November ADP data allows us to guesstimate nonfarm payroll employment, while the Fed’s data for industrial and manufacturing production in September gives us more of a reading on September. First, key indicators followed by te NBER’s Business Cycle Dating Committee (BCDC):

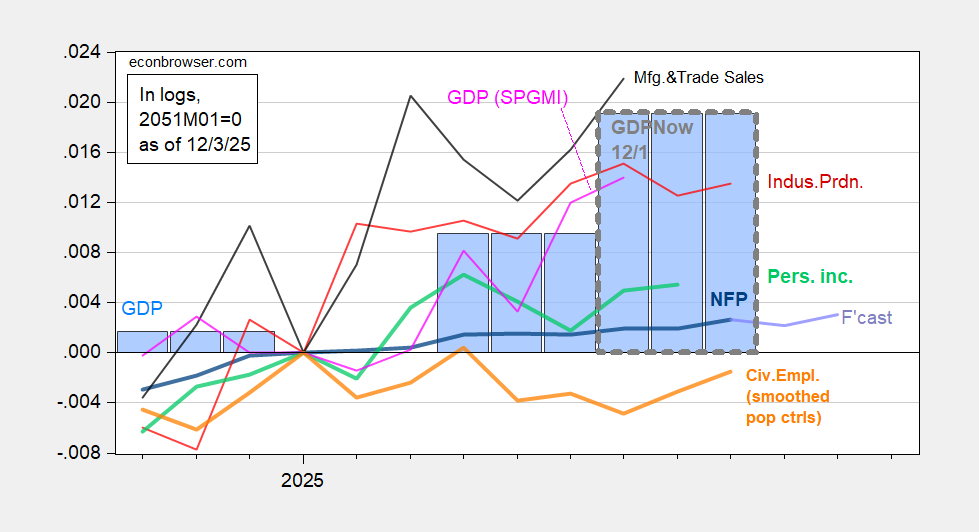

Figure 1: Implied NFP preliminary benchmark revision (bold blue), ADP based author’s estimate (light blue), Bloomberg consensus employment for implied preliminary benchmark, (blue square), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink),GDP (blue bars), GDP from GDPNow of 12/1 (blue bar, gray outline), all log normalized to 2025M04=0. Source: BLS, ADP, via FRED, Federal Reserve, BEA 2025Q2 third release, Atlanta Fed, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/2/2025 release), and author’s calculations.

NFP is estimated using a first differences interpolation of BLS series, adding 22K per month government employment (increase in September), subtracting 150K in October for the Deferred Furlough Program. Both measures of employment — establishment and household — are pretty flat and could easily be decreasing.

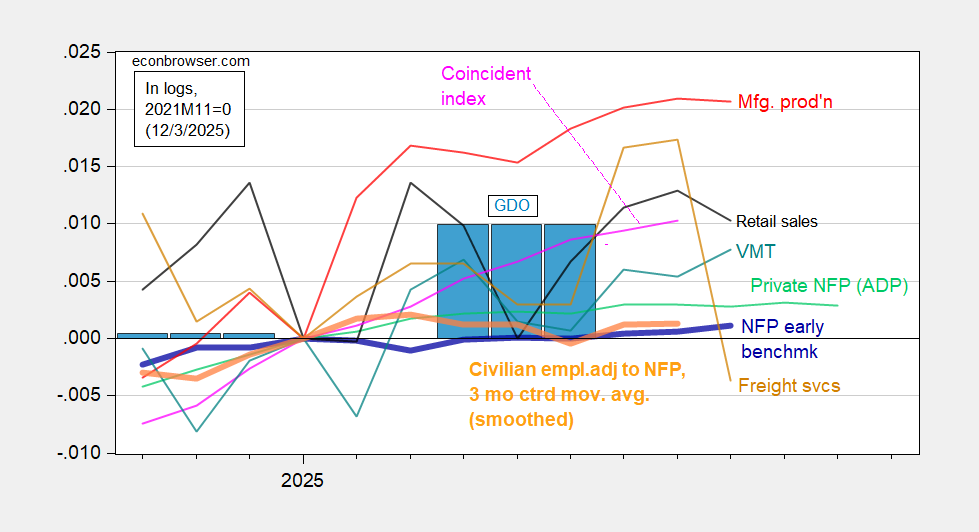

Now, alternative indicators suggested by various commentators are shown in Figure 2.

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), ADP private nonfarm payroll employment (green), real retail sales (black), vehicle miles traveled (tan), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: BLS, ADP,via FRED, Philadelphia Fed [1], Philadelphia Fed [2], Bureau of Transportation Statistics, Federal Reserve via FRED, BEA 2025Q2 third release, and author’s calculations.

Industrial production rose slightly, while manufacturing production fell slightly. Real retail sales are down, while freight services are way down (hence, the “freight recession”).

All these indicators will be revised over time, with GDP being the “most” revised (hence, why the BCDC places less weight on GDP).

Even Bessent is smart enough to know that the law requires certain conditions be met in order to impose non-IEEPA tariffs. Heck, it’s the fact that IEEPA requirements weren’t met which led to the case bow before the Court. Bessent is jawboning the Court. He’s saying “Don’t bother upholding the law. We’re going toget the result we want, no matter how you rule.” If the Court requires that the law be followed under IEEPA, it’s likely to require that the law be followed for all tariffs.

The standard implied by Bessent’s lobbying is narrowly focused on outcomes, as opposed to the rule of law. This Court ruled that Presidents cannot be prosecuted for violating the law while performing presidential duties. It is now up to the Court to keep the felon-in-chief from violating the law.

Law? What law. They just ignored the Civil Rights Act to come up with a partisan hack decision on gerrymandering in Texas. What do you suppose they will say about counterefforts in other states?