I haven’t been following the development of stablecoins, both before and after the signing into law of the so-called “GENIUS Act”, so I found this paper a must-read: “Stablecoins: A Revolutionary Payment Technology with Financial Risks”, by Rashad Ahmed, James A. Clouse, Fabio Natalucci, Alessandro Rebucci & Geyue Sun, NBER Working Paper No 34475. [ungated version]

The GENIUS Act, recently signed into law, establishes a dual federal and state regulatory framework for stablecoins, effectively segmenting the USD stablecoin market into GENIUS-compliant stablecoins and those that are not. This paper discusses the use cases and potential benefits of stablecoins in terms of payment system efficiency and costs, as well as their substitutability with money market mutual funds and bank deposits. It then analyzes the financial stability risks associated with both GENIUS-compliant and unregulated stablecoins using empirical analysis and historical case studies. It concludes by discussing the economic implications of the emergence of a large dollar stablecoin ecosystem. The discussion is supported by a new survey of expert opinions canvassed through Large Language Model (LLM) analysis of all U.S. podcast episodes on stablecoins from January 20 to July 17, 2025.

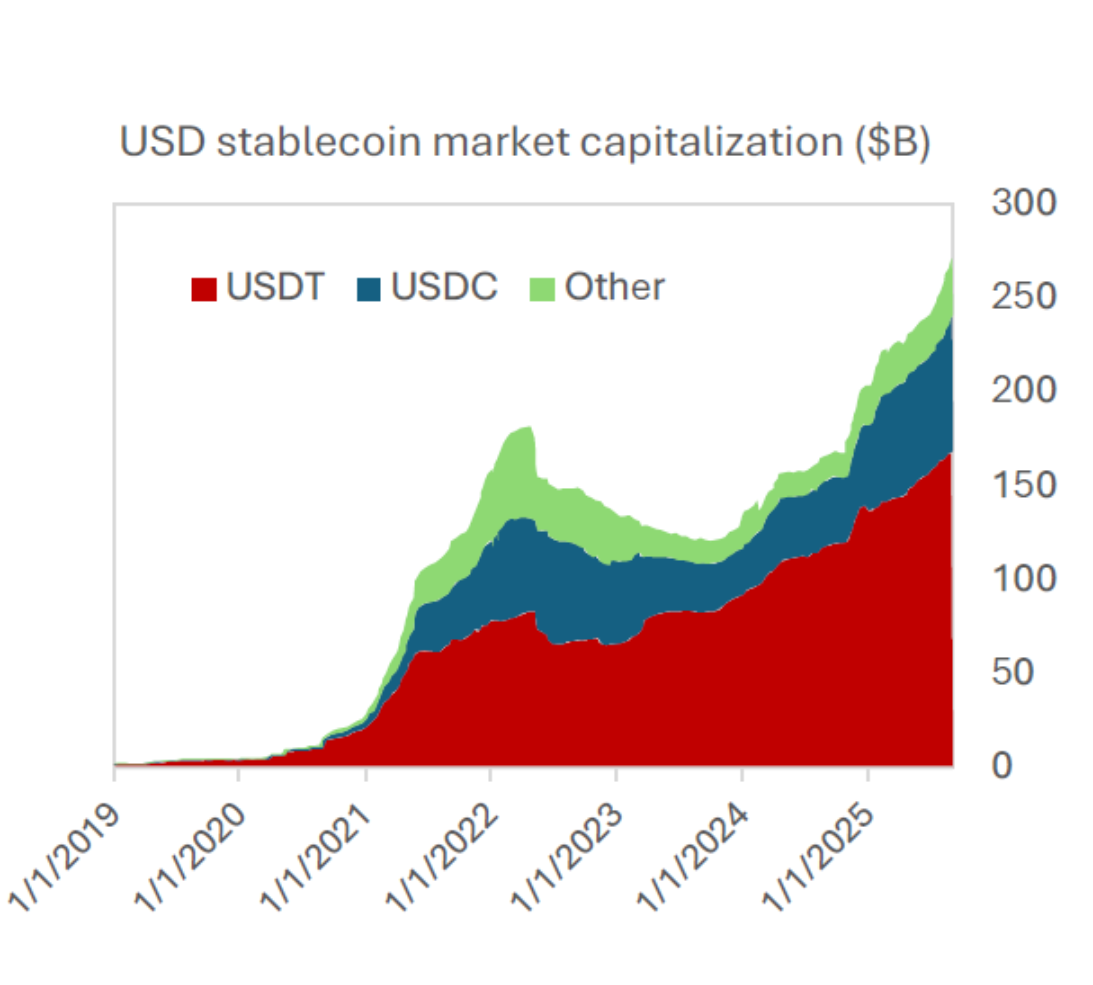

Here’s a picture of stablecoin capitalization:

Notes: The left-panel plots the market capitalization of USD-pegged stablecoins. USDT and USDC are the tickers of stablecoins issued by Tether and Circle, respectively. ‘Other’ includes ten other USD stablecoins (TUSD, BUSD, FDUSD, PYUSD, RLUSD, DAI, FRAX, UST, USDE, USDS).

Source: Ahmed et al. (2025).

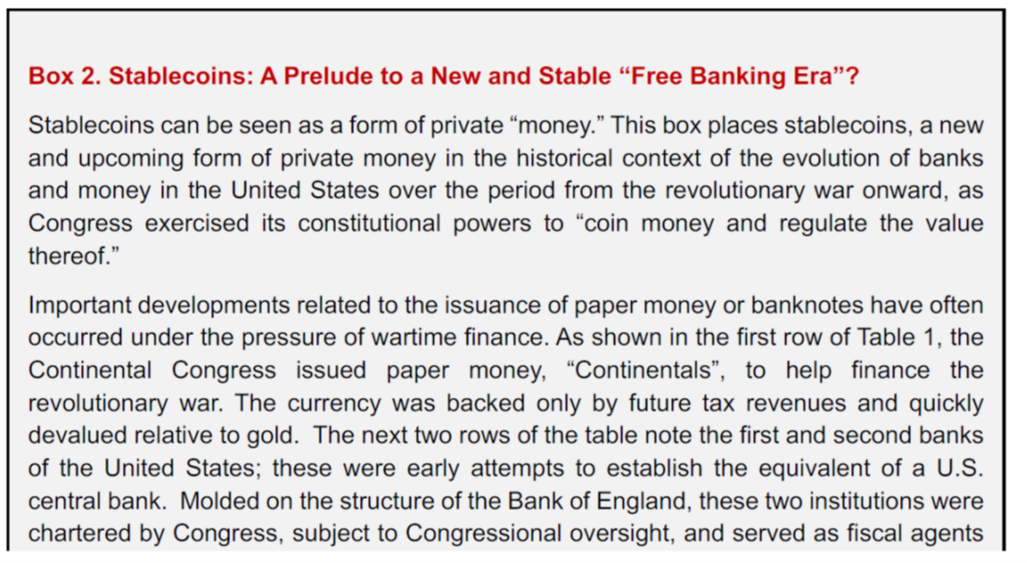

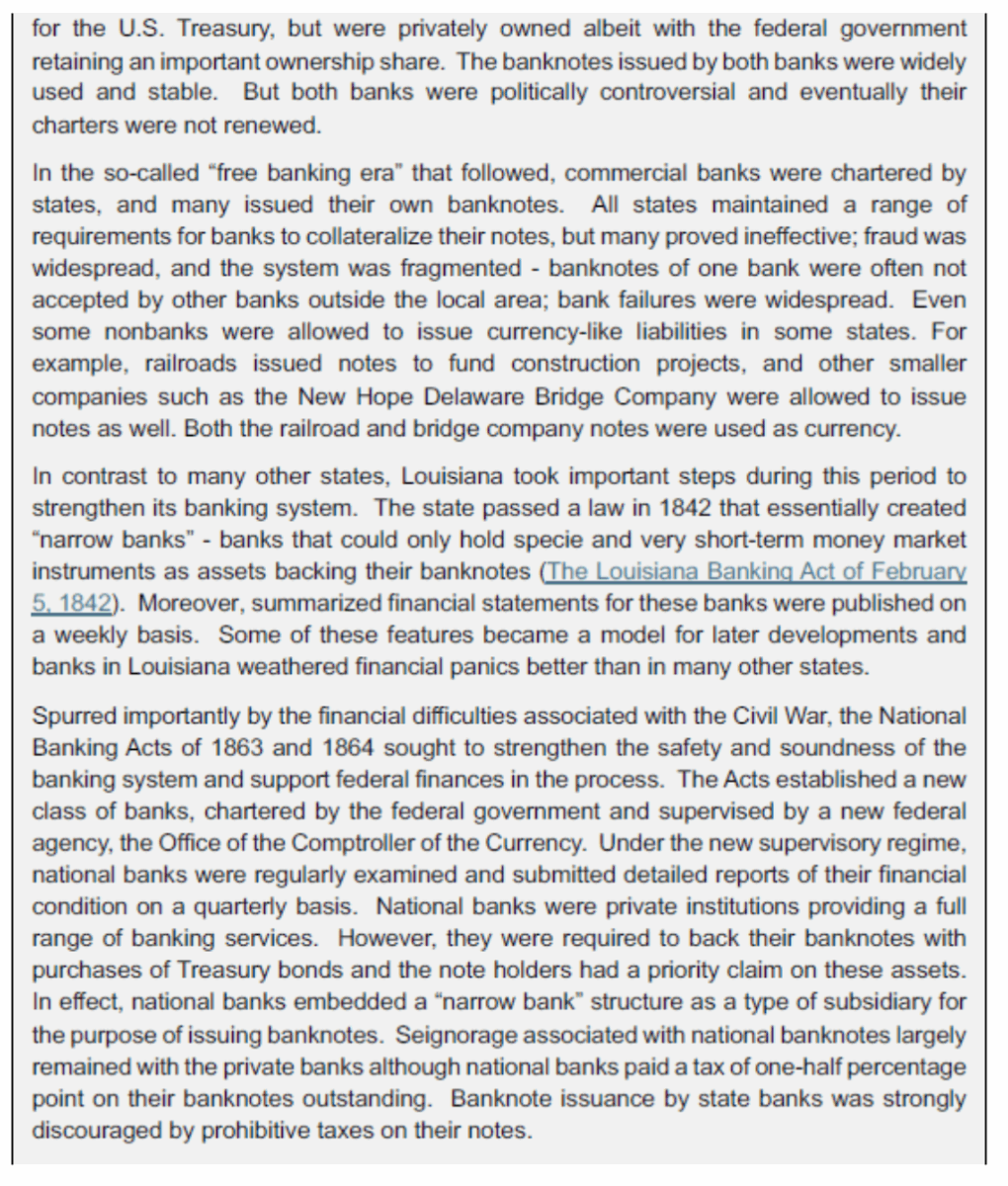

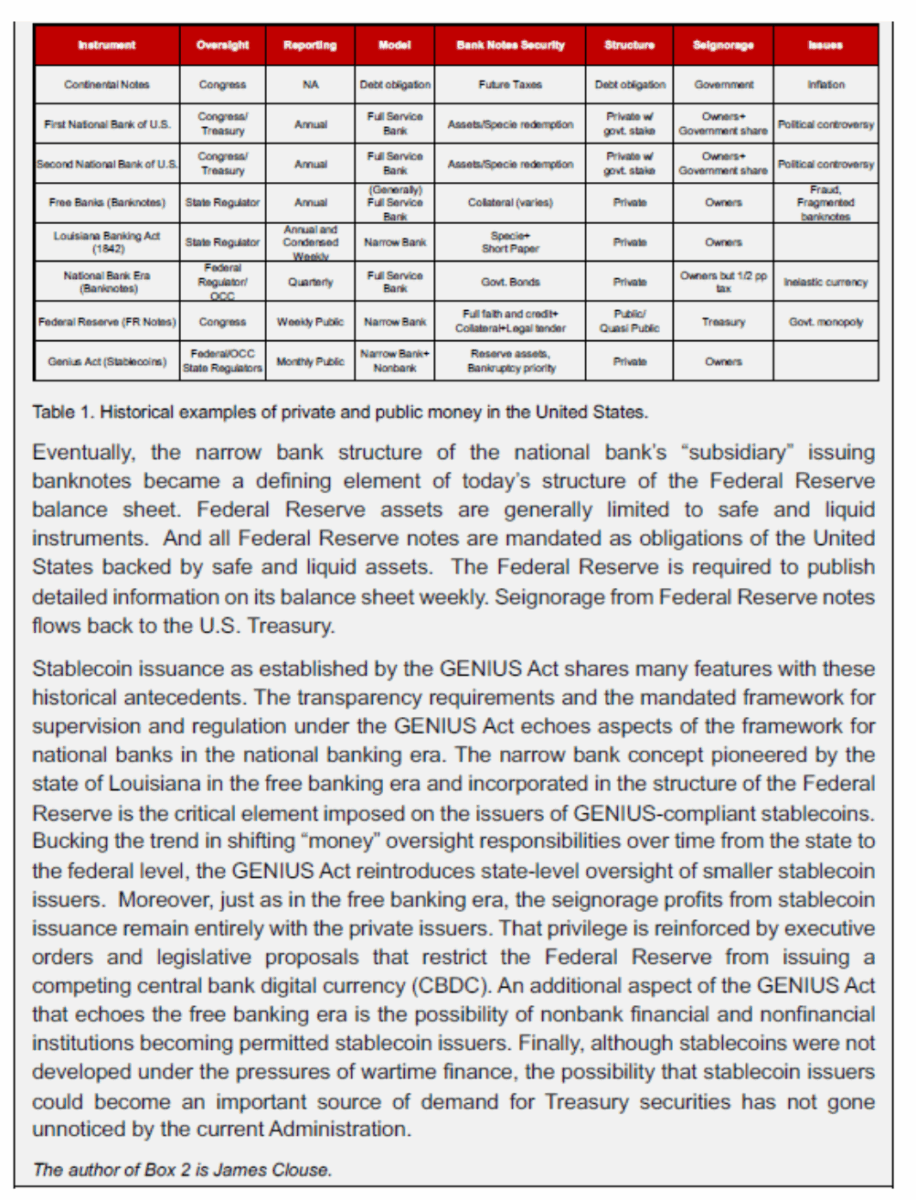

The paper is quite balanced in its assessment of the pluses and minuses of stablecoins. What I thought, when I first heard of stablecoins, was the question: “haven’t we been here before?” Sounds like free banking … and indeed, the paper has this box:

See more on free banking Sanches (2016). A much more optimistic view on free banking is provided by Watts (2025) [link fixed 12/8].

I have not seen compelling evidence to encourage the development of stable coins outside of the treasury. if it is not a stable coin, perhaps there is a business model to be allowed. but as far as stable coins go, by definition they should act as cash with better digital processing powers. a stable coin that is profitable for the issuer is probably not a stable coin, in the way the market expects. it has risks greater than that of a treasury. a crypto coin is not a stable coin.

It’s just more crypto funny money. When the finance industry comes up with an innovation, you can be pretty well assured that it is a way to create and profit from friction in the market. No more, no less. Why would a stablecoin be any different?

Looks like bo5h links are to Sanchez. No Watts.

Macroduck: Thanks! Link now fixed.

stablecoin to buy a cup of coffee isn’t the end game. payment rails are evolving as fast as tech. this is a good post about what internet native settlement (powered by stablecoins) can do

https://blog.cloudflare.com/x402/

the question is, should stablecoins be run and regulated by the private sector? or should government run them or provide significant oversight? since it is a digital replacement for money, not sure that the private sector risk should be transferred to a “stable coin”.

I worked for the FOMC trading desk. Was President and CEO of Salomon Brothers Intl and initiated interest rate swaps in 1981. The encapsulation of stable coins as “evolutionary” rather than “revolutionary” is key for the analysis! That being said, the underlying factors engendering the development was technological! The blockchain in this case. Ergo Stablecoins is just the next iteration. Think of quantum computing effecting SC’s. More if you wish

Mr. Slater,

I, for one, would welcome more i fnformation. I make one request – write entirely for the uninitiated. It’s easy for readers to assume they know what insider language means, and to miss the real point.

Does your interest in crypto-currency mean you’ve put down the hammer and chisels?

Another way to look at stablecoins is that they are equivalent to unregulated money market funds.,

Without interest accrual? With no greater interest than is paid by money markers?

So there is an argument for blockchain technology as a payment system. Do households need blockchain for payments? If not, then we should be wary of any persin or group pushing blockchain activity for households.

If stable coins are like unregulated money market instruments, but have no legitimate advantage over money funds, then we should be wary if anyone pushing stable coins for households.

And so on, down the list. The push for hpuseholds to invest in various financial tech thingies sounds a lot like the pitch for patent medicines out of the back of a wagon – good for lumbago, sciatica, flat feet, shingles, dropsy, the vapors, moles, warts, loss of appetite…

If financial tech innovations are good for legitimate business transactions, but not otherwise, then leave household investors alone.

The worrisome point is stable coin issuers becoming part of the Treasury market infrastructure. What happens when there are nothing but stable coins somewhere in the Treasury ether sphere instead of FRN electronic payments? Will my SS payments be in stable coin? What about my IRS refund? What happens when the value fluctuates to the downside or the upside? What happens if the value of one issuer’s stable coin goes to zero? Who takes the loss?

Somehow this will turnout to be a backdoor way of looting the Treasury and leaving the rest of us with nothing but digitalized madness.

That was essentially my point. these need to be zero risk (or treasury level risk) items, as they act as money. not sure there is much profitability there. so if somebody is making a profit, it is either friction or misplaced risk. not against digital currency, but this needs to be addressed.