There’s an idea floating around that asserts that the high price of oil is — at least in part — due to the weak dollar. Does this make sense?

From the Times yesterday:

October 30, 2007

Oil nears $100 mark as crude reaches yet another record

By Steve Hawkes

Oil prices moved a step closer to the $100 a barrel mark yesterday as supply disruptions in Mexico, the weak dollar and the threat of attacks on oil facilities in Sudan pushed crude to another record high.

US light crude soared to $93.80 a barrel before settling at $93.53, up 67 cents. In London, Brent crude reached a milestone by powering through the $90 mark to strike a record of $90.50.

Dealers said investors were increasingly focused on $100 a barrel and added that a widely expected cut in interest rates by the US Federal Reserve tomorrow could fuel yet more buying given the prospect of further falls in the US dollar. Dollar weakness has boosted the price of dollar-denominated commodities and helped oil to surge by more than a third since the middle of August. It has risen more than 50 per cent this year.

…

[Emphasis added]

A causal flow is imputed in this discussion: namely dollar weakness causes the price of oil to rise, because oil is denominated in dollars. In the face of a declining dollar, with the relative price of oil being set in equilibrium, the dollar price of oil must rise. Figure 1, which depicts the time series of log oil prices and the value of the dollar (against a basket of other major currencies), does seem to lend support to this idea.

Figure 1: Log oil price per barrel (WTI) (blue) and log Fed major currencies dollar value (red), daily averages except for October (Oct. 29). Source: St. Louis Fed FRED II.

As the index of the dollar’s value declines, the oil price ascends. While not denying this “numeraire” interpretation, I think one needs to be wary of attributing unidirectional causality. In particular, it’s useful to consider two graphs.

Figure 2: Log oil price per barrel (WTI) and log Fed major currencies dollar value, daily averages except for October (Oct. 29). Source: St. Louis Fed FRED II.

Figure 3: Log real oil price per barrel (WTI, deflated by CPI-all) and log real Fed major currencies dollar value. Source: St. Louis Fed FRED II and Federal Reserve Board.

Two observations. First, Figure 2 indicates that, while there is a negative relationship between the dollar’s value and the price of oil (in logs), that relationship is not statistically significant after accounting for serial correlation; nor is it significant in first differences.

Second, the idea that it’s just a numeraire issue — weak dollar implies more dollars per barrel of oil — does not seem to be consistent with a negative correlation between the real price of oil and the real value of the dollar, plotted in Figure 3.

In point of fact, one should expect two-way causality. A higher relative price of oil should weaken a country’s real exchange rate if it worsens the country’s terms of trade (i.e., the country is a net importer of oil). In addition, if the change in the relative price induces obsolescence of some of the capital stock, this would induce an economic contraction that might depreciate or appreciate the currency, depending on variety of assumptions (home bias in consumption, capital/labor ratios in the nontradable versus tradable sector, complementarity of capital and labor with energy, etc.). In Chinn and Johnston (1996) [pdf], a 10 percentage point rise in the real price of oil induces a 2 percentage real depreciation in a typical OECD country real exchange rate. That estimate relies upon exogeneity of real oil prices (an assumption not invalidated by the data).

Close readers will see that my discussion of how to apportion how much of the dollar decline is causing — versus being caused by — oil price increases is related to the issue of how to identify oil price shocks. There are numerous ways of accomplishing this goal. For one instance, see the IMF’s April 2006 World Economic Outlook Chapter 2, which uses a particular VAR to identify the shocks (thanks to Alessandro Rebucci for reminding me about this study). In that case, there is essentially zero effect of the oil shock on the real value of the U.S. dollar.

Instead of trying to tease out a specific number, let me just discuss the conceptual difficulties in ascribing the oil price increase to the dollar decline. The key here is to recall that oil is a storable commodity, and hence will be sensitive to expectations regarding current and future monetary policy. Similarly, the exchange rate is the relative price of monies, which is also determined by current and expected monetary policy (in at least two countries). In this interpretation some portion of both prices is determined jointly determined.

The idea that monetary policy drives both the dollar and commodity prices is taken up by Frankel (2006) [pdf].

Frankel argues that monetary policy slack, as summarized by the real interest rate, drives commodity prices. Assuming prices of non-commodity goods are sticky, the real price of commodities is equal to the long run real equilibrium commodity price and the real interest rate adjusted by convenience yield.

q = q~ – b (i-pi-c)

Where q is the log real price of the commodity, q~ is the long run equilibrium log real price, i is the interest rate, pi is the inflation rate, and c is the sum of convenience yield, storage costs, and the risk premium, and b is a coefficient (a function of price stickiness). (For a discussion of what goes into the risk premium, see this job market paper by Alquist.)

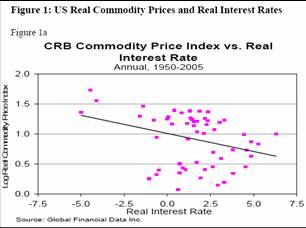

Over the 1950-2005 period, he finds a statistically negative relationship between real aggregate commodity price indices (Goldman-Sachs, Dow Jones, CRB, Moody’s) and the real interest rate (so estimating this regression implicitly holds constant the long run real price and the convenience yield).

Figure 1a from Frankel (2006). Scatterplot of CRB real commodity price against real interest rate.

Interestingly, oil is one commodity for which no statistically significant estimate is obtained. Of course, that could be because of the omission from the regression of the long run real equilibrium oil price (the determinants of which are discussed in one of Jim’s recent posts.

What to take from this discussion? I’d say my main conclusion is that one should be careful in imputing causality. Recent movements in oil prices might due to nominal factors, in which case one could say a weak dollar (in the sense of currency losing value against a bundle of goods) is associated with a higher dollar price of oil. But there could be relative price changes that would induce dollar declines.

And just to make sure everything is confusing, even if nominal dollar and oil price movements due to monetary shocks are the reason for the correlation, the resulting dollar movements — in the presence of sticky prices — can result in real exchange rate movements (see Frankel (2006) that re-allocate wealth and spending power between countries, and hence feed back to oil prices.

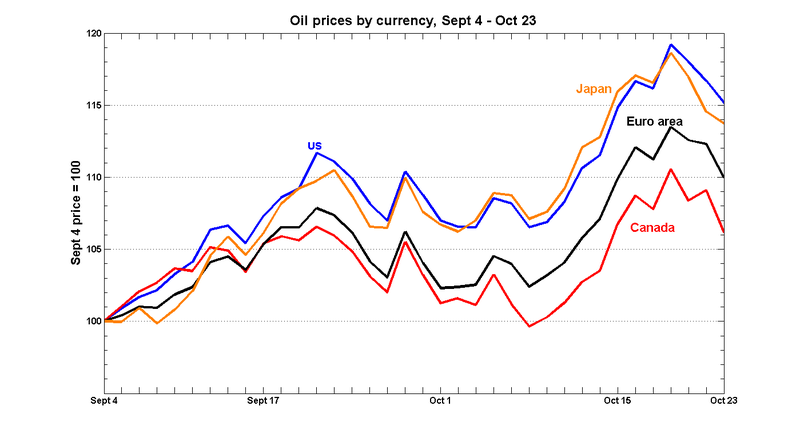

[Late addition] I forgot to add this illuminating graph from Worthwhile Canadian Initiative that Jim Hamilton earlier mentioned to me.

Technorati Tags: dollar,

oil prices,

commodities,

monetary policy

I was very interested by your article and feel it is very well written.

One additional issue regarding dollar valuation and oil markets might be the impact of a weaker dollar on oil demand in non-dollar economies. Since oil prices are denominated in dollars, non-dollar economies (with floating exchange rates) have not seen the same increase in oil prices faced by dollar economies. As a result, one would expect that there has been a lower price effect upon their oil demand than would otherwise be expected.

Since the price effect upon demand is lower, prices need to rise even higher in order to clear the market. So a weaker dollar could lead to a higher equilibrium world oil market price than would otherwise be expected.

I’m not sure I stated this very clearly, but I would be interested to see your thoughts on this topic.

A very interesting and timely article indeed. Even more so for me as my yesterday’s bed time reading was an article by faculty members of my former uni which discusses the identification of oil price shocks using terrorist attacks as an instrument (http://www2.warwick.ac.uk/fac/soc/economics/staff/faculty/oswald/chengrahamoswald2007.pdf)

Anyway I recently commented on a post with the same topic on seekingalpha, arguing that there is an indirect link between the USD and the oil price – any opinions on this are appreciated:

While the world currently gets enough oil, there is not much headroom in terms of production at the moment, and the common perception is that only the OPEC/Saudi Arabia is in a position to increase production significantly in the very short term, giving its quota decisions a lot of pricing power, despite all the cheating of OPEC members. Various OPEC members have been rather supportive on a high oil price, as their oil revenues are dollar-denominated while many of their expenditures are not (e.g. those construction projects are partly paid in Euros). Given this restoration of OPEC power and their incentive for a high oil price, why should they not try to align their production quotas with their own desired oil price?

I think the difficult thing is determing what the desired OPEC price actually is. There are two competing factors: desire to fund current fiscal needs versus the avoidance of encouraging a shift away from petroleum energy. The latter is especially important for Saudi Arabia, which arguable has much, much longer time horizon for oil production than other OPEC members. OTOH, fiscal requirements are rising rapidly, especially as OPEC countries have some of the fastest growing populations in the world and few non-oil economic opportunities.

Thank you for a well written and thought provoking article, but I’m not sure that you are actually addressing the causality issue that is commonly published in the press these days. The idea that oil prices are inversely related to the dollar is, I think, based on the theory that the dollar’s reserve currency status is currently at risk. The relationship is just a sign that pricing of oil is in fact being done in some other currency.

Thus the only relevant data for analyzing this issue is after 2000 when the US deficits started to undermine the belief that the US was capable of getting its economic house in order.

(I don’t feel comfortable commenting on the real vs. nominal issue, since I’m not convinced that it is possible to use data to calculate accurately the value of the real exchange rate — especially in an environment where a reserve currency shift may be underway.)

One should certainly beware of imputing causality in a universe where there are no independent variables. The argument that a weak dollar is causing the high price of oil is, as ST says, relevant more since the dollar’s place as reserve currency has come under pressure.

But the connection is not carried out in a vacuum. The meltdown of the housing bubble and the credit market chaos, along with the Fed’s dumping in as much liquidity as the credit markets want, all contribute to an appetite for commodities, of all types. Gold, wheat, oil, etc., as a semi-liquid hedge.

There is no room for stock speculation in a weakening economy (though I suspect some of the strength we see in stocks is similarly loose money looking for a place to light). Real estate speculation has hit an unfortunate bump. Why not now commodity speculation? Or currency speculation? One should not underestimate the liquidity sloshing around looking for a new market to play in.

On the same subject, I recommand you the paper we published in Energy Policy last summer. We focus on the role of China in this causality :

China and the relationship between the oil price and the dollar, Energy Policy, vol. 35, Issue 11

Menzie,

Thanks for the post. I see a number of problems with your analysis. First, the price of oil has two components 1) supply versus demand and 2) value of the dollar. Concerning supply, it is widely known that the developing countries are seeing huge economic growth from their positive supply side tax policies, especially China, so this has changed the normal ratio between money and oil. But let us look more at the second component since your post is about the value of the dollar versus the rise in the price of oil.

First, defining the value of the dollar against a basket of currencies builds in an error. Let me illustrate. If the general price level of currency A is one and the general price level of currency B is two the ration between the two is 1:2. Let us assume that one bbl of oil is valued in currency A and that the cost is one. That would mean that it would cost two of currency B to buy one unit of currency A to exchange for one bbl of oil; the price of oil in currency B is effectively two.

Now let us assume that there is international inflation so that the general price level of currency A is now 2 and the general price level of currency B is 4. The ratio between the two would remain 1:2 and so there would be no inflation or deflation in your analysis, but the price of oil in currency A, all things equal, would be two. This would be a purely monetary increase in the price of oil from 1 to 2.

To actually determine if the price change is due to inflation you would need to compare oil not to the currency, even the currency adjusted for exchange. You would have to compare the price of oil to a basket of goods, or one good that would be representative of a basket of goods, and you would have to do the same with the currency. Gold is such a representative good for analysis purposes.

If you look at a graph of oil to gold you will see that the ratio is very consistant (allowing for supply/demand changes.) The ratio becomes even more interesting if you look at a graph of oil against the dollar going back to the early 1900s. The graph of the ratio is virtually flat until Nixon broke the final link to gold in the 1970s. Since that time the price of oil has been more like the measurement of a seismic shock. Since the break with gold the price of oil has been driven by monetary policies in the US, but it is interesting that, as our illustration demonstrates, through oil US monetary policy does drive inflation in other countries.

It is this connection between US monetary mistakes and oil that is causing other countries to reconsider pricing oil in dollars. If the dollar was “as good as gold” no one would ever question it.

“Two observations. First, Figure 2 indicates that, while there is a negative relationship between the dollar’s value and the price of oil (in logs), that relationship is not statistically significant after accounting for serial correlation; nor is it significant in first differences.”

Sorry to ask a naive question, but I am a little unclear about what you meant by “accounting for serial correlation”.

I think it’s useful to strip away the basic problem (supply, demand, intertemporal aspects) away from the numeraire issue.

Think of the relevant relative price being oil versus an “international widget”. This relative price is determined by current supply and demand aspects, and expected future supply and demand conditions, and how prices move with other prices (risk premium) and the option value of having oil (convenience yield).

Then think of there being US widgets and non-oil-exporting country non-US widgets. Changes in the oil/widget price have implications for the US widget vs. non-US widget relative price. This is one aspect of how oil prices affect the dollar.

So far, a “real” model. Now allow for money, and allow for sticky prices. Then, monetary policy can have an impact on relative US vs. non-US widget prices. This can feed back to the oil/composite widget relative price, which we see as being denominated in USD. So the numeraire issue is there — but not in a simple, direct, causal manner.

What is essential to this view is, of course, non-neutrality of money in the short run — a proposition I think most readers of this blog would agree with.

Robert Bell: The standard OLS formula for calculating the standard errors assumes the residuals are independent and identically distributed. When the errors are serially correlated, then the formula understates the true standard errors. Hence, one needs to adjust, either by using generalized least squares, or by using some semi-parametric correction to the standard error formula. The method I used was Newey-West with an automatic lag selection for the kernel.

Menzie: Oh I see – that make perfect sense and is described in Jim’s book. The way I read it I thought you were doing some sort of transformation on the variables themselves.

Thanks for clarifying.

P.S. Not that differencing isn’t a transformation … 😉

Robert Bell: Glad that clarified matters. The HAC standard errors are particularly needed when the relationship is estimated in (log) levels. After first differencing, the degree of serial correlation is minimal.

Thanks for the comments Menzie.

The question of causality seems to be one of the most difficult. Recognizing that the supply and demand for the dollar and the supply and demand for oil significantly determine the price of oil the question is does oil price dollars or does the dollar price oil? It appears that the period prior to Nixon’s break with gold seems to indicate that it is the change in the value of the dollar that generates the change in the dollar price of gold. Granted there are many components of the price of oil but it is hard to ignore the change in volatility of the oil price before and after the dollar break with gold.

dickF, This,to me is best explaination of dollar vs. oil relationship. Intuitively, it seems to me if the price of oil is increasing the value of the dollar should be rising not falling because you have to sell your currency to buy more $. But as you said dollar price is due to demand and supply. Currently demand for $ is lessening therefore weaker $ at the same time demand for oil increase therfore higher oil prices.

thanks for the GREAT post! Very useful…

I have written several published and unpublished articles on the subjects for the last 10 years. For a conclusion of the theoretical work that explains the relationship between the dollar value and oil prices see:

http://www.mees.com/postedarticles/oped/a47n33d01.htm

Also see:

http://www.mees.com/postedarticles/oped/v48n15-5OD02.htm

Cheers