In my post on the dollar’s trajectory, one person asked about purchasing power parity (PPP). Here is a brief discussion of the relevance of this concept to exchange rate forecasts.

An unsophisticated way of thinking about the way the exchange rate is determined to think about what must be true about prices of goods expressed in a common currency. Consider about two identical widgets, one in Japan, one in the US. From an American’s perspective s/he can sell it in the US for let’s say $100, or in Japan. Suppose the exchange rate, S, is 0.01 $/¥ (i.e., 100 ¥/$). Then the American could ship it to Japan, and (assuming no transportation costs, tariffs, etc.) sell it for

PiUS/S ==> 100 {$/widget} / 0.01 {$/Yen} = 10,000 {Yen/widget}

(where i pertains to the i-th good, US refers to US and JP to Japan) Now consider the Japanese widget. If it’s selling for more than Yen 10,000 (let’s say Yen 12,000), then the Japanese producer will be undercut by the US producer, who could sell it for Yen 11,999, and make a hefty profit relative to what s/he could in the US. Consequently the Japanese producer will be forced to drop his/her price. (If the Japanese price is less than the US, then the reverse would occur.) Now consider if there are many widgets in each country. Then the US producer would start shipping lots to Japan, driving down Japanese prices, and driving up US prices (as the supply of widgets in the US declines). This process is called arbitrage. Eventually prices (after adjustment by the exchange rate) would equalize. This suggests the following equality:

(1) PiUS = SxPiJP

Suppose (1) this is true for all goods, and (2) the basket of goods in the US is the same as the basket of goods in Japan. This then implies the following:

(2) S = PUS/PJP

This expression is called “absolute purchasing power parity”. If this relationship holds only up to a constant proportion, (1+psi) (i.e., prices in common currency are higher by psi percent), then that is called “relative purchasing power parity”. An example is:

(3) PUS = (1+psi) x S x PJP

Here the price level in the US is psi percent higher than those in Japan after converting Japanese prices into dollar terms by way of the exchange rate.

One can think about a lot of reasons why this process might not happen completely, or very fast.

(i) First, transportation is costly for a lot of bulky or massive commodities.

(ii) Second, tariffs and other trade restrictions still exist.

(iii) Third, laws, regulations, and standards (health, safety, consumer protection) differ a lot between countries, so commodities or services may have to be altered in order to cross borders.

(iv) Fourth, and perhaps most importantly more macroeconomic issues, prices may be sticky. This condition may arise because firms don’t like changing prices all the time, or because workers don’t like changing wages continuously. This will lead to some “stickiness” in prices (in the latter case because prices depend on wages). Hence, one should not expect this equality in prices expressed in a common currency to hold every instant.

Reasons (i) through (iv) mean that absolute PPP is unlikely to hold even over long stretches of time. If reason (iv) is relevant, then even relative PPP is unlikely to hold in the short run.

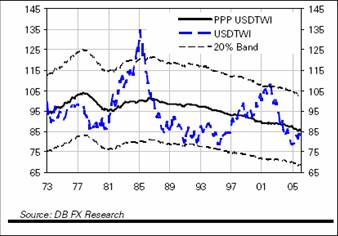

What does relative PPP imply for the dollar? In the figure below reproduced from Deutsche Bank, the relative PPP for the US trade weighted dollar is shown, along with the plus/minus 20 percent band.

Source: DB Exchange Rate Perspectives, March 2006.

What is clear from this figure is that deviations from relative PPP can be large and persistent. A popular estimate for the half-life of a deviation from relative PPP is three to five years (Rogoff, Journal of Economic Literature, 1996). This is why relative PPP is not often used for short forecast horizon predictions of exchange rate. (A paper by Cheung and Chinn (JIMF, 2001) documents the disdain that forex traders have for PPP as a forecasting device). For more on PPP, see Taylor and Taylor, “The PPP debate”.

Technorati Tags: exchange rate,

purchasing power parity

I used to make my living forecasting exchange rates. I found PPP to be very helpful. Back in 1994 I predicted the Mexican peso devaluation six months before the event. The convincing factors were watching some Mexican friends visit us in New York and go shopping-they said the savings were enough to pay for the trip. We also visited Mexico and the local prices-in dollar terms-were very expensive. It was obvious the peso was over-valued. So it was just a matter of time.

PPP is helpful in working with annual budgets, longer term financial planning,etc. It’s of no use to a foreign exchange trader. For those folks a long-term investment is a three-day weekend.

Hey, what’s this? A PPP discussion without the Economist Magazine’s Big Mac Index? Surely amongst all those equations on PPP you could have worked in at least a minimal reference to those soggy unappetizing bundles of fat, carbohydrates, and salt.

Why the qualifier “unsophisticated”?

I found it fascinating that in the graph, it is not obvious that there is a large overvaluation of the dollar. This is in contrast with the widely held belief that the reduction of the US current account deficit requires a large depreciation of the USD. How does one reconcile these two perspectives?

And, where does the high US productivity growth fit into the story? If US productivity growth is strong, this means that at the old exchange rate and at the old price level, the US is able to export more. So if the PPP apparently shows no depreciation of the USD, there should still be a large trade surplus. But we know that the opposite happened.

The lead article in the latest issue of the Journal of Economic Dynamics and Control by Mahmoud El-Gamal shows that using a nonlinear adjustment mechanism rather than the usual linear one substantially improves the record of PPP as a determinant of forex rates. I am at the conference of the Society for Nonlinear Dynamics and Econometrics at Washington University in St. Louis, and several papers presented here make somewhat similar arguments, although clearly there are still some serious lags in the reversion to PPP.

Jim Miller: I agree that relative PPP can be useful; I used it to assess overvaluation in the period before the East Asian crisis in this paper.

T.R. Elliot: I think MacParity has been done to death. On the other hand, the more subtle implications of MacParity (what determines the rate of reversion) is interesting — see Parsley and Wei.

venky: Unsophisticated because it’s essentially a parity condition, rather than a model per se.

Ajay: Being near PPP doesn’t rule out movement away in short to medium term. One way of putting things is that relative PPP is a weak attractor. Productivity has an impact in different ways depending on how the exchange rate is modeled. For one example, where faster productivity growth appreciates the equilibrium exchange rate, see this paper.

Barkley Rosser: Thanks for the reference. There is a by now very large literature on nonlinear dynamics and PPP. Some of the earliest papers include Alan Taylor and Maurice Obstfeld’s work using threshold autoregression. Lucio Sarno and Mark P. Taylor have also had a series of papers using smooth threshold autoregression models (here’s one). Despite the evidence that such specifications might outpredict a random walk, I think the jury is still out, until an exhaustive cross-currency, multiple sample period, study is undertaken.

Au but “The gold is in the ground.” Samual Adams

The gold is in the productivity and the value of the gold is in the sell of the produce. That is market economic.

what`s the significance of absolute and relative ppp to undeveloped countries