Recall CEA has asserted that imported goods prices (incl tariffs) have fallen relative to domestically produced, based on conjoining 2017 IO tables and PCE data. I wondered whether imported goods prices and prices of close substitutes have fallen. To investigate, I do something simpler: look at steel import prices (ex-tariffs) and steel PPI (incl. tariffs).

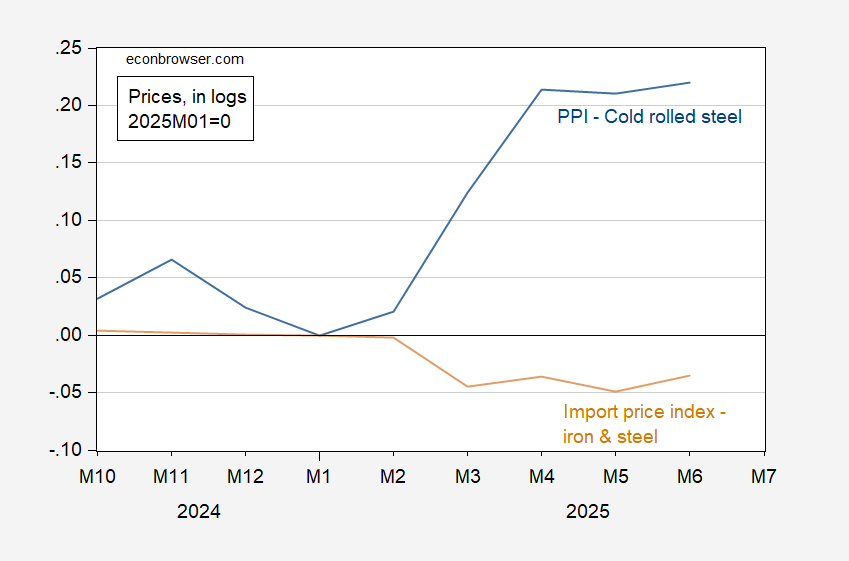

Figure 1: Import price index for iron and steel (tan), PPI for cold rolled steel (blue), both in logs 2025M01=0. Source: BLS, and author’s calculations.

Effective June 4, a 50% Section 232 tariff has been in effect, rising from the previous 25%. Since January 2025, the import price index has fallen 3.5%, while the steel/iron PPI has risen 22% (log terms). So as the 50% tariff comes into play, we should expect — on net — continued increases in the price of steel.

More discussion at NYT.

Given that we know $20-$25 billion a month is coming in to the Treasury on tariffs, and Ford is saying they took on over $1 billion in tariff costs in the most recent quarter, I don’t get how we aren’t seeing significant price increases for these goods. Your chart shows that foreign companies are having to take slightly lower prices, but it looks like businesses are eating quite a bit of the costs.

Not sure how that doesn’t translate into either big price increases being passed onto consumers for the rest of 2025, or shrunken profits and layoffs if consumers aren’t paying the higher prices.

I keep waiting for the logical completion of this cycle, and it’s not happening. So what’s the missing link in this equation?