That’s the question posed yesterday by Calculated Risk. Here’s how I’d answer it.

|

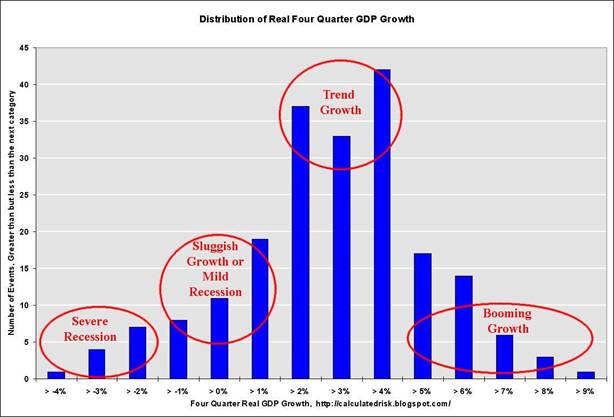

CR begins with the above histogram, whose height shows the probability of observing a growth rate of real GDP over 4 quarters at a level indicated by the number on the horizontal axis. CR notes that for the 4 quarters ended 2007:Q1, real GDP grew only 1.5%, and for the 4 quarters ended 2007:Q2, growth was 1.9%, either of which he classifies as “sluggish growth or mild recession” for purposes of the diagram above. He then concludes

recessions do matter in that economic activity slows down, but the key point here is that there is very little difference between sluggish growth and a mild recession.

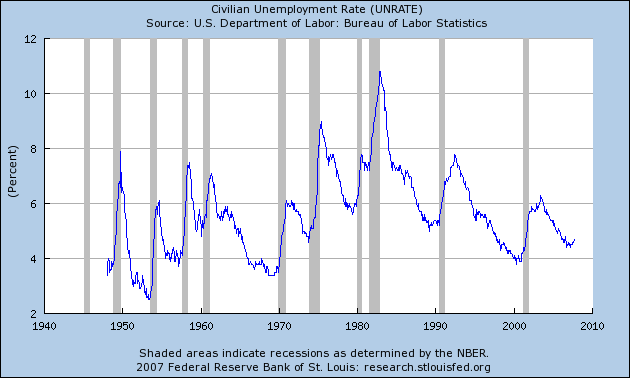

Another graph that I think is interesting to look at for purposes of this discussion is the unemployment rate. One of the very striking things about this series is its tendency to spike up during the episodes we characterize as recession. This does not appear statistically to be a smooth response to slower growth, but instead looks to me like a discrete phase into which the economy sometimes shifts.

|

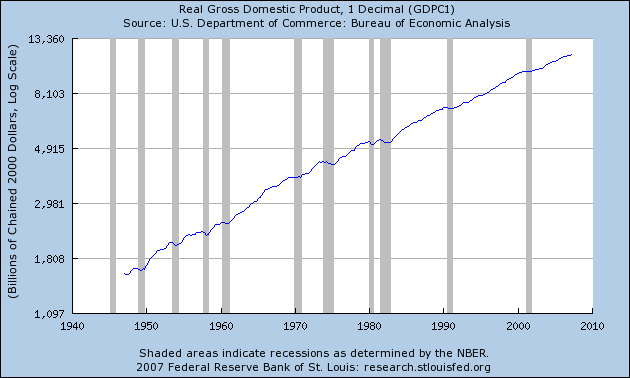

I believe there is also a fundamental difference between the forces that are driving economic dynamics during the episodes that I would characterize as recessions and those that govern normal times. The normal situation is that the primary factor limiting how much the economy produces is our physical capabilities– how many people are willing to work, the quality of their skills and technology, and the physical capital available for them to use. All these factors tend to increase over time, accounting for the broad tendency of real GDP to grow from decade to decade.

|

It is hard for me to accept the claim of many modern macroeconomists that the same factors could also be driving business cycle downturns. We obviously don’t have any decrease in population during a recession, and no capital has been destroyed. I am deeply skeptical of the assumption by many academic economists that adverse “technology shocks” could account for a decrease in the level of overall economic activity. Instead, the spike up in the unemployment rate suggests to me that there is an idling of potentially productive resources that occurs during a recession, and that the dynamics that produce this tend to kick in fairly quickly once they set in. I discussed this idea further in a recent academic paper, What’s Real About the Business Cycle?

That’s why my answer to CR’s question– does a recession matter– is a definite “yes”.

Technorati Tags: GDP,

recession ,

macroeconomics,

economics

I have posted a chart of the y/y % change in Employment. It illustrates how, when this number drops below zero, an accelerated downturn occurs.

At 110k jobs/month, a 5.3% unemployment rate can be expected in one year. This assumes an average growth rate of 1.5% for the Labor Force.

You can see this graphically at

http://www.wrahal.blogspot.com

Very interesting post. Thanks JH.

There exists a different explanation (statistically consistent as cointegration tests confirm) of the reasons of the fluctuations in economic growth:

Real GDP per capita in developed countries,

MPRA Paper 2738, University Library of Munich, Germany.

mpra.ub.uni-muenchen.de/2738/01/MPRA_paper_2738.pdf

Abstract

Growth rate of real GDP per capita is represented as a sum of two components a monotonically decreasing economic trend and fluctuations related to a specific age population change. The economic trend is modeled by an inverse function of real GDP per capita with a numerator potentially constant for the largest developed economies. Statistical analysis of 19 selected OECD countries for the period between 1950 and 2004 shows a very weak linear trend in the annual GDP per capita increment for the largest economies: the USA, Japan, France, Italy, and Spain. The UK, Australia, and Canada show a larger positive linear trend. The fluctuations around the trend values are characterized by a quasi-normal distribution with potentially Levy distribution for far tails. Developing countries demonstrate the increment values far below the mean increment for the most developed economies. This indicates an underperformance in spite of large relative growth rates.

CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC

Modelling real GDP per capita in the USA: cointegration test,

MPRA Paper 2739, University Library of Munich, Germany.

http://mpra.ub.uni-muenchen.de/2739/01/MPRA_paper_2739.pdf

Abstract

A two-component model for the evolution of real GDP per capita in the USA is presented and tested. The first component of the GDP growth rate represents an economic trend and is inversely proportional to the attained level of real GDP per capita itself, with the nominator being constant through time. The second component is responsible for fluctuations around the economic trend and is defined as a half of the growth rate of the number of 9-year-olds. This nonlinear relationship between the growth rate of real GDP per capita and the number of 9-year-olds in the USA is tested for cointegration. For linearization of the problem, a predicted population time series is calculated using the original relationship. Both single year of age population time series, the measured and predicted one, are shown to be integrated of order 1 the original series have unit roots and their first differences have no unit root. The Engel-Granger approach is applied to the difference of the measured and predicted time series and to the residuals or corresponding linear regression. Both tests show the existence of a cointegrating relation. The Johansen test results in the cointegrating rank 1. Since a cointegrating relation between the measured and predicted number of 9-year-olds does exist, the VAR, VECM, and linear regression are used in estimation of the goodness of fit and root mean-square errors, RMSE. The highest R2=0.95 and the best RMSE is obtained in the VAR representation. The VECM provides consistent, statistically reliable, and significant estimates of the coefficient in the cointegrating relation. Econometrically, the tests for cointegration show that the deviations of real economic growth in the USA from the economic trend, as defined by the constant annual increment of real per capita GDP, are driven by the change in the number of 9-year-olds.

Any comments on Hussman’s perspective on recessions?

Recessions are not caused by a general shortfall in spending, but instead by a mismatch between the mix of goods and services supplied by the economy and the mix of goods and services demanded.

OK, that link should have been:

http://www.hussmanfunds.com/wmc/wmc071001.htm

BR, that is exactly my view as well. Here’s a link to another research paper of mine in which I lay that idea out.

Your vision sounds like Friedman’s “plucking” scenario. Is that a coincidence or a real influence (phun, phun).

Also, the demand-supply mismatch paper (JPE, ’88) seems to be in a way like the Austrian scenario, except that it’s formal (and makes more sense :-)) but I see no Austrians in the references. Is the resemblance all in my head?

Anyway, more posts on these fundamental issues would be awesome!

Oh my, what a big residual you have!

James Hamilton is one of the leading scholars of our time (including for his work on oil) but I just cant understand how he justifies the suggested inference according to which if RBC theory is true (in a sense) then recessions dont matter. Heres th…

Looks like whenever the Civilian Unemployment Rate graph bottoms out and heads back up with the kind of curve we see it tracing out now, a recession is imminent. Indeed, I see no exceptions in the graph — only a period in the ’60s comes close.

Why should it be puzzling that this happens? The economy is regulated by feedback control mechanisms operating with long lags and dead times in some of the loops. If the gain around a feedback loop is greater than one at the frequency where the phase shift due to lags and dead times exceeds 180 degrees, the result is destabilizing positive feedback instead of negative feedback, and the system will oscillate at that frequency, with the amplitude of oscillation set by whatever other constraints there are on the system. Add in some straightforward rate-dependent positive feedback (e.g., people piling into whatever investment vehicle is currently rising in price, and baling out of whatever is falling), and the oscillations take on just the form we see in the graph. This is how you make oscillators in electronics (the constraints there are the power supply voltages).

In the economy, this manifests itself as periods of uptrending malinvestment inflows of money and people into whatever is booming, punctuated by short periods of collapse when the uptrend hits external constraints and the phase-shifted and/or rate-dependent positive feedbacks are withdrawn. It then takes a while for the malinvested human, financial and physical resources to start recycling back into productive areas.

JDH:

Fascinating post and paper that helps illuminate something I’ve been thinking about a lot lately. In the last year, I’ve come to largely accept the neoclassical idea that the main driver of economic growth is innovation. Possibly I am biassed to like this idea because it helps my self-importance (since I make my living by innovating, and have spent the last two decades inside the various institutions of innovation our society has – universities, the defence funded contract R&D sector, and venture capital funded startups). However, I think my conviction has more come from thinking about micro-examples where the neoclassical set of ideas makes more sense. Eg if housing contractors have circular saws, the Keynesian idea translates into the limitation on growth being that they haven’t invested in enough circular saws, whereas the neoclassical idea is that contractors will quickly invest in as many circular saws as are useful, and further progress in labor productivity will await the invention of the nailgun.

So if we accept the idea that the primary driver of growth during normal times is innovation, then the limitations of growth during normal times are the speed with which we can a) come up with new useful ideas and “reduce them to practice”, and b) diffuse them throughout the relevant portions of society. (Ie exactly the set of tasks that the typical startup spends its time obsessing about for some particular innovation).

Now my experience of scientific and technical progress is it is inherently bursty. Every so often there are breakthroughs that open entirely new areas (eg the invention of the transistor, or the discovery of electromagnetism), and then thousands of smaller innovations of various sizes are required to take that initial breakthrough and translate it to all the many products and services that are now possible that would not have previously been possible. In some fuzzy sense the “size” of an innovation feels like it is drawn from some scale free distribution – some innovations will utterly transform society (once fully developed) while others will only slightly improve the working of one particular product.

The overall process of innovation feels like stumbling blindfolded through an an “abstract landscape” of “possible innovations”. At times, one is lost in steep mountainous terrain where it appears difficult or impossible to make useful progress (eg the last twenty years of theoretical physics where most of the effort has gone into string theory, which has yet to make any contact with anything empirically testable, let along useful to society). At other times, one stumbles through a pass into a broad verdant valley (eg the invention of the transistor) which can then be explored and utilized for decades (though the inventors may or may not appreciate the scale of the potential of the invention at the outset).

So, we might expect this process of exploring an abstract fractal innovation landscape to show through into economic performance also. The most societally significant innovations lead to periods of high growth for a while. This was the basic idea behind Greenspan’s theory in the 1990s that the economy could grow faster for a while without running into inflation because of the effects of the diffusion of the Internet into the economy.

Let me draw another strand of thinking in here – or another way of looking at things (given that we grant that economic growth is essentially a record of the diffusion of scientific and technical progress into society). The most influential twentieth century ideas on the nature of scientific progress come from historian of science Thomas Kuhn, with his distinction between “normal” science which operates in the context of an established theoretical paradigm of the domain in question, and periods when such paradigms prove inadequate to explain the expanded range of phenomena that scientific and technical progress has made available to test the paradigm with. Eventually paradigms fail, and there are periods of discontinous change as a new paradigm is constructed which is better able to account for the phenomena at hand. Examples include the replacement of classical physics by quantum physics, which was a fairly abrupt process in the early twentieth century, or the nineteenth century replacement of the model of heat as a “caloric fluid” with modern ideas of energy as a conserved quantity in the laws of thermodynamics (which in turn is now understood to arise from time translation symmetry in the underlying physical dynamics).

It seems to me this idea of paradigms, and more-or-less abrupt transitions between paradigms, can be extended from a tool used for understanding purely theoretical scientific developments, and also be used as a tool to understand the process by which scientific and technical developments are understood to affect society.

In particular, I would suggest a model in which periods of intense growth are driven by the adoption of some particular new innovation, and an associated accepted paradigm of the societal significance of the innovation. So for example, the 1990s growth was driven (in part) by the evolution of the Internet and the WWW in particular, but also by a generally agreed paradigm which said that these inventions were going to transform society.

In the language of my abstract innovation metaphor, we had broken through into a new valley of innovation that we could exploit readily, and we all agreed it was big (though in fact we couldn’t really tell how big). But it was big enough to spawn a giant landgrab as entrepreneurs, software engineers, venture capitalists, etc all attempted to stake claims to portions of the new space that had been opened out.

In this model, what causes a recession is then the paradigm shift as the limitations of the new opportunity are recognized. The paradigm governing economic understanding that operated from the Netscape IPO in 1996 to the dotcom crash in 2000 was, in hindsight, overly optimistic about the societal potential of the Internet as an innovation. While transformative, the Internet was not *as* transformative as many people believed, or at least not as rapidly as people believed. The potential for near-term internet ordering of petfood and groceries was greatly overestimated (my own participation in this social process was to overestimate the immediacy of Internet security threats to society).

The effects of the overoptimism of the 1990s was to build unneeded capacity in the Internet sector of the economy. Venture capital flows were four times a high in 2000 as they are now, and we had more venture capitalists, more startups, more optic fiber, etc, etc than we needed in the near term.

The paradigm shift to a more realistic appraisal of the development of the economic impact of the Internet occurred fairly abruptly in 2000-2001 causing the excess capacity to be simply dropped in a hurry. This obviously causes ripple effects throughout the entire economy as the newly unemployed can’t spend etc, and it takes time for all the misallocated resources (people, buildings, venture capital funds) to be repurposed to something that is actually societally desired in the near term. And this is what causes the recession.

Now, I would argue that the economic events of the last five years can also be understood in part through a broadly similar narrative, but this time the relevant field of innovation was financial. The development of new types of financial securitization and risk reallocation through CDOs etc was again an innovation leading to a new paradigm. These structures had the effect of making credit more available to a wider group of people and thus increasing housing prices and driving economic growth by allowing utilization of the thereby increased housing equity to drive consumption.

But once again, the significance of the new innovation was initially overestimated and the “new paradigm” was initially too optimistic, resulting in housing prices that were too high and too much capacity in the mortgage, housebuilding, and financial sectors. We are now going through the shakeout of that excess capacity. Once again, the paradigm shift has been abrupt – from the subprime lender shakeout in February to the credit crunch in August and now the dismal third quarter warnings of the large investment banks. And I strongly suspect that since the needed capacity reduction still has a long way to run, we will be in recession before it is done.

I would also argue that the 1970s recessions can be understood in a broadly similar framework. The application of the innovation of oil powered machinery to society gave rise to a long period of very high economic growth from the 1920s to the 1970s (interrupted by a depression in the 1930s for unrelated reasons, and a war in the 1940s that was in part over oil resources).

The 1970s oil shock driven recessions can basically be understood as the end of the initial optimistic paradigm of the application of oil powered machines to society. Oil supply in the west was reaching its peak, and henceforth further growth in oil supply would be at the discretion of OPEC, as we found out very painfully in 1973 and 1979, and in consequence we withdrew oil from some marginal uses (eg electricity generation), and focussed on using it more efficiently elsewhere rather than applying it liberally to anything we could think of. Economic growth has been markedly lower in subsequent decades than it was from 1942-1973.

I realize that much of the above is presently anecdotal and speculative, and this kind of account may be unappealing to an econometrication, since it’s necessarily descriptive, and doesn’t lend itself to studying statistical regularities in time series over time, since the various overlapping cycles of innovation, adoption, overcapacity, and retrenchment are all somewhat unique, depending on the nature of the underlying innovation.

But really, if you accept the neoclassical idea that economic growth is driven primarily by innovation, aren’t you necessarily forced to start looking at the specifics of what is being innovated when, in order to understand the main dynamics of the economy?

And it does seem to me this kind of account does lead to hosts of interesting research questions. Eg how much of the growth of the economy between 1945 and 1973 should be attributed to the application of oil powered machinery, and how much to the application of transistors and digital logic, and the resulting electronic and computer products?

Perhaps I should add to the above, that the way you prevent this kind of oscillation in electronic or physical systems is by ensuring that the gain (amplification ratio) around the loop is less than one at the frequency (inverse of period) at which the phase shift reaches 180 degrees, and that the amount of rate-dependent feedback through purely positive feedback paths is held to a level less than the amount of stabilizing negative feedback.

The economic analogs are financial regulation constraints.

The challenge is in finding the optimal tuning for the loops — in industrial process control, it’s sometimes better to allow some overshoot and “ringing” in the settling-out rather than damp the system to prevent any overshoot at all. What you can’t allow is for the oscillations to keep building in amplitude (which is what may be happening now due to serial bubble-blowing).

And you couldn’t ask for a better example than this.

Thanks Professor. So, perhaps one scenario is that the economy isn’t in need of some of those complex derivatives from the financial services industry that are hard to understand.

BR has it exactly: Recessions are caused by a mismatch between the mix of goods and services supplied by the economy and the mix of goods and services demanded.

Austrian business cycle theory elucidates this concise generalization. Credit bubbles generate misallocation of resources.

a fundamental difference between the forces that are driving economic dynamics during…recessions and those that govern normal times. The normal situation is that the primary factor limiting how much the economy produces is our physical capabilities– how many people are willing to work, the quality of their skills and technology, and the physical capital available for them to use….It is hard for me to accept the claim…that the same factors could also be driving business cycle downturns.

OK, but…it is hard for me to believe that the same factors are driving the sluggishness of the past year or so (which is probably not a recession). The Fed was, until last year, deliberately attempting to slow the economy, and everything I’ve seen suggests that the slowdown is mostly due to demand-side factors (and/or mismatches, if you prefer) related to residential housing rather than to a change in the availability of labor, human or physical capital, or technology. So doesn’t that bring us back to,

“It doesn’t matter if you call it a recession”?

BTW I remember hearing Fisher Black give a seminar paper back in the early 90s with a similar mismatch idea. At the time I didn’t know about your paper, so I didn’t notice if he referenced it. I think he was more interested in capital mismatch rather than labor (but now that I think about it, I can’t remember if it was physical capital or human capital).

If one plots CPI inflation (annual) and shift it three years ahead, s/he obtains the same (with minor details) curve as shown in Figure 2 of this post.

(I showed these two curves – UE and inflation – in my post

http://inflationusa.blogspot.com/2007/07/how-to-construct-valid-phillips-curve.html )

WOuld you interpret this 3-year leading inflation as the driving force of future recessions?

Stuart, you might be interested in some of the research by Boyan Jovanovic,

such as this paper.

Chewing on JDH’s encapsulation [like this]:

I for one am yet to understand – after 5 years of economics grad school, a PhD, and two years in teaching – what a technology shock is supposed to be.

But maybe that’s just me.

That crew over at CR is pretty resourceful. If your hopes for a recession are fading, let’s set the bar higher and show how we are falling short. There’s gotta be a dark cloud enveloping that silver lining somewhere!

We’ll have another technology shock – not the kind used so happily in the 80’s – when BK judges are allowed to cram down the amount of a home loan, thereby altering the verbiage of securitization documentation and (gasp) forcing lenders to pay attention to who they put in a home! Oh, the horror – how dare they force anyone to utilize sound lending practices!

JDH,

Very interesting post. The one thing I would like to add, though, is that the two graphs do not themselves make the point I think you want to make. I think you want to show a sharp difference in the change in the unemployment rate from “sluggish growth” to “mild recession.”

In particular, the second graph shows that unemployment clearly rises (dramatically) during a recession. However, it does not illustrate the severity of the recession, and hence the connection between the severity of a recession and the change in unemployment. If I could have my way, I would like to see a cell chart or two-line graph relating the quarterly GDP growth rate and one the quarterly unemployment growth rate. Alternatively, changing the log-GDP chart to a quarterly %change chart would be nice.

(Yes, I know the last two recessions have been particularly soft and fall in the “sluggish growth or mild recession” part of the bar chart, yet see dramatic rises in unemployment. I don’t suspect your thesis will be invalidated.)

Finally, I wonder why it is that the unemployment spikes in your graph are so closely correlated with the NBER-defined recessions and not with the very-near-but-not-quite-NBER-recessions. Specifically, why don’t isolated quarters of negative growth lead to a similar (but smaller) loss of employment than two or more quarters? Such quarters look (from the %change graph) to have happened in/around 1957, 1972, and 2000.

EE

In physics, there is a joke:

Because this large term in equation obscures the results one has to omit it.

Technology shock is an euphemism of this large term, which disturbs accurate results, as presented by equations of real economic growth. If you reduce the right-hand side of the equation by this term you obviously obtain an exact relationship between other variables.

Professor, Fischer Black’s theory of the business cycle was widely dismissed by academic macroeconomists at the time. Your post reminded me of some of his “issues” with the other business cycle theories at the time, as laid out in his two books. I’d be interested in whether you have read his research and if so, do you think it a more plausible explanation of the business cycle than the more accepted academic theories you seem to dismiss in your post here?

professor Hamilton,

The always idiosyncratic Ed Leamer of UCLA has been circulating a most thought-provoking paper titled HOUSING IS THE BUSINESS CYCLE.

http://www.nber.org/papers/w13428.pdf

I am curious as to your thought on that paper,seeing that it presents a perfectly logical mechanism through which the financial market influences real GDP: Reduction in interest rate encourages housing construciton, which in turn is the single biggest component of the GDP.

THanks.

A minor correction for the Professor in that the first graph is not strictly “probability” but rather historical performance. It can’t be a basis for prediction of the future based on any underlying randomness of economic behavior.

Another historical record of other eras or other societies would yield different results.

I would admit that this graph offers some insight into the future American performance if 1) governance doesn’t alter the free enterprise system AND 2) energy EROEI remains fairly constant.

Stuart’s prior post, as usual, offers some more insight into these conditions.

JDH:

Thanks to the links to Jovanovic’s papers, which are interesting. The specific one you link strikes me as being a fairly flawed model in that it assumes that the economy as a whole sometimes adopts technologies which reduce output. This strikes me as completely implausible. Sociologists and marketers have been studying diffusion of innovations for decades and it’s pretty clear that there’s a bell curve of attitudes to new technology from “early adopters” who love new technology and try all kinds of things, through “early majority” and “late majority” customers who adopt a technology once it has become proven and mainstream, and then to the tail end who only adopt a technology after it has become quite painful to function without it.

Within this diffusion process, people talk to each other, listen to key opinion-makers etc, and generally share their judgements about the value of the innovations. Innovations which excite people as particularly valuable spread more rapidly through the social networks in a particular market (much as more infectious diseases will spread more rapidly through a vulnerable population). Now, it’s certainly possible for a technology to excite the early adopters but then fail to “cross the chasm” into early majority customers (because it turns out to be more flashy and overhyped than really useful), but it’s pretty much impossible for a technology to diffuse completely throughout the entire potential market without it being actually useful to the great majority of customers. Customers will detect that the technology doesn’t help them, and the wave of negative buzz will begin to inhibit further diffusion and limit the size of the market.

So the idea that the economy might experience negative shocks from completely adopting counter-productive technologies seems, well, pretty silly. Eg, the tech stock crash did not arise because people decided the Internet didn’t help them after all and disconnected from it – as Jovanovic’s model might suggest – Internet usage continued to rise through the crash. Instead, the crash arose because investors had, in the early stages of diffusion, overestimated the eventual size and speed of the adoption process and created excess capacity and excess stock market valuations in the firms selling various Internet technologies. Once enough data emerged that this overoptimistic paradigm (ie collective judgement) could not be sustained, it collapsed and a more realistic paradigm took its place very rapidly. However, the misallocated resources took considerably longer to reallocate.

I guess to take this idea any further, I’d have to go look at some breakdowns of employment statistics.

Professor, you are right in that

“The normal situation is that the primary factor limiting how much the economy produces is our physical capabilities”

but your list of those physical capabilities:

“– how many people are willing to work, the quality of their skills and technology, and the physical capital available for them to use.”

is painfully incomplete. (To your credit, almost all of today’s economists would also make that pitfall.) You omit one crucial physical capability: the availability of energy inputs.

Neoclassical Economics has been able to get away with this omission because its theory was developed while the world was on the upward way to Hubbert’s Peak. Thus, the availability of ever greater energy inputs could be taken for granted.

But the world is about to enter the downward slope soon, if it’s not doing it right now. After that, energy inputs will relentlessly decline, year after year, before stabilizing at a level much lower than today’s. And so will GDP, regardless of monetary or fiscal policy, as no monetary stimulus can reverse the decline of an oil field, and no monetary stimulus will be necessary to increase oil exploration efforts (or diversion of grain feedstocks into biofuels) since the price of fossil fuels will be high enough to do the job by itself. Accomodative monetary policies will only succeed in driving the oil price higher and an abandonment of the USD as the world reserve currency (Steil 2007)

This implies a paradigm shift in Economics. The Solow model, where Y(t) = F(A,K,L) with A aka TFP being some loose measure of “technological progress” depending only of time, is dead. Welcome to the evolutionary model (Ayres 2003), where Y = F(K,L,U) with U = f R, where

U is useful work,

R is the raw energy (exergy) input

and f is the efficiency with which energy input is converted into useful work.

To make my point more succint, you are right in that, up to now, recessions have been triggered by lack of aggregate demand, an that an idling of potentially productive resources occurs during a recession.

But after Peak (Oil + Gas + Coal) the “limits to growth” (actually the “enforcement of negative growth rates”) in economic output will not be the consequence of insufficient demand but of a relentless *physical* constraint from Nature, namely the decline in the production rate of fossil fuels. Stimulating aggregate demand with monetary policy will not be able to increase output at all.

Will there be an idling of the other productive resources after that (labor and capital)? You bet.

A simple way of expressing what has been said would possibly be:

As mankind progresses we learn to orginize ourselves better and better, creating new inventions, institutions and methods, so that we are better able to produce whatever goods we currently desire.

Sometimes this changes what we desire, or our changing tast modifies what is the best way of organizing society (think: we now prefer cars over horses – thus demad for oil is exceeding demand for hay).

These changes causes a need to reallocate “how we do business”. These reallocations are called recessions, because it means that we will have to redeploy some productions factors (labor, capital or institutions/processes).

bellanson