That’s the title of a report by the Trump administration CEA earlier this month. It’s an interesting question whether this is the relevant question or not.

What the CEA analysis does is to use the 2017 Input-Output tables to determine what the final goods prices (in CPI or PCE deflator) do, taking into account the amount of imports used in each category. This seems like a reasonable way to proceed, until one thinks about how tariffs work. Consider the simplest case, where the US is a small country.

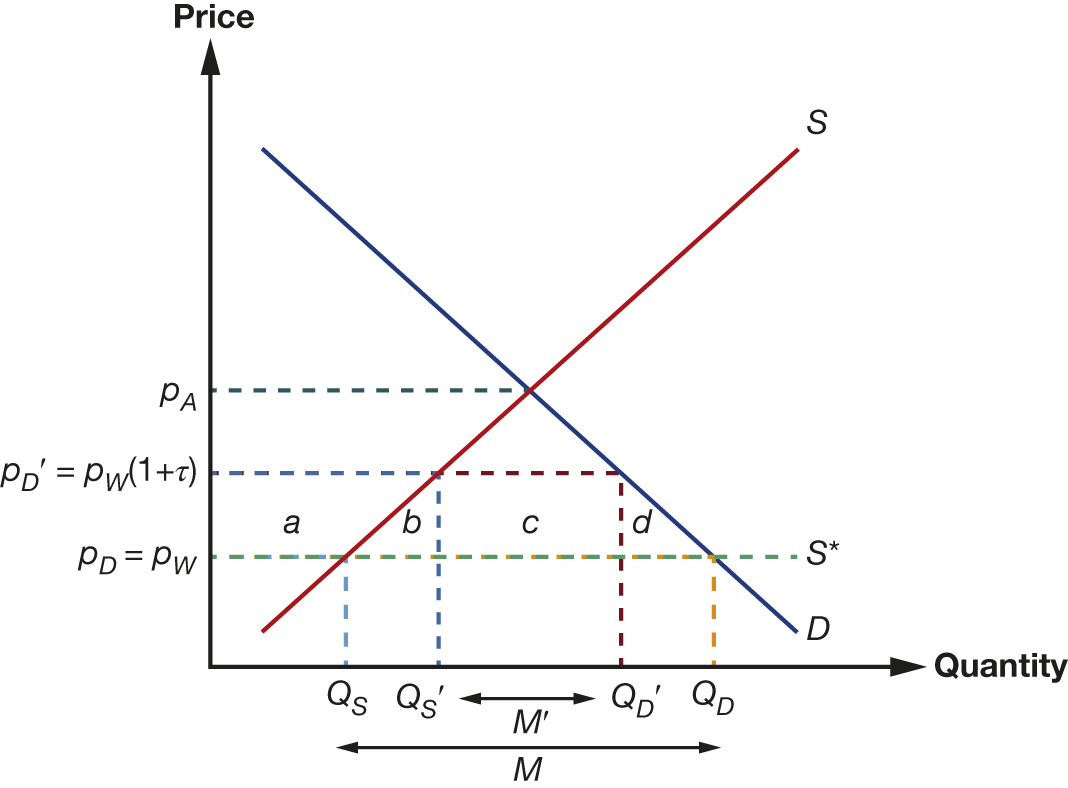

Source: Chinn and Irwin, International Economics (2025).

Then using the methodology of the Trump CEA, the importance of tariffs for final demand prices is denoted by M×(Pw(1+τ)-Pw.) [I hold import quantity at pre-tariff level M because CEA uses 2017 IO tables].

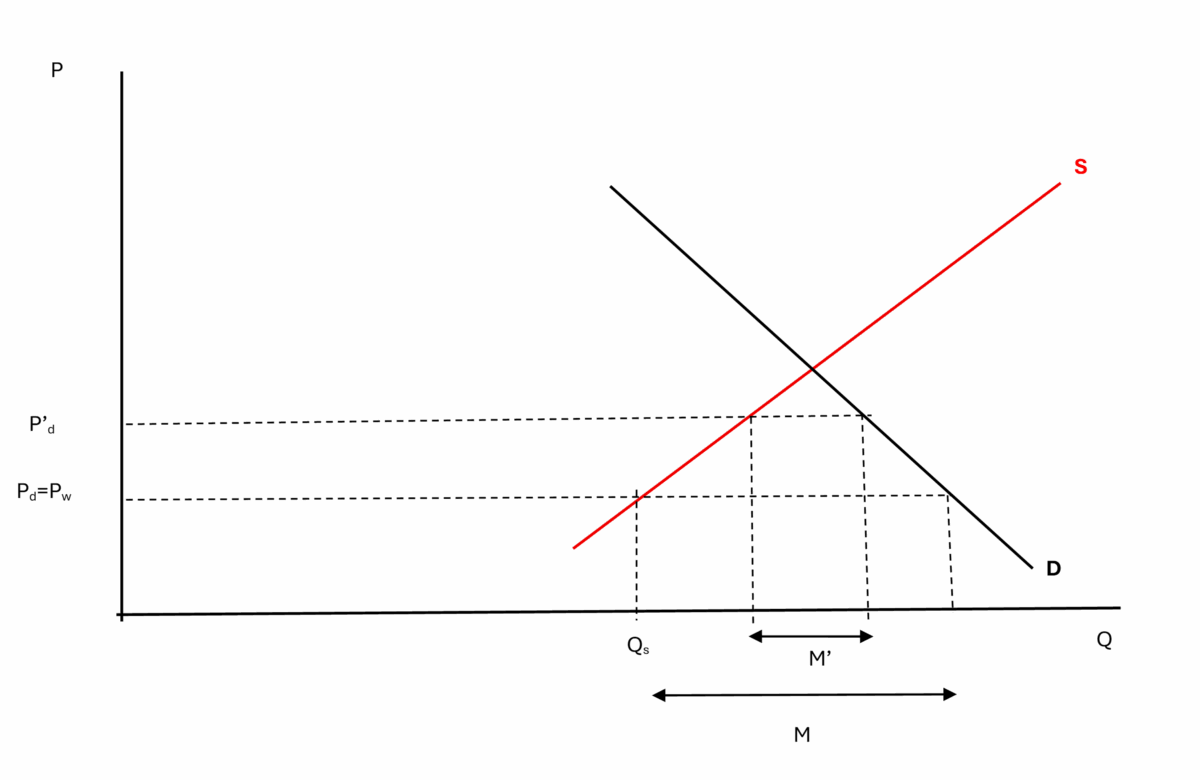

However, as is known from basic economics (like the kind one learns in first course econ in undergrad, or even high school), import competing domestic firms also raise their prices. Hence, the prices are raised for quantity M, as well as quantity Qs. In the figure above, this doesn’t change much. However, consider an alternative, where domestic production is much larger relative to imports:

Now, price increases apply to quantities 0 to Qs and M. In other words, a much larger share of final production. In other words, the CEA calculations are ignoring the presence of domestic alternatives. For some products (think coffee), there is virtually no domestic production. But for others, there are. Consider steel — Nucor raised their prices when tariffs were announced, even before they were implemented.

By the way, if the imported goods are durables, I would expect that domestic, import-competing firms would raise their prices before tariffed goods entered (recall, the universal 10% tariff was only implemented in April, and the CEA analysis applies to final prices through May).

The CEA report cites a Fed analysis which uses similar methodology to theirs. I will merely observe that in the case of imported Chinese goods, there are fewer import-competing domestic firms, so the preceding critique need not apply as forcefully.

Odd that CEA used 2017 I-O data. We’ve had 2024 data since September. Minton and Somale use 2022 data. Given the tendency of the felon-in-chief’s CEA to arrive at conclusions vastly different from those of unbiased researchers, I wonder whether they simply went shopping for a set of I-O data that supports the results they want.

After all, the structural changes inflicted by the felon’s first-term tariffs would not be fully reflected in 2017 I-O tables. We have reason to assume substantial changes in response to those tariffs.

The dollar has weakened by about 9.3% so far this year. That should have it’s own effect on import prices, with a lag. Given the normal lag, the effects should be measurable now and increasingly as Q3/4 go by, but not in Q1 or early Q2. The CEA’s claim is that there is no change in trend in the divergence between domestic and imported goods prices, which is contrary to the expected effect of dollar weakness. So the CEA is claiming that neither tariffs nor a weakening currency show up in their homegrown price data series. Perhaps there’s a problem with their data series.

Finally, we can check some accounts of prices of imported goods to see what’s happening to actual import prices, without data diddling from the felon-in-chief’s minions.

Flowers, up between $10 and $40 per arrangement:

https://www.yahoo.com/news/tariffs-impact-charlotte-flower-prices-205347936.html

Copper up about 30% from year ago:

https://tradingeconomics.com/commodity/copper

Remember when the felon yelled at Walmart for saying prices would go up due to tariffs? Especially things like toys, bananas and rose – which we mostly don’t make anymore:

https://www.nbcmiami.com/news/business/money-report/walmart-says-it-will-hike-some-prices-due-to-tariffs-heres-what-shoppers-may-pay-more-for/3615577/

Speaking of toy prices:

https://www.msn.com/en-us/money/companies/tariffs-leading-to-less-selection-higher-prices-for-holiday-shopping/ar-AA1IXfl7

My conclusion? Hassett is buttering his bread with the felon-in-chief, and doesn’t care at all whether the things he publishes have any credibility.

As the donaldtrump/JeffEpstein stories mount upon each other (pun intended) one wonders what headlines the Orange Abomination can create that would push aside a sometimes perverse American public’s hunger for pedo stories?? The only one I think that would do it is a military strike against his best buddy Putin.

Have a soothing Sunday night dinner everybody.

Um…well…yeah. I was about to ask if anyone else had noticed a bunch of saber rattling between the U.S. and Russia when I saw your comment. This kind of rattling:

https://www.newsweek.com/trump-zelensky-moscow-st-petersburg-putin-russia-strikes-2099034

https://www.foxnews.com/world/russia-says-nato-threatens-wwiii-latest-deterrence-plan-could-take-down-kaliningrad-faster-than-ever

https://www.thesun.co.uk/news/35930833/ukraine-drone-blitz-moscow-airspace-closed/

https://www.express.co.uk/news/world/2082545/nato-military-strike-kaliningrad-russia-ww3

Nothing su tle here. We are deep into “F#$@ You!!!” territory.

Maybe something to do with the economy?:

https://www.msn.com/en-us/money/markets/eu-targets-russia-with-toughest-sanctions-package-in-years/ar-AA1IQyGE

https://www.msn.com/en-gb/money/other/russia-economy-on-brink-of-recession-as-putin-pretends-everything-is-fine/ar-AA1IWHRN

Subtle is not something Donald does. Giving some of our best weapons to Ukraine would be a very cheep way to find out how they would do against current Russian defenses.