Both have to be “handled with care”.

Revisions

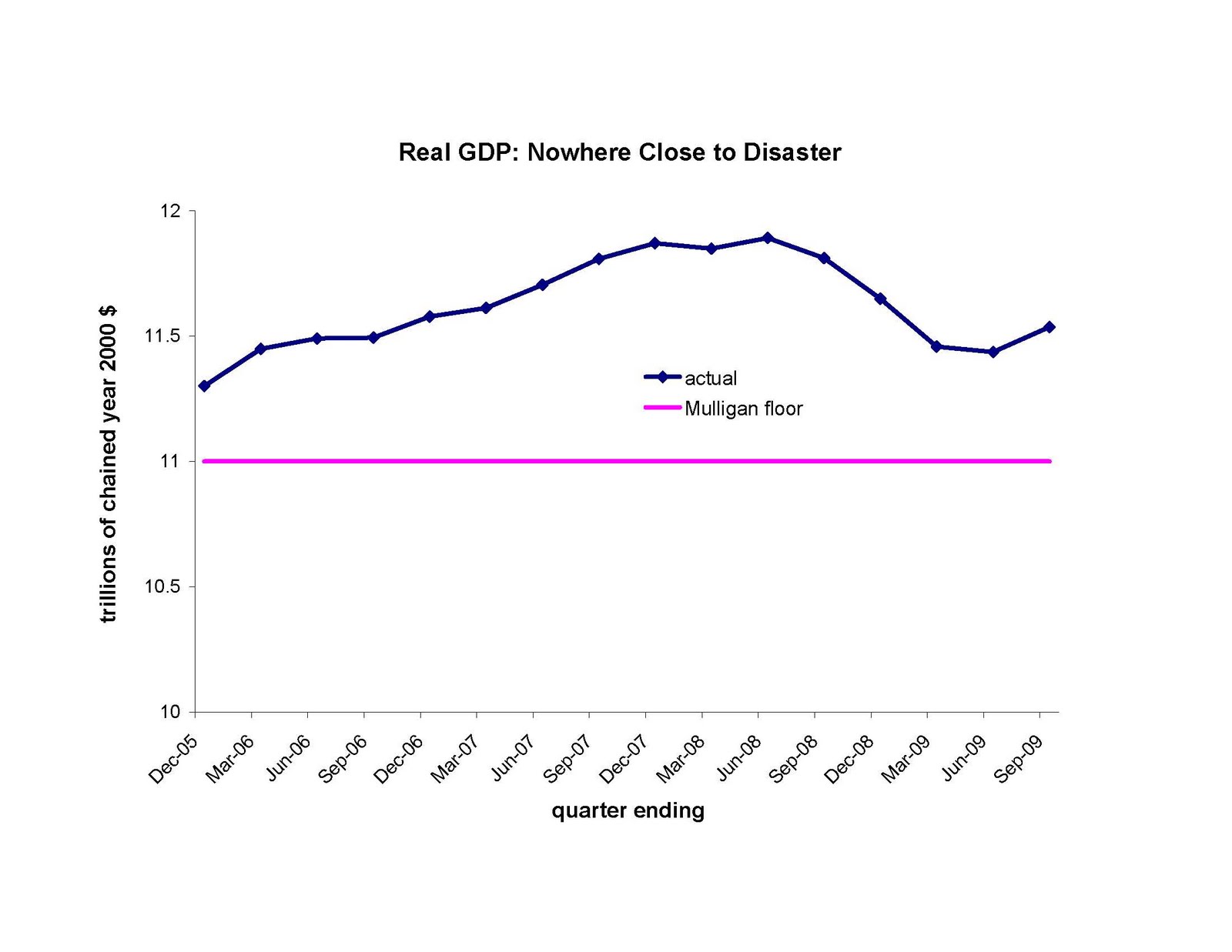

We’re all tempted to make predictions on the basis of the last data point. And even more difficult to resist is the temptation to make definitive statements on the basis of data that are sure to be revised. For instance, we see this question from Casey Mulligan, “Where’s the GDP Disaster?”.

Last October, when we were told that spending and incomes were about to collapse, I predicted that “real GDP will not drop below $11 trillion (chained 2000 $).”

Professor Mulligan provides this graph.

Figure from Mulligan, “Where’s the GDP Disaster?”

I think this is an excellent time to recapitulate the hazards of making definitive assessments on the basis of data that are sure to be revised [0] [1]. To illustrate this point, I go back to the last recession, which according to the NBER extended from 2001Q1-01Q4.

Figure 1: GDP in billion Ch.1996$, SAAR, according to the April 26, 2002 and October 30, 2003, advance releases. NBER defined recession dates shaded gray. Source: St. Louis Fed ALFRED.

I plot the vintages of GDP in Ch.1996$ available as of April 2002 (the advance release for the first quarter after the recession ended), and October 2003 (advance release for 2003Q3).

Note that GDP in the latter vintage was 1.6% lower (in log terms) in 2001Q2 than it was in the corresponding period according to the earlier vintage. This amounted to a 5 148.6 [corrected 11/1, 10:35am] billion Ch.1996$ difference.

Now, I replicate Professor Mulligan’s graph. I draw Professor Mulligan’s floor, along with real GDP, and an alternate for 09Q1-09Q2 that would obtain if GDP turned out to be 1.6% lower in a later vintage.

Figure 2: GDP in billion Ch.2000$, SAAR. GDP calculation involves deflating nominal GDP by the base year 2000 deflator, obtained by dividing the 2005-base chain deflator by .88648 (the value of the 2005-base deflator in 2000). The “alternate GDP path” applies the difference between the April ’02 and October ’03 estimates of 2001Q2 GDP (in log terms). NBER defined recession dates shaded gray, assuming recession ends in 09Q2. Source: St. Louis Fed ALFRED, NBER and author’s calculations.

I calculate GDP in Ch.2000$ by dividing the 2005-base chained price index by the average value of the index in 2000, which is 88.648, and then dividing nominal GDP by this base-year-2000 index.

The graph indicates that in 09Q2, GDP was only 2.3% above Mulligan’s floor.

And Conditional Forecasts

In some sense, the critical aspect of Professor Mulligan’s argument that the events of 2008-09 were never going to be disasterous is that he made his projection conditional on none of the extraordinary measures undertaken by the Fed, nor on the the fiscal stimulus by the Federal government being implemented. It’s useful to recap his statement from October:

NO DEPRESSION; NO SEVERE RECESSION

The medium term fundamentals point toward more real GDP, more employment, and (to a lesser degree) more consumption. Some employment and real GDP declines may occur in the short run, but they will be small by historical standards. Professor Cooley recently explained “The losses to date represent less than .5% of the work force. In the relatively mild recession of 2001 to 2002, job losses equaled about 1% of the work force. In the much more severe recession of 1981 to 1982, job losses totaled nearly 3% of the labor force–six times today’s figure. And in the (truly) Great Depression–invoked, now, with an alarmist frequency–job losses between 1929 and the trough in 1933 were 21% of the labor force.” Note that 21% over 3 1/2 years is an average decline of 2% every quarter for 14 consecutive quarters! If employment declines 2% in even one quarter, or 5% over a full year, I will admit well before 2010 that a severe recession is happening and that my 2010 forecasts are unlikely to be attained.

According to the BLS, national nonfarm employment was 136,783,000 (SA) at the end of 2006, as the housing price crash was getting underway. Real GDP was $11.4 trillion (chained 2000 $). Barring a nuclear war or other violent national disaster, employment will not drop below 134,000,000 and real GDP will not drop below $11 trillion. The many economists who predict a severe recession clearly disagree with me, because 134 million is only 2.4% below September’s employment and only 2.0% below employment during the housing crash. Time will tell.

Now, I assume that Mulligan feels free to compare a forecast conditioned on no fiscal policy against one with fiscal policy to the extent he believes multipliers are near zero or even negative. And perhaps he believes money is neutral in the short run. If so, then of course it’s fine to make the comparisons he does. But for those of us who believe that monetary and fiscal policy have textbook effects, then making that comparison is problematic. In the absence of these stimulus measures, I believe we may very well have breached that 11 trillion floor.

To see this, consider CBO’s assessment that by 2009Q4, the stimulus package would have an impact of between 1.4 to 3.8 ppts of baseline GDP. The midpoint is 2.6 ppts. That’s well within the range of the Mulligan floor.

So, to conclude, in my view, a “GDP disaster” would have occurred in the absence of aggressive actions by the Federal Reserve, the US Government, as well as fiscal and monetary authorities abroad.

I suppose that one can read this bit of analysis as also concluding that we have, in fact, had a “GDP disaster” as stimulus funding is artificially injected and not economically produced? That’s another way of asking if “the stimulus” isn’t a distortion of economic realities.

Employment is already down to 130.9 million and they will reduce that by 0.8 million when they incorporate the benchmark. Perhaps Casey should talk with Kevin Hassett about how to rationalize dumb-ass forecasts. Or he can talk to Steve Levitt

“So, to conclude, in my view, a “GDP disaster” would have occurred in the absence of aggressive actions by the Federal Reserve, the US Government, as well as fiscal and monetary authorities abroad.”

How about a too much lower and middle class debt disaster with a quick and sharp GDP disaster being one of the symptoms has been avoided?

How about the GDP disaster will be long and drawn out and possibly not quite as sharp? In other words, attempts to save debt prices, housing prices, and stock prices for the rich?

I see bailouts for banks; the domestic, politically connected rich, and the foreign, politically connected rich. I see practically no bailout for the lower and middle class.

I think taking on Casey Mulligan is a bit like picking on the fat kid in dodge ball.

“But for those of us who believe that monetary and fiscal policy have textbook effects, then making that comparison is problematic. In the absence of these stimulus measures, I believe we may very well have breached that 11 trillion floor.”

The problem is these are just beliefs. Where is the science that would allow us to make these statements with a little more confidence? We invest literally trillions in stimulus programs and the best statements we can come up with start with “I believe”? It is problematic that we do not have more of a consensus on fiscal and monetary policy effects.

I see repeatedly in the popular press statements that the stimulus program and easy money are “responsible” for much or all of the 3.5 Q3 growth rate. What are these statements based on? How is causality established? An alternative explanation is that GDP is simply reverting to the long run path – mean reversion that would have occurred even absent fiscal policy.

I will concede that the evidence on the effectiveness of monetary policy is firmer. As for fiscal policy, there is simply too little convincing evidence one way or the other. Trillions in spending seems like a lot for a policy that has at best uncertain effects.

look at this graph of payroll employment from the BLs and remember it will be revised down. Menzi’s argument about conditioning on Fed actions and stimulus is well taken. But even with Casey’s multipliers of zero. He looks like a fool

http://data.bls.gov/PDQ/servlet/SurveyOutputServlet?request_action=wh&graph_name=CE_cesbref1

Romain Wacziarg: Thanks for your comments. I agree that it is distressing that so much commentary alludes to “beliefs”. As for the science, I have tried my best to bring to the debates the “science” of estimating multipliers, by reviewing various economists estimates studies — see the mulitplier category here on Econbrowser.

I do wonder about your argument that GDP is merely reverting to trend, given the question of whether GDP is trend or difference stationary (see these posts [0] [1]). Anyway, time will tell.

The most peculiar thing about Mulligan’s forecasts concerning GDP and employment is that his “floor” for GDP represents an 8% drop from peak and his “floor” for payroll employment represents only a 2.4% drop from peak. Why would he give himself so much wiggle room on GDP but so little on employment, especially when Okun’s Law suggests that that the drop in employment should be perhaps half as great as the drop in GDP?

Mulligan has a history of embarrassing himself publicly with his statements on macroeconomics. I sometimes wonder if he should stick to his area of competance (microeconomics). But I suspect he feels compelled to share his opinions for ideological reasons (this seems to be a pattern at Chicago). If so I think he is unintentionally undermining his cause (one can always hope).

On the point offered by Romain Wacziarg concerning GDP reverting to trend, I would like to add the following. Econometrics aside, one has to consider the mechanism by which GDP returns to trend. Certainly the monetary and/or fiscal policy response has to be taken into account. I often find it perplexing that people say that output always reverts to trend without noting that that often happens in large part because of a policy response. (I know that Mr. Wacziarg is not stating something that extreme.) In our own case with interest rate policy having hit the zero lower bound, the massive expansion of the federal reserve balance sheet and decline in monetary velocity there is considerable evidence that monetary policy is not able to provide the normal amount of stimulus. It is also precisely under these conditions where we expect to see discretionary fiscal policy be more stimulative (short term interest rates being fixed).

To take the Krugman vs Mankiw debate topic a little further, it has been a common observation that deeper recessions lead to faster recoveries. (See for example Milton Friedman’s “plucking theorem.” Friedman proposed that in recessions GDP behaved like a plucked string with the “plucking” evidently being some kind of shock, usually being demand in origin.) My own observation is that the pattern is more robust when one looks at the unemployment gap (difference between actual and NAIRU) than the output gap. The relationship apears to be exponential rather than linear however. Nevertheless this pattern of the recovery speed being proportional to recession severity is probably due to the fact that the policy reponse is similarly proportional.

A low inflation/deflation environment presents special difficulties for the exercise of monetary policy. The faster prices adjust, the faster the economy will turn around and resume growth. The problem is that prices are sticky, they don’t adjust quickly to changes in monetary conditions, and wages are even stickier. Getting workers to accept pay cuts for example, which would be necessary in a low inflation/deflation situation, is much more difficult than to ask them to simply accept more moderate wage increases as might be the equivalent in a moderate to high inflation situation.

A bigger problem is that the Fed’s ability to expand the money supply by cutting interest rates is much more limited in a low inflation/deflation situation. The zero lower bound means that interest rates cannot be made as negative in real terms as when inflation is higher. Also, low inflation (or more seriously, deflation, particularily highly leveraged asset deflation) magnifies the real burden of debts.

Thus I am convinced that the pace of recovery this time is highly conditional on the fiscal policy response. And needless to say this presents political difficulties that the exercise of monetary policy is relatively unencumbered by. This is just another reason why, when Mulligan offers his “expert” opinion, to put it somewhat indelicately, I wish that he would put a sock in it.

“In the absence of these stimulus measures, I believe we may very well have breached that 11 trillion floor.”

A grammar note: don’t you mean “might”, not “may”? I think that would be much clearer.

Economists may blame FED on subprime crisis but maybe it is wrong to conclude like that because the major reason of excess liquidity and bubbles is from the currency intervention by Asias central banks. When there is capital inflow into Asia countries, mainly from current account surplus first and capital account later, Asias central banks intervene the markets by injecting another liquidity; though they use sterilization but the outside liquidity is still on. Surely, the liquidity will flow back to US in form of the Asia central bank and private investments. Thats why US face the subprime crisis and bubble in asset prices even though there are no fundamental supports. This I called the liquidity reflectivity effects.

FED may use the right monetary rule and inject the suitable liquidity to stabilize the price and growth in the past; however, when the currency intervention occur, the excess liquidity will occur in the two continents and we can see why there were the bubbles in Chinese and US markets together at the same times.

This time is different because FED have the objective to devalue the dollar to suitable level to support the growth and solve the trade imbalance (that should be done to sustain the economy); however, Asia countries, especially China and Middle East, still use the same policy: interventions. Thats why we see the V-shape recovery in financial markets and maybe in the economy later. However, we would see the low inflation for sometimes under sticky price like the past cycle with too much excess liquidity. Nevertheless, the excess liquidity will turn into uncontrollable and create another bubbles that maybe larger than anyone expect and will create upward pressure on the inflations.

I think only way the excess liquidity will reduce is the quit of Asia central banks to intervene the market. Although FED start to increase the interest rate, the liquidity is still on like we see the past cycles that FED increased the FED Fund rate in 2004 but the bubble was going on till 2007 and it ended be itself not by FED or other central banks.

How can we achieve to reduce the excess liquidity? I think it is very difficult because the US central bank and Asia central bans have the different objectives. FED may need the price and growth stability without concerning the change in the exchange rat; however, Asia central banks need the exchange stability because their growths come from the international trades. That s why no conclusive policies both sides to tackle the excess liquidity and no one think the excess liquidity will cause the severe effect in the global economy. Even the one country use policy to control liquidity but the others donot, the excess liquidity will exist.

Maybe the next bubbles will surely happen, and it will be the same result that we past; unless Chinese government and Middle East start to float their currencies.

Justin,

Gimme a break! I wasn’t that bad at dodge ball…

By the authority invested in me…under the august body universally respected, I do declare:

Ever the gentleman and scholar, Menzie.

But by the hecking demons teeming inside me, something else:

Mulligan, the professor and not the stew (and not to be confused with that island on TV either), exercises the Public Relations exercise…which negates the substance of that promotion. (Bernanke with his 60 Minutes sets the BAD example and the impaired follow suit, yes?)

If there is no problem with the current malaise, it requires no attention.

We don’t need no fat-boy tellin us how it is.

No. We need kharris to tell us that she is not a pound over-weight and fit as a fiddle…Our Dodge Ball Queen.

See? Reports that bolster confidence…not reports of WaMu bank runs months after the fact…mysteriously escaping even UTube exposure.

Anyone else having tangles with…dissolving Authority (following Chom with the present particple and not “the dissolution of authority”)?

Let me skip Mulligan and whether ‘Time will tell.’, for this disturbing derivative:

“fat-boy” vs “Professor”…a revelation of Infidels in The Choir.

This is the real flu, yes? (I accept your responses as authoritative…ok, maybe only genuine…possibly deluded, but the median I shall endorse…ok, possibly the core median…as a preliminary –revisable and of course ready for any benchmarking as conditions warrant. Hell, I will take the log of itall, so respond with all your might.)

So, you’re a rocket scientist. (Play with me you fool, Dodge Ball is not It.) Let’s see your work…and the Ares Test Flight performance stands in stark contrast to the unfolding disaster which is not a condemnation of economics so much as the domination of Public Relations by vested interests whose fondness for truth, transparency and all that…is none of your goddamn business.

Time is running out, tis.

Last October, when we were told that spending and incomes were about to collapse, I predicted that “real GDP will not drop below $11 trillion”

Yes, Casey Mulligan, that’s because the government stepped in and made sure those forecasts were not realised (a stepping in, incidentally, that you opposed). It’s a good example of why economic forecasting is impossible in any world where agents who can change outcomes react to the forecasts.

The disaster is in the real economy, the balance sheet, and in the purchasing power of after tax income for the middle class.

If we look at unemployment and count people in the same way as we did in the 1970s we would find unemployment rates close to 20%. The problem isn’t just the rate but the momentum. No matter how it is spun, creating more government jobs, which is where most of the gains have been, is not a good thing for the real economy. All those people will need someone in the private sector to make enough money that is transferred to unproductive government workers. Capital will be depleted and Americans will become poorer as cumbersome regulations, high taxes, and stupid energy policies force industries to move their operations abroad.

As tax receipts fall and foreign investors refuse to buy long dated treasuries the government will use the Fed to monetize its debts. That will force prices for many essential goods much higher at a time when wages are not increasing and household balance sheets are deteriorating.

At the same time we have a massive amount of debt held by federal, state and local governments, as well as by consumers and businesses. Those debts cannot be repaid by money of equal purchasing power so Congress will push monetary expansion that will devalue the purchasing power of the treasury notes even further.

The end result of this will be a decline of the portion of the scarce resources that are consumed by Americans and a relative decline in the standard of living of Americans in comparison to the rest of the world. While energy and gold prices should correct sharply their long term movement remains higher. When Americans figure it out and move into the commodity sector in a futile attempt to protect themselves from a plunging FRN we will see a massive bubble develop that will make those who saw the big picture develop and purchased their commodity shares in the 1990s very rich. Sadly, many of the real gains will be confiscated by high taxation but they should do much better than the fools who trusted economists that don’t seem to have any common sense and do not understand the effects of central banks on the business cycle.

Vangel makes the mistake of equating debt owned by individuals and debt owed by corporations, relatively short term debt, versus the debt owed by localities, states, and the Big Kahuna, Uncle Same. Individuals die, corporations go out of busniess, they both can go into bankruptcy. States are in comparison more enduring entities. And they can always raise taxes (and the links between taxation and economic growth seem to me the most ideological and bias producing the results desired field in economics. Everyone for instance is moaning about Japan’s growing Fiscal debt, but this is partly a policy choice of the Japanese elite as they have one of the lowest tax rates of OECD nations, particularly their taxes on personal income, corporate profits, and capital gains (see: http://www.oecd.org/document/60/0,3343,en_2649_34533_1942460_1_1_1_1,00.html. In fact, this chart is full of inconvenient facts for both doctrinaire Liberals/Social Democrats (where I tend to be) and libertarian conservatives (Japan and Mexico, who conservatives rarely hold up as examples of good economic management these days, both have very low taxes compared to other OECD nations, but supposedly socialist France and Germany also both have lower real taxes on income, profits, and capital gains then the United States at the end of the Bush II regime – but I digress.) The U.S. standard of living, relative to the rest of the world has been declining since 1945, and that is a good thing, as first Western Europe, then Japan, then Korea, Taiwan, Singapore, and now the BRIC nations and the rest of Southeast Asia have raised their standard of living to near the American standard. The problem for America now is not the relative decline (while in absolute standards it grows), but that the standard of living is declining in absolute terms (since the Civil War, the fourth time that has happen, the other periods being the period from 1873-1879, 1893-1896, and 1929-1933). Further, contrary to what Vangel speculates will happen, what is the opposite. Foreign central banks, particularly the Bank of China, are intervening in the market to buy dollars in order to keep their currencies from appreciating against the dollar. And within the U.S. the dollar is appreciating versus the value of the assets that most Americans hold such as their houses while their debts have not been haircut unless they “strategically” foreclose. Real wages are flat or declinning (even if sticky), and with high unemployment anticipated for the next 5 years, along with the outsourcing pressure, it is likely that real wages will continue to decline through this period.

The period when consumption, sprawl, and finance were the main engines of our economic growth has come to an end. Given the short term mind set of American business and the dominance of an ethics of selfishness in the leadership of these firms that allows them to enrich themselves at the expense of the investors, customers, employees, and long term viability of their businesses, any long term investment has to be initiated by the Government, much like it was done by the Government in the 19th century with the building of canals and railroads. But looking at Congress and the current mindset of the Republican Party, that also appears very unlikely. For reasons very different than Vangel, I also tend to be pessimistic, but is that reality or just my temperment?