As the decoupling thesis becomes more and more tenuous [1], and the rest of the world exhibits greater evidence of a slowdown [2], [3], [4], leading to predictions of a more persistent and deeper slump in the US than previously anticipated [5], I wonder — where did that presciption of a one percentage point of GDP fiscal stimulus come from?

From the President’s speech on Friday:

After careful consideration, and after discussions with members of Congress, I have concluded that additional action is needed. To keep our economy growing and creating jobs, Congress and the administration need to work to enact an economic growth package as soon as possible.

As Congress considers such a plan, there are certain principles that must guide its deliberations: This growth package must be big enough to make a difference in an economy as large and dynamic as ours — which means it should be about 1 percent of GDP. This growth package must be built on broad-based tax relief that will directly affect economic growth — and not the kind of spending projects that would have little immediate impact on our economy. This growth package must be temporary and take effect right away — so we can get help to our economy when it needs it most. And this growth package must not include any tax increases.

Specifically, this growth package should bolster both business investment and consumer spending, which are critical to economic growth. And this would require two key provisions: To be effective, a growth package must include tax incentives for American businesses, including small businesses, to make major investments in their enterprises this year. Giving them an incentive to invest now will encourage business owners to expand their operations, create new jobs, and inject new energy into our economy in the process. [Emphasis in bold italics added: mdc]

As far as I know, there’s no measured threshold effect in fiscal policy. And if there is, why not 1.5 percentage points of GDP? Why not 2 percentage points? Is the Administration working backwards from projected growth via fiscal multipliers to obtain the 1 ppt. figure? Somehow I suspect not.

To put matters in perspective, consider where the debate has moved over just the past few weeks. Larry Summers writes an op ed in the January 6th FT, advocating: “…a $50bn-$75bn package implemented over two to three quarters [which] would provide about 1 per cent of gross domestic product in stimulus over the period of its implementation.”. On January 10th, the Hamilton Project and Brookings held a conference on fiscal stimulus; a number of around $100 billion is kicked around. Even on the 17th, Bernanke is quoted as noting the possible usefulness of a $70 billion stimulus (although he did not rule out smaller or larger stimuli) (Bloomberg). Now the number being cited as of the 18th is around $140 billion. All this has happened so fast that the White House “Fact Sheet” accessed on January 18th still lauded the the strong growth in the economy (it’s been changed since then):

Fact Sheet: December 2007 Marks Record 52nd Consecutive Month of Job Growth

More Than 8.3 Million Jobs Created Since August 2003 In Longest Continuous Run Of Job Growth On Record

On January 4, 2008, the Bureau of Labor Statistics released new jobs figures – 18,000 jobs created in December. Since August 2003, more than 8.3 million jobs have been created, with more than 1.3 million jobs created throughout 2007. Our economy has now added jobs for 52 straight months – the longest period of uninterrupted job growth on record. The unemployment rate remains low at 5 percent. The U.S. economy benefits from a solid foundation, but we cannot take economic growth for granted and economic indicators have become increasingly mixed. President Bush will continue working with Congress to address the challenges our economy faces and help facilitate long-term economic growth, job growth, and better standards of living for all Americans.

The U.S. Economy Benefits From A Solid Foundation

Real GDP grew at a strong 4.9 percent annual rate in the third quarter of 2007. The economy has now experienced six years of uninterrupted growth, averaging 2.8 percent a year since 2001.

Real after-tax per capita personal income has risen by 11.7 percent – an average of more than $3,550 per person – since President Bush took office.

Over the course of this Administration, productivity growth has averaged 2.6 percent per year. This growth is well above average productivity growth in the 1990s, 1980s, and 1970s.

The Federal budget deficit is down to 1.2 percent of GDP (in FY07), well below the 40-year average. Economic growth contributed to the highest tax revenues on record and a $250 billion drop in the deficit over the last three years.

U.S. exports in October 2007 were 13.7 percent higher than exports in October 2006.…

It’s been a quick turnaround from zero to 1 ppt. of GDP. The question I now want to pose is — if matters deteriorate further as the rest of the world sinks into slowdown — why not more? (Note — I’m not advocating more stimulus; rather I’m trying to highlight the constraints that have been imposed by the ill-conceived policy decisions of the past seven years.

I think the answer resides in the fact that we have been running deficits for the past seven years, and even at the top of the expansion, we were still running a deficit in excess of 1 percentage point of GDP. It’s also useful to consider what 1 percentage points of fiscal stimulus is now going — expenditures in the Iraq theater of operations.

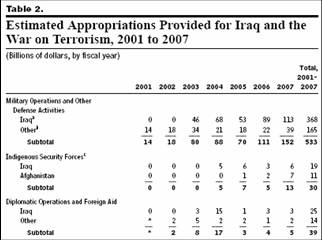

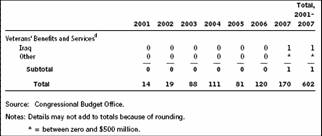

As I’ve noted in previous posts (here, and here) costs of the troop level surge in Iraq were likely to push current costs (and future refurbishment and equipment replacement costs) further higher. My burn rate estimate for FY 2007 was on the order of $11 to $12 billion per month. In October 2007, the Congressional Budget Office estimated Fiscal Year 2007 expenditures at about $122 billion (see Table 2, below).

Table 2 from CBO, Statement of

Peter Orszag, Director, “Estimated Costs of U.S. Operations in

Iraq and Afghanistan and of Other Activities Related to the War on Terrorism,” before the Committee on the Budget U.S. House of Representatives (October 24, 2007).

The fiscal year ended in September; the elevated level of troops can be dated around June. This means FY2007 figures incorporate only about 3 to 4 months of elevated expenditures associated with the surge, while FY2008 expenditures will incorporate about 8 to 9 months of surge-related expenditures. This suggests to me that FY2008 expenditures in the Iraq theater of operations will exceed $122 billion recorded in FY2007.

So, if the economy softens even more than it has, one could certainly contemplate more tax cuts and government transfers and expenditures. But I think one has to carefully consider (1) how much more Treasuries the rest-of-the-world will want to purchase, given their bloated stocks of Treasury securities (2) and at what interest rate, and relatedly (3) how many more dollar assets (both private and government) they want at current yield/default risk characteristics, especially given likely trends in the dollar’s value in the next few quarters. (See Brad Setser on what it takes to get continued financing)

Hence, in my mind, 1 ppt. comes from the fact that we embarked upon a reckless path of long-lived tax cuts (especially in 2003) aimed at the highest income deciles at a time when the economy was growing, and expanding discretionary spending rapidly, as demographic and health care cost challenges loomed (or were exacerbated by Medicare Part D). Now when we need the maximal policy flexibility, we are, truly, facing the situation with (at least) one hand tied behind our back.

Technorati Tags: recession,

fiscal policy,

monetary policy,

tax cuts,

budget deficits,

government debt.

It seems to me it’s a damn good thing we’ve been running large deficits for the past 7 years; otherwise we would have had either a weak(er) economy during this period or an even more extreme housing boom. If there is a constraint preventing more aggressive use of fiscal policy today, the underlying source of that constraint has not been irresponsible fiscal policy but the combination of the international savings glut and the lack of domestic demand outside the housing sector.

“But I think one has to carefully consider (1) how much more Treasuries the rest-of-the-world will want to purchase, given their bloated stocks of Treasury securities (2) and at what interest rate, and relatedly (3) how many more dollar assets (both private and government) they want at current yield/default risk characteristics, especially given likely trends in the dollar’s value in the next few quarters.”

I’m not sure how carefully one has to consider these things. Yields on US Treasury securities are ridiculously low at the moment, and apparently the market is still clearing. (Judging by the action in futures markets tonight, 10-year TIPS yields should be around 1.2% when they open.) If we had to offer a few percentage points more, it wouldn’t be so terrible.

Anyhow, even an aggressive fiscal policy is unlikely to be large enough to make the difference between recession and normal growth. Which means we won’t need to offer higher interest rates; we can just let the value of the dollar drop to the point where people can’t believe it will drop any further. That’s a good thing, because the increased demand for US goods would make up the additional required stimulus.

In fact, if bigger deficits really have the perverse effect of reducing the value of the dollar by causing investors to sell dollar-denominated assets in favor of other currencies (rather than, as I would expect, the effect of increasing the value of the dollar by marginally raising the interest rates offered on dollar assets), that is so much the better. That means any given fiscal stimulus will be that much more powerful, because it will not only increase demand by the usual channel but also increase demand for US goods relative to foreign goods by weakening the dollar.

To answer your question, Dean Baker of CEPR proposed exactly 1%, aimed almost completely at low-income people. He said that it might not be enough, but would be a good start.

But I think one has to carefully consider (1) how much more Treasuries the rest-of-the-world will want to purchase, given their bloated stocks of Treasury securities (2) and at what interest rate, and relatedly

And as I write this, the 10 year is sitting at 3.5%, lower than what Bernake cut prime to.

If there is an interest rate risk, why are T-bill rates dropping? What are they going to bottom out at?

Keep in mind that I’m looking at the rate on EXISTING t-bills. That pool of T-bills simply dwarfs whatever new T-bills would be added by the stimulus.

As I said before, with rates this low, why wouldn’t we back up the truck on fiscal stimulus? Well, other than the fact that short term stimulus doesn’t work.

How about instead we just make the ’03 tax cuts permanent?

My admittedly-vague memory is that Dean Baker proposed the targeted 1% only after W said it should be 1%. And Baker’s argument is based (accurately) on the idea that people who are liquidity-constrained (i.e., don’t have enough money to live on) will spend any monies received, so you get a reasonable multiplier effect not present if you give it to those of us funding our IRAs.

Obviously, the financial system is tottering and people are fleeing to the relative safety of U.S. Treasuries. If the financial system does not collapse and stability is restored, then the demand for Treasuries will plummet. It may only be possible to avoid collapse by massive fiscal and monetary stimulus. The price of avoiding collapse may then be a collapse in the market for Treasuries! Interest rates will soar and housing will be pummeled once again.

The root of today’s problem is in failure to adapt to globalization. A sinking U.S. dollar is part of the process. Lower wages and higher unemployment also seem to be part of the process, and this will lead to dramatic political upheaval…

knzn: If we had run a smaller deficit from 2001-07, then admittedly growth would have been slower, but we would have accumulated less government debt and less foreign debt; we probably would have had less a frenzied housing boom w/o the tax cuts.

Furthermore, upward pressure on commodity prices and energy prices would have been lower. At this counterfactual juncture, we would be facing less inflationary pressures which are currently constraining policy. In addition with less cumulated debt, we could engage in greater countercyclical stimulus without worrying about portfolio balance effects.

Dollar depreciation is not costless; it worsens the terms of trade, meaning that we have to give up more US widgets to get a single foreign widget. So a depreciation is good in domestic aggregate demand terms, not so good in real consumption terms.

We almost certainly would have had a more frenzied housing boom w/o the tax cuts. The Fed’s concerns about deflation in 2003 would have been more severe, not less severe, and monetary policy would have been used even more aggressively. The incentives to develop creative mortgage products would thus have been that much stronger, and the rates on even conventional products (and the opportunity cost of any given payment) that much lower. (Try calculating the present value of a perpetual stream of housing services discounted at 0%.)

It’s not clear that there would be less inflationary pressure today: that inflationary pressure is, in a sense, intentional, and the Fed’s intentions in 2003 would have been the same. The counterfactual hope, I guess, is that the Fed would have run out of ammunition before it could have realized those intentions.

Also it’s not clear to me that we would have less foreign debt. There would be less government debt, but a greater proportion of it would be held by foreigners, because, with US interest rates (and other US asset returns, presumably) even lower, the downward pressure on the dollar would have been greater, and China would have had to accumulate even more dollar-denominated assets in order to implement its exchange rate policy.

The terms of trade are an issue, but I think that the average terms of trade over time would be more or less invariant to any of these policy thought experiments. In the long run, trade has to balance, which means that any period when the dollar is overvalued has to be compensated by a period when it is undervalued. We’ve enjoyed superior terms of trade for a few years; now we have to pay the piper. Maybe it would be better if there were no piper to pay, but in that case we wouldn’t have had a chance to dance. If we choose to eschew the macroeconomic benefits of a weaker dollar today, we’re just putting off paying the piper; aggregated over time, there is no terms-of-trade benefit, but there is a macroeconomic cost.

knzn: While the reasoning makes sense, I think your assessment of the Fed reaction function doesn’t quite match mine, and hence, I disagree.

The Fed was taking a lesson from the Japanese experience in cutting rates quickly. But by the time it reached a target Fed Funds rate of 1%, it’s not clear to me that they would have cut any more. Hence, I’m not sure what you mean by asserting the Fed would have stimulated even more. Conceivably it could have kept the interest rate low longer, but that’s not obvious to me.

On whether inflationary pressures would have been greater or less in the absence of fiscal stimulus. Holding relatively constant the Fed’s response (given the argument in the above paragraph), there would have been less fiscal stimulus in the system. This would have meant a smaller shift outward of the aggregate demand curve in P-Y space. The result is less upward price pressure. In addition, in a world with quasi-fixed or highly managed exchange rates vis-a-vis the US, the policy rates would have been higher in the rest of the world, meaning less global money supply growth.

On foreign and government debt. What you say makes sense — particularly if we live in a neo-Ricardian (or Barro) world. I assume that’s not true. Hence, this is a point of disagreement. (Of course, if I believed in a neo-Ricardian world, I would dispense with IS-LM and AD-AS altogether).

>>>

Brian Wesbury has proven what little he knows about the problem through his writing of this paragraph.

Mr. Wesbury’s “REAL ASSET” apparently includes imaginary equity in the riskiest 10% of a 100% mortgage on a 4-bedroom tract home in Stockton, CA.

IMO, he shouldn’t be managing other people’s money.

I know this comes late, but I found the reference to 1% in the CBO’s Director Blog, posted Jan 22nd:

“Our estimates suggest that stimulus of between and 1 percent of GDP or so would reduce the elevated risk of recession to more normal levels, as long as the stimulus is well-designed.”

http://cboblog.cbo.gov/?p=57