I wouldn’t read too much into the new starts, permits, and sentiment data, but I don’t take them as very encouraging.

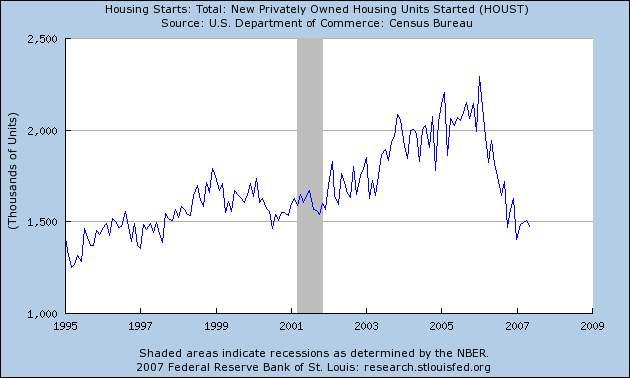

Housing starts, which seemed to have been moving up, nudged down last month.

|

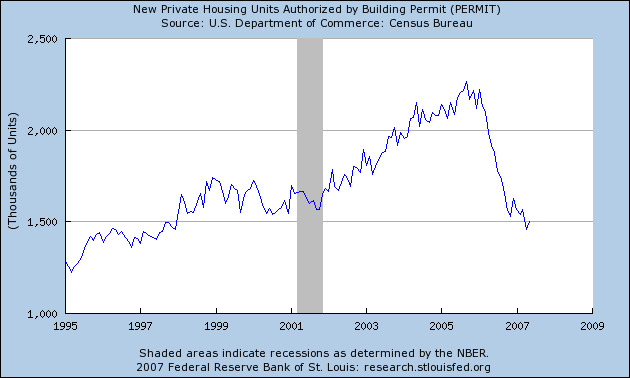

While housing permits, which had been trending down, nudged up.

|

What really counts at this point, though, is home sales– it won’t do any good to build the homes, if nobody buys them. And even if sales do start to rebound, the recent higher mortgage rates would make me worry that it could be short lived.

Sentiment among home builders fell to a 16-year low. And the University of Michigan index of consumer sentiment, which had been trending down, took a significantly sharper tumble down this month:

|

That last one worries me. The index still remains above recent lows. But don’t forget that those low values in the fall of 2005 were enough to bring GDP growth well down, even when housing was still going strong.

Technorati Tags: macroeconomics,

housing,

consumer sentiment

It may be worth noting that single-family starts and permits were down. Single-family permits hit a new low for the cycle. Singles are generally taken as a sort of “core” measure, less subject to volatility than the multi-family series.

Professor, you are a cool customer. I read the data as continued ‘bad.’

May personal consumption comes out next week. I think that we’ll see continuation of the weakness that we saw initially in March and April.

This spring, we finally saw the housing slowdown impact consumer spending.

Beat the crowd and go to ‘frown,’ soon, Professor!

jg wrote:

This spring, we finally saw the housing slowdown impact consumer spending.

jg,

Is housing impacting consumer spending or is it market forces impacting both housing and consumer spending together? Could it be that there is no cause and effect between housing and spending but that they are symptoms of the the same malady?

Calculated Risk discusses the housing wealth effect by referencing an LA times article and a few words by Bernanke:

http://calculatedrisk.blogspot.com/2007/06/ucla-forecast-housing-slowdown-spilling.html

On a different note, David Cohen at ASPO speculates on whether OPEC is purposely holding back production:

http://www.aspo-usa.com/index.php?option=com_content&task=view&id=155&Itemid=76

He references Hamilton and Staniford. This is something I’ve long wondered about. If oil is peaking, such that large production increases become difficult in the near future, then does it make any sense for the Saudis–as an example–to drive production up for the short-term such that prices plummet? Why do it? Why not find a higher price for oil that still works?

I think this makes a lot of sense. Find a new higher ceiling. It may even smooth out the transition to what lies on the other side of peak–particularly since there is no political will in the united states to increases taxes on gas.

Also of interest is the effort by congress to punish OPEC for not going all out producing more oil. As if they owe us cheap oil. I’ve run into a few conservatives who think that we have a right to Saidi oil. I wonder whether we have a right to cheaper iPods as well? Or other products.

Monopoly powers should be viewed with concern and caution. With that in mind, consider that the US has a sort of monopoly on the projection of offensive military power. Is that any more fair than the Saidi/OPEC monopoly on oil prices? Probably not.

DickF, an answer to your question is way beyond my capabilities. You know the macroeconomics better than I do — huge consumer debt overhang, rising interest rates, falling housing prices. I could not begin to tease out which — high debt service or falling housing prices — initiated the decline. And, such is complicated, I think, by the fact that both began moving in the ‘wrong’ direction at the same time.

What do you think?

Well I’m no Dick but jg, you sound like you might be way beyond my and Dick’s capabilities to entertain Dick with this fundamental question of causality.

I’d invoke the Invisible Hand [I just prefer this to ‘Market Forces’, you?] or Aristotle’s throttle if I knew anything about either, but sadly…

It’s not enuff the Greenspan and Kennedy can publish a lengthy report on the size and effects of MEW.

‘tsnot.

Right now for instance I could be under market influences [see how much better The Invisible Hand works here?] to type and not even know it. Not really…

All those who claim otherwise are just not big wonderers, you know?

Professor Hamilton,

where does the recession probability index stand if the preliminary Q1 GDP figure of 0.6% is used instead of the 1.3% advance estimate?

Macskawati, just that one change alone (not using any of the revisions to earlier data) would increase it from 16.9% to 20.1%. But I prefer to wait until we have 2007:Q2 data in before putting too much weight on the update.