Back in late October, I was invited to a Bank of Canada workshop (organized by Brigitte Desroches and James Rossiter), entitled “Understanding economic outcomes in uncertain times”. I was flattered (and a little surprised) to be asked to participate in a panel discussion on “blogonomics”, chaired by David Wolf of the Bank of Canada. On the panel were esteemed fellow bloggers David Altig of Macroblog and Stephen Gordon of Worthwhile Canadian Initiative.

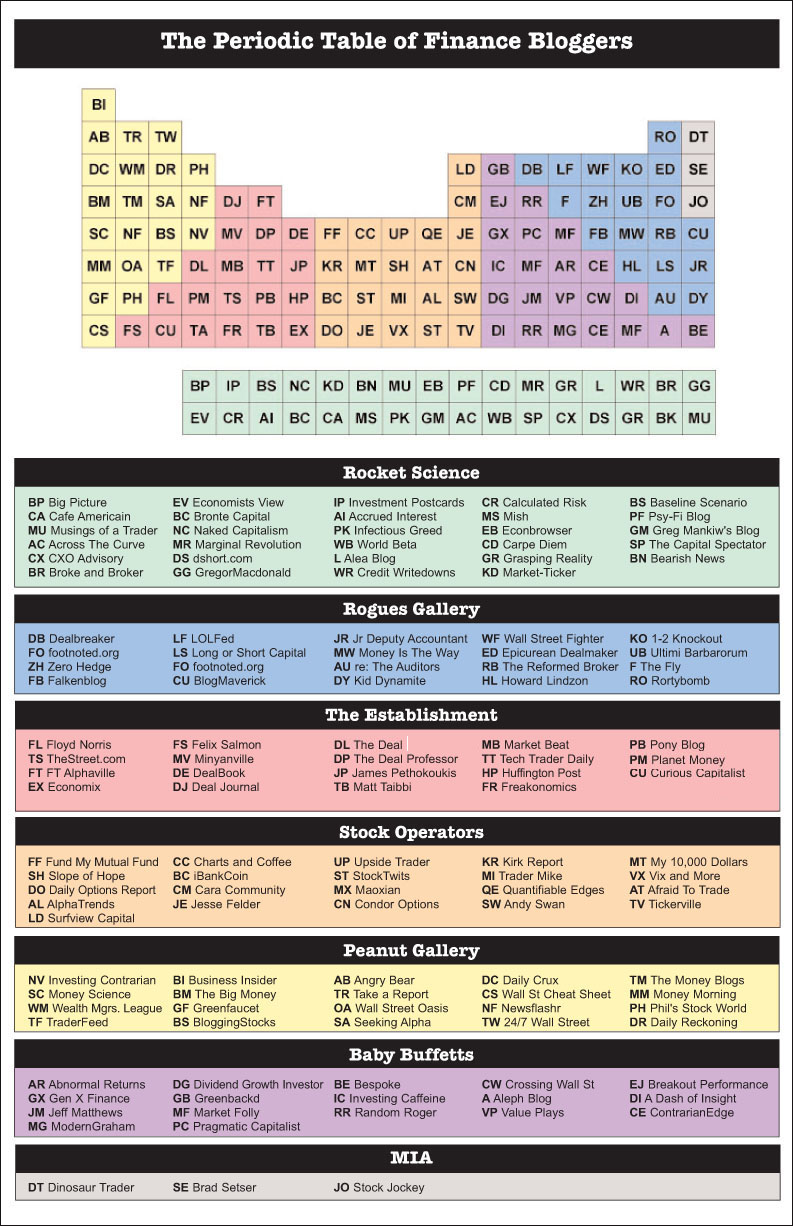

Source: The Periodic Table of Finance Bloggers.

Some questions posed by the panel chair were:

- Why do you blog?

- To what extent has your experience blogging matched your expectations going in? Has the response been surprising on any dimension? Has it taken up more (or less) of your time than you’d thought? Has the process of blogging had an unforeseen impact on your work and thinking?

- What effect do you think the emergence of economics blogs such as your own has had on the economics profession? On academia? Policy? Markets? The public? Any specific examples you can share from your own blogging experience?

- What is the most ‘trouble’ you’ve ever gotten into from something you’ve written on your blog?

Rather than going through all my answers (and I’ll have to leave David Altig and Stephen Gordon to recount their answers), I’ll just make a few general observations.

To me, the most interesting outcome was the general impression that certain bloggers had substantial impact on policy discussions. While I had conceived of my role as trying to fill the gap between academics and those working in journalistic arenas, the discussion emanating from the panel participants and the audience was that in fact blogs had an increasing impact in policy debates. There was, however, a distinct generational divide in terms of who were influenced by blog content. Blogs were followed most closely by younger economists, while the more senior economists had, shall I say, little patience for following economics blogs.

That being said, it also seemed to be the case that as the number of quality economics blogs had proliferated, it was less and less feasible for individual economists to consistently read select blogs. “Aggregators” — in my lexicon, blogs that collected lots of links in addition to presenting the blogger’s own view (e.g., Economist’s View) — were increasingly relied upon to do screening (although both Altig and I lauded the topic-specific Calculated Risk and the now-dormant Brad Setser’s blog as really important resources in understanding the development and propagation of the current financial/economic crisis).

Some conclusions were unsurprising. We agreed that blogging had had little impact upon the nature of our research. Nor did we believe that economic research as an activity had changed as a consequence. Rather, the development of an economics blogosphere had accelerated the pace of disseminating ideas. But in the end, there was no substitute for closing one-self off in a room, and thinking through models and/or data carefully, in order to write an academic paper.

We also pretty much agreed that “blogging” did not represent a discrete break with previous modes of discourse in the economic policy arena. In particular, briefs and commentary pieces published by the various Federal Reserve Banks had filled the role of blogs in an earlier period. From my perspective, then, the creation of “CBO Blog”, for instance, does not represent a qualitative change in the means by which information is conveyed.

I think one of the big advantages of a well-developed blogosphere is that the set of “experts” quoted in the newspapers and online venues has been expanded. Previously, you would see the same individuals quoted again and again. That is no longer the case, I believe. So, to the extent that one wants a diversity of views represented, this is a positive development.

There was also some discussion of which blogs did not contribute positively to general policy debates. For me, those included those focused on theoretical frameworks that, to me, presented non-falsifiable propositions.

(For some related discussion related to bullet point (1), see this post.)

Love the table!

Well, you know, you’ve probably tanked my Thanksgiving weekend. Now I’ll have to go through that periodic table of bloggers to find out what they’re saying!

I think you and Jim can rightfully be proud of Econbrowser. It is both influential, and as importantly, teaches those of us interesting in learning about the world economics.

Happy Thanksgiving!

Ok, I am going to do a little victory lap here…..

Black Swans do not drift in, they are delivered by a cruise missile in the middle of the night, holidays, or on the weekend.

http://oahutrading.blogspot.com/2009/11/chart-of-charts-112109-slam-down.html

http://oahutrading.blogspot.com/2009/08/mania-chronicles-and-dubai.html

http://oahutrading.blogspot.com/2009/11/blow-off-top.html

http://oahutrading.blogspot.com/2009/11/30-year-gap-study-and-some-political.html

As America tryptophans out and wakes up weary tomorrow, with half a trading day to “panic out with”, this could be very interesting. Looks like nearly “perfect timing” by our financial overlords. Lots of Turkeys (aka Lemmings) getting cooked today.

The quest for knowledge and truth is a Long March,that both rocket scientists professor Chinn and professor Hamilton are accomplishing daily to my great interest.

Should you one day,land in the same universe of Brad Setser, please do share with us your observations on mutant species.

Thanks

Just curious. How were the blogs chosen for the table? It seems to leave out a lot of the most popular business and economics blogs and include some obscure.

One thing you didn’t comment on-

the power of underdogs to write quality content, and have the world beat a path to their door. Calculated Risk was started by one, then two “nobodies”. That it could be singled out for praise by you, and Krugman, says something.

Both about the failure of experts to provide us (and the Queen of England) with quality info when we needed it; and about the power of the internet as an equalizer.

RicardoZ: You’ll have to ask The Reformed Broker yourself. Perhaps it’s how closely attached to reality the commentators are? Just a guess.

It’s laughable that this supposed periodic table of finance bloggers doesn’t include any of RGE Monitor’s blogs or noted finance experts who do blog.

Many of the supposed finance bloggers listed aabove demonstrate very little knowledge of finance.

I am of course sorry that econospeak did not make the cut to be in the table, but, oh well. What I was unable to figure out was what the locations represent, if anything.

I tend to agree with your general view of the situation regarding the relationship between the econoblogosphere, policy, and research, Menzie.

Menzie wrote:

Perhaps it’s how closely attached to reality the commentators are? Just a guess.

LOL!!

LOL!!!

LOL!!!!

Anonymous 5:06 AM (aka RicardoZ): Please elaborate. Who do you believe should’ve been on the table, so we can assess your judgment. Somehow, I think I have a gleaning, but inquiring minds would like to know for sure.

Yes Menzie I was Anonymous. Sorry.

I did not see “The Conscience of A Liberal,” Paul Krugman’s blog, even though it is the number one finance/economics blog on WIKIO. I thought that perhaps it was because Krugman was poltical but the Huffington Post was included and it is strongly political. WIKIO does not even include it in its finance/economics blogs.

It would have been nice to see more of a mix of contrasting views such as Russ Roberts’ “Econtalk” (Russ has fantastic interviews BTW), “Cafe Hayek” (JDH has mentioned them in his reference to blogs), and/or “Mises.org.” Granted “Cafe Hayek” and “Econtalk” are not in the top blogs, but “Mises” is number 23 on WIKIO.

Then there are the obscure, for example “Matt Taibbi” is not in the top 100 of WIKIO’s finance/economic blogs.

My question was serious not rhetorical. I was actually interested in how the chart was developed. Perhaps they had some logical way of choosing those on the chart rather than just personal opinion.

RicardoZ: Ah, actually didn’t know of Wikio, so I’ve learned something. I suspect that the periodic table reflects the idiosyncratic concerns of the Reformed Broker, specifically those that are relevant to finance, rather than economics more broadly. Implicitly, I suspect that this means that the Reformed Broker finds the writings of Krugman, Roberts, Cafe Hayek and Mises of minimal usefulness to making asset allocation decisions.

Thanks Menzie.

Interesting reflection Menzie. Thanks for sharing; glad you received the invitation.

I find the best economic blogs occasionally offer insights and reflections of the kind that a graduate student or colleague might hear in a hallway discussion between professors, researchers and graduate students. Reflections that come after reading hundreds of articles and books. Reflections that may not easily find their way into peer-reviewed material.