So how worried should you be?

Freddie Mac said today that not only did it lose $1.2 billion in the third quarter, but it bounced up against capital requirements imposed by federal regulators, forcing it to sell $45 billion in loans in September and October….

Freddie Mac estimated its core capital at the end of the quarter was $34.6 billion– a mere $600 million above the 30 percent capital surplus requirement set by the Office of Federal Housing Enterprise Oversight (OFHEO).

If it can’t raise more capital– one move being considered is to cut shareholder dividends by 50 percent– then Freddie executives say they may have to limit growth or reduce the size of the company’s retained loan portfolio, and slow down the pace at which it guarantees loans.

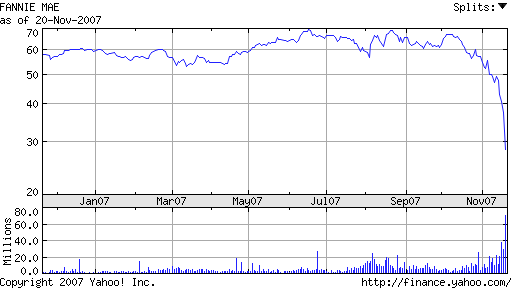

Fannie Mae, which on Nov. 9 reported $1.4 billion in third-quarter losses, has a little more leeway– its core capital at the end of the third quarter was $41.7 billion, or $2.3 billion above OFHEO’s requirements.

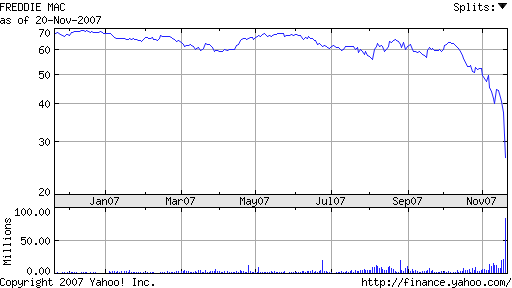

The price of Freddie stock fell 29% yesterday, with the company’s market value now less than half of what it was a few months ago.

|

Fannie shares were battered almost as severely.

|

To explore what this might mean, let’s begin with a little background. Both Freddie and Fannie were initially created by the U.S. Congress with the goal of expanding the residential mortgage market. They are for this reason referred to as “government-sponsored enterprises”, or GSEs, even though both eventually were converted into private companies for which there is today no explicit government guarantee of their debt. InmanBlog points us to the 2007 Performance and Accountability Report from OFHEO, the government office responsible for regulation of the GSEs, which includes some nice graphics to illustrate what’s at stake.

|

After a homeowner has borrowed money to buy a home, the original lender likely resold that loan to Fannie or Freddie. The GSE in turn collected some of those mortgages in a pool which was sold in the form of mortgage-backed securities (MBS) to private investors, for which the GSEs collect a fee in exchange for guaranteeing payment on the MBS. Other mortgages purchased by the GSE are held directly by the GSE for its own investment portfolio. The GSEs obtained the funds for these investments primarily with money borrowed directly from private investors, which instruments are referred to as “agency debt”. The total volume of mortgages either held outright by the GSEs or packaged and resold by them as mortgage-backed securities has tripled over the last decade, currently standing at around $4.7 trillion. That’s about the size of the total publicly-held debt of the U.S. Treasury.

|

Of the loans held by the GSEs outright, a significant chunk is in the form of MBS issued by private enterprises outside the GSEs, $170 billion of which represents securities derived from subprime mortgages.

|

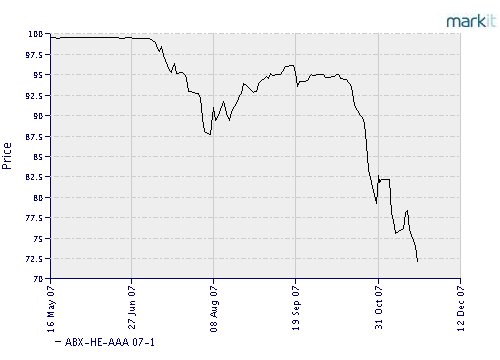

And how big a loss might the GSEs expect to take on these various assets and liabilities? Since the subprime MBS aren’t traded directly, we don’t have a direct observation on their worth. But we can get an indirect idea from the ABX index reported by markit.com. This is an index based on the prices of credit-default swaps on about twenty different AAA-rated tranches of privately-issued subprime MBS. These credit-default swaps are essentially an insurance policy a holder of an MBS can take out against the possibility of capital loss. Felix Salmon is leery of relying on the ABX index, on grounds that there may be a hedge component in these prices and that the reference securities will likely do worse than a “typical” AAA subprime MBS. Notwithstanding, this seems like a decent way to come up with a quick ballpark figure. With the 2007-01 AAA-ABX at 72, we might guess that a holder of $170 billion in AAA subprime MBS has an expected loss in the neighborhood of $50 billion. It’s not clear to me to what extent the GSEs may themselves have already purchased such credit default swaps to hedge this risk, the extent of counterparty risk in any such hedge, or how much of that $50 billion loss may have already been entered on the GSEs official accounts.

|

The OFHEO has been setting minimum capital requirements for the GSEs, currently at around $34 billion for Freddie. Here’s a graph showing how Freddie was managing to stay above the minimum requirements set by the OFHEO up through the second quarter:

|

What happened is that the third-quarter losses bumped Freddie below that line, meaning they need to take steps such as cutting the dividend and selling off assets in order to satisfy the OFHEO requirement. Here’s what Felix Salmon thinks about that:

because OFHEO is being strict with Freddie, it’s being forced to sell tens of billions of dollars’ worth of mortgages. Freddie should be part of the solution to this mortgage-bond crisis; instead, it’s contributing significantly to the magnitude of the problem. Freddie should be a source of liquidity in the market, not a forced seller.

This is all wrong. The reason why capital-adequacy rules exist is to make sure that there’s a cushion in times of crisis. Well, guess what– this is a time of crisis. The capital-adequacy rules should be loosened, but instead OFHEO is sticking to its decision to impose significantly tighter requirements on Freddie.

This is no time to be punishing Freddie for past accounting irregularities– or even present accounting irregularities, for that matter, if such things existed. Let’s keep our eyes on the prize, people. Fannie and Freddie can and should be using their deep pockets and their mortgage expertise to buy up undervalued and fundamentally-curable distressed mortgages, both above and below $417,000, at less than the mortgages are worth but more than the market is asking.

Instead, they’re dumping mortgages onto the secondary market in order to comply with OFHEO’s capital-adequacy requirements. There’s a time and a place for those kind of requirements, and it is emphatically not now.

Whether you share Felix’s view has to depend in part on how you view the magnitude of the underlying problem. If you thought that the market was overreacting to the default risk, then the key goal of policy would be to reassure markets and provide a buyer for the currently unwanted assets, perhaps in the form of a super-SIV or further balance-sheet expansion of the GSEs such as Felix recommends. On the other hand, if you believe that big losses are ahead for all holders of mortgage debt no matter what, then maintaining solvency of the GSEs may be job 1. From either perspective, though, I think you would regard cutting (or eliminating) the GSE dividends as an unambiguously healthy and favorable development under the circumstances.

Of course, there’s lots of middle ground in between. Perhaps you think we’ll probably muddle through OK, unless the sale of Freddie’s assets would so depress the market as to hinder extensions of new loans to creditworthy borrowers, thereby reducing home sales further, thereby depressing house prices further, thereby inducing more borrowers to default, so that we go from the good equilibrium to the bad equilibrium. But figuring out exactly where we stand currently on that slippery slope between A and B is not an easy matter.

Here’s my bottom line: if Freddie cuts its dividend, that’s a good thing. All the rest is worrisome.

Technorati Tags: macroeconomics,

housing,

gse,

Federal Reserve,

economics,

subprime,

Freddie Mac,

Fannie Mae

Very nice summary of the problem, Professor.

Good to see the smart guys like you coming around to the worry that some of us ‘tin foil hat’ types have been living with for a few years.

I have direct responsibility for managing my company’s cash. I have stayed clear of commercial paper and agency securities since 2005; nothing but U.S. Treasuries for us. Yes, I have foregone some yield during the interim, but I was not sure when things would begin unwinding.

I think things have begun unwinding.

Maybe you need a ‘health of the financial markets’ input to your recession indicator/emoticon, because there are many, many storm clouds near overhead, now.

I would have thought that the reason for the capital-adequacy rules would be to reduce the possibility of moral hazard: to make sure that Fannie and Freddy’s incentives are aligned with those of their creditors when it comes to assuming risk.

If that’s the case, then now more than ever those rules are important to prevent the GSEs taking ever-increasing risks with borrowed money.

I agree we are in a pickle and will have to hold our noses to see this thing through. However the moral hazard that created the monster is still in evidence.

Suppose the gov’t decides to view the GSE’s as GSE’s to maintain liquidity. The idea of increasing the mortgage amount to cover overpriced housing is really just creating an opportunity to pass the expected loss to someone else. The corruption in the appraisal process needs to be cleaned up first, along with the Enron style of accounting. Should we provide the GSE’s with tax payer capital in support of fallacious appraisals ?

IMO, investors expect losses because the price of the underlying collateral is overpriced and is adjusting down. People will not buy MBS because they are over-priced. Until the certainty of housing prices and the price of the securities adjust to reflect the repayment risk, the market will be in turmoil.

The GSE’s, the regulators, the lenders, the rating agencies, the borrowers (have I left anyone out) have all been lying, not mistaken. And they continue to lie. Would you recommend that your pension fund buy CDO’s ? Why did the GSE’s.

I think you have the dynamic of what’s going on but I think until the lying, cheating, and stealing stops, and the true price of the underlying is evident, the crash will continue. If, as you suggest, the MBS securities are currently under-priced relative to the potential losses, then efficient price discovery and re-pricing is the best solution.

The RMBS market involves enormous sums of money tied to securities that the market seems to have lost the ability to value on a fundamental basis. The combination of higher than historical default rates with bad trends in market prices, default rates, home prices, and the fraction of ARMs with upcoming resets has created a situation with far fewer willing buyers/holders than when the securities were created. Perhaps the most useful govt. response would be to collect and prominently publish all the info necessary to help the market figure out rational pricing.

Professor,

The focus of you piece is on the subprime book of the GSE’s. Isn’t it time to start looking beyond subprime?

Think of the GSE’s as trillions of contingent liabilities supported by tens of billions of capital: 100:1 leverage (visible — perhaps more through derivatives).

How do they arrive at 100:1? Simple: it is the output of econometric models of losses. These econometric models doubtlessly employ the past fifteen years as a data set, perhaps more but with fewer variables (FICO use for mortgage underwriting dates back only to the early nineties).

Now, professor, what faith do you have in these econometric models right now? Could it be that geographic correlations are understated? Could it be that the relationship of HPA to defaults is understated? Could it be that the three or six sigma range for severities is understated? HGow about the relationship between uneployment and default levels and severities?

Simply put: are the last ten or twenty years an adequate data set? Would YOU run a business at 100 time leverage based on that model output?

This is more than a little bit on the conservative side:

“Felix Salmon is leery of relying on the ABX index, on grounds that there may be a hedge component in these prices and that the reference securities will likely do worse than a “typical” AAA subprime MBS. Notwithstanding, this seems like a decent way to come up with a quick ballpark figure. With the 2007-01 AAA-ABX at 72, we might guess that a holder of $170 billion in AAA subprime MBS has an expected loss in the neighborhood of $50 billion.”

If you go to Freddie’s 3Q presentation here:

http://www.freddiemac.com/investors/er/pdf/slides_112007.pdf

you’ll find enough data to choke a hippo. what the data suggests is that Freddie’s suffering the ills of a harsh dichotomy — the majority of its book of biz is sound – 86% fixed rate, 91% owner-occupied and overall the garbage ratio is relatively small: 8% Alt-A, 9% IO and 1% option arm note: due to the overlap of categories percentages are not additive). The problem FRE has is that the 38% of its book concentrated in ’06 and ’07 vintages has very different characteristics from the overall book: 39% Alt-A, 44% IO and 14% option arm. (WHAT were they thinking, these past 21 months, enquiring minds want to know?)

Even though ’07 and ’06 are only 38% of the Freddie’s book, these two unseasoned fresh vintage years account for 23% of the serious delinquencies, which suggests that the ultimate default experience will be so bad that 67% of the $2.558 billion adjusted reserve was directed towards just these two cohorts of loans.

Or look at it another way — FRE has only $36 bil. of core capital and FNM another $42 bil. of core capital — the “in the neighborhood of $50 bil.” loss on just the $170 bil. of subprime MBS would wipe out about 2/3 of the total $78 billion in GSE core capital. THAT’s not where we are or where we’re going to be, let us all hope.

Anyway, should both FRE and FNM COMPLETELY eliminate their dividends? Of course. Should they be allowed to expand above-and-beyond the OFHEO-directed limit? In a potentially long-lived crisis when we’re probably no further along than the 2nd inning of a 9 inning game, I think the answer has to be, NO. Survival should happen, but needs to be assured.

JDH, this is a very informative post.

My question though is to what extent these GSEs would be able to count on a taxpayer-funded bailout if things worsen. The Labour-led government here in Britain has already pumped GBP25B (over $50B) into Northern Rock and it’s not even a GSE. Just how explicit is implicit US government backing? That’s the question methinks.

Here is a question. According to the flow chart the GSEs buy mortgages according to OFHEO rules that seem to preclude subprime garbage. These are then packaged into MBSs that can be sold to Wall Street. The question is how did the GSEs end up holding MBSs that contain the questionable mortgages?

My understanding is that to get the AAA rating, subprime tranches started out with about 12% subordination. The insurers thought they were being safe in their underwriting if they figured a 50% recovery rate in default on the subordinated tranches. So to get a 28% loss rate on the AAA level with a 50% recovery you would have 12+28*2=68% default rate. Alternatively you could have a 40% default rate at 100% loss on defaults – take your pick. I find those kind of numbers hard to believe. The rating agencies pooh pooh them as well, but an independent outfit called Egan-Jones made headlines a few weeks ago by claiming basically that they are good rules of thumb, and therefore that the financial guarantors like MBIA and Ambac would wind up in default. If subprime, in toto, was really that bad, the loss on ’06-’07 Alt-A and prime is probably much larger than people expect as well, and the survival of many financial institutions will be in danger. The difficulty in coming up with solid estimates is a huge problem in and of itself, and shows up in vigorous debates about which institutions took the correct amount of write downs.

November 22, 2007

The travails of Fannie & Freddie continued to attract attention, with James Hamilton of Econbrowser reviewing their purpose, capital structure and capital adequacy and concluding:

Perhaps you think we’ll probably muddle through OK, unless th…

“…. thereby depressing house prices further, thereby inducing more borrowers to default, so that we go from the good equilibrium to the bad equilibrium.”

Professor, what is the bad equilibrium? My econ background is fairly limited, I’m afraid.

Thanks,

George

George, I’m using “bad equilibrium” to refer to precisely the sequence of events that you repeat– unecessary asset sales set in motion a chain of events that leave us much worse off than if those initial asset sales could have been avoided.

The question is how did the GSEs end up holding MBSs that contain the questionable mortgages?

According to the flowchart, the GSEs mostly buy mortgages from lenders that pass the OFHEO standards, some of which they sit on and others they chop up into MBS and sell. They also issue bonds. Now, note that they are also, according to that chart, buyers of MBS from the open market…

I can well imagine that somebody might sell crappy MBS to Freddeh and buy good (OFHEO cleared) ones from him!

The question is how did the GSEs end up holding MBSs that contain the questionable mortgages?

OFHEO PROVIDES FLEXIBILITY ON FANNIE MAE, FREDDIE MAC MORTGAGE PORTFOLIOS

Statement of OFHEO Director James B. Lockhart on Issuance of Letters by Fannie Mae and Freddie Mac Regarding Nontraditional and Subprime Mortgage Products

Interagency Guidance on Nontraditional Mortgage Product Risks

As you can read on Calculated Risk, Freddie said in February 2007 that it wasn’t going to do any more Nina (No income no assets) loans, but only beginning in Sept 2007. Their reason for such a long delay: they didn’t want to disrupt the market. So they got stuffed with the worst mortgages all year when others were turning them away. Should Freddie and Fannie be forced to respect their capital requirements? Of course. Any economist who would say otherwise probably would also say that in a recession you run a deficit because when the times are good you can – yeah, run a deficit.

Anyway, Freddie and Fannie have been stuffed about as good as your Thanksgiving turkey. They’re going down, the only question is when.

One speculation I wonder about, but haven’t seen much commentary on, is a possible connection between the subprime crisis and illegal immigration.

Consider that subprime loans often involve applicants with low income; the greatest default rates occurred with applicants that had poor or no documentation of their income; we recently saw a lot of stepped up enforcement against employment of illegal immigrants; away from Ohio and Michigan, the other sharp increases in subprime default were concentrated in California, Florida, Arizona, and Nevada – states that have large populations of illegal immigrants; all of the risk models are confused by rising defaults in the face of apparently good employment statistics (which presumably largely exclude employment rates for illegal immigrants).

Is all of the above coincidence?

Freddie and Fannie were in political difficulty and tried to gain some cover by raising the amount of support given to lower income borrowers. The largest-volume method they seem to have used was by buying billions of dollars of non-prime MBS (note, this option doesn’t appear in the flowsheet above).

FRE and FNM have certainly gotten mixed signals from Congress and the regulators – on the one hand, OFHEO was beating on them to hold down the growth of their portfolios (especially their retained mortgage portfolios) to lower their risk profile, while on the other hand Congress was questioning their very existence since FRE and FNM provided so little support to less-creditworthy borrowers. Kind of like pulling back on the reins of a horse to slow him down while whipping the back end to make him go faster.

Josh, I don’t think the states you cite as having large populations of illegal immigrants actually have all that many more than states like Texas where the bubble didn’t inflate very much. And I really don’t think many of the loan officers who approved all these bad loans were illegal immigrants, nor were many of the investors who failed to do due diligence on the mortgage-backed securities. Fannie and Freddie are not known for hiring illegals.

No, it seems most of the people responsible for this mess were citizens or legal aliens. It’s too bad, since people have been having so much fun blaming immigrants for everything under the sun lately.

Jeff, most people point to the reversal in home prices as a primary factor in explaining the large number of mortgage delinquencies and foreclosures that caught so many qualitative and quantitative analysts in the lending industry by surprise. It’s hard to dispute that as a very important cause, but it’s also intriguing to wonder why models going back several decades which predicted that foreclosures would be low when unemployment rates were low turned out to be so wrong. When we look around the country, we see some areas where unemployment and foreclosures were high – like Michigan and Ohio – an other areas where foreclosures were high while unemployment remained low, like California, Florida, and Arizona. Against that background, it’s an interesting question whether home price declines by themselves were severe enough to invalidate the models, or whether something else is going on. Above I through out a speculation (labeled as such) about what else might be going on – i.e. the unemployment statistics could be misleading if they failed to measure employment of undocumented workers and, I should have added, employment in mostly cash industries like some types of residential contracting.

You make a good point that Texas probably has a high level of illegal immigrants, and hasn’t had a big real estate boom, crash, or super high foreclosures. But perhaps the fact that real estate remained particularly affordable in Texas was a key mitigating factor? c.f. http://originatortimes.com/content/templates/standard.aspx?articleid=2202&zoneid=5

You shouldn’t read my speculation as an attempt to *blame* illegal immigration for an economic problem in a perjorative policy-related sense. It could just as easily have been read as blaming the employment crackdown policy, but that wasn’t my intent either.

I think Freddie will get the worst of it because while Fannie was brought up short earlier by their regulator, Freddie took the opportunity to catch up to its cousin, unfortunately at the worst of all possible times with respect to the quality of the loans.

I certainly believe that they have been operating in their own best interest but you can guarantee that when the going gets tough, they’ll say they were just trying tohelp the little guy and do what congress wanted, and so deserve a bailout.

JDH’s use of the word “equilibrium” also struck me as misapplied.

As an engineer, I see the economy as a process with feedback and feedforward. We’ve been in a regime where rising home prices and low interest rates have accelerated the rise in home prices (a second order differential effect in overly simple math terms.)

Think of it in physics terms – change in position is displacement, rate of change of position is velocity, rate of change of rate of change of position is acceleration, rate of change of rate of change of rate of change of position is jerk, etc.

If prices have peaked and and are now declining, a clampdown on GSE lending could add a second order differential NEGATIVE feedback effect.

Markets do more than give instanteous valuations of assets, they think forward so that asking for a market valuation is asking for a prediction of the FUTURE value, discounted to time of transaction.

What we should all hope for is a dampening response from our instititions so that second and third order differential effects are not in themselves the drivers of market changes. This is my definition of boom and bust.

That said, the underlying fundamental issue is how much of our national income and wealth do we decide to invest in meeting our housing needs and wants? That can change and the market mechanisms must allow for repricing to that criterion.