.