No, this was not a good housing report.

The Census Bureau reported today that seasonally adjusted new home sales fell 6.6% in the month of June alone. April and May sales numbers were also revised down from what they were earlier reported to have been.

|

On a seasonally unadjusted basis, this leaves us far below what we should see in a usual summer selling season.

|

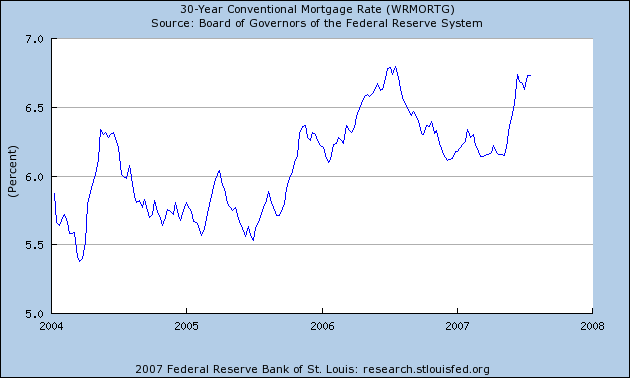

Part of the explanation is the surge in mortgage rates that began in May, which would start to show up in June home sales. Given the historical lags between mortgage rates and home sales, those higher mortgage rates will have an even bigger effect on July and August home sales.

|

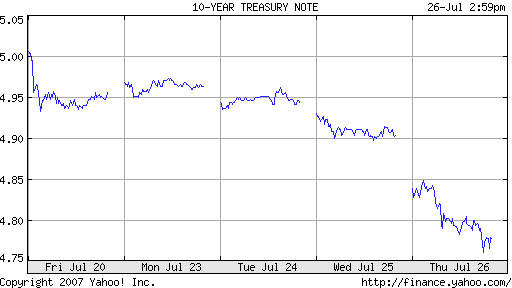

I’d earlier attributed May’s surge in long-term interest rates to increased investor optimism about the level of real economic activity. It seems Wall Street took a look at today’s housing report and declared a big “whoops”:

|

But an even more important factor for recent home sales than the higher mortgage rates may be the tightening lending standards, an adjustment that also seems unlikely to be finished yet. Tanta noted a Bloomberg report that sales of collateralized debt obligations (which ultimately fund many mortgages) fell from $42 billion in June to $9.1 billion so far this month.

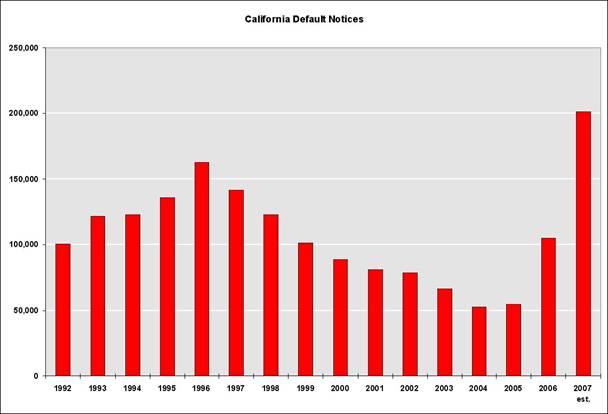

This has continued to a point where substantial real estate price declines may be hard to avoid, and the implications of those for broader financial defaults and the aggregate demand for goods and services are what have me most worried. Even without those price declines, notices of default in California (the first step in foreclosure) have reached the highest level since Dataquick began tracking these numbers in 1988.

|

Looks like it might be a good time to bring the fed funds target back to 5%.

Technorati Tags: macroeconomics,

housing,

recession,

economics

“Looks like it might be a good time to bring the fed funds target back to 5%.”

Seriously? I mean, are you joking?

Rather than a big whoops on the economic (or housing) outlook, I think the near-25 bp drop in the ten year rate reflects the opening shots in the great liquidity war of 2007.

Today’s highly-leveraged masters of the universe typically are short securities such as the ten year treasury, while holding long positions in higher yielding securities that are less creditworthy, less liquid and/or have longer maturities . . . . . when credit spreads start to widen quickly, as they have recently, these highly levered arbitrageurs can potentially lose money on both shorts and longs. In anticipating or responding to margin calls, the covering of short positions in high quality bonds can push treasury rates down substantially in the short run. Also, credit crunches are by nature deflationary and widening credit fears can also trigger a “flight to quality” among investors who aren’t leveraged up in the game.

There were unspecific rumors flying around today of multi-billion dollar hedge funds in trouble. The lack of specificity suggests that the rumors are just unfounded speculation at the moment, but based on how quickly the two Bear Stearns hedge funds evaporated into the either, I’d expect that within a week or two the world will find out which major funds (if any) are in serious difficulty.

Anyway, keep your eyes and ears open for market speculation going forward on the characteristics and value of the “Bernanke Put” versus the “Greenspan Put”. The uncertain tendencies of a newly-minted Fed Chairman will likely add to the tension over the next couple of weeks.

“Looks like it might be a good time to bring the fed funds target back to 5%.”

And what would that do to the value of the Dollar in international currency markets.

It is interesting, with the collapse in Treasury rates of almost 15 bps today, current coupon mortgage rates only fell by 5 bps. Seems with higher risk premia and increases in implied volatility, mortgage nominal spreads may blow out even as Treasury rates fall. So much for lower Treasury rates helping out…

Where are you getting the mortgage data, Rubicon?

That data must be wrong. Paulson and Bernanke said some time ago that the housing market was bottoming. I must have a different definition of bottom I guess.

Professor, with M2 and M3 growing by leaps and bounds; with household debt to disposable income at an all-time high; with home prices out of whack with income and rents; the last thing that we need is inducement for more borrowing.

Time to take our medicine: a protracted recession to write-off silly loans and bring down inflated asset values (e.g., homes, stock prices). It will be painful. But it is long, long overdue.

July 26, 2007

The day ended, at long last, with not just a sound thumping for US Equities, but just about everybody else as well, including Canada.

Liquidity in the US Corporate markets was terrible (worse than yesterday), with marked spread-widening after yet anoth…

Hummm.

Last week the problem was all of the damned excessive debt being pumped out.

Now, you want to rev up the debt pumps again.

Oh my dear sweet Jesus. In this democracy, all roads DO lead to inflation.

I do believe that the time is just about right to complete the closure of the last of my US based positions. The USD is headed for ‘toilet paper’ status. Bring on the ‘new dollar’ as Jim Rogers is now predicting.

Senate Finance Panel Backs China Currency Measure (Update1)

By Mark Drajem

July 26 (Bloomberg) — The Senate Finance Committee approved legislation aimed at pressuring China and other countries over their currency practices, in the first move to toughen U.S. rules in this area in almost two decades.

The measure, approved in a bipartisan 20-to-1 vote, would force the U.S. Treasury Department to overhaul how it looks at currency policies of other nations and allow U.S. companies to get higher anti-dumping duties to compensate for the effect of a weak currency.

…Progress on the Finance Committee’s measure may be complicated by the Senate Banking Committee’s claim of jurisdiction over the issue. The banking panel plans to vote next week on its own version of currency legislation, which is also aimed at reworking how the U.S. Treasury examines the currency practices of other nations.

This may be a little off subject, but it does apply when you consider most of the financial reporting yesterday.

The housing news totally overshadowed the monetary attacks congress unleashed against China. The Asian markets crashed after the news.

All day I heard that the markets crashed because of the housing and sub-prime markets, but can I remind everyone of a little congressional faux pas called Smoot-Hawley.

Certainly the housing problem should be a concern but the FED could move housing in the right direction with one little announcement. The housing problem is nothing compared to an international currency and trade war.

With a 20-1 vote congress sent a strong message to the markets. The yesterday the markets sent a message to congress, but sadly while the markets listen with hyper-sensitivity congress is stone deaf.

Oh, if we could only have the Democrat party of the early 1900s.

JDH,

So CA mortgage defaults are not correlated with job losses in the state.

Yet this was the assumption built into the vast majority of default models on Wall Street and in academia.

What went wrong? It would be interesting to get an academic’s perspective. Overconfidence in model outputs? Overemphasis on empirical work based on historical data? Too-limited data set? Mis-application of Gaussian probability distributions?

Perhaps we needed more “thought experiments”, and less reliance on empirical work.

Heresy.

jg and esb, I’m expecting borrowing to decline no matter what the Fed does. And this is not a slippery slope, where a drop in rates means the Fed has to keep on dropping. We watched and waited at 5.25%, and can do the same at 5.0%.

o.k. gloom and doomers- 9.3% drop in residential fixed investment. down quite a bit. economy still growing.

no big deal. we can wait @ 5.25% and cut 50 bbp if needed. no need to panic.

I don’t think that this is something that can be fixed just by moving the FED rate down. It seems like something that requires suffering to remind people why there are fundamentals. If your kids booze it up all night, maybe the hangover and losing their license will help them learn. We talk about how the market rewards winners and punishes losers, helping everyone learn for next time. That’s what we need here too.

Agreed, Ken. 5.0% is no fix. It just strikes me as perhaps a better policy choice at the moment.

I think I’ll wait a couple of months before buying a house.

Prices here in Silicon Valley do seem to be plateauing but I suspect that there will be bargains from desparate sellers.

Probably the time to buy will be when the mortgage rates dip in response to slow sales.