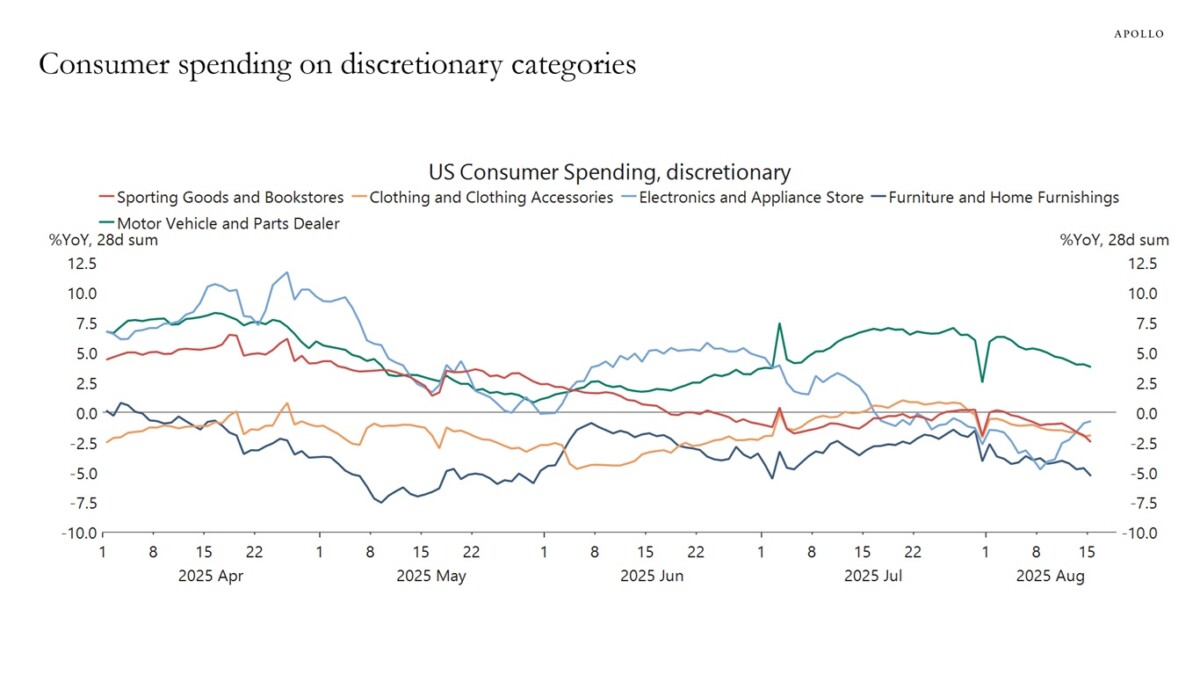

Torsten Slok provides this illuminating picture of discretionary spending (y/y), by category.

A year ago, I wrote about how the lack of clearly slowing discretionary spending failed to signal a slowdown. And indeed no recession followed. What would really be helpful now is the corresponding picture from Andreolli et al. (2024), updated.

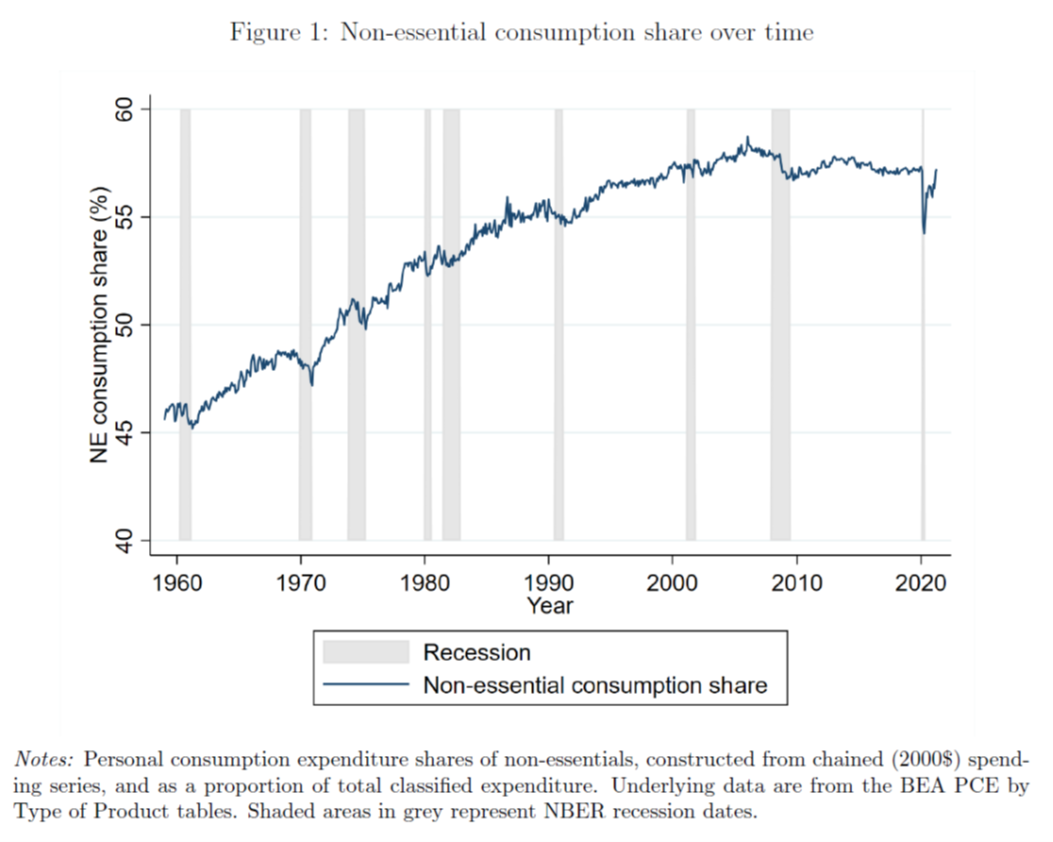

Source: Andreolli et al (2024).

The second figure, from Andreolli et al., suggests a change in behavior after the Great Recession. After decades of non-essentials making up a larger share of spending, that share flattened out after the crash.

What happened? Did spending shift away from Andreolli’s definition, or has the steady improvement in household income relative to essentials stopped?

Or mayb it’s a response to wealth. First step in my WAG, it looks like it has something to do with the savings rate:

https://fred.stlouisfed.org/series/PSAVERT

The decades-long slide in the personal savings rate accompanied the increasing share of non-essentials in household consumption. A massive decline in household wealth in the housing crash seems like a good reason to limit non-essential spending.

There was another big drop in wealth during the Fed’s latest tightening, mostly concentrated in financial assets rather than real ones. However, supply interruptions obviously made a mess of the non-essentials series during and after the Covid recession, so I’m not sure how much we can gleen from the behavior of the non-essentials series in the supply-squeeze period.

Oddly, demand for non-essentials doesn’t seem very responsive to the real median wage in the latter years of the pre-Covid expansion; the median real wage shot up while the non-essentials share held steady:

https://fred.stlouisfed.org/series/MEHOINUSA672N#

Anyhow, seems complicated to me. The observation by Andreolli et al. that distribution of jobs and income influence demand for non-essentials might make things less complicated, but I haven’t thought through how.

For what it’s worth, here’s a look at decompositions of retail spending by income, age group, education and housing status:

https://www.federalreserve.gov/econres/notes/feds-notes/a-better-way-of-understanding-the-u-s-consumer-decomposing-retail-spending-by-household-income-20241011.html

As the authors note, exhaustion of post-Covid-recession government transfers may account for reduced retail demand, with households at different income levels running through excess savings at different times – poor households first.

It has been widely observed that well-off households have done most of the shopping in this expansion. Maybe they’ve now run through their excess saving.

Households, in aggregate, hold less saving now than at the onset of the Covid recession:

https://fred.stlouisfed.org/graph/?g=1LOXh

The private sector as a whole holds vastly more saving now than at the onst of recession. That’s because business profits have been high, transfering savimgs from households to businesses.

Note that the two series are indexed to the beginning of the recession. In dollar terms business savimgs are vastly higher than those of households, contrary to old-fashioned economic deoctrine.

Maybe well off households have run out of things they want to buy and places to store those things once they are bought. Eventually, what else do you really need? I wouldn’t know, having never been in that position.