A couple of stories that provide some personal perspective on the scope of the current problems.

From the Wall Street Journal:

Travis Jackson walks through his modest ranch house, admiring the kitchen’s built-in spice rack and the red-oak floors. He draws back the curtains, and sunlight illuminates the pride on his face.

The young banker just bought Federal Reserve Chairman Ben Bernanke’s childhood home at a foreclosure sale….

Mr. Bernanke’s family sold the property more than a decade ago. It ended up on the block late last year after its former owners fell behind on their mortgage payments.

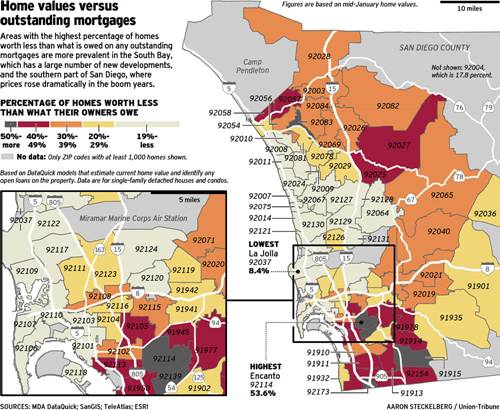

Though some may read cosmic significance in that story, for me it’s just a vivid personal illustration of how widespread this phenomenon has become. Also along those lines, the San Diego Union-Tribune reports that 28% of homeowners in San Diego County owe more on their mortgage than the house is worth; statewide, the number is 26%. The median home in San Diego last year sold for 45% (or $160,000) less than the same house had previously sold for. If you live in the area, here’s their map of how that breaks down geographically:

|

Technorati Tags: macroeconomics,

housing,

credit crunch,

economics,

recession

Guess they are still waiting for Obama to make their house payment and pay their fuel bills.

The American Republic will fall when the politicians learn they can bribe people with their own money. –Alexis de Tocqueville

We had a guy go from Hope and Change to Doom and Gloom after taking office.

Now, the only thing we have to fear is Obama himself. 2 Billion Dollars for Modern Day Brown Shirts in ACORN. Guess there is just not enough money left to save jobs and homes.

I wonder why Vista (92083) is so hard hit compared to its environs?

fascinating. How about Bernanke’s current home ? Sorry, I meant the FED…

Since this is an anecdotal post, let me share one.

I had a brief phone conversation yesterday with a credit challenged young lady wanting to buy and finance a car. It is NOT unusual at all among subprime borrowers. You know, the same people buying houses with nothing down a short while ago.

The background: She has had one car loan before and it reports as charged off with a deficiency balance.

Me: So, what’s the story on your last car?

Her: Well, I bought it and was going along making the payments just fine, then it was stolen. The police recovered it a short time later but, I didn’t want to pay the insurance deductible since I really didn’t like the car anymore so, I just gave it back to the bank.

I explained the error of her ways and referred her to a buy-here pay-here dealer. She still has no clue that she did anything wrong and cannot understand why a bank would not be willing to finance another car for her. I wanted to tell her to just wait. I think there might be a good chance that Chris Dodd and Barney Frank might intercede on her behalf with those mean bankers but, I knew the joke was waaay over her head and she might very well wait for that to happen like all the other lemmings.

With twenty years experience dealing with auto and home finance on the front lines, I can say with absolute certainty that the vast majority of sup-prime borrowers are not people who suffered a personal catastrophe and become sub prime temporarily. No, the vast majority of sub prime borrowers will always be sub prime borrowers because they are too stupid to be otherwise. They are not simply young kids with no experience, they are thirty, forty, and fifty year old people who haven’t learned anything in all those years. If you are going to lend to them, you had better damn sure know what you are doing or you will lose your a$$. Ron White is absolutely correct. You can’t cure stupid.

The solution is to fight back. There is a reason why we spend $8,500 dollars per student in our schools and they leave with out a simple clue in regards to Liberty, Compound Interest or the very few jobs mandated to our Federal Government by our Constitution.

The Job of the Union Mobsters in our schools is to keep the meek on the DNC Plantation.

I saw this Socialist BS coming down the pike and contacted my CPA before the election. Now that I am with in $1800.00 of breaking into the top 4% of tax payers. I have quit producing income.

There is no way I will pay for the mess the socialist dems have made in California and Washington if I do not have to.

I will spend as much money as I can in Nevada and exchange my RE to outside California.

65% of China think Americans are as Socialist as they are. I would tend to agree.

It seems that the commenters to this post don’t understand the rational for stopping or suspending foreclosures.

As the number of foreclosures increase, the greater the supply of homes on the market, causing the price of homes to fall even further. This results in more people owing more on their mortgage than their home is worth. Thus even more people walk away from their homes, further increasing the supply of homes, etc. etc.

In other words, the rationale for suspending foreclosures is to reduce the risk of an overcorrection in the housing market.

Suspending foreclosures would make sense makes sense to politicians who want to win votes. I’m not sure it makes sense to economists.

As long as the Government moves dollars out of the private sector into the Government sector. How can RE rebound?

If Mark to Maket is a good idea for Banks and Grandmas retirement. Then finding a bottom to the Residental Real Estate ASAP should be good also. The sooner the better.

If those Sub-Prime Home owners are so shallow that they walk from and home that could double in value with in ten years. Then let them walk and do not make any more loans to them period. I would go out and buy ten properties right now except for the fact that Capital Gains tax is so high it does not pay for me to take on risk. Then add the fact our Government is about to throw our economy into inflation with out Building Nuke Power plants, drilling for oil or building new refineries.

Should we make an economic recovery. Americans $13.00 per week will not offset $200.00 per barrel oil.

At least Jimmy Carter lived long enough to see Socialist voters elect a worse President then he was.

“is to reduce the risk of an overcorrection in the housing market”

asset bubble deflation is *not* overcorrection.

instead of using billions to artifically inflate the price of non-productive assets perhaps this money could be used for education, infrastructure, and research/development.

All suspending foreclosures does at this point is slow the price correction down and drag out the pain.

There might be a rationale for doing something to reduce the damage from an overcorrection once home prices get back near long-term average price-t0-rent or price-to-income ratios, but the Case-Shiller and other measures suggest there’s another 10%-30% downside before we get there.

And of course, incomes are going to be going down.

Even as someone who deliberately bought cheaper than he could, I can accept some legislation to deal with the massive pain that foreclosures cause. But with limits.

“The American Republic will fall when the politicians learn they can bribe people with their own money. –Alexis de Tocqueville”

True, except that almost every other country is stupid enough to be even more prone to this than America.

America is the dumbest country in the world, except for every other one.

Real Estate in the better suburbs around DC is booming, due to the vast wealth that is flowing to that area.

Assume that the owner of mortgage that goes into foreclosure is unable to recover more than 70% of the value of the mortgage, the Federal government should FORCE all homes occupants,where the mortgage owner applies for foreclosure, to spend time with a financial conseulor, to see if this particiulary household that is behind in the payments, could likely make the payments if they were reduced to 70% of the orginal amount.

Federal money would be better spent paying for conseuling, to separate out those household that have the ability to pay a reduced payment schedule. It is a mistake to treat all household that fall into foreclosure alike. It is also a mistake to give judges unlimited ability to adjust mortgage payments. The possible reductions should be capped by law.

Changing the law so that all foreclosure threatened houseld have the possibility of reduced payment avoids the problem of securing the agreement of the mortgage holder.

Dave Johnson: Now that I am with in $1800.00 of breaking into the top 4% of tax payers. I have quit producing income.

Apparently you are moving from the 33% to the 35% marginal bracket. It would seem irrational to refuse to earn an extra dollar in order to avoid paying an extra 2 cents. But in another sense you are doing a national service by refusing to work longer. There is currently a severe shortage of jobs and someone else can use the work. Thank you for your contribution.

“If those Sub-Prime Home owners are so shallow that they walk from and home that could double in value with in ten years.”

If everyone under 30 believes this then there in lies our “floor” What happened to the good old days when you bought a home to retire in. If you were able to gain at most 4 percent per year appreciation you would consider yourself lucky. In my opinion the folks under 30 are still brainwashed to believe real estate should double in 10 years.. Those days are over…

“Changing the law so that all foreclosure threatened houseld have the possibility of reduced payment avoids the problem of securing the agreement of the mortgage holder.”

Subsidizing mortgages is wrong. It is wrong this administration will actually do this. The unintended consequences will be shocking to anyone including the president the damage this will do. The saying “what comes around goes around” is human nature at its best. To ask me to subsidized via my taxes a house twice the size of my 900 sq ft. home with a 240 a month mortgage payment will do damage that will take a very long time to fix. I have always been fiscally responsible and charitable. I will not donate a red cent penny to any organization and as I type I am scanning the stimulus package to make sure I “game” it as much as I can. I am a women and will soak it for every penny..

Joseph

The top 1% pay over a third, 34.27% of all income taxes. (Up from 2003: 33.71%) The top 5% pay 54.36% of all income taxes (Up from 2002: 53.80%). The top 10% pay 65.84% (Up from 2002: 65.73%). The top 25% pay 83.88% (Down from 2002: 83.90%). The top 50% pay 96.54% (Up from 2002: 96.50%). The bottom 50%? They pay a paltry 3.46% of all income taxes (Down from 2002: 3.50%). The top 1% is paying nearly ten times the federal income taxes than the bottom 50%! And who earns what? The top 1% earns 16.77% of all income (2002: 16.12%). The top 5% earns 31.18% of all the income (2002: 30.55%). The top 10% earns 42.36% of all the income (2002: 41.77%); the top 25% earns 64.86% of all the income (2002: 64.37%) , and the top 50% earns 86.01% (2002: 85.77%) of all the income.

What I have learned is it does not pay to produce in a Socialist Country.

With out so much as a simple thank you from those who take from those who produce. The Government with leaders like Palousy, Obama, Reid and Kennedy get all of the credit for giving away my money.

You folks also forget the Tax Burden of living in California which I hope to change as soon as I can.

I can not afford to take more risk to pay for Socialists to buy votes with me money.

David,

Pls list the source of your numbers.

You also forgot to look at the Payroll Tax which is much burden for the low income people.

Pls check also how high eee low the taxrate of the top 20 largest US companies is. SURPRISE – SURPRISE

Hermann Tammen,

My name really is Dave.

*Data covers calendar year 2001, not fiscal year 2001 – and includes all income, not just wages, excluding Social Security UPDATED IRS Table of Numbers from 2001.

Many have a problem with the rich. I myself think Soros would stop at nothing to make a fast buck or be a King maker in the interest of a European Socialist Lite America.

This being written, Most of the rich folks I have met do not understand how any of us can be poor. Most work 18 hour days because they are doing what they love to do and the money follows.

Maybe you might want to look at the number of jobs created by the top 20 Companies, take the total payroll of those employeed by such Company and the amount the employees pay to the State and Federal Governments who earned none of the money generated by employee or the employers.

A simple studie would be to look at States dominated by Democrat Government vs State dominated by Republican Government. The results are eye opening.

Gov. Arnold has been rolled by the Dems in Sacramento sense the day he walked in the doors. Arnold was never a Conservative but way to the left of JFK. Liberals (Socialist) have killed the State though energy policy run by aging Hippies, illegal immigration and the Government buying votes with other peoples money. Teachers Unions blowing $8500 dollars a kid and they need more bucks? Hum.

Now we have poor people with one or more cars, TV, Phones, Homes to live in, Food, water, heat and AC.

Most of the world would love to be part of America’s poor.

There will never be enough money for this type of Government who really are thieves worse then the Mobsters of our past. At least mobsters had a soul and I can not say the same for those who just voted for Pork and Spend.

Dave Johnson, I agree with your rants about government spending, but it drives me crazy that you seem to blame only democrats. Bush borrowed from future generations $5 trillion — more than the 43 presidents that preceded him. And for 2/3 of his two terms, the Democrats had no vote whatsoever, it was all Republicans 24/7. Yes, they thought tax cuts would be paid from growth, but they were wrong, horribly wrong.

Our road to hell has not been paved by the DNC, it is paved by Reps and Dems alike.

Wow…are the comments always like this? More links to real data please if you have an opinion based on reality and policy.

The interesting reality in the trends in “hot” areas for people to owe more on mortgages than their homes are worth, is that the causes underlying these trends are still never discussed. Builders made double and triple their investments during the hot time, a math that will always result in someone holding the bag when the music of expansion stops. The math that should drive real estate pricing is “cap rate” math, where the estimated rental income is determined on a property and you multiply that amount, net of the hard expenses such as taxes to get a triple net rental income. Once you have that, you multiply it by some number (15X perhaps, but not more than 20X) and get an estimated value. If you buy homes with that math, you’ll never be where people are. In Los Angeles you can rent a “$10 million” home for $15-20,000 per month, which indicates that the home is really worth $2-3.5 million, but no one talks about this disparity. If you go back to the Reagan days when he reduced interest rates, this rental disparity didn’t exist. It has moved over time to a place where people try to sell a property for 50X its rental income, which is ridiculous. No investment should have a 2% return, even in a ZIRP environment. People need to mass together to stop the 2 party political system, which will only continue to destroy out nation.