At the start of this month, I joined others in predicting that U.S. gasoline prices would soon be below $2.50 a gallon. The price has already dropped 20 cents to $2.60 a gallon since then, and it now appears likely to go down at least another 30 cents from here.

|

Although crude oil prices can be quite hard to predict, retail gasoline prices are at times a little easier, because it often takes some time for price declines in crude oil or bulk gasoline to work their way down to the retail level. A useful advance indicator of where retail prices are headed is the NYMEX gasoline futures contract, which yesterday traded down to $1.55. This futures price does not include taxes or the wholesale and retail markup, which in recent years have averaged about 60 cents a gallon. Using that 60 cents benchmark, a retail gasoline price below $2.20 a gallon appears to be quite reasonable to anticipate.

So why are gasoline prices coming down so dramatically? There are important seasonal factors in U.S. gasoline prices, which are higher in the summer due to summer fuel requirements and greater gasoline demand. Everyone always seems as shocked when prices go up in the spring as when they come down in the fall, even though to some extent that same pattern is repeated every year. However, much more than just the usual seasonal is in operation this fall. The drop in crude oil prices, down $14/barrel over the last month, has now become the dominating factor.

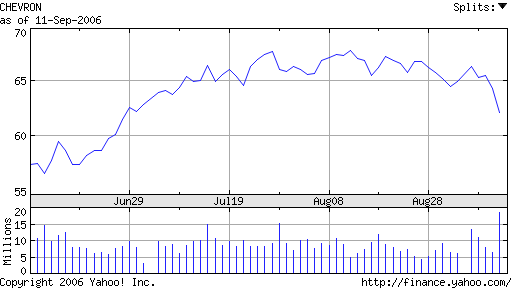

Some might be tempted to attribute part of the recent decline in crude oil prices to last week’s widely publicized ultra-deepwater production tests from the Gulf of Mexico. However, it seems pretty unlikely that this has made a material contribution to crude oil prices. Some qualifications about these Gulf of Mexico prospects have been noted here as well as at the Oil Drum. Moreover, if last week’s news was that big a deal, you’d think it would be most apparent in the valuation of the stocks of the companies that announced it. But Chevron’s stock is now well below its value before the announcement,

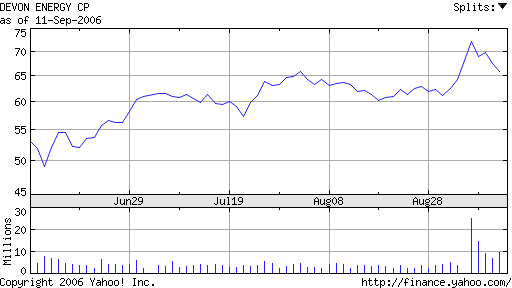

while Devon has given up half the bounce it received last week:

So what is going on? I’ve argued that speculation in oil has in part been driven by the asymmetric payoff structure in a tight market. With limited excess capacity, any supply disruption had the potential to produce quite a spike up in prices, and that possibility may have been regarded as sufficient compensation to speculators for the risk of a price decline that would be expected to occur if none of those events took place. But we’re now operating on the flip side of that same calculation– hurricanes have so far failed to disrupt this season’s production of oil from the Gulf of Mexico and the conflict with Iran seems to be playing out as an awkward standoff. The absence of bad news means prices had to drop.

Furthermore, there is some evidence that petroleum demand is finally starting to be tamed, which is of course one way to create more excess production capacity in the world oil market. My concern here is that the incipient economic slowdown may be the most important factor responsible for declining petroleum demand. And to the extent that’s the story, the oil price declines are not exclusively a harbinger of good economic news.

Even so, if we do get to $2.20 a gallon, it’s hard to believe that won’t provide some relief for sagging consumer sentiment and budgets, as indeed the prospective gasoline price drop looks quite similar to the favorable sequence last fall that may have helped the economy shrug off the GDP slowdown in 2005:Q4. There’s no question that $3.00 gasoline has been one of the reasons some of us have been pessimistic about near-term economic prospects, and that reason for gloom at least has now vanished.

Other concerns certainly remain, but let’s issue an official Econbrowser declaration on the energy news:

Technorati Tags: gas prices,

gasoline prices

not allowed to change your mind… it is already 2.52 here in NJ 9/13/06

Down to 2.15 where I live. It will be interesting to see what GDP is this quarter.

The price of oil in the past several years has declined precipitously at this time of the year. Smile for a while.

Can’t we blame Pres. Bush on this too?! You know he gets his oil buddies in a smoke-filled room and gives them his “pep” talk: Now look here, time to lower the price on oil, what with the election cycle coming up and the news from Iraq not looking so good. So make it happen.”

Sadly, some people actually believe that happens, when it’s simply supply and demand (with a few special market forces!). We may as well enjoy the cheap gas while we can, as Mideast political tensions do not seem to be easing any.

Is there any information to show the cost of gasoline going up as the processing costs increase due to the use of heavier crude stock (or lack of sweet light crude)? As the feed to the refiners gets coarser, I would imagine the output would decrease as well as the need for more processing per unit of gasoline.

There are many reasons gasoline is coming down in price but few seem to see the link to the FED pause. Businesses have taken the FED pause as a signal that the FED is fed up (pun intended) with harming the economy and will once again allow it to produce. Now that would seem to signal higher oil demand and higher oil prices but actually the impact is greater than oil. The anticipation of increased business activity will actually reduce inflationary pressures.

Gold is falling indicating reduced inflation which will translate to world oil price declines.

As usual the FED will take credit for seeing a reduction in inflation when no one else did. In truth the FED, who contributed to inflation with its attacks on the economy, will actually be the cause of reduced inflation with its pause.

Here in northern Utah, the price of gas has only come down about 5 cents. The paper reports the reason is that demand locally is still high. Sigh.

Can’t we blame Pres. Bush on this too?!

Don’t worry, there is still Iran to go!

Also, crack spreads are finally reasonable after spiking to $20+ earlier in the year. Cf the MS team here:

“..crack spreads widened to as much as $22/bbl. and pump prices rose above $3/gallon by early August… That was then. With the completion of refinery maintenance, the end of the summer driving season approaching, and the market having finished absorbing some of the dislocations from the environmental change, wholesale gasoline quotes have plunged more than 50 cents from their early August peak in the past month. Pump prices, as they typically do, are declining with a lag, having fallen more than 30 cents over the past four weeks. Barring further shocks, the weakness in product prices could put further pressure on crude quotes in the very short term, in our view.”

Visually, cf http://www.advfn.com/p.php?pid=qkquote&symbol=NYMEX:UCV6

US inventories of crude have been rising for 18 months or so (indicating to me a potential imbalance between production and demand), and IMHO finally got to the point where a price correction was induced.

Also, there was considerable concern that this was going to be another highly disruptive hurricane season in the GOM and it just hasn’t turned out that way and time is running out. THAT’S a lot more important for near term energy prices than the new deep water development by Chevron and Devon.

Last, while Iran is refusing to halt uranium enrichment as a precondition to UN negotiations, the August 31st deadline has come and gone and nothing much has happened and it’s becoming clear that no meaningful developments are likely to happen in this dispute until sometime in 2007.

Add in the incipient economic slowdown in the US precipitated by the downcycle in the housing market and you’ve got a prescription for a big fat correction in energy prices led by crude oil. With no potential for a cold snap (or hot streak) to cause a short term demand surge, it’s quite difficult to see any reason at all to want to be long oil in the short run . . . . . so all those market participants and speculators hanging onto high cost inventory are going to become panic sellers before too very long.

Stock market wise, sell energy and buy retailers, restaurants and airlines.

Free Gas For Everyone!

Woo Hoo! Happy times are here again. Time to throw those hybrid cars in the waste bin and break out the Hummer H-1 you’ve mothballed for the summer months. Time to start feeling fantastic again and shelve those worries about…

Anarchus,

Good post.

I only take issue with your statement: “the incipient economic slowdown in the US precipitated by the downcycle in the housing market” Consider that the economic slowdown was caused by the same conditions that caused the downcycle in the housing market.

I wonder if the increased spread between retail and Nymex price that you note is larger than usual because the price of gasoline additives is higher than usual right now. Do the futures you quote include the price of the additive? If not, do you know if additives are a big part of the usual 60-cent spread?

I love your blog, and please forgive the basic question.

-Andrew Ward

Andrew, this is just a rough calculation, using a national average for the price of gasoline (which combines the different communities and formulations as if they were all part of one big sample) and the NYMEX contract for regular unleaded. The issue you point to would indeed introduce a seasonal into the spread between the two, but that’s all the more reason to be confident that the national average retail U.S. gasoline price is in the midst of a dramatic decline.

Does anyone have solid information on changes in Saudi shipments, especially of light sweet crude?

While I’m not big on conspiracies, I would find it credible that the Saudis might use their market power to influence US elections.

Looking at a chart for the last few years, e.g. US Retail Gas Prices, helps me keep a longer term perspective. Gas prices are dropping, but are still historically high and could easily turn around and run up even more.

Regarding Joseph Somsel’s comment, I’m not sure there is much of a correlation between the election cycle and gas prices. Interesting to consider. I assume not. But there does seem to be a correlation between the election cycle and the reappearance of Osama bin Laden. He returns in video and as bogeyman in propagandistic US political speeches, just in time for the election season.

I don’t care much for conspiracies, but it’s not a stretch to call it Orwellian. Or Rovian.

Driving home from work tonight I saw unleaded with 10% ethanol at $2.1999 per gallon. Score one for Econobrowser.

I am not sure, FEDs got the pumps on overtime again, while we are having a modest commodity pullback in late summer, I could see things easily pick back up again around Halloween…..no matter what the economy does.

FEDs simply isn’t going to allow the economy to deflate IMO, they will pump, pump and pump to inflation becomes a economic downer.

There’s an election coming! Can’t have people upset about gas prices…

Still over $3/gal in Santa Barbara…

Let me ask a related question about futures. Gasoline futures don’t go out too far, but oil goes out six years. Recently oil has fallen from the low $70s to about $64. We’ve all seen all the explanations – lack of hurricanes, Israel and Iran tensions reducing.

Fine, but why does this have such an effect on expectations for oil prices many years out? 2012 oil has fallen from $71 to $64 in the past month. Does the relative calm of the past few weeks really give us good cause to think that oil will be 10% cheaper six years from now?

More generally, what drives trading in 2012 oil? Who are the people trading in it, are they mostly amateurs or professionals? Speculators or hedgers? Why are they interested in bets with such a long term payoff? Is it mostly traders executing spread strategies and other advanced techniques where the 2012 serves to hedge other positions? I’m wondering what is really going on in that rather unusual market.

From a practical standpoint, it’s unusual to get futures contracts with any liquity further out than 18-24 months. As the oil market has strengthened and gotten more volatile over the past few years, trading in the more distant expirations has picked up. Even so, once you got past the Dec 2007 contract expiration, there’s very uneven open interest in all but the Dec expirations. There is decent open interest in the Dec monthly expirations out to 2010.

The good professor’s written some very detailed explanations (check the sidebar to the right) on how the futures markets interact with the spot market, but the simplest way understand how current prices interact with prices several years down the road is to forget the futures markets completely and think like a market participant.

If you know you need a bunch of crude oil in Dec 2010, you can procrastinate and wait and buy it on the spot market on 12/1/2010, OR you could buy it today at the current spot price and pay storage and insurance costs and “carry” it out to 12/1/2010 when you use it. With many participants in the crude markets having scheduled demand and/or scheduled production ranging out over a decade or more, and adequate storage around, a pretty efficient marketplace has developed in this kind of action.

That’s why IMHO the crude oil market has gotten slightly out of balance – it’s PAID very well to buy extra spot oil and hold it as inventory over the past couple of years and more than a few market participants have probably gotten a little too enthusiastic about that game. And over the past 12-18 months the amount of crude oil held in inventories systemwide has gradually crept up to a pretty high level. NOW that the price of crude has broken down technically on the charts and seems to be going DOWN, market participants speculating at the margin by holding extra crude are now looking at potential losses on inventory they don’t need. As they start to move toward the exit slowly the price slides even more, pulling additional holders of inventory to start liquidating. In the short run, if there’s a pell mell rush to the exit there could be a very abrupt decline in the spot price of crude . . .

Speaking of a market “slightly out of balance”, Amaranth Advisors, a $7.5 billion hedge fund, announced today that it was going out of business owing to massive losses on natural gas related investments.

As Warren Buffett likes to say, “you can’t tell who’s swimming naked until the tide goes out . . . . . . ”

Okay, this is a simple. I need to know what in the hell makes Republicans think that the gas prices falling has nothing to do with the upcoming elections. For me, it might be conspiracy but you really can’t prove it either way. So I guess for Republicans, you’re gonna stick to the Supply and Demand crap that the news feeds you. But if it is supply and demand, then why are the prices going down and going down fast? You can’t say that the demand is any lower, people are driving less or that somehow we just discovered a new source of oil. What’s left? Election year. You can’t say that you know how much oil is left in the world. If that was the real issue, then the gas prices would have not declined. That is a FACT.

All of this is just bait for Republican votes or is it? I also don’t understand where they get these bogus polls on the news that make it seem that the Republicans are even close in winning. You have to take the voters that can’t even get to a computer. Those voters are usually poor and guess what they are not republicans so those polls should not even be taken seriously. Anyway, I don’t care about Liberal opinions and I care even less about Republican’s opinions. All I know is that as soon as the Republicans took over, the gas went up and kept climbing. When Republicans didn’t have control, the price of gas was low.

Put it this way, if you gave an employee a couple of chances to do a job right and they kept screwing up, why would you want to keep giving that employee a chance. I would get another employee. That is what needs to be done with the entire government because it is an employee that keeps screwing up. It’s time for a new employee. You can’t deny that. There are too many screw ups. That is just business. That has nothing to do with Democrats or Republicans. If the Democrats were in office and screwing up, you bet your life I would say the same thing. I know that some hardcore Republican will not like what I have to say but for that person, try being broke for a couple of years with no help and see how easy your life would be. When I say broke, I mean REALLY BROKE, not what you think is broke. Live in the getto for a couple of years and make the same money someone there EARNS. Take yourself out of the little routine that you’re in and think about others instead of your comfort zone. You will think different.

Humpty Dumpties, Ford and GM, were about to fall off the wall street so all the kings horses “oil companies” and all the kings men, “Bush’s Men” helped to keep the Humpties on wall street again.

In reply to Anarchus post, I’m a centrist so I don’t favor either party, but just thought I’d let you know that Republicans had majority during clinton’s reign when oil was at the all time low.