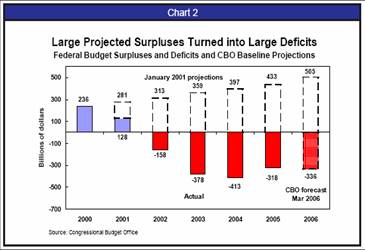

What if we had not cut taxes for the richest and increased discretionary spending faster than the rate of inflation?

This diagram shows what could have been.

Source: Joint Economic Committee, “We’ll be forever in their debt.”

Before people start bringing up recession (which is long over) and GWOT, note the Congressional Research Service, in a report based upon CBO data, concluded that of the 3.7 percentage points of GDP deterioration in the standardized budget balance between FY2000 and FY2004, 2.8 percentage points were accounted for by a reduction in (standardized) receipts, and 1.1 percentage points by quasi-standardized policy changes in spending. Perhaps old news, but useful to remember when you hear various pundits babble about increased revenues from tax cuts.

Technorati Tags: budget deficits,

full employment budget surplus, and

tax cuts

According to the report you linked, the “actual budget balance” changed 6.0 percentage points and the “standardized budget” changed 3.7 percentage points. The 2.8 percentage points of change due to “tax cuts” composes 45% of the 6-point actual budget change, not the 3.7-point standardized budget change.

Be careful whom you accuse of “babbling.” She might actually follow your link.

Include tax receipts FY2005 & FY2006 into your analysis. You will hear alot more from those “various pundits babble about increased revenues from tax cuts”.

I’ve posted a similar comment before — you should really discuss such critiques in terms of % of GDP. The nominal dicsussion is misleading.

Also, citing a CRS report from March 2005? That’s terribly dated, particularly given the 2005 record of tax receipts.

And, most importantly, it is only fair to note that whenever citing JEC reports, you should note which staff produced the report. The report you cited is from the minority (D) staff. JEC is not nonpartisan like CBO and JCT.

This JEC report is quite informative. You’ve highlighted the main point quite ably leaving it to this Angrybear to pick up the other yummy morsels offerred by the JEC report.

RD,

If we were comparing outcomes in two different periods, adjusting against GDP (and inflation) would be critical. What is offered here, though is two sets of outcomes, one projected surpluses, the other projected (and actual) deficits. The point is clear, and not at all misleading, regardless of whether one adjusts for growth and inflation.

It is true that, in this world, one must keep the source of projections in mind. If memory serves, the CBO has come to similar conclusions regarding the budgetary impact of tax policy and non-defense spending on the budget balance, though the magnitudes may be different. It is honest to call attention to sources of analysis. It is also honest to recognize when conclusions from sources that can be seen as suspect are supported by conclusions from sources that are presumed to be virtuous.

A budgetary counterfactual

A terse analysis of the results of tax cuts and spending hikes.

Anonymous —

Not quite. “Chart 2” from the JEC report uses the 2001 CBO baseline forecasts AND the actual budget numbers from the historical record. GDP in the 2001 baseline forecast (year by year) is different than the year by year record of GDP (GDP was higher than forecasted). This is surely relevant to the issues at hand. Excluding it doesn’t increase your information, does it?

Moreover, the linked CRS report – appropriately – discusses these concepts as a % of GDP, in order to provide a sense of scale to the reader – not to correct an apples to apples comparison problem as you offered as a strawman. The counterfactual is correct either way — but it is misleading to discuss in nominal dollars. The intent of the JEC report is clearly to scold – and we can’t shake our heads in disgust unless we have a sense of scale.

Finally, the CRS report was written before we learned that tax receipts were up over 14% in 2005 from 2004.

It sure is interesting how the US could “cut taxes for the richest” — and yet GDP and tax receipts grew faster than forecasted by CBO.

To be fair, if inflation takes off, then supporters of tax cuts may be taken to task for inflationary fiscal policy.

“The 2.8 percentage points of change due to “tax cuts” composes 45% of the 6-point actual budget change, not the 3.7-point standardized budget change.”

Is a 2.8 pct deterioration a better result if the total budget deteriorated 6 % than if the budget deteriorated 3.7 pct ? I’m confused by this “Rovian” logic. In a normal world, -6 pct is worse than – 3.7, and -2.8 pct is just as bad.

No matter how you slice it, the macro-economic results from the policies of this administration are bad, especially when you consider the monetary stimulus of loose money and fiscal stimulus of uncontrolled spending. The monetary and fiscal accelerators were thrown in as an insurance policy just in case the “tax cuts” experiment resulted in a large loss in tax revenue. The entire budget deficit is related to the same “policy” package.

I think the results of 2005 were a typical pre-inflationary surge brought on by non-sustainable stimulated growth. At any rate, the 2005 results only made the results appear “less” bad.

When the economy cools and higher interest rates on the debt kick in, more of the iceberg will emerge.

Apologies for the hiatus in posts — I have been away traveling.

Emily: I hope people will follow the links — that’s why I provide them. Unfortunately, I don’t understand your point. You say:

Well, let me quote directly from the CRS report:

I will let that speak for itself.

RD: I should have mentioned that the JEC report was from the Democrats. But I remain unconvinced that your proposed modifications would change the substance of the point that the fiscal situation has declined precipitously since the beginning of the Bush Administration. Yes, 2005 receipts were up, but from a relatively low base expressed as a share of GDP. I remember Doug Holtz-Eakin’s parting shot regarding this transitory nature of the deficit improvement – soon entitlements combined with the extensions of tax cuts will lead to widening deficits (as a share of GDP).