That’s today on Meet the Press. I agree that it doesn’t look like we’re in a recession now, given the limited amount of current economic data we have; nonetheless what little employment data we have is not that encouraging.

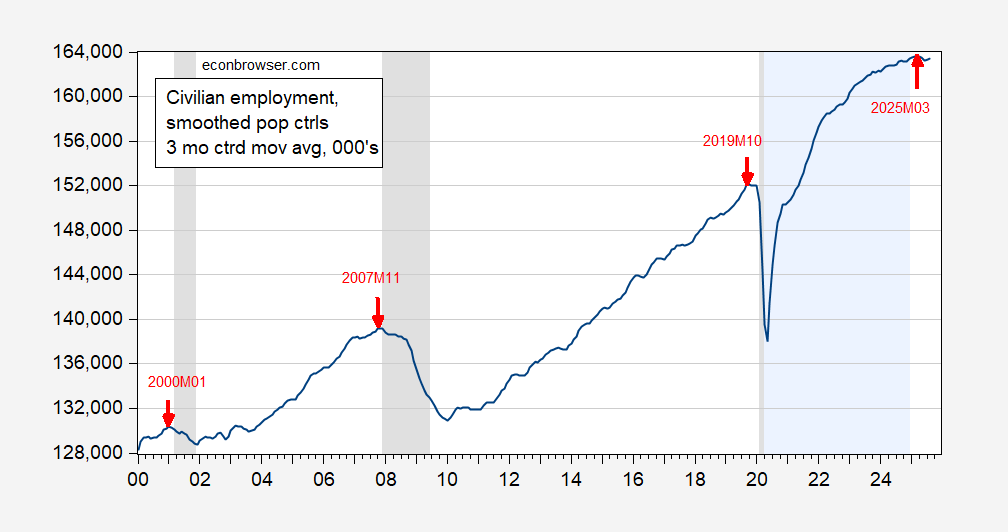

Figure 1: Three month centered moving average of civilian employment (blue), in 000’s on log scale. April 2020-December 2024 data is with smoothed population controls (period denoted by light shaded blue area). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, BLS, NBER and author’s calculations.

Note the local maxima are typically before a NBER defined peak (2000M01 precedes 2001M03, 2007M11 precedes 2007M12, 2019M10 precedes 2020M02).

While I warn people about relying on the civilian series for high frequency tracking, it is more useful looking at the implied trends – which is what I’m doing in Figure 1.

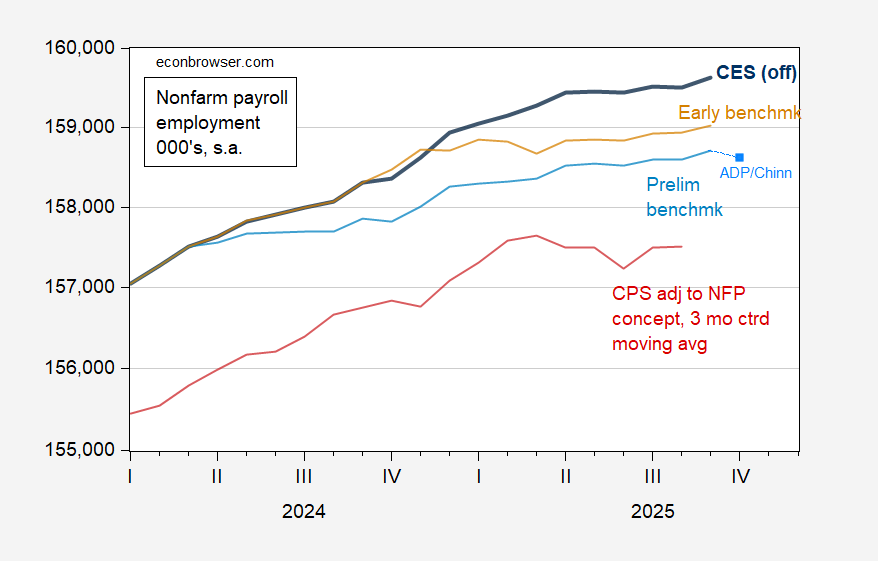

It’s also of interest to consider what the various versions of the CES numbers indicate:

Figure 2: Nonfarm payroll employment (official) (bold blue), implied preliminary benchmark revision, with April-September growth equal to official (light blue), Chinn estimate based on ADP data (sky blue square), Early benchmark revision, with extended benchmark growth equal to official (tan), and Current Population Survey civilian employment adjusted to NFP concept, using smoothed population controls, 3 month centered moving average (red), all in 000’s, on log scale. Source: BLS via FRED, BLS, Philadelphia Fed, and author’s calculations.

The methodology to estimate October NFP (implied preliminary benchmark) is described here, except I now use a regression over 2022-2025M09 data to predict 2025M10 private employment, add in 22K and subtract 150K (to account for deferred furlough program effects).

Bessent’s assertion is even more daring than Lazear’s 2001 claim. We’ll see.

Political appointees don’t admit to the possibility of recession while in power. To do so would be bananas!

https://time.com/archive/6853887/business-yes-we-have-no-bananas/

At least this time, Bessent’s dishonesty is conventional. Most of the time, he breaks new ground when lying, saying things earlier Treasury Secretaries wouldn’t be caught dead saying.

What i find interesting is the 30% drop in cryptocurrency- and noticed this morning that “Stablecoins could draw valuable retail deposits away from euro zone banks and any run on a coin could have widespread stability implications for the global financial system, the European Central Bank warned on Monday.” What??! I thought these were “stable”? Who coulda knew??

Remember when the GOP wanted to pass legislation for each state to have their own cryptocurrency? And I wanted to put all of Grandma Betty’s govt checks into “AlabamaCoin”

I read, I believe in “Seeking Alpha” over the weekend that the current Administration’s “anti-immigrants” policy, that about 2 million foreign workers have left the workforce, primarily self-departures, with about 600,000 arrests detentions and deportations this year, the result being that 2025 will see a net negative immigration addition to the U.S. working population. Since native born population has seen a “birth bust” since 2007-09 and the great financial crisis, the likely result even in an non-recessionary economy is that we may see very low and perhaps even negative employment numbers. https://www.atlantafed.org/cweo/workforce-currents/2025/11/05/will-tight-labor-markets-be-the-new-normal

So, going forward, very low job growth numbers may not be a sign of a recession, but rather the result of the Administration’s Mass Deportation and Incarceration policies and actions, policies and actions which are insane from an economic point of view, but give a thrill up the leg by those driven by both a “will to power” and a vision of a “pure”, e.g. White America.

Your reading wrong. There were bigger reductions in 2024 in immigration of 2 million immigrants. There is no demand for labor right now as unemployment as risen. its why your seeing self deportations. There is no jobs for them and too many came over from 2020-23. Mass deportations??? Please.

Your tone suggests a degree of assurance that your evidence doesn’t support. In other words, you sound like maybe a Dunning-Kruger kinda guy.

The error you’ve made, and that other commenters here have made, is to look at deportations as all there is to know about immigrant labor. There are better ways of assessing what’s going on with immigrant workers. Here, for instance, is the Labor Department’s series on foreign-born workers:

https://fred.stlouisfed.org/graph/?g=1O9sF

I’ve charted both level and change to get past the seasonal adjustment issue. We had been adding one to two million foreign-born workers each year in recent years, but have lost 822,000 since last September. That’s a swing of 1.8 to 2.8 million, not 600,000.

Aside from doing a poor job of thinking about the data, you have also done a poor job thinking about cause and effect. That is to say, you haven’t really thought about it; you’ve just decided that there is no scarcity of immigrant labor, without offering any evidence. You’re essentially claiming that a 1.8-2.8 million swing in the flow of immigrant labor has nothing to do with an aggressive effort to suppress immigrant labor, without even knowing how large the swing is. Not good enough.

Dismissing the other guy’s argument without actually addressing it may work great when sitting on a barstool, but you should try harder here.

a typical drive by Home Depot in the Houston area would often see 20-40 migrant workers looking for a day job. Now you see about 5 or so. Most are simply not willing to risk ICE. But the work is still needed in the area. It’s not like manual labor and landscaping suddenly stopped in houston. The demand is there, the workers are not. It is getting harder to get these tasks done over the past couple of months. this will become inflationary.

There are a good many ways if counting immigrant labor. Here’s one:

https://fred.stlouisfed.org/graph/?g=1O9xa

The BLS foreign born workers series shows a roughly 1.5 million drop, peak to trough, and 822,000 y/y in August. We know there are problems with this series. We also know that “undocumented” often means under-counted.

I won’t pretend that I have the correct number, but I’m quite sure Ernest has the wrong one.

well, if he continues to TACO his tariffs, then perhaps he will end up with a bump. the economy will improve if he comes out in early 2026 and says that tariffs are now off the table. and if he gets a drop in interest rates, that will be helpful on the growth side, although we will then live with the penalty of excess inflation for the next decade at least. but that is not trump’s problem.

the economy is growing primarily due to productivity increases, as employment is not growing. that is a risky growth profile. much ado is thrust upon AI as the reason for this productivity growth. I think some of it is true, as recent online interactions with bots, rather than human agents, have been much more efficient for me. but the result was simply a renewed sirius xm subscription at a reduced price. and this is not isolated, as I have done the same thing for several subscriptions recently. not sure if this is really long term profitable for companies. AI has uses, but not sure if justifies the productivity gains I have seen recently. my experience is that AI is still pretty dumb, although it would admirably replace some folks in the workforce, like bruce hall. but AI is still not very trustworthy, if you tried to use it to execute your own work. I have doubts and seem to be in the Michael Burry camp, that AI is in a bubble right now. it is creating alot of garbage, because the true cost to use it is being subsidized. but that will not continue for more than a year or two, tops.

Off topic – AI and interest rates:

https://www.wsj.com/finance/investing/flood-of-ai-bonds-adds-to-pressure-on-markets-88f17995

The timing of this article could have been better, given what stocks are up to today, but that doesn’t make the content any less true. What is not emphasized, perhaps because it is now widely known, is the extent to which debt issuance on behalf of AI companies is masked on those companies’ balance sheets through odd financial structures – leases that mask debt, but which carry the same obligations and risks as debt.

The WSJ is not the only one noticing this problem:

https://www.reuters.com/business/retail-consumer/doubleline-wary-ai-funding-wave-that-could-alter-us-high-grade-debt-market-2025-11-24/

The volume of new debt from AI issuers not just a problem for them, but for other issuers, as evidenced by widening aggregate spread measures:

https://fred.stlouisfed.org/graph/?g=1O8Em

Know who else has a problem with widening spreads? Private equity firms and their acquisitions. Corporate real estate bonds are harder to roll over, too.

And, just to tie in one more current issue, manufacturing firms attempting to retool in the face of high tariffs are competing with AI firms for financing. This piece makes the point about Canada’s pace of retooling, but this boosting domestic goods production is supposed to be the reason for tariffs, and higher borrowing costs are a direct impediment to “America first” retooling:

https://www.theglobeandmail.com/business/article-canada-corporate-debt-binge-businesses-seek-retool-trade-war/

There are no mass deportations. In 2024 total immigration fell by 2 million raw. This year, with the tribute system of illegal immigration, its fallen by 1.2 million when factoring new arrivals.Simply no demand for them(seeking alpha article missed that). Saw it in 2024 yet inflows were higher, showing the larger deportations in 2024. Its economics and normalization from a bubble. Next is the panic stage. So where is immigration contracting?? Construction and Services. Still growing in Manufacturing and flat in agricultural.

Secondly, the tariffs aren’t large enough to matter. Micro wise sure. But take autos. The business have fading demographics, loan debt issues and thus overcapacity. A tariff may make it harder, but Its not driving that bus down.

Thirdly, China removing subsidies is a be careful what you wish for. Its the reason by the crypto decline in recent weeks and will slow the world economy even more.

Ernest: FY 2024 (Oct 2023-Sep 2024) removals of noncitizens by ICE were 271K ( https://www.ice.gov/doclib/eoy/iceAnnualReportFY2024.pdf ), while ICE removals as reported on October 27 were 527K (self-reported FWIW ( https://www.dhs.gov/news/2025/10/27/dhs-removes-more-half-million-illegal-aliens-us ), presumably for the first 8 months of Trump. Pro-rating, one would get something on the order 750K. Seems to me that deportations/removals are up, even before self-deportations are counted.

That data is Ice removals official. Unofficial show large deportations in 2024 outstripping supply by more than this year.. Note, this was true from 2016-17 as well. My point?? If they are aren’t deported, they are kicked back on the street. This is why illegal immigration rose from 2017-19 from 11 million to 14 million. Many of these removals were “bogus” as well this year. Its why total deportations are the best meter. ICE is just inflating their totals to cover up the quotas.

“Note, this was true from 2016-17 as well.” Note? We can’t very well “note” because you haven’t provided a source. Nor have you explained why unofficial data (whatever they may be) are preferable to official data. Looks like you simply got caught misrepresenting the official data, so you suddenly like some other data better.

And let me repeat, for what I believe is the third time, that deportation numbers are not all there is to know about immigrant labor. You just keep trotting out the same numbers – getting them wrong in the process – and ignoring all the other evidence.

Also, here’s a suggestion: do some reading on what’s called “marginal analysis” in economics. You keep claiming that some number or some effect doesn’t matter, without any effort to explain why. Seems like you’re just dazzled by crude magnitudes, without ever thinking about how changes in magnitudes effect the economy. Then, we’re just supposed to believe that you have some special knowledge that others lack. AlI see is a guy who doesn’t know much, but claims to have all the answers.

Nothing this man says can be believed.

Way-the-heck off topic – an electoral politics ramble:

Marjory Taylor-Green is quitting the House as of January 5. Apparently, she wants to devote her time to becoming governor of Georgia. The holiday season is traditionally when incumbents announce that they won’t seek re-election, so maybe Marjorie is just getting ahead of the rush. And rumor is, there’s going to be a rush. I guess we’ll know soon.

Congress is in bad odor with the public, Republicans are tearing at Republicans, the mid-term curse seems likely to run strong next year, what with the felon-in-chief being so unpopular. The economy is not conducive to re-election for the party in power and Republican strategists are warning that Memorial Day is Republicans’ last chance to win back public approval.

The logic of mid-term retirement is strongest for swing-state politicians, which is one reason mid-term elections often result in a shift in the House majority. Johnson is hanging on to his speakership by a thread, so start chilling the bubbly!

Meanwhile, Jasmine Crockett has been hitting the talk shows so she can be asked whether she’s running for the Senate. Anybody unsure what that means? If she runs next year, 4-term Senator John Cornyn will be her opponent. Recently, Cornyn’s overall voter approval rating is 25%, disapproval 49%. Even among Republicans, his approval rating is only 47%. No wonder Crockett is eager to take a crack at him. Maybe he’ll avoid all that trouble and retire.

https://texaspolitics.utexas.edu/set/john-cornyn-job-approval-trend#overall

By the way, Texas is now only about 40% White, but both Senators are White guys and the House delegation looks like this:

https://www.govtrack.us/congress/members/TX#representatives

It’s understandable that a lower court has declared the latest effort at racial gerrymandering unconstitutional. It’s now up to the utterly partisan, corrupt, disreputable Supreme Court majority to decide whether to disenfranchise over half of the population of Texas. The decision could come any day, and almost certainly will come before December 8, when candidates must file election papers.

a few years ago, I noted on this blog that texas could realistically turn blue (or purple) over the next election cycle. I was a naive fool to believe that. the rest of America needs to take a hard look at what is happening in texas. it is being run like a banana republic, where voter disenfranchisement is now the expected norm. republicans are systematically altering the voting process in texas to intentionally reduce the democratic vote, especially in larger cities leaning democrat. the targeted language in the new laws is jarring. you have maga types sitting outside of voting sites with guns in a blatant effort to intimidate voters. you have early voting sites closed because, surprise, they have historically been democratic leaning sites.

people think its texas, just leave those idiots alone. but as texas goes, so does America. trump and republicans would not be in control if texas were a free voting state. it is not. and American democracy is compromised.

Hegseth, as Secretary of Defense, should take a little trip to US Military Academy at West Point to see the large bronze plaque bolted to the wall at Constitution Corner. It says:

Loyalty to the Constitution

The United States boldly broke with the ancient military custom of swearing loyalty to a leader. Article VI required that American officers thereafter swear loyalty to our basic law, the Constitution.

While many other nations have suffered military coups, the United States never has. Our American code of military obedience requires that, should orders and the law ever conflict, our officers must obey the law. Many other nations have adopted our principle of loyalty to the basic law.

This nation must have military leaders of principle and integrity so strong that their oaths to support and defend the Constitution will unfailingly govern their actions. The purpose of the United States Military Academy is to provide such leaders of character.

https://bsky.app/profile/jaimi.bsky.social/post/3m6ffozosrk23

I support Mark Kelly. I dare trump or hegseth to try and court martial him for his statement. I am confident that in spite of the maga fools in this country, the nation will overwhelmingly support Senator Kelly and his position. Anybody taking a stand against Senator Kelly is not following the Constitution.