Paul Krugman ([1],

[2],

[3]) has been arguing vigorously that U.S. budget deficits are no cause for concern. I see things differently.

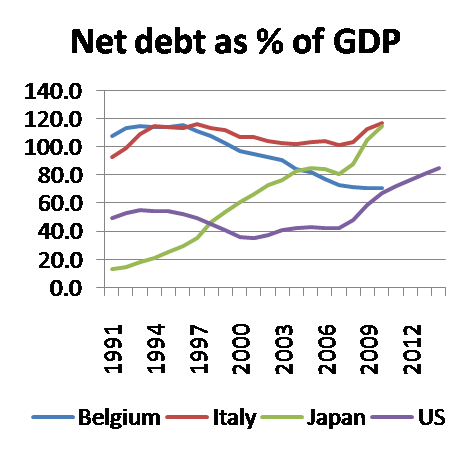

One of the arguments that Krugman makes is that, although the U.S. debt-to-GDP ratio is expected to double over a short period, the higher level would still be substantially below those currently observed in Italy and Japan, and only modestly above that of Belgium. Paul suggests that if these countries can run up debts of this magnitude without serious repercussions, so can the United States.

|

But European politics may not import all that well to this side of the Atlantic. Receipts of the U.S. federal government have never exceeded 21% of U.S. GDP, even at the height of World War II. A permanent move to taxation levels significantly above that would require a major shift in the political landscape, for which I see no consensus of support. To me that implies that any spending trajectory inconsistent with the long-established U.S. norm may be headed for a political brick wall.

|

One of the ways I have suggested for personalizing this issue stems from the observation that $1 trillion is approximately the total personal income tax receipts collected by the U. S. federal government in 2006. So, to calculate what another trillion in deficits means for me personally, I take the amount I paid in federal income taxes that year and double it; $10 trillion in new debt will require 10 years at that higher rate to pay off. It’s going to be a real problem for any politician who tries to service the growing debt burden by raising taxes. That’s why I see troubles ahead for managing the federal cash flow.

But Paul feels I’m using an inappropriate metric:

Jim gets scary numbers about the debt burden by assuming that we’ll have to pay off the debt in 10 years. But why would we have to do that? Again, the lesson of the 1950s– or, if you like, the lesson of Belgium and Italy, which brought their debt-GDP ratios down from early 90s levels– is that you need to stabilize debt, not pay it off; economic growth will do the rest.

Normally, you’d think that putting off repaying a debt does not make it any smaller. The federal government can (with my wallet) pay the trillion today, or it can wait 10 years to pay one trillion plus 10 years’ interest, or wait 20 years to pay one trillion plus 20 years’ interest. The present value of the service cost on one trillion dollars in debt is exactly one trillion dollars today, no matter how long you put off paying. My comments on how much a trillion really is are perfectly appropriate for discussion of any repayment timetable.

Perhaps Paul is suggesting that there may be a potential free lunch available from postponing payment in this case, arising from the fact that the economy’s growth rate has historically exceeded the government’s cost of borrowing. If I put off paying another year, with interest the amount I owe grows 2% in real terms, but my income grows 3%, so things get easier the longer I put it off.

Let me go on the record as favoring the consumption of truly free lunches. If everything the government buys really is free, then by all means, let’s have them buy more, and more, and more, and rather than double my taxes, let’s cut taxes all the way to zero. Unfortunately, I expect that Paul would agree with me that in fact there is a limit to just how much we can count on supersizing this particular happy meal. At least I know that he entertained such concerns, as Scrivener and Verdon note, when in March of 2003, Paul contemplated the implications of the debt-to-GDP ratio that was then reaching 40%:

we’re looking at a fiscal crisis that will drive interest rates sky-high….

But what’s really scary… is the looming threat to the federal government’s solvency.

What I presume was producing Paul’s concerns in 2003, and is giving rise to my concerns today as well, is the fact that the low cost of government borrowing relative to the economic growth rate– which could produce the apparent free-lunch calculus– is predicated on the historical political equilibrium, which Paul worried might not be continued after 2003, and I certainly worry might not be continued after 2009. Specifically, I would suggest that the low borrowing cost that the U.S. government traditionally faced was very much attributable to the responsible management of the debt. Once that responsibility becomes called into question, the U.S. will cease to enjoy that privilege. This kind of problem gets messier, not neater, the longer you put it off. And that’s why you might not want to assume that an apparent free snack can be scaled up to an unlimited feast.

Which brings me to Paul’s third argument:

Right now, however, the bond market seems notably unworried by deficits. Long-term interest rates are low; inflation expectations are contained (too well contained, actually, since higher expected inflation would be helpful). No problem, right?

Alas, I’m getting the sense that the Obama administration is intimidated all the same. We’ve got the president telling Fox News that he’s worried about a double-dip recession if he doesn’t reduce the deficit soon– as opposed to the concern I and other have that he’ll have a double dip if he doesn’t provide more support. (And why is Obama talking to Fox News, btw?) And the buzz is that admin economic officials are telling him that the bond market needs to be appeased, even though rates are low.

This is truly amazing. It’s one thing to be intimidated by bond market vigilantes. It’s another to be intimidated by the fear that bond market vigilantes might show up one of these days, even though you’re currently able to sell long-term bonds at an interest rate of less than 3.5%.

Paul is absolutely right that, at the moment, we’re observing an amazing willingness of investors and foreign central banks to lend to the U.S. Treasury. On Monday the Treasury successfully auctioned $44 billion in 2-year notes paying the lowest yield on record, and last week the nominal yields on some bills on the secondary market actually turned negative— people paying for the privilege of being able to lend to the government. So if the government were to borrow another dollar today, invest in anything with a positive rate of return, and repay the sum in two years, it would indeed be a great deal.

Those remarkably low yields at the moment in my mind are a result of a flight to safety. Many people are afraid to hold anything other than treasuries until there’s some more clarity to the economic and financial landscape. It’s not so much a market vote in favor of the U.S. Treasury as it is a market vote against everything else.

But the question before us is, what will the situation be another two years down the road, when the government will need to go back to bond markets to roll over the debt it issued on Monday along with new debt to cover the several trillion added to the federal debt between now and then? Krugman’s position is that we should trust the term structure of interest rates to give us the answer. If markets anticipate an explosion of short-term interest rates a few years down the road, why is anyone today buying the longer term debt at such low yields?

If you thought that there is some chance that treasury yields will only rise slightly over the next few years, but also some risk of solvency problems and a panic flight from the dollar, what you might want to do is to take a long position in treasuries hedged with a long position in commodities. I agree with Paul that the long-term treasury yields are hard to reconcile with a market worried about the solvency risk. But I would add that the run-ups we’ve seen in commodity prices are hard to reconcile with a market sold on the deflation scare. What I see is investors buying both bonds and commodities, suggesting that people are spreading their money across a variety of strategies to be in position for several alternative scenarios from here.

Is it possible that some time within the next five years, the U.S. Treasury will run an auction in which there are not enough bids to roll over the debt? My answer is yes.

For other thoughtful perspectives, see Brad DeLong,

Carlo Cottarelli,

Dean Baker,

Tyler Cowen, and

Free Exchange.

UPDATE: Krugman responds

Jim,

This is a superb post.

Professor,

I know this may be amazing if anyone has seen my postings here but I do agree with Krugman on one thing. Economic growth could in fact take care of our national debt problem if we simply held the debt constant – provided we had policies of debt rather than redistribution.

But Krugman fails in achieving this. First, he has not at all called for stopping the growth of deficit spending. As a matter of fact if anything he has called for more deficit spending as he crys for more stimulus.

Second, he does not understand the difference between a redistribution model and a growth model. He sees growth as coming from government, but that is foolish since the government produces nothing and actually hinders production through taxation and regulation. Krugman’s government spending policy prescriptions are always taking existing wealth and redistributing it to less wealthy, or, if you will, taking from the most efficient producers to waste the money on inefficient producers.

Krugman finds himself caught in a Catch 22. He follows a social security model, not a growth model. And a social security model cannot be supported without growthing wealth in society something the social security model stagnates to fund security. Krugman needs growth to fund his suggested programs but his programs actually consume existing capital through redistribution and inefficiency stiffling growth.

Are banks using ‘free’ FED money to invest in long term treasuries, which in turn keeps long term rates low? If the cost of funds for a bank is ~ 0 and they get a certain annual (real) return on t-notes and bonds of 3.5% to 4.5%? It seems like an arbitrage opportunity so banks should be willing to buy up all the govt debt that is issued. I thought this was the back door method to improve bank balance sheets.

Prior to the crash, the big investment banks relied on securitization for easy profits, now they use the free fed money. At the same time, the FED is telling all banks to raise lending standards and improve their balance sheet. The result is that few borrowers (households and business) qualify for a loan. Banks are left with few profit generating alternatives other than buying government debt. Very convenient for a government that needs to issue a boatload of debt.

Good post. Krugman is a bit of a soft target, since everybody knows he’s full of, err, something. He proves old Marx’s most accurate observation: that economic systems always create the ideology they need to justify themselves. As government sponsorship of bubbles developed into a pattern, it was inevitable that somebody would develop an ideological system in which government sponsorship of bubbles is held to be right and good. Krugman saw the niche and filled it.

It’s widely recognized that the low rates on Treasuries are a result of monetary stimulus creating excess liquidity. It can’t all go into asset bubbles. On top of the recent $300 billion of Fed purchases of Treasuries, a large part of the bigger and ongoing Fed purchases of paper from the GSEs gets cycled through the financial system and ends up buying Treasuries. Any monetary stimulus inevitably adds to the pool of capital available to buy Treasuries. This is basic stuff.

I hope Krugman’s characterization of Obama is right and that Obama is beginning to understand that a continued monster deficit would force the Fed to continue monster monetary stimulus and create monetary havoc. I hope.

The marxists’ view of a capitalist economy has always been that you could milk the producers as much as you want and they will still produce, like the draft horse in Animal Farm. And if the captains of industry “go Galt”, why then the government can just take over and make everything work even better.

Any major tax increase at this point will cause a disastrous depression, which will result in civil discord like we have never experienced. And without a major tax increase the economy will never expand enough to pay off the debt we have now. At the very best, we face decades of stagnation. And there is no other country to act as the engine of the world economy if we decline the job.

JDH,

I don’t think this is an entirely fair representation of Krugman’s argument. His point is not that we can run huge deficits forever and that deficits don’t matter. His point is that critics are overstating the consequences of running high debt/GDP ratios. Italy and Belgium are even more politically disfunctional than the US Senate, so if they can chug along for 20 years without the sky falling down, then we should be able to as well. My reading of Krugman’s argument is that right now deficits are playing a constructive role because no other private entities are willing to soak up excess savings. Krugman strongly criticized the Bush Administration for ignoring the deficit back when we should have been running something close to a balanced budget. One of his critiques was that Bush’s reckless policies would cramp future Administrations in their ability to run deficits when they had to. So it’s not like Krugman has ever argued that sustained deficits leading to high debt/GDP ratios is good public policy. But given the hand that the Obama Administration was dealt, it doesn’t make sense to get overly concerned about adding big deficits for a couple of years until the economy gets back on its feet.

As to the right way to view the burden of debt, the problem is that if we don’t do what’s necessary to pull the economy out of the ditch, then the a smaller debt will seem like a much bigger burden if we have Japanese still price deflation and flat growth.

James said, “The long-term treasury yields are hard to reconcile with a market worried about the solvency risk. But I would add that the run-ups we’ve seen in commodity prices are hard to reconcile with a market sold on the deflation scare.”

Is there not another explanation? That the market is betting that the dollar will fall further, but no one is betting that US solvency is a serious issue?

The two bets are fairly different, one being in USD, the other being independent of movements of the dollar. This does not appear to be in conflict. Could it not just be that people are betting that the US is safe, but hedging against a decline in the USD?

Another data point seems to back up this interpretation. Despite very high debt, the Japanese 20 year bond yield is only 2%. That low yield would seem to indicate both that markets are comfortable with Japan’s solvency, but are concerned about further drops in the dollar.

James, don’t trust Krugman. He is a man of the GS gang, don’t trust him.

I don’t think that Krugman cares about “monetary havoc or not”.

But I do think that his only interest is in lobbying for his buddies. 2001: housing scam, 2009: global warming (cap-and-trade) scam.

Great post. I think you arguments are more internally consistent than Prof. Krugman.

Greg, your looking at the wrong end of the curve. If you want to see national solvency, look at short term rates. They are the canary in the coalmine. It would be like the FFR blowing up overnight and the crediters demanding higher short term rates to fund the debt.

People always screw that up.

Nice bet. I agree.

“Is it possible that some time within the next five years, the U.S. Treasury will run an auction in which there are not enough bids to roll over the debt? My answer is yes.”

So what happens then? I suspect Krugman would like to see a Cloward-Piven crisis in order to foment political changes more to his liking. The jerk. Anyone that thinks the government spending a dollar is anywhere near equal to me spending one is my enemy. Keep hoping Tom. Obama will tell Fox he is worried about deficits as long as they will let him. Obama and Pelosi and Reid only understand votes and want to buy as many as they can with Bernankes money until the crash.

The argument above assumes that we will continue irresponsbible policies of not increasing taxes. Well, if you take the Republican kool-aid pledge, you might have a crisis.

What is more likely is that productivity will increase, we will raise taxes to the same level as prior to 2001, that we will cut exemptions, exclusions and deductions.

Afterall, if you look at the recent OECD report on taxes to GDP we rank very very low–lower than Switzerland and Japan and Ireland–and we have a budget that has higher military expenditures than all of the other OECD countries combined.

Good post 2slugbaits.

It is too bad that American resistance to raising taxes is taken as a binding constraint. Too bad for most Americans that is.

As a result of widely popular American aversion to steep excise taxes on dirty fossil fuels, this private investor stays well overweight on oil-levered e&p companies. Furthermore, as long as most Americans believe that terrorizing civilians in Mid-East oil producing countries is the ticket to energy security, the oil sector will remain attractive.

As an energy sector investor, I take comfort that nobody challenges the xenophobic and imperial views of salient pundits like Boone Pickens.

I don’t think that Krugman cares about “monetary havoc or not”.

But I do think that his only interest is in lobbying for his buddies. 2001: housing scam, 2009: global warming (cap-and-trade) scam.

You mean like the 9-11 war on terror scam? Give me a break “Hooker”.

2slugbaits accurately summarizes PK’s views. JDH does not. Interestingly, PK compares the deficit hysteria to the run-up to the Iraq war. I’m coming to the view that Republican economists like JDH will be the Judith Millers this go around.

What makes the deficit so scary is that there’s no good reason to expect it to get any smaller in the coming years. Rather than reforming entitlements, this administration, like the previous one, is creating a massive new one. Rather than reducing a defense budget that is larger than the rest of the world’s, we’re continuing the Iraq war and expanding the Afghan war. We’re not withdrawing from Cold War bases in Europe, Japan and Korea. And like Jim says, there’s no appetite for increasing taxes any time in the near future.

Is there not another explanation? That the market is betting that the dollar will fall further, but no one is betting that US solvency is a serious issue?

The two bets are fairly different, one being in USD, the other being independent of movements of the dollar. This does not appear to be in conflict. Could it not just be that people are betting that the US is safe, but hedging against a decline in the USD?

JDH addressed this indirectly by saying that those other countries ability to repay their debt (without excess currency dilution) using higher taxation might be judged to be greater than U.S. willingness. In other words, current politics in the U.S. is such that the bet is that the high debt will be paid instead by printing money.

I wish that the parent article was broadened a bit by taking a portion of Krugman criticism and recasting it as criticism of the common practice of always measuring debt-to-GDP instead of debt-to-revenue. It’s unreasonable not to at least take the latter into consideration, as large changes in taxation may a) change the economic picture or b) not be politically realistic.

Also, changes in the rate of govt. debt issuance must be taken into consideration in predictions of future market price.

If my understanding of the Primary Dealer requirements is correct it is impossible for a Treasury auction to fail as each member dealer MUST bid for their market percentage which in total sums to 100. What could happen is a tail or “got out” of historic proportions that would in a technical sense be a failure of sorts.

My working thesis is if the Fed is trying to drive everyone crazy with massive liquidity, don’t expect much sanity in the markets.

Krugman’s greatest stated fear is 2010=1937 and his greatest stated hope is that fiscal and monetary stimulus creates lasting employment. And health care, and global cooling, …..

Simple enough. But since everyone knows we don’t have a simple business cycle recession and a half full outgap to fill up with helecopter drop of money from the sky, all we need is something more believable to read about.

Also, I haven’t heard any economists talk about how our falling interest rates on treasuries the last 30 years(from 12% to 3.5%) have probably helped us afford an increasing debt/GDP ratio.

Also, also, I think in a democracy we should be allowed to vote on becoming Italy or Belgium. Voting on becoming Japan won’t work, by the way.

Jeff,

“What makes the deficit so scary is that there’s no good reason to expect it to get any smaller in the coming years.”

I don’t think that’s quite right. The Bush tax cuts will soon begin to expire. That will be a new source of revenue. With a little luck the economy will pick up and so will tax receipts, which should help out. And unemployment benefits should fade. Most of today’s deficit is due to the effects of Bush’s tax cuts, the war and increased entitlement spending due to a weak economy. The part of the deficit actually dedicated to “stimulus” spending is not all that much. The whole ARRA bill was only $787B spread out over several years…and one-tenth of it was to fix an AMT problem. And if you look at the CBO numbers the deficit will come down in the medium run. Now there is unquestionably a long term structural problem, but that structural problem is not because of ARRA. Everyone agrees that a structural solution will require some kind of controls on Medicare/Medicaid; but yet when the Democrats propose cuts in certain kinds of Medicare spending (usually in the budget lines for waste, fraud and abuse), the GOP jumps all over it.

As to spending on Iraq. That is clearly coming down very soon. A lot of units started to stand down a few weeks ago. Now the Afghanistan thing may be a different story, and I’ll grant you that one. We don’t know Obama’s plan, but if the rumors are true it doesn’t have “fiscal responsibility” stamped on it. It will be interesting to see how Obama squares Afghanistan spending with his PAYGO commitment for other programs.

Professor,

The public sector debt is just a number. I like your understanding of reserve accounting and this is one of the places I started learning it. I am somewhat stumbled by your conclusions about the “debt”. The US government will never be able to pay back its debt! A closed economy has to be in deficit forever! (with a few exceptions where the economic activity is high and hence taxes are high).

Just from the identity S – I = G – T, deficits increase private sector saving. Public debt is a misnomer in a fiat currency regime.

Imagine a country in which the propensity to consume out of income is 0.2 and that from the accumulated wealth till the previous period is 0.1. The public debt at “equilibrium” could be 900% of GDP. Inflation is the only risk of public debt.

Not so long ago Krugman was “terrified” by the longer range perspective and its “looming threat to the federal government’s solvency”…

~~ quote ~~

I’m terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits… we’re looking at a fiscal crisis that will drive interest rates sky-high…

But what’s really scary, what makes a fixed-rate mortgage seem like such a good idea, is the looming threat to the federal government’s solvency.

That may sound alarmist: right now the deficit, while huge in absolute terms, is only 2 , make that 3, O.K., maybe 4 percent of G.D.P.

But that misses the point … because of the future liabilities of Social Security and Medicare, the true budget picture is much worse than the conventional deficit numbers suggest.

… the conclusion is inescapable. Without the Bush tax cuts, it would have been difficult to cope with the fiscal implications of an aging population. With those tax cuts, the task is simply impossible. The accident, the fiscal train wreck, is already under way.

How will the train wreck play itself out? … my prediction is that politicians will eventually be tempted to resolve the crisis the way irresponsible governments usually do: by printing money, both to pay current bills and to inflate away debt. And as that temptation becomes obvious, interest rates will soar.

… investors still can’t believe that the leaders of the United States are acting like the rulers of a banana republic. But I’ve done the math, and reached my own conclusions — and I’ve locked in my rate.

~~~

Thus explaining why he paid good money to refinance from a variable rate into a fixed rate mortgage. (I wonder how that’s working out so far?)

So, after the long-term budget situation gets much worse he switches from …

[] being terrified by the looming threat to the federal government’s solvency because the Bush tax cuts make it simply impossible … to cope with the fiscal implications of an aging population, since remember, because of the future liabilities of Social Security and Medicare, the true budget picture is much worse than the conventional deficit numbers suggest.

… to …

[] being “sanguine“, and supporting Obama’s renewal of the Bush tax cuts because interest rates aren’t likely to increase soon, and even with the renewal of the tax cuts (now call them then “the Obama tax cuts”) in the longer run the debt held by the public won’t be any larger in 2019 than it was in 1950 for Ozzie & Harriet, and things worked out fine for them, and Belgium and Italy can carry that much debt too, so what’s to worry?

Krugman versus Krugman

(“But, Paul, because of the future liabilities of Social Security and Medicare, isn’t the true budget picture much worse than these conventional deficit numbers suggest? And now simply impossible to cope with because of those tax cuts?” … “What? What?”)

It’s almost as if Krugman’s opinion of deficits spins 180 degrees upon whether he likes what the deficits are financing — such as creating a new entitlement (Is that too cynical?)

Anyhow, when Krugman says to look at how all these other countries can have more debt than the US without being hurt so far as they head towards their own retiree funding crises, we might also look at some of their projected future sovereign credit ratings.

As to the US, before the recession and the arrival of all this new debt, with 2007 as a base line, we were heading towards needing a 50% across-the-board income tax increase (or the equivalent) by 2030, for starters, to keep the US from taking its spot on that chart.

You know, 2030 is not so far away — only 2/3rds the term of a new mortgage. (Krugman might have been right about his mortgage after all!)

Most of you guys continue to focus on the issue of the deficit as if it were divorced from the monetary stimulus. Any deficit must be funded, either by borrowing from abroad, borrowing domestically, creating new money, or some mix of the three. The mix has changed over the past year, but currently the US deficit is being funded mainly by inserting newly created money into the private financial sector and then borrowing from that pool. So instead of the classic crowding-out affect that you would expect if the Treasury were borrowing such large amounts in the absence of equally large monetary stimulus, you have a more complex situation in which wealth is being redistributed through money creation. It is a different kind of crowding-out, which does not work through higher interest rates, as those are being suppressed by monetary stimulus.

That includes the counteracting of the deflation that normally occurs in recessions, which used to be considered a mostly good thing as it knocks the bubble component off of prices and puts the more responsible people who avoided the bubble in better positions.

Compare this recession to the last major recession, of the early 1980s. It featured >10% deflation, >10% unemployment, real wages fell, the savings rates jumped. And then the economy came back very strongly, and the US regained its position as the driver of global growth.

Now we’re told that deflation is bad, that the responsibility of government is to ensure that wages don’t fall even after a ridiculous bubble, and that consumers don’t reduce spending even after a ridiculous consumer credit spree. Recessions are natural processes that clear out inefficiency and misinvestment from the system. By resisting that process we are essentially carrying most of the inefficiencies that arose during the last bubble along with us as we head into the next bubble.

What I completely fail to understand from proponents of stimulus is how they expect it will lead to sustainable growth. Yes it temporarily cushions the decline in economic activity by resisting the natural tendency of people during recessions to reduce spending and increase savings. But what does that have to do with sustainable growth? Sustainable growth is about increasing efficiency through improved technology. Yes, government has important roles to play in education, infrastructure, research, justice, etc. But growth is driven by private investment. And that is being crowded out.

Jim Glass,

It’s almost as if Krugman’s opinion of deficits spins 180 degrees upon whether he likes what the deficits are financing — such as creating a new entitlement (Is that too cynical?)

It’s too cynical.

Krugman’s objections to Bush’s deficits were completely different. The Bush tax cuts created a structural deficit that would persist through good times and bad. The current issue is the cyclical deficit, which should disappear as the economy improves…BUT…and it’s a big BUT, the economy cannot improve on its own and requires large deficits now. See the difference? Structural versus cyclical.

BTW, Krugman did say that while he opposed the Iraq war, the build up for the war almost certainly stimulated aggregate demand during the early years of the Bush Administration. That’s not an endorsement of militay Keynesian, but it is recognition of the simple facts of algebra.

If I thought the fallacy of corporations and rich people “doing the right thing” and spending their windfalls to hire and help others actually would happen, then I’d think it would be worthwhile to back off government spending to spur employment and consumption.

Anyone with a pulse knows that it is not true, and it’s why taxes must be raised on corporations, capital gains, and ridiculously high incomes (i.e. 7 figures), in order to keep any source of employment going. And that one source is government spending and infrastructure, especially as long as we cling to the other fallacy of the last 30 years- no-barrier trade with no requirement for matching work standards.

Debt and deficits are legitimate concerns, and so is a lack of demand from the vast majority of Americans. How in the world does increasing our feudal economy by cutting taxes for the rich and reducing spending on services for the unemployed and working poor solve either of these problems?

Outside of GOP bubble-land, it doesn’t, so now we have to pay for the last 30 years of trying to have our cake and eat it too.

2slugbaits,

Why do you assume there will be a recovery with current policies when there has never been a recovery from funding “stimulus” with deficit spending. Historically this has brought us the Great Depression (Hoover policies), Eisenhower’s great stagnation, Nixon’s Great Inflation, Carter’s Great Stagflation, and now the Bush/Obama Great Bubble Burst.

If you want a real coorelation to prosperity take a look at stable gold prices, or in other words a stable purchasing power of the dollar.

Agreed. If wealthy people and the corporations they run were interested in building a stronger country, they would not have been amassing cash for so long, they would have been plowing it back into productive investments.

RicodoZ,

Not sure where you’re getting your facts, but they have a “fair and balanced” whiff about them. During the Carter years deficits never exceeded 2.9 percent of GDP. And they never exceeded 2.2 percent during the Nixon years. The problem during during Carter and Nixon years was not the deficit, it was bad monetary policy. And oh by the way, you might want to look at GDP growth during the Carter years. The “stag” in “stagflation” during the 70s refers to low worker productivity growth and not low GDP growth. Reagan and Volcker fixed the inflation problem with tight money & high interest rates even while Reagan ran spectacular deficits.

We have vaccines for seasonal flu and now H1N1. One of these days they might develop a vaccine for the gold bug.

Ramanan hits the mark.

The U.S. cannot have a $500 billion/year or more current account deficit, run a public sector surplus (T-G>0), and grow the domestic economy over the long haul.

The U.S. Treasury owns a printing press and issues debt in the the unit it prints – it is impossible for the U.S. Government to be insolvent. The danger to our personal solvency, but not the Government’s, is inflation.

The best way to get back to a reasonable long-term fiscal balance is to achieve full employment and normal capacity utilization in the economy. Which to me means we need more fiscal stimulus, not less, and a tax code and trade policies that encourage investment in domestic real assets.

Then the politicians can reduce the deficit to make the liquidationists, the Austrians, and the hard-money folks happy without harming the rest of us too much.

Thank you for the post, Professor Hamilton. Someone really needed to make a reasoned rebuttal to Krugman’s facile, simplistic arguments.

His mix of political goals and economics, seasoned with Fox-news-like rhetoric, is really veering out of control. Yesterday he compared the people with concerns about the deficit to those wanting to invade Iraq.

And this from a guy who called for a housing bubble…

When the deficits were a fifth of the size they are now, but when the President happened to be GWB, Krugman was screaming from the raftertops.

Now that the President is Obama, deficits don’t matter. Krugman might even get his Nobel Prize rescinded for criticizing fellow Nobel Laureate (the leftists stamp of approval) Obama.

JDH is a “Republican economist”? Huh? Since when? Is that the mentality of neo-Keynesians these days, that anybody who doubts the doctrine is therefore “Republican”.

I am well to the right of JDH economically and I have never voted anything but Democrat. Get a grip.

GK,

“When the deficits were a fifth of the size they are now, but when the President happened to be GWB, Krugman was screaming from the raftertops.”

I agree. And that ought to have been your first clue that Krugman is not saying “deficits don’t matter.” Cyclical deficits don’t matter…or if they matter, not very much. But structural deficits matter a lot.

Professor,

Since you have given me a year of intellectual “free lunches” (and the hope for many more) I offer only my thanks, and a wish for you to have a very pleasant Thanksgiving (same to Prof Chinn).

One question if I may, you write, “…The present value of the service cost on one trillion dollars in debt is exactly one trillion dollars today, no matter how long you put off paying.”

I am familiar with simple bond math, and inflation. The present value of the principal is always one trillion, yes? (discounted by inflaiton)? Service costs will vary with maturity, or am I misreading?

JDH, some solid thinking. When Krugman compares the situation to Belgium and Italy, he’s comparing to countries that economically don’t matter in the large scale of the world economy. The US economy and its debt matters. It takes different thinking, as you have started here. You are ahead of your time on this topic. Complex systems have many leads and lags, as you know. We are now seeing state governments doing severe layoffs and facing insolvency, like commercial enterprises did a year ago. Its a lagged effect. We will see similar things happen at the Federal level – the lag is just longer. Then Federal expenses and debt will matter in way that they don’t yet.

Who wants to be Republican anymore? Republican plus credibility has become one of those oxymoron statements like jumbo schrimp and all the rest.

The rumor going around here in the McCain state is that when ranked among states getting federal assistance, Arizona came in 52nd, behind both Israel and Mexico.

Krugman is having great fun referring to the future Palin Presidency. Let me help out and write the 2016 party nomination speech for Sarah.

“Why you should vote for me as your President. I was mayor of a town of 8000, then became governor of Alaska for a while, but quit before the term ended because I knew that greater things are in store for me. I have spent the last 6 years writing two books and making some speaking engagements. I feel it is time for me to give something back and accept the job of the US Presidency.”

Obama’s only threat in 2012 is if Kerry runs as an independent.

ISLM:

All I see from JDH’s posts are presentation of facts mixed with analysis and a “let the chips fall where they may” attittude. That he disagrees with Krugman, does so in plain English and in open and is respectful, speaks volumes.

But if you’re saying that his presentation of fact and his interpretations thereof might interfere with your politics…. well then, nuff said. A currency crisis hits all, brutally.

We can only conclude that JDH would have supported the U.S. staying out of WWII because it was too expensive. The debt run up during WWII was much greater than today and surely would have panicked him. Of course JDH might claim that this isn’t the same scale of emergency, but that might be because he has a job and pension guaranteed for life — as long as we don’t spend money on something besides those with guaranteed government jobs and pensions. Things look a bit different to the millions of unemployed.

You can see from this chart that the debt to GDP was much higher after WWII and we successfully paid it down over the next 30 years. This occurred during a period of high taxes and high prosperity. Then the Reagan revolution hit and things have been uphill ever since. The lower taxes go, the greater the debt and the worse the economy. The only relief was a short respite under Clinton when taxes were raised. There is no reason to believe that we can’t lower our debt again as long as we adopt responsible tax policies.

Remember that it was Greenspan who said that a budget surplus was a great threat and Republicans immediately turned a surplus into tax cuts for the rich. Cheney famously said “Reagan proved that deficits don’t matter” — for Republicans. So the pattern is clear — Democrats must balance budgets by cuts of social programs so that Republicans can run up the debt in tax cuts for the rich.

As JDH says “A permanent move to taxation levels significantly above [21%] would require a major shift in the political landscape, for which I see no consensus of support.” He just gives up on addressing the real problem, the decline in tax rates since WWII, and instead says we must cut spending in a time a crisis. If he spent as much time complaining about low taxes as he does about the deficit, we might actually get somewhere. Of course we can’t raise taxes right now, but we could commit to it in the future, just like WWII. But nothing will happen as long as JDH and the Republicans take tax increases off the table.

JDH is being unfair to Krugman accusing him of inconsistency. Krugman has be entirely consistent. In 2001 he was adamantly for stimulus in the face of recession just as now, repeatedly warning of a liquidity trap. He didn’t like stimulus in the form of inefficient tax cuts for the rich, but he supported stimulus all the same. Then in 2003 he was also consist. We were no longer in recession and as in the proverb of the ant and the grasshopper, that was the time to save for bad times than were to come. Unfortunately Bush and his minions didn’t save. Krugman was complained about the profligate tax cuts that continued for years after the recession when we should have been saving. They spent us into the a giant debt hole right before the biggest recession since the Great Depression. But just because Bush squandered the surplus it doesn’t negate the fact that we still need deficit spending now to get us out of this crisis. The time for JDH to complain was back in 2003 with Krugman.

Professor Hamilton-

I think you’re being a little disingenuous when you quote Professor Krugman from 03′. He never says when the catastrophe will take place. His point is that in boom times we need to be saving for the next phase of the business cycle and here we were going into the trough with huge deficits and almost no where to go on interest rates. Party on! Well now we have a choice of letting millions of Americans slip in to poverty and millions more in to deep poverty by doing nothing or we take the lesser risk of increasing the stabilizers.

I would like to remind you professor of the swedish case with accumulated deficits of 100 % of GDP mainly created by the right wing governement during the financial crisis 1992 and the current situation where the accumulated deficits is aproximately 30 % of GDP without amortizing but through growth

of GDP. It seems to me to be an empirical fact.

The Obama cabinet has absolutely no private sector experience. This was not true of Carter or Clinton. They really are true believers in socialism (like 2slugbaits and J. Miller are).

Obama has done the impossible :

1) Make many Republicans wish for Bill Clinton

2) Make Jimmy Carter only the second-worst President of our lifetimes.

J. Miller wrote :

Anyone with a pulse knows that it is not true, and it’s why taxes must be raised on corporations, capital gains, and ridiculously high incomes (i.e. 7 figures), in order to keep any source of employment going.

That is probably the most ignorant thing I have ever read on an economics blog.

1) US Capital Gains tax rate is already much higher than China and India (both are 0%). The US needs to match their cap gains tax rate to be competitive.

2) US Corporate Tax rates are among the highest in the world, and higher than China (35% vs 27%).

Not once in your screed did you even talk about reducing spending. Your desire to subsidize laziness and single motherhood is apparent.

Socialism failed, by the way. That is why Americans don’t want it tried here.

The good news is that the US tax base is maxed out. Any increase in taxes (such as is planned starting in 2011) will cause a DECREASE in revenue.

The more socialist a place becomes, the more the capital and talent of that place goes elsewhere. In case you didn’t know, capital and talent is leaving California for Texas, Nevada, and Arizona (all with no state income tax).

That is why Globalization keeps socialism in check – countries have to compete on which place can be more business friendly.

The marxists’ view of a capitalist economy has always been that you could milk the producers as much as you want and they will still produce, like the draft horse in Animal Farm. And if the captains of industry “go Galt”, why then the government can just take over and make everything work even better.

Indeed. Look at J. Miller and 2 slugbaits.

Feminism is much the same – that if courts are used to ensure that women are freed from all their traditional responsibilities to society, that men will merely pick up the greater burden. That doesn’t happen : See Detriot, and the African American community in general. That is what happens when men no longer have an incentive to support the system that does not treat them well.

Bill wrote,

Afterall, if you look at the recent OECD report on taxes to GDP we rank very very low–lower than Switzerland and Japan and Ireland–and we have a budget that has higher military expenditures than all of the other OECD countries combined.

I think the US should reduce its military expenditures. That will force the 25+ countries that are protected by the US, and thus save their own money, to pull their own weight for a change.

If US military spending goes down, the military spending of Canada, Taiwan, South Korea, Israel, and all EU NATO countries would have to go up. Thus, their spending on welfare entitlements would have to drop.

Furthermore, as long as most Americans believe that terrorizing civilians in Mid-East oil producing countries is the ticket to energy security, the oil sector will remain attractive.

er… I am not sure if you have ever looked at a world map, but Afghanistan does not have oil.

The biggest oil producing countries in the ME : Saudi Arabia, Kuwait, and the UAE, are all HEAVILY dependent on US protection. They would be very unsafe without the US military umbrella.

Great post, 2slugbaits.

JDH is either misunderstanding or intentionally mischaracterizing Krugman’s argument. Krugman is not saying and has never said deficits don’t matter, he’s saying they don’t matter NOW, when the Fed is at the zero bound and a the US is on the verge of slipping into a deflationary depression.

Another thing I’m sure Paul as an expert in trade understands, is that more stimulus is devaluative of the dollar, and the dollar needs very much to fall to help rebuild the US export sector, vital if the US is to recover. This would also punish China for its monetarism by lessening the value of its reserves and offloading some of the burden of global rebalancing onto them whether they like it or not.

To put it simply, if the world wants to lend you money for nothing, you take advantage of the opportunity, provided you can spend it productively.

Whether the US can spend it productively is another question. Republicans would like to spend as little as possible to help anyone anywhere, uninterested in whether a depression results or not. Saner heads would like to build a stronger, more stable global economic player out of the US. It seems Krugman still has hope that by directing govt. spending to wise investment: putting people to work, getting credit flowing again, and building infrastructure for the future, for example, we can do the latter.

I’m not sure he’s right. But we’ve seen what the “free market” financial sector does with our money. I’m certainly ready to try something new.

GK said:

“Socialism failed, by the way.” and “The more socialist a place becomes, the more the capital and talent of that place goes elsewhere. ”

I wonder if you’ve heard of a little country called “China”? They seem to be doing rather well. And they’re downright Communist.

I love a healthy debate, but when the party on the other side can’t even get even bother to get the most simple of facts right, heaven help us.

Joseph,

Except consider the fact that 2003 would have been 1937 if we had cut the monetary and fiscal stimulus then. If it weren’t for the artificial real estate boom, we would have had nothing replacing the Information Age Boom.

Agreed Iraq was not as good a jobs program as WWII, even tho it is lasting longer and we are getting growth in Afghanistan. If it weren’t for WW11, Keynes may never have become a famous economist. Don’t know JDH’s position on that one. Bush thought it would help, and ultimately be paid for by cheap oil, but that is one of many reasons people believe that Bush is an idiot.

I hate it when rich people end up with all the money too, and the last thing we need is tax breaks for the rich.

But I think the big challenge for economists and everyone else is to figure out why we do seem to need constant “stimulus” of one sort or another in order to have a “good” economy. I think we had real interest rates being positive for only maybe 3 years this entire decade. The debt has ballooned. If Keynes were alive today, I’m confident he could figure out what the problem is. However I’m always disappointed that his modern day disciples can’t seem to.

Hey G(oj)K(O)- You’re comparing the U.S. to places with 3rd World living and working standards like India and China? No wonder you don’t get my point. Let those a-holes go to China if they think it’s so oppressive here, and tax the life out of them on their U.S. assets. I think we’ll still make it without their help, and they’ll be crawling back to return here when things turn around.

It ain’t ignorance, just reality of the outside world. Not investing in production and deciding not to give chances to real people means failure in the long run (and the short run in our case). Employment is the 1st, 2nd, and 3rd priority to deal with right now, and discouraging hoarding with higher tax rates and demanding real work standards is the way you do it. Try checking out the real world instead of econ theory, you may find it to be an interesting place.

2nd tip- The S&P index isn’t the economy.

P.S G(ojo)K(e)- You ever realize that ending wars is cutting government spending? As is cutting farm subsidies and Social Security in the long run? I sure do, and maybe you will too once you get a job other than “professional day-trader.”

If deficits don’t matter then what the heck, lets spend twice as much as we do now. Whoa, Krugman might say, I didn’t mean doubling would work. So, I would say, Then what is the threshold? As a Nobel Prize winner show us your calculations. But he can’t. So, why even listen to him?

2slugbaits,

One of the primary components of GDP is government spending so when you attempt to prove a reduction in government spending by quoting GDP you are actually proving government spending.

What is your evidence of bad monetary policy during the Nixon and Carter years? Because I rely on a stable indicator I can point you exactly to the problem times of monetary policy. I am just curious what your indicator is.

By the way a gold bug is someone who believes in buying gold as the best investment. I do not believe gold is a good investment. It is only a good investment if your alternative is the dollar. Apparently you do not understand monetary theory well enough to understand what I am saying. I suggest you read a good book on monetary policy like THE THEORY OF MONEY AND CREDIT by Ludwig von Mises. It might revolutionize your thinking.

RN claimed :

I wonder if you’ve heard of a little country called “China”? They seem to be doing rather well. And they’re downright Communist.

er… they are less socialist than Obama’s US. As I said earlier, China has a lower cap gains tax rate than the US.

Why not lower the US cap gains tax rate to match China’s?

Plus, China has a stock market, which you may not be aware of.

Please educate yourself about basic facts before you comment on sophisticated subjects.

I love a healthy debate, but when the party on the other side can’t even get even bother to get the most simple of facts right, heaven help us.

So why don’t you actually learn facts, rather than project your limitations onto others.

You don’t even know that China has a stock market, and a lower cap gains tax rate than the US. It is a dictatorship, but a better practitioner of low-tax free markets than the US.

Get a clue….

J. Miller,

Ad hominems as your opening move shows you to be even more empty than I had expected.

Socialism failed. That you have made it your religion is shameful.

2nd tip- The S&P index isn’t the economy.

It is more of the economy than your socialism fantasies (which are really just jealously on your part) are.

Norman,

But to these people (RN, J. Miller, Krugman), socialism is edgy and chic, so it must be tried again, despite failure in country after country.

The good news is that Obama’s approval rating after 10 months is at a level it took Bush 5 years to drop to. Most American people are smart enough to know socialism when they see it, and keep RN and J. Miller relegated to the extreme fringe.

JDH is a “Republican economist”? Huh? Since when? Is that the mentality of neo-Keynesians these days, that anybody who doubts the doctrine is therefore “Republican”.

Tom, you see, for these people, being a ‘Republican’ is far worse than being Roman Polanski.

It is not about economics for them, it is about adhering to a fanatical religion. These people aren’t very bright.

I am not an economist and I live far from USA. But I have to say thanks to your analysis every time I read it.

“So, I would say, Then what is the threshold? As a Nobel Prize winner show us your calculations. But he can’t.”

Norman,

Actually, he has shown us his calculations.

http://www.princeton.edu/~pkrugman/optimalg.pdf

This is an awesome post, Professor Hamilton. It’s great to see another prerspective, one that is more studied and factual. Great job!

Cedric Regula,

You are misinformed about Arizona’s position in the tax booty sweepstakes. It is in the “welfare” category (as are most red states) receiving $1.19 in federal spending for every tax dollar.

http://www.ritholtz.com/blog/2009/11/fed-tax-sentspent-by-state/

GK wrote:

“Tom, you see, for these people, being a ‘Republican’ is far worse than being Roman Polanski.

It is not about economics for them, it is about adhering to a fanatical religion. These people aren’t very bright.”

You are the consummate evidence for my point. Why oh why can’t we argue on substance, not nonsense?

I have nothing against Republicans. Rather, I fear for our nation when Republicans begin to become like you, i.e. insane.

For example,

a) no Democrat thinks Republicans are worse than Roman Polanski.

b) It’s very much about economics, and examining how some, though certainly not all, free market beliefs fail us. Religion is something right-wing wackos base policy on, not sensible Republicans.

And lastly,

c) say what you want about Krugman (shrill, inciting, even wrong), you won’t find a single sane person who thinks he’s “not very bright”.

You seem cogent enough to at least -try- to argue on the merits. Yet all three points you make are simply off-the-charts nuts.

Explain again why anyone should ever listen to you and your ilk?

2slugbaits at November 25, 2009 08:41 AM: Indeed Krugman does not believe we can run huge deficits forever, and I do not represent him as believing we can run huge deficits forever. I represent him as believing, as I myself believe, that it is conceivable that an irresponsible time path for federal deficits could pose a “looming threat to the federal government’s solvency”.

ISLM at November 25, 2009 09:46 AM: I do not claim to be a spokesman for any political party, candidate or elected official, nor do I recognize any party, candidate, or official as speaking for me. My goal as an economist is to understand objectively and accurately how the economy really works.

Rob at November 25, 2009 03:11 PM: You asked so nicely, I have

written up the math for you.

Joseph at November 25, 2009 03:58 PM:

(1) I have discussed the WWII debt here. (2) I do not put tax increases off the table. I have doubts about their political feasibility, and those doubts lead me to raise the solvency question. (3) I did not say, and do not believe, that “we must cut spending in a time a crisis”. (4) I do not accuse Krugman of inconsistency. (5) I tire of your argumentative style of attributing to me things I did not say and do not believe.

Dave at November 25, 2009 05:09 PM: “Disingenuous” means “lacking in frankness, candor, or sincerity; falsely or hypocritically ingenuous; insincere”. How, pray tell, were my quotations from Krugman any of these? Please do not use the word if you don’t mean it, and please know that, if you think

that “disingenuous” describes something I have said, then you have unquestionably misunderstood my point.

RN at November 25, 2009 06:16 PM: Ditto as per Dave. I do not claim that Krugman believes that deficits don’t matter– indeed I establish that he agrees with me that solvency is a legitimate issue to raise. And please note from the title onward, my concerns have to do with the future time path of deficits– we all agree that a big deficit in 2009-2010 is unquestionably the right policy and indeed completely unavoidable.

JDH wrote:

“…my concerns have to do with the future time path of deficits– we all agree that a big deficit in 2009-2010 is unquestionably the right policy and indeed completely unavoidable.”

Thank you for that very important clarification. For nowhere in your post do you make that vital point.

Rather you say only, “Paul Krugman…has been arguing vigorously that U.S. budget deficits are no cause for concern.”

The conspicuous lack of any time-frame mention or the word “temporary” is noted.

So thank you for clarifying. I’m sure you understand my and other posters’ confusion.

With your key correction, it’s clear we’re all arguing the same point: that is, these horrific deficits MUST be as temporary as we can sensibly make them. The question is figuring out costs vs. benefits based on things like bang for the buck, interest rate and future funding effects, generational equity, etc.

Thank you for your great work.

A simple way to look at this is, living off a high-interest credit card temporarily is a sensible thing to do if you need to to survive, and if you behave during the “survival” period to bring your life back to a place of financial stability.

The argument should not be about the credit card, it should be about the behavior.

JDH,

Thanks for clarifying that. As you can tell, many of your readers have (mis)interpreted Krugman as saying deficits don’t matter. So it sounds like your disagreement with Krugman comes down to whether or not we should just run cyclical deficits in 2009-2010 versus 2009-2011 versus 2009-2012. And if we still need stimulus in 2013, then we’ve got bigger problems than just a cyclical recovery. That’s a technical issue over which reasonable people can disagree. And it’s also a matter of how you see the risk. For example, Krugman, Thoma and Delong see the risk asymmetrically…the consequences of exiting from the stimulus too soon are greater than the costs of staying with it too long. Others see the stimulus as a complete waste of time, effort and money that will lead to no good end. That’s the “Treasury View” that Krugman has been battling. Your clarifying comments tell me that you do not agree with the “Treasury View.”

2slugbaits,

Thanks for the reference to Krugman’s paper. What a great example of why we are in so much trouble!

Krugman has learned well from Keynes. His economics is designed to support his opinion rather than letting his economics drive his opinion. Also he has learned well how to “coin a phrase” to obscure his point. On this to those who find their eyes glazing over reading such a paper, let me suggest a way to cut through the crap. When you come across a verbose phrase used to complicate a simply concept use your word processor edit function to replace the verbose phrases throughtout the paper with the common meaning. That will help you understand the foolishness of the logic. [As an aside this is also useful with Keynes’ GENERAL THEORY.]

Initially I was going to comment on the foolish statements in the paper but after I finished copying them to a word document it was over two full pages long. So let me trim it down.

Krugman is essentially giving the same advice he gave Greenspan and Bernanke to create a real estate bubble to stimulate growth. (How did that work out for you) He states:

It wasnt until I wrote down a very simple maximizing model that I realized that this was wrong, that a monetary expansion perceived as temporary may be entirely ineffective…

So Krugman’s solution is permanent monetary expansion, or at least the appearance of permanent monetary expansion?

He later states:

…when the economy is in a liquidity trap government spending should expand up to the point at which full employment is restored. [Krugman’s emphasis]

Krugman, ever a believer in the discredited Phillips Curve, would have us expand government spending until we reach full employment when it is pretty obvious that excessive government spending has created the current unemployment.

Again thank you for the paper. It helps pinpoint why our economy with its current leadership is such a disaster.

@RN wrote:

“c) say what you want about Krugman (shrill, inciting, even wrong), you won’t find a single sane person who thinks he’s “not very bright.”

RN, considering his arguments at the beginning of the housing bubble, I think that Krugman is not very bright. Anyway, quite sure I am insane.

@JDH at November 26, 2009 07:34 AM:

your answers are a step back from your counter-wording against (or should I say disagreement with) Krugman in your original post. Your original post is very honest and straight-forward. Well James, keep on the right track.

JDH, you have to excuse people if they misunderstand your intentions. There are only two variables to the debt — taxes and spending — and when you declare one of them out of the realm of possibility, one can only assume you want to cut spending.

Conservatives keep acting like the repeal of the New Deal is just around the corner. It isn’t. People like their Social Security, they like their Medicare, they like their unemployment insurance. Americans like socialism even if they don’t like the name. (My favorite was the tea party protester who screamed “Keep your government hands off my Medicare”.)

It is about time that we grew up and started taxing like a socialist country. The U.S. tax rate as a percent of GDP is at the bottom of all OECD countries. All of those debt issues would just go away by raising the rate a few percentage points to the average of the OECD. Isn’t it about time that the adults in politics realized we aren’t going to cut back on social welfare and need to increase taxes responsibly. I haven’t heard you mention the solution of increasing taxes, just complaints about spending.

Bob in MA

“You are misinformed about Arizona’s position in the tax booty sweepstakes. It is in the “welfare” category (as are most red states) receiving $1.19 in federal spending for every tax dollar.”

Maybe, I think it was how Arizona faired in stim spending where we came in low.

This data is the “long term” picture. But I read the comments and people raised some questions about how the sausage is made. Simliar questions apply to AZ. For example we still have a small population, 7-8 million, a high percentage is retirees(from other states), not all of whom live in Scotsdale. We also have snowbirds, and must keep the state in nice shape for them in the winter time. We also have a lot of military bases and National parks. We have lots of indian reservations but also indian casinos.

So it deserves some closer inspection on where the federal tax revenue is coming from and where the federal spending is going before concluding that AZ is a welfare state.

Joseph,

“I haven’t heard you mention the solution of increasing taxes, just complaints about spending.”

I may be misreading JDH, but my sense wasn’t that JDH is against raising taxes to match long run spending. His point is that there is something in American politics that is out of touch with reality and raising taxes is a lot harder to do here than it is in Europe. Being against taxes is in our DNA to the point of sometimes being a pathology. The right thing to do is to run deficits now and raise taxes in the future when the economy has recovered. But our DNA won’t let us do the right thing, so we have to do stupid things today in order to stop ourselves from doing even stupider things tomorrow. I think that’s the gist of JDH’s point where he says: “But European politics may not import all that well to this side of the Atlantic.” On that I’ll concede that JDH does have a point.

Jim:

I think your first point is an important one – that the comparison of total debt to GDP misses the different degree to which the government can realistically lay claim to that revenue stream – but the point would been strengthened by actually making the cross country comparison with explicit data. What is the ratio of debt/government receipts in various high-debt countries?

I guess we will have to patiently wait for the year that the government decides it’s ok to raise taxes on the US taxpayer to European levels, while the US consumer still has extraordinary debt levels, while maybe cutting corporate taxes in line with France and China, and continuing on with the 10 year plan of trillion dollar deficits every year, possibly stabilizing deficit spending at 3% of GDP assuming the economy did get better, which is not designated as “stimulus” spending, but money nonetheless to my simple brain.

So that’s my thought of the day, and now I have a smaller turkey to attend to.

My concern is that we don’t have the same industries we used to have to grow our way to prosperity. We are allowing unchecked immigration of unskilled folks whose children do not perform in school at a level that inspires confidence in what contributions they could make to our future economy. They will likely consume more in social services than they ever pay in taxes, while the population of more productive workers retires from the labor force and takes their income tax base with them.

A great post. Thank you.

Too many people are historically ignorant, and think that socialism/Marxism is the solution.

Hence, the screams to raise taxes rather than cut spending. They really are true believers in the socialist religion.

The good news is that the American public clearly rewards a President that presides over a budget surplus, and punishes those that create deficits.

1) Clinton’s approval rating in the final 2 years was above 60%, due to a budget surplus (due to factors beyond his control, but still).

2) Bush started out high, but as spending outpaced revenues, dropped to low approval ratings after 2005.

3) Obama’s approval rating is at disastrous levels after just 10 months, and deservedly so.

Too much spending = political failure. Period.

But socialists/Marxists like RN and J. Miller never learn.

RN,

Your extreme lack of general knowledge is even more evidence given your cowardice in dodging my points.

You claim China is doing well BECAUSE it is a Communist country.

I say hogwash – China is an autocratic dictatorship, but with more capitalims than the US, since it has a lower tax rate than the US.

If it is Communist, why does it have a stock market (a fact you were not aware of)?

So your own points prove me to be correct (that the US should match China and lower its tax rates), and you to be wrong.

Please educate yourself about the basics of a) economics, and b) geopolitics.

@JDH-

The definition of frankness is open and honest in expressing what one thinks or feels; straightforward; candid. And I do believe when you quote Krugman without putting his views into the proper context–in terms of the business cycle– than you are being all of these in regards to Krugmans quote and to what you know to be true. There is too much at stake here to be posting things like this. True courage is defending the weak not the rich.

-Dave

From Rasmussen :

http://www.rasmussenreports.com/public_content/politics/obama_administration/november_2009/48_expect_tax_hike_fundamental_challenge_for_obama_administration

By a 59-24 margin, Americans believe that increased government spending hurts the economy.

By a 59-19 margin, Americans believe that tax hikes hurt the economy.

(crickets chirping in RN’s and J. Miller’s ashamed silence)

It appears that America is the wrong country upon which RN and J. Miller can foist their Marxism onto. Their inability to demonstrate basic knowledge of economics certainly doesn’t help their case.

Thank you!

I understand that you must be courteous to an esteemed colleague, but Krugman’s position on spending is incoherent.

So, it’s refreshing for someone to say so (in an oh-so-nicest way)

And in my view, any argument predicated on GDP growth duplicating in future years the debt-based, bubblicious Great Moderation reflects a serious departure from reality.

It seems that your concern about the deficit and the growing national debt depend entirely on concerns about the US government’s ability to borrow at attractive interest rates in the future. And as far as I can tell your entire analytical model for predicting the interest rate the US Govt has to pay in the future is this:

“I would suggest that the low borrowing cost that the U.S. government traditionally faced was very much attributable to the responsible management of the debt. Once that responsibility becomes called into question, the U.S. will cease to enjoy that privilege.”

That seems like a thin thread to hang predictions of doom on! Since you entire argument depends on a future surge in borrowing costs I would think that maybe you would put more effort than this into analyzing what determines the interest rate paid by the US Govt.

It occurred to me that there is a simple test of the theory that interest rates are determined by market perceptions of responsible debt management. So I looked at rates paid by the US Govt on long term bonds during World War II when it was borrowing like a drunken sailor on a war whose outcome and duration was uncertain. If there was any time in recent history when investors should have been concerned about the long term ability of the US Govt to manage and pay its debts when due it would have been the period 1941 to 1943. Yet the rates on long term US Govt bonds dropped to a 20-something year low during that period. From this I deduce that interest rates are determined by a multitude of factors, and it is possible for the US Govt to pay low rates even while demonstrating near total disregard for fiscal prudence.

GK said:

“By a 59-24 margin, Americans believe that increased government spending hurts the economy.”

Yeah, and 61% of Americans don’t believe in Evolution.

What “Americans believe” and what is true often diverge by parsecs.

So I’ll thank you for making my point for me once again: A large percentage of Americans are a remarkably stupid bunch, and as long as they are, and members of said aforementioned class (a superb example of which you provide) have the right to vote and scare Congress from even being able to approach doing the right thing, America’s descent will continue.

Your reply to Krugman’s first argument is based on conflating stocks and flows. I quote with a totally fair legitimate ellipses

“$10 trillion in new debt will require 10 years at that higher *rate* to pay off. … The *present value* of the service cost on one trillion dollars in debt is exactly one trillion dollars today,same present value”

Krugman is suggesting that one present value is consistent with more than one rate. It has nothing to do with dynamic efficiency. It has a lot to do with the fact that stocks are not flows.

Your claim that you have to double income tax receipts for 10 years to pay 10 trillion is, as written, total utter nonsense. You don’t mean to say that tripling for 5 or increasing by 50% for 20 years wouldn’t work, but when you get around to discussing Krugman’s counterargument, suddenly you act as if you have proven both of those claims.

This is just not acceptable. You obviously must understand that the rate at which one repays can be lower if one is willing to spend longer repaying.

Reading his post, I noticed a rather harsh hint that you were other than 100% intellectually honest. I can imagine that you are angry with Krugman. However you won’t get back at him by conflating stocks and flows.

I don’t really understand why Krugman has this effect on people. However, those people who are respected economists would be well advised to avoid the temptation to shoot themselves in the foot whenever Krugman criticizes them.

Anyway, I think you really want to post a retraction of the nonsense you wrote here immediately.

update: I was confused. I guessed the nonsensical conflatoin of stocks and flows was your reaction to a hint of an accusation of less than 100% intellectual honesty. Having clicked more links, I understand that the allegedly maybe not quite exactly 100% honesty consists of toning the claim down and that the howler howled even louder in August.

In other words, the nonsense about ten years was an unforced error. Furhtermore, you assert that when Krugman argues that one can satisfy an infinite horizon budget constraint paying the interest on debt you assert that he is hoping for dynamic inefficiency and not uhm counting on arithmetic. His claim does not need g>r it needs g>0. Of course you know that, I mean you’re an economist. So why are you trying so hard to convince me that you know nothing about economics.

I don’t want to be rude but well I have been already so I will ask you to ask yourself something. Could a student pass any economics course graded by you if he or she made arguments like those you make in this post ?

I can tell you that I might pass a student in undergraduate macro who argued at this level, but I strongly suspect that you have higher standards.

2slugbaits:

Have you not noticed that the Congress and the last two administrations are far less responsible than past ones? Your faith that deficits will come down soon is touching, but methinks naive. A Congress and Administration that cannot say “No” to the wealthiest people in the country (bank bondholders) is finding it impossible to refuse anyone else, either.

In fact, I predict that before the midterm elections next year, the Congress will pass, and the President will sign, legislation that makes permanent many of the “temporary” spending measures contained in the “stimulus” bill. They’ll call it a “jobs” bill or something like that, but it’s effect will be to permanently expand the size of the federal government. Do you think I’m wrong?

Very good post, Jim.

Thanks for presenting the other of the deficits argument.

I have run a lot of numbers during the past few weeks, and expect that we will see an internal U.S. Government budget crisis unfold by year 2020.

Here is an idea for dealing with the deficit and debt — and the recession both — which prevents the Republicans from stopping it through the filibuster:

A stimulus can be done through reconciliation, and therefore need only 50 votes and the VP to break the tie, if it’s deficit neutral. But how can it be deficit neutral and still be a stimulus?

The answer is that it must be deficit neutral over a period of 5 years. So, put in the spending now, and the tax increases, on the very wealthy, on pollution, to pay for it, or more than pay for it, 3 or more years later. If the recession is not over by then, roll it over, that is do another one of these stimuli at that time.

It’s not that unlikely that you can find 50 Democrats in their caucus of 60 that will support a very large stimulus, especially one that is deficit negative over 5 years. With the tax increases that start in year 3 permanent, this could pay down perhaps over a trillion dollars in debt over 20 years.

And, it’s crucial to note that the stimulus spending can be largely high return investments of the kind the free market will underprovide, like infrastructure, alternative energy, and education, which grow GDP long term and therefore decrease the government debt as a percentage of GDP.

Krugman answers are a bit superficial. Until he explain how and who is going to repay the debt I contend that maybe deficits do not matter but debt yes.

The tax of financial transactions or any windfall tax could be good way to raise revenues in the future. Yet more should be said about sustainability and solvency conditions because if its true that interest rates are low and treasuries are fully subscribed, investors are increasingly worried about debt in the world, particularly in industrialized countries, and they are hedging long-tail risk with CDS. If you do not consider a Black Swan default what about a roasted turkey filled up with debt?

http://mgiannini.blogspot.com/2009/11/rich-countries-bond-defaults-or-debt.html

Jim

An excellent post, thank you.

PK responds on his website:

“So the debt question is what happens when things return to normal.”

My question is:

And what happens if we do not “return to normal”?……What if we are in a “new normal” for the medium-to-long term? (Pimco’s term)….

What if we have a lost decade? (Japan is about to enter its third lost decade.) What if we cannot spring our liquidity trap without causing a double dip?

PK has been concerned about these precise risks for years. So what’s with the equilibirium thinking? It’s all a tad too convenient for me.

Left or right, there is NEVER an easy time to get control of the deficit. If the road ahead is going to be as rocky as Mr. Krugman claims…..better strap on those boots now … before the vigilantes decide to help us out.

Nick in Japan

Robert Waldman: These are mathematical statements. My math of the stocks versus flows is right here. Where’s yours?

Here is how it works in Greece. I’m not an economist, I just read about it. But I’ve picked up enough so far that I know some economists will jump in and say this is all because Greece was silly enough to join the EU and have to use the Euro for currency, and this whole thing could have been avoided with NOMINAL growth with debt denominated in their own currency. Lira anyone?

Can’t say I understand why any invwestors think a 2% rate premium is sufficient to cover the risk of near certain default, tho. I will never get that one.

Government Debt Spirals

Greece tests the limit of sovereign debt as it grinds towards slump

By Ambrose Evans-Pritchard, The Telegraph