Monday’s announcement that Chinese growth was decelerating was not surprising; that it decelerated to below the consensus of 9.7% growth to 9% (y/y) in 2008Q3 was a surprise. This was reflected in the headlines: “China growth rate slows sharply” (FT), “China less likely to buffer world crisis as its economy slows” (LA Times), “China’s economy feels chill from global crisis” (AP). For detailed numbers, see Haver.

Figure 1 depicts the growth rate for China’s real GDP over the past 14 years.

Figure 1: 4 quarter growth rate in real Chinese GDP, latest vintage (blue) and August 2006 vintage (red). Source: CEIC (older vintage), ADB, and press accounts (newest vintage).

Inclusion of the data going back to 1995 (caveat: accomlished only by relying to possibly non-comparable older vintages of the GDP data) puts in some perspective this drop-off in GDP growth. While the 2008Q3 rate is very low relative to recent rates, it’s not an unheard of pace of expansion.

Since I’m not a China expert, I consulted one; Arthur Kroeber writes the GaveKalDragonomics China Insight (not online; here’s Dragonomics’ website). In the latest edition from 15 October (before the 08Q3 release), he writes:

…

China’s economy is slowing, both because of the

global crisis and for domestic cyclical reasons. But the slowdown will be modest,

and in the main provides a welcome and necessary opportunity for industrial

consolidation, rather than posing a more existential risk. A few sectoral problems

— notably in high-end property and low-end exports — will tend to erode bank

profits from their current very high levels over the next couple of years, but with

the possible exception of one or two small and under-capitalized banks the

financial system faces no significant balance sheet risk. However, hopes that

demand from China will substitute for falling OECD demand and rescue the

world from recession will prove ill-founded. And commodity prices have

incorporated a too optimistic view of medium-term Chinese demand growth and

will need a further downward re-rating.

He continues:

We expect that China will post real GDP growth of around 9.5% in 2008,

followed by growth in the range of 8-8.5% in 2009-2010. These growth rates are

considerably below the 11-12% growth rates of the last two years, but are very

strong by any other reasonable standard, and only a shade below the long-term

trend rate. They are supported by underlying trends in demographics,

productivity and urbanization. The structural problems that contributed to the

previous two Chinese recessions (1989-90 and 1998-99) simply do not exist any

more. Hence the current cyclical downturn will be milder than the earlier ones.

His reasoning is that China’s financial system is insulated from the rest of the world by its focus on the domestic economy, the Chinese economy in real terms remains fairly closed, bank balance sheet risk is small, and — while the property market at the high end is problematic — it remains solid at the low end.

One interesting picture in the document is reproduced below:

Figure 1: from Arthur Kroeber, “Apres le deluge,” GaveKalDragonomics China Insight (15 October 2008).

I think that others will find it interesting that net exports represent such a small contribution to overall economic growth (recalling that this is a mechanical decomposition using national income accounting). On the other hand, if one is familiar with the debates over the value added component of Chinese exports [0] [1] [2], then this allocation in the 2003-07 period might not seem too surprising.

Since this is merely a mechanical accounting, it’s important to think about the multiplier and spillover effects — i.e., how the transmission of economic effects might differ between different types of activities. Income associated with export industries might go to agents with a higher marginal propensity to consume, and therefore imply a higher Keynesian multiplier. FDI built for export industries might have greater technological spillovers. On the other hand, as Feenstra and Hong have shown, output oriented toward satisfying domestic demand might have greater employment effects; to the extent that workers have a higher MPC, that might mean a higher multiplier associated with less exporting.

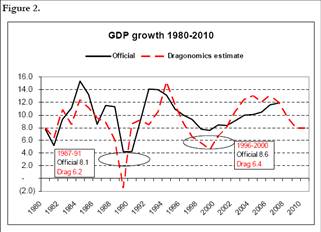

Kroeber is fairly sanguine about prospects, given the latitude afforded by a slightly positive fiscal balance (pretty close to zero percent) [3]. Figure 2 presents Dragonomics’ estimate of true GDP (as opposed to offically reported) and the outlook out to 2010. (Plenty of reasons to wonder about those Chinese GDP statistics [4] [5])

Figure 2: from Arthur Kroeber, “Apres le deluge,” GaveKalDragonomics China Insight (15 October 2008).

One observation I will make is that I think China is arguably a relatively open economy. It’s true that when measured in PPP terms, the economy looks relatively closed; but using current exchange rates to do conversions implies that exports plus imports as a ratio of GDP is about 65% (exports are about 35%, imports about 29%). (Using PPP implies a trade openness ratio of about 34%).

That suggests to me the open economy interpretation of the Chinese economy might be pretty appropriate (even if it’s not exactly “small”). I might note that terms of trade effects could also work their way through influencing consumption decisions, even if in an accounting sense net exports account for only a relative small proportion of GDP growth.

That being said, overall, I agree with Kroeber that one shouldn’t overstate the new figures; there are good economic reasons to believe that the government has tools to mitigate the extent of the slowdown — although growth will slow down. Hence, one of the supporting forces for world growth will be diminished, but not removed — unless one of those political factors (which admittedly are completely opaque to me) should come into play as growth slows down…

Technorati Tags: China, net exports,

trade openness, slowdown,

and GDP.

No concerns that political ownership of banks & therefore political allocation of loans might have distorted the allocation of resources in China?

No concerns that roughly half of the Yuan used to buy US$ debt have been created out of thin air rather than sterilized? No price to paid for this? I guess there is a free lunch after all.

The allocation of fixed investment might be worth a look, Menzie, before reaching conclusions about future growth.

I’m not a China expert either, but here’s a thought experiment. Let’s say last go round the Chinese banks proved spectacularly bad at allocating resources. let’s say the government responded by having the export sector take the lead in doing so. Where would you expect fixed capital investment to be concentrated in such a case? Now introduce huge hot money flows. Those funds will be destined for what kind of investment?

In other words, China may have experienced a bubble in its export sector, and by now we do know a thing or two about bubbles…

BTW, it must be said that the analysis presented above sounds familiar. I believe was saw something similar in reference to the popping of the housing bubble and its impact on the U.S. economy:

“Housing is only x% of GDP, therefore even a 50% decline in housing construction will only subtract x% from GDP growth.”

algernon: Of course one has concerns about a command-and-control aspect to the direction of credit. My point is not to critique the allocation of credit and the structure of the economy (for sure, one can imagine better allocations), but rather the trajectory of GDP given these conditions.

In regards to:

I’m not sure what you mean by half the yuan created out of thin air. Please elaborate. (I agree there is a potential cost to excess reserve accumulation but the first part of the statement is a mystery to me.)

David Pearson: I did not do justice to Kroeber’s arguments in the short excerpt I presented; but he argues that more of the bank loans are profitable than in downturns past. Time will tell if this holds true going forward.

Now, I agree that the export sector will probably take a hit; the question will be how fast that capacity can be redeployed to satisfying internal consumption demand.

by the way, if you look at the graph of projected growth, you’ll see that Dragonomics’ assessment of the downturn is not trivial — essentially from a 12% growth rate sustained over several years to a 8% growth rate. I will observe that these numbers are lower than the corresponding mid-September projections from the IMF’s WEO, so I don’t think these numbers are incredibly optimistic.

Marc Faber said Chinese GDP was actually 5%.

Anyone care to comment. It would not surprise me if the Chinese were cooking the books (we are).

re. ‘I’m not sure what you mean by half the yuan created out of thin air. Please elaborate. ‘

if i may jump in…yuan don’t grow on trees. the central bank prints them up – out of thin air. when it buys dollars from China’s exporters with those freshly printed yuan, it can ‘sterilize’ these money supply additions by draining yuan from the banking system. given that money supply growth in China has been around 20% per annum for several years, it’s a good bet that it failed to do so to some extent.

this, as algernon implies, has wide-ranging economic effects. inter alia it leads to a misallocation of resources and capital consumption.

while it can not be quantified how much capital in China has been malinvested, it can be inferred from the huge money supply and credit growth that has taken place that the degree of malinvestment is fairly large , and that the economic retrenchment that will be necessary to repair the capital structure will be far more pronounced than is generally assumed.

note that China’s stock market has by now fallen by over 70% from the highs of late last year. stock markets usually don’t fall by 70% when all that can be expected is a mild downturn. also, the strength of China’s bank balance sheets may turn out to be a figment of someone’s imagination. in 2006 and early 2007 countless experts (including a certain former Fed chairman) were gushing over the incredible strength and soundness of US bank balance sheets after all!

it has been mentioned that real estate prices in China are falling. actually, crashing would be a better description. China’s banks are surely on the hook for a number of failed investments in real estate as well as other areas of the economy. in addition, the large state-owned banks probably have never overcome their state of technical insolvency – it is only by dint of being propped up by the government that they have avoided to admit to it.

the most likely thing to happen is probably that the world will be surprised again and again by how fast China’s growth recedes over the coming year.

It is my understaning that when the PBoC buys US Treasuries, roughly half of the Yuan/Remimbi they use are sterilized, to wit, they are borrowed from the Chinese people via the state banks. The other half are new Yuan, “printed up” just for that purpose.

It is easy to speculate that China’s M2 growing in the 17-18% range in recent years & some surge in domestic inflation are related to this activity. I would assert that this money creation to peg the Yuan has seriously misallocated resources, especially to a structure of production geared to exports, the demand for which was never sustainable. They will pay a serious price in my view.

I very seriously doubt that China will maintain growth anything like projected by Dragonomics. Unless they undertake truly massive fiscal stimulus, the global slowdown combined with the old accelerator-multiplier mechanism will wreak havoc on their goods-production-oriented economy (as it will on capital-goods exporting Germany). I think an international economic expert would have a much better chance than a China expert at predicting what will happen to China’s economy as a result of the current global slowdown, because I think China’s fate will depend more on what happens to its exports than on its own internal adjustments. And that fate could be dire indeed if developed countries take action against China’s currency policies. (Could that be one of the “opaque political factors” you mentioned?)

PT, I’m with you, at least in your conclusion.

Algernon, for an idea of what an international-economic-expert turned China-expert thinks, I usually check out the blog of Peking University professor Michael Pettis (“China Financial Markets”). He’s very experienced, sometimes a little snarky, but very pessimistic, perhaps proving your point. He also makes the same argument similar to yours — that without a massive fiscal stumilus large enough eventually to break China’s credit, the size of the adjustment they need to compensate for the US adjustment is going to overwhelm them.