Faster appreciation against the dollar. And apparently against a broad basket of currencies.

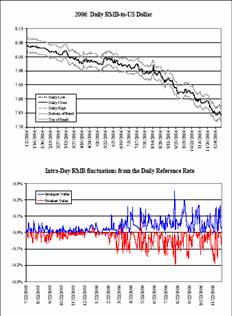

The Treasury Department’s Report to Congress on

International Economic and Exchange Rate Policies presents an interesting graph of the Chinese Yuan’s (CNY) exchange rate against the dollar, along with daily highs and lows, and the band.

Figure 1: CNY/USD exchange rate. Source: Treasury Department’s Report to Congress on

International Economic and Exchange Rate Policies (December 2006).

The level of the CNY is depicted in level terms. It is difficult to discern changes in the pace of RMB appreciation in level unless the exchange rate is presented in log terms (the value of the RMB is presented below). And more importantly, it is the trade-weighted exchange rate that matters. I’ve plotted the (log of the) Bank for International Settlement’s trade weighted value of the RMB as well.

Figure 2: Log value of CNY against USD (blue), and against broad basket of currencies (red), both rescaled to 0 in 2005m06. Source: St. Louis Fed FREDII and BIS.

What the graph makes clear is the pace (in percent) of RMB appreciation against the US dollar is accelerating. That’s not news, although it bears repeating. Interestingly, the pace of appreciation against the currencies of China’s trading partners is roughly the same as that against the dollar, over the past 16 months. That is something that is not often heard.

By the way, that’s not an argument that all is well; merely an observation on the current state of affairs. More discussion of China here and tangentially here.

Technorati Tags: China,

renminbi,

exchange rate,

yuan

The appreciation against the euro is even greater. It has amazed me that the EU is so good at managing the stability of the euro but so awful at free markets. Europe could be producing more than the rest of the world if it could just get rid of the socialist handicap strangling its economies. They have a great example in the success of Ireland. They should attempt to duplicate Ireland’s success in other EU economies rather than trying to pull Ireland down to their production levels.

It does appear that the US is having some success at getting China to change the value of their currency, but there will be little if any impact on China’s growth. What many seem to miss is that China’s biggest trading partner is China itself.

Menzie – again, nice econoblog with Kash. And you had noted RMB appreciation even before the great blog. Bernanke is calling for RMB appreciation and many of us agree. It seems the Chinese Central Bank is listening – even as they take this on their own pace.

5 years from now, Ireland will be a total failure……..much like the US. Ah, the ignorence of man. You have no clue Dick.

FWIW, Socialist handicap? No such thing. If Socialism was really running Europe, you wouldn’t any of the financial institutions that exist there now nor the need for it as Jesus commented(and laid the foundation for secular Socialism).

Europe is essentially the same as the US, though they decide on less productive markets for saftey nets. Their choice.

Five,

Ireland seems to be an excellent success story, apparently resulting from lower taxes/less socialism. Perhaps you could enlighten us with some evidence to the contrary.

Menzie — do you know the trade weights the BIS uses, and when they were updated? that matters, obviously, b/c of the big increase in China’s trade with europe. I have a very rough nominal trade weighted index for the RMB v the g-3 (euro, yen. dollar) weighted by China’s 2005 trade with europe, us and japan but using the import and export data of China’s trade partners to deal with the Hong Kong issue (this undercounts everyone’s exports to china, but it should have too much of an impact of the overall weighting). the RMB looks very flat v. this index in 06 — appreciating v. $ and depreciating v. the euro — after appreciating in 05 (largely b/c of the $/euro, not the RMB/ $). I think the DBS (singapore bank) index shows something similar.

Brad Setser: Take a look at the documentation here. The most recent trade weights being used are 2002-04; the weights are available here. The IMF and BIS series agree through May 2006 (the latest time period I have the IMF data for).

What might be more important is the fact that these Divisia indices are built on weighted changes in exchange rates. As I pointed out in this post, weighting the levels might better get at the increased importance of China I think you’re trying to isolate.

algernon, Ireland is now just a tax haven.

Many companies operating in EU book their profit in Ireland instead of other countries: Dell, HP, Microsoft do zero profit in all EU countries but Ireland.

This all done through intellectual property, which as you should know is a big communist-like government intervention in an otherwise free market.

The Ireland miracle (for the past few years part) is just accounting and benevolence from other EU countries which do not currently enforce their own tax code strictly (to stop accounting magic) and also gave lots of money to build up Ireland infrastructure (and agriculture).

The appreciation against the euro is even greater.

I see no one has taken you up on this Dick, so here I am. How does the Yuan appreciate further against the Euro than the dollar when the Euro is apprciating against the dollar?

Again, perhaps my lack of education is preventing me from seeing the obvious. I’d be grateful if an expert could led me to higher ground.

A major reason for Ireland’s economic miracle, unrelated to tax policy or socialism, is its highly favorable dependency ratio.

praquetwin,

My error. I meant depreciation against the euro. Good catch. Sorry.

Both the dollar and the yuan are losing value against the euro but the yuan even more.

Pianoguy,

Thanks for the link to the Gladwell piece. His analysis of the GM problem is very good. His solution is a little strange since it would take the problem he identifies at GM and nationalizes it, but his argument of dependency is important. It is a strong argument against the pay-as-you-go Social Security system. It was encouraging that he seemed to support the 401k system. More such personal saving systems would take care of both the demographic problem and the portability problem.

To his point on Ireland it simply made no sense. The introduction of contraception in 1979 that reduced the birth rate should have increased the dependency problem since it should have reduced the working age population without effecting the retirement population. Ireland’s outflow of migration peaked in 1989 so any demographic change seems to be more due to migration than contraception. But since this reversed in 1989 it makes no sense that demographics created Ireland’s prosperity. We are back to economics and Ireland’s implementation of supply side policies.

DickF

Your comments imply that you didn’t completely understand the article.

First you ask why “nationalizing GM’s problem” would be a solution. The answer is simple: GM has a competitive problem vis a vis companies with a less old work force. If we “Nationalize” the problem we are leveling the playing field.

In addition by nationalizing the retirement benefits they will become portable, which allows companies to compete for the workers more fairly. Today you can expect that workers who are partially vested in a defined benefits plan will be reluctant to move to a new company (for fear of loosing their benefits), even if the “new” job would be better paying, in a growing industry.

It is not in our national interest to penalize new companies, employing old workers, with existing skills.

Sure enough, in the US you typically see new industries employing new skills rather than applying existing work skills in a new manner or in a new market — You don’t see Silicon Valley hireing a lot of machinists, they want programmers.

What we should encourage is upstarts in existing industries, e.g. Southwest Air (which by the way, partially owes its success to a younger workforce)

As to your point on Ireland — it’s a documented fact that their Dependency ratio is among the lowest. Why that is, is less clear, but the relatively recent introduction of contraception is not an unreasonable explanation. Remember that it is not just retirees that counts as dependents, children do too.

Applying the “glasses” of Socialism vs. Capitalism isn’t very illuminating in this context. A better way of looking at national differences in Europe and the US is to look at what each society focuses its efforts on:

In the US we spend a lot of our Federal budget on defence, in Europe the focus tends to be towards what could be loosely termed Health and wellfare.

Both stimulates the economy, and diverts resources from “real” productivity (making things)

Note that in the US we do spend even more resources on health, it’s just that it’s not signle payer, it’s a plethora or employer and employee paid insurance plans. If you were to add that cost to our taxes you’d find that our tax rates are just as high as Europes.

The vitality of an economy is less related to how “socialistic” the political climate is, and more to how willing you are to take risksk – Compare Silicon Valley to Detroit, and you’ll find Motown to be more conservative than Silicon Valley – but there is no doubt that it’s less prosperous.