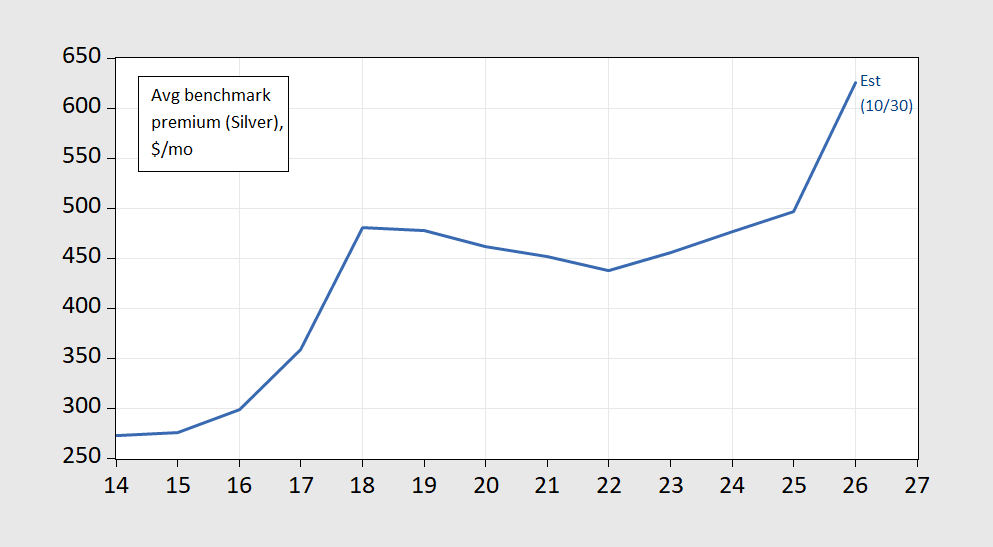

Data from Pew, for average marketplace benchmark plans, per month:

Figure 1: Average benchmark ACA premium (Silver plan, 40yr old), $/mo (blue). Note there is wide dispersion in plan premia given different states, demographics, income. Source: KFF, accessed 10/30/2025.

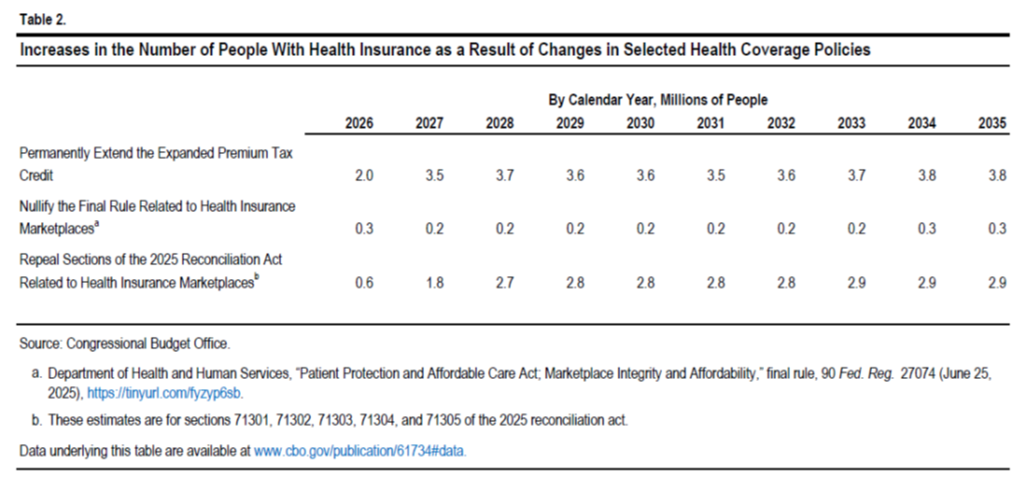

As noted in the CBO letter, in 2026 (2027), 2 (3.5) million more people would be covered by permanently extending the expanded premium tax credit, relative to not.

Source: CBO, 18 Sep 2025.

The cost of making the expanded tax credit permanent would cost about $350 bn over ten years. For comparison, making permanent the provisions of the TCJA cost about $4.6 trn over ten years.

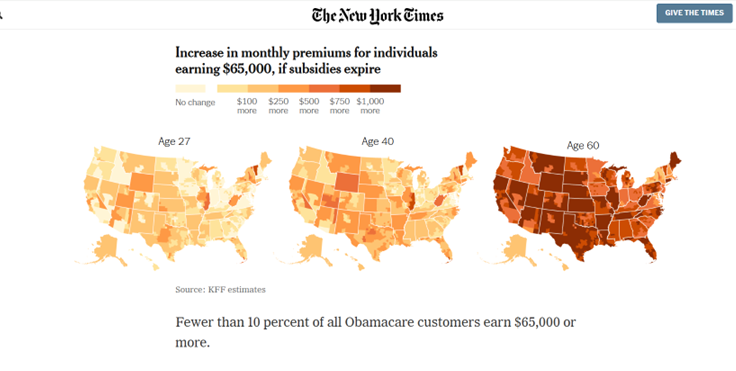

Heterogeneity of impacts is illustrated by this graphic from NYT based on Pew data:

Source: NYT, 30 Oct 25.

Part of the logic of Obamacare was that the insurance industry would have a much larger pool of insured individuals, thereby lowering the cost of insurance per person. Also, the incentive toward adverse selection, even after tampering by the Supreme Court, is reduced by subsidies. There is the potential for the eeduction in subsidies to increase costs for unsubsidized private health insurance.

I realize this sounds contrary to econ 101 – increased demand increases price – but that ignores market structure. Insurance is built on sharing of risk – the more widely share, the better.

stopping the snap funding is a bad thing. funding snap is a good thing.

same goes for ACA subsidies. what is wrong with keeping 40 million Americans on health insurance rolls?

why do these items need to be negotiated? why should democrats give something up to get what Americans deserve in the first place? these items should not be negotiated, they should be passed. these are not democratic priorities, they are American priorities. they need to be passed, not subject to some back room negotiation so that rich folks can get a further tax cut. republicans need to start doing the right thing here. no negotiation should be needed.