Another week to read what you like into the economic tea leaves.

The sharp February drop in the University of Michigan index of consumer sentiment was described by Sudeep Reddy as “the latest ugly sign of an economic downturn” and by Paul Krugman as more evidence that “the wheels are coming off this economy.”

|

Ugly indeed, though this series is quite capable of sending a false signal.

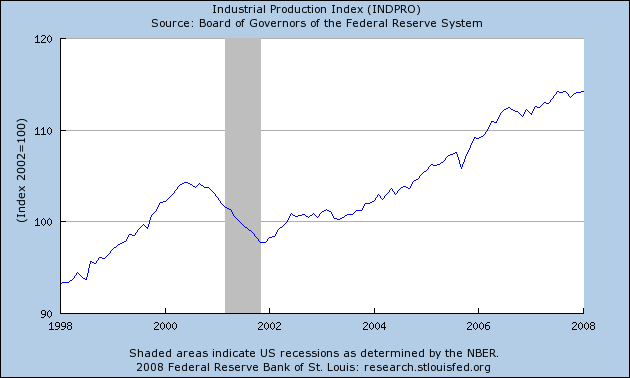

By contrast, Mark Perry crows that the “U.S. economy is alive and well” on the basis of the 0.1% rise in the Fed’s industrial production index in January relative to December, and a 2.3% gain over January 2007, though all of that year-on-year growth comes from the first half of 2007. Still, so far we haven’t seen the sharp decline that might have been expected if a recession has actually begun.

|

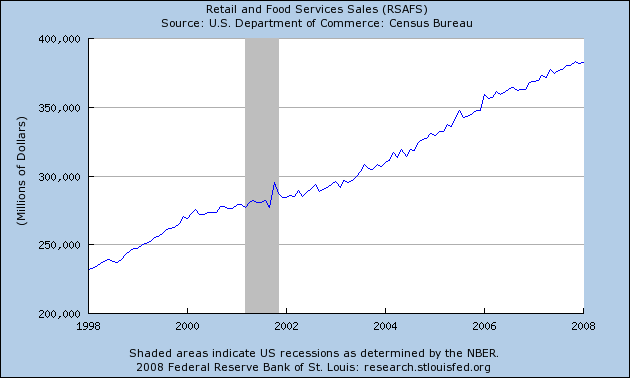

Other key indicators also support the conclusion that growth has slowed but has not yet made a recessionary move into sharp decline. For example, nominal retail sales were up 0.3% for the month and 3.9% year to year.

|

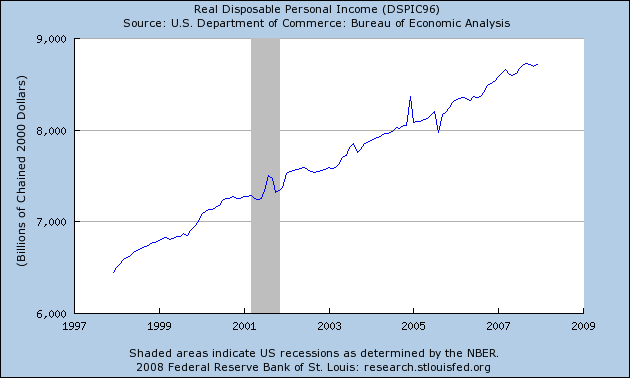

Real disposable personal income likewise eked out a 0.2% gain for the month in December and 2.1% for the year.

|

Taken as a group, these numbers would not refute the conclusion of Paul Krugman, particularly if some of these series end up being revised downward. But neither are the presently available numbers inconsistent with the assessment offered on Thursday from Federal Reserve Chair Ben Bernanke:

At present, my baseline outlook involves a period of sluggish growth, followed by a somewhat stronger pace of growth starting later this year as the effects of monetary and fiscal stimulus begin to be felt.

Also this week, the Congressional Budget Office revised its forecast for GDP growth up by 0.2% for the year on the basis of the anticipated impact of the recent monetary and fiscal stimulus. CBO now anticipates 1.9% growth of real GDP for 2008 as a whole, more on which from Menzie and Greg Mankiw.

So take your pick of what to read into all this. To try to make it simpler, let me pose it as a multiple-choice question. Will real economic growth in the first half of 2008 be (a) slow, or (b) negative?

Technorati Tags: macroeconomics,

consumer confidence,

economics,

recession

There are lies, damned lies and statistics.

-Mark Twain

a, if you’re a FED economist. b, if you’re a consumer.

I surfed over to and asked the online magic eightball the following question:

“is the economy in recession now”

and it immediately responded back with

“yes.”

No joke.

I do all my investing with that magic eightball. It’s never let me down. (Is joke.)

Regarding consumer sentiment you write:

“Ugly indeed, though this series is quite capable of sending a false signal.”

Looking at the graph you posted, however, I see a potential false signal in 2005 (after Katrina), but I don’t see any other false signals — at least readings that are this low that didn’t presage a recession.

After the 1990 recession, we saw a series of higher lows.

I’m not saying consumer sentiment is an reliable indicator, but I’m not seeing other “false signals” on the graph where we go below 75.

Am I missing something?

Anonymous, certainly there have been large abrupt drops that were not associated with recessions. And there have been values lower than the current value (for example, in 1978 and 1992) without the economy technically being in recession. I’d want a longer series before drawing too strong an inference. But I certainly agree with you that the latest numbers on consumer sentiment do not look good.

Professor, during the housing bubble you continued to argued otherwise and look at where we are now! And now similar pattern of counter arguments are posted against the clearly slowing economy. I have to wonder where will we be in a few months, given your certain disposition?

Answer: Zero.

The fun will begin in Q2 2009 as we gear up for the New New Deal.

(Sounds better than whatever silly name the Congress would give to the next “stimulus package.”)

My bet is that the NND will be infrastructure, education-support, and first-time-homebuyer focused, as it should be. Infrastructure spending is needed, as is solid K-12 (and beyond) education support. A properly designed first-time-homebuyer program would be a “bottom-up” way to put an immediate floor under home prices.

Unless, of course, we get McCain. Then we get more bombs.

Lots of bombs.

Lots of body bags.

Intrade.com betting still has 2008 with a ~65% chance of a recession, although that is down from almost 75% in mid January. Doesn’t tell us whether it is expected to hit in the 1st or second half of the year. These modest odds though would indicate that things don’t look all that bad, suggesting that any slowdown might well hold off until later in 2008.

What’s kind of scary is that looking at that consumer confidence number through the lens of not being in a recession.

What happens if we do go into recession? Unemployment claims are not consistent with significant layoffs right now. What if that starts happening?

Anon, in what sense am I posting counterarguments against a clearly slowing economy when I say the only question is whether we’re going to see (a) slow growth or (b) negative growth? I believe I’ve been consistently quite bearish on housing since March 2007. As for the use of the term “bubble”, I suppose I should write on this again.

Isn’t RSAFS one of the few numbers that is *not* inflation adjusted? Thus plus 3% would effectivly mean nothing …

Bye egghat

JDH (and Menzie),

I know you guys have made this point numerous times before, but it did not get mentioned here this time. Is it not the case that the main item that has been propping up the economy from actually falling into recession has been the surge of US exports as a result of the fall of the dollar? Is this not how we can explain the contrast between falling consumer confidence in the US with the lack of a fall into actual recession so far?

Does it seem to you that oil price spikes have a particularly strong effect on consumer sentiment? What strikes me about the current slowdown is that it seems to be coming mainly from a drop in consumer spending. Recent failure for this spending to drop more might be blamed on higher prices for goods with inelastic demands (oil and food). Also, the drop might be slower in materializing than drops in business spending, leading to a slower, more drawn-out period of economic malaise.

Karl, yes, I believe the data suggest that a response of consumer sentiment to oil prices may be a key reason we see a historical correlation between oil price shocks and economic downturns.