UCSD Ph.D. candidate Sam Dastrup has completed a very interesting study with his advisor Professor Richard Carson of what accounts for differences across U.S. communities in the magnitude of the decline in real estate prices that we’ve seen over the last several years.

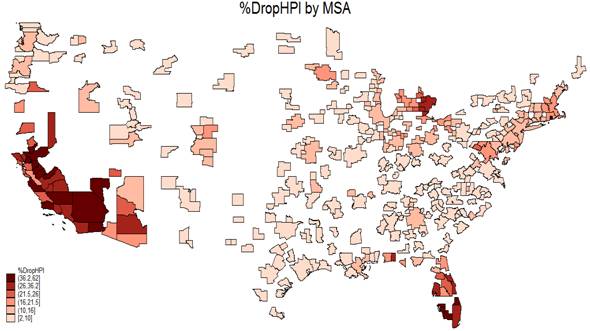

Although many commentators write as if there were a national housing market, there have been huge differences in the experience across communities. Dastrup and Carson examine the OFHEO matched-sale data for house prices as calculated separately for 358 U.S. standard metropolitan statistical areas. As seen in the map below, the magnitude of the price decline has differed greatly across U.S. communities, with the biggest drops in the southwest, Florida, and Michigan.

|

Dastrup and Carson look at how the magnitudes of the price declines correlate with a number of other community characteristics such as overbuilding (as measured by growth in building permits relative to the local labor force), extent of subprime lending, owner-occupied units, and fundamentals such as median income. Dastrup and Carson find that all of these measures were statistically significantly related to the magnitude of the housing price decline. But by far the most important variable was the magnitude of the previous price run-up, which all by itself can account for more than half of the observed variance in the size of the price decline across different communities.

|

I see this as consistent with earlier research by Marco Del Negro and Christopher Otrok which documented a common national factor driving much of the U.S. housing price boom, which in the Del Negro-Ostrok specification was allowed to affect different communities with different coefficients. My understanding of what happened is that low interest rates and in particular a deterioration of underwriting standards fueled an increase in housing demand everywhere in the earlier part of this decade. The magnitude of the price increase that this produced differed across communities as a function of local conditions. When these aggregate factors reversed, so did the prices.

The more prices were artificially bid up, the more spectacularly they declined.

Postscript to potential employers: Sam’s a great teacher, and looking for a job.

It would have been interesting to supplement the studies with the banks leverage for each states involved in the real estates prices run up.

Wishing Sam a happy landing

Land prices as opposed to building materials and construction costs account for most of the differences in housing costs across the US. Looking at total home prices without separating out land costs from residential structure costs dampens the price changes to the components and will lead to misleading statistical measures.

Using an example from “The Price of Residential Land in Large U.S. Cities” by Morris A. Davis and Michael G. Palumbo, http://morris.marginalq.com/davispalumbodata_files/2007-02-Davis-Palumbo.paper.pdf:

“Going into the recent boom that is, at the end of 1998 we estimate that land represented about 81 percent of the average single-family homes value in San Francisco, whereas in Milwaukee land accounted for a share of only 33 percent. This means that, abstracting from any changes in real construction costs, a cumulative 90 percent increase in the real price of residential land in both cities would have translated into a 73 percent increase in home prices in San Francisco (0.73 = 0.81 x 0.90), but only a 30 percent increase in home prices in Milwaukee (0.30 = 0.33 x 0.90).

Of course, the fact that the price of land appreciated at the same rate in both San Francisco and Milwaukee does not imply that both areas experienced the same sized demand or supply shock.

Rather, our point is that a simple comparison of gains in house prices might make San Francisco seem glamorous compared with Milwaukee, but the rapid pace of appreciation in the price of residential land in Milwaukee tells a different story about conditions in Milwaukees housing market.

And, its not just Milwaukee: As we show below, for many other cities across the country, data on home prices significantly obscure the increases in residential land prices that have been registered over the past two decades and particularly in the recent housing boom.”

To understand the macroeconomic and macroeconomic effects on house prices, one needs to disaggregate land prices from residential structure prices. A equivalent price increase in land values in two different areas of the country, where land costs as a percentage of total cost are different, will lead one to conclude that there were different appreciation rates when in fact the land costs may have had identical rates of appreciation in both parts of the country.

My hunch is that housing price behavior in the Detroit MSA, as well as most other Michigan MSAs, is not consistent with the previous price run-up story. For these communities, the dominant local factor was arguably the monotonic malaise in the US automobile industry.

In study after study it’s again and again the previous change in house prices which explains short terms gains (the bubble) and then the relative size subequent mean reversion in housing prices. No combination of observable macroeconomic variable does a great job at explaining this change. Why is this? Because the largest single drivign force is the “unobservable” expectations of future price changes. All those peopel flipping houses etc., rushing to buy even though couldn’t afford to were doing so largely because they expected housing prices to rise. Why were they expecting this – because in their expereince and the experience of their peers this is what had been happening. There’s a paucity of good survey data on housing market expctations but virtually all the data that exists points to this adapative behaviour in expecations that leads to housing booms and busts. Loose lending standards clearly enabled more people to act on their misguided expectations and made the boom/bust cycle larger.

I wrote a thesis on expecations formation in assets markets 10 years ago. Nothing signficant has changed. Economists have gradaully lost faith in the rational expectations hypothesis but are largely yet to grapple with questions of how people form expectations in different situatuions and hwo we can dtermien whose expectations drive “the markets” expectations .

I go into more detail at http://reflexivityfinance.blogspot.com/2009/01/misconception-3-easy-credit-caused.html

I think economists should be required to spend time on a cattle ranch and figure out what it takes to make herds of cattle stampede, and is a “cattle rational expectations hypothesis” relevent or neccesary??

I remind everyone that the housing correction is only half-finished.

Housing only stopped falling due to a) the $8000 credit and b) 0% FF rates.

When these temporary factors are gone, and the Federal tax rate rises on 1/1/2011, there will be another recession.

The increase in CA state taxes doesn’t help either.

In CA, homes in 2020 will be the same price as their 2006 peak. Assume a 5% cost of capital, and 50% of the value is lost.

GK,

I don’t know why prices wouldn’t go back to 2000 levels. Wages aren’t much higher. Other consumer costs besides just taxes are coming too. Like higher mortgage rates than 5% someday. We have to fix global warming. That will be a few bucks. We have to pay for health care. Sounds like a trillion or so there.

And we can be sure that we get a bigger tax increase than just the expiration of the Bush cuts. Remember the $1++ trillion deficits as far as the eye can see. They already have been kicking around regressive taxes like VAT or a national sales tax. Soaking the rich won’t be enough. And of course all state and local governments are broke. Little governments need money too!

Cedric,

“We have to fix global warming.” No, I don’t think so. The latest e-mail archive published on the web from the fraudsters pushing for AGW should put to rest at least this canard…

Also, can someone explain to me what is wrong with writing off every unpayable debt so we can clear the deck? Why pretend to live in a virtual debtors prison? Those who lost lost. let us clear the slate and start over. That can hardly be a more serious moral hazard than what we are experiencing with the bail-outs and bonuses! Worthless make-work just wastes human capital in addition of the lost and wasted capital in malinvestments.

Or, maybe I am just a physicist, not sophisticated enough for modern “economics”.

A pulse. Goes up, comes down as a fad. Why would You need economic indicators for that?

Couldn’t you factor this in by only looking at price declines from 2000 to today? If only gains from 2000-2006 were wiped out then most housing markets should show the same price change profiles from 2000 – today. An additional graph would be easy to come up with and would show a lot.

First rate comments today.

JDH wrote:

The more prices were artificially bid up, the more spectacularly they declined.

Professor,

I don’t mean to threaten your relationship with your peers but it is refreshing. Sometimes you sound down right Austrian.

It is nice to see good research confirming and documenting what is believed by those who know the markets.

The markets with the greatest excess on the way up will have the greatest fall. This has always been true. Not just for real estate.

As a RE investor I live for times like now to buy cheaply in the wake of a panic. I did this in the mid 1980s and again in late 1990s. Same for stocks – I bought lots of stock during the first qtr of this year (also the 1st qtr of 2003).

Panics are great!

I agree with the point that land is the asset at issue. The cost of the structure should move with the cost of construction. It is the underlying land that is the speculative basis. At least that is what I have observed over the last 30 years.

Well, I think SD is in for a lot more than just a revise to the mean. I think it’ll slip well below that. Other peer cities have much newer and better infrastructure and here’s the real key- they aren’t in the dying state of California.

I predict in 10 years you can buy in La Jolla for (in todays $$)the 400k ish range.

zephyr It is the underlying land that is the speculative basis. Yes. I have struggled in vain to point out to many that the equation ISN’T (cost of land) + (cost of construction) = (price of housing) + profit. Rather it is (anticipated price of housing) – (cost of construction) = (cost of land) + profit. The price that you can get for unveveloped land is driven by the anticipated price for finished housing, not the other way around.

I note the strong link between non-recourse mortgage lending and housing price declines (outside the anamolous Rust Belt where two of the big three going bankrupt is an obvious source of the outlier).

People naturally take bigger risks in “Heads I win, tails you lose” situations. The logic that drives bubble markets with non-recourse loans is the same as the logic that drives excessive risk taking by executives compensated with stock options or performance bonuses (with no downside) and by the same logic that drives heavily leveraged companies to take excessive risks. The same problem was perennial in commercial banking as well (where ten year failure rates for third party investor owned banks frequently exceeded 50%), until the FDIC set minimum capital requirements.

The only big anomoly is Nevada, which has recourse mortgages, but had a big boom followed by a big bust. The boom in Nevada may have been driven by the spillover of real estate money from the neighboring California and Arizona markets.

Simple explanation Increased demand drives up prices. Demand , in this case, is affected completely by belief that house prices will go up for ever. No adverse effects from buying real estate complete with re-inforcement of beliefs by real estate industry, overwhelmed caution in purchasing real estate.

Supplemented by desire of public for bigger , better, costlier real estate , with commensurate inflation of perceived societal status by said purchasing led to boom.

Bust comes when people can not find tulips for the new buyers.

JackO

What if the researchers had used a valid home price index that encompasses a much larger share of the housing market, and that does not include refinance transactions (with the known appraisal flaws)? Such data are available!

JackO: If its just tulips all the way down, why was the housing boom distinctly regional? The boom was overwhelmingly confined to just a few states. Almost half of all upside down mortgages are in just five states.

Steve van Emmerrick’s increasing returns/butterfly effect hypothesis provides a mechanism for regionalism, but the fact that these particular states got hit, rather than others would have to be quite a coincidence for this hypothesis to work. Otherwise, you’d increasing returns/butterfly effect driven housing booms spread more or less randomly across the U.S.

Yes, booms numbers can show how far out of whack from fundamentals prices are likely to be in a particular local market. But, this still doesn’t go very far in explaining why prices got so out of line with fundamentals in one place, but not in another. Simple high demand due to job creation, or low supply due to geographic limits on expansion, for example, should play into the fundamentals, so the cause needs to be elsewhere.

Non-recourse lending incentives to take risks could go a long way towards explaining why particular states had big booms and hence big busts when the fundamentals catch up with the market.

“Steve van Emmerrick’s increasing returns/butterfly effect hypothesis provides a mechanism for regionalism, but the fact that these particular states got hit, rather than others would have to be quite a coincidence for this hypothesis to work. Otherwise, you’d increasing returns/butterfly effect driven housing booms spread more or less randomly across the U.S.” ohwilleke.

Clearly as ohwilleke points out you need to having something other than speculation starting the booms if adapative expecations formation is an important factor in driving a boom.

In all the booms I’ve studied you tend to have the following fundamental factors strongly evident at the start of a boom – relatively low and/or decreasing real interest rates, relatively high economic growth, relatively high constraints on new supply (regulatory and/or physical) and or new supply starting from low levels, low and/or decreasing unemployment, high credit availability, relatively high affordability in terms of prices versus incomes and relatively low rent/price ratios, relatively low price levels compared to alternative housing locations etc. It’s these “fundamental factors” that start the houing prices increasing for the first 12-18 months in any particular “housing market”. Then the speculation takes over and drives the more rapid price rises in the mid to late stages of the booms.

By the end of the boom the fundamental factors are generally pushing against the prices rises i.e low affordability, increased supply, high price/rent, higher and/or increasing interest rates, high price levels compared to alternative housing locations etc. Once prices stop rising the speculation stops and the fundamentals start push prices down. Clearly in the case of the recent boom/bust the whole dynamics of loose credit, forclosures etc had a larger impact than is normal in other booms I’ve studied in the US, UK, Europe, Japan, Sweden, Hong Kong, Australia, Candada etc. These booms and busts in other countries housing markets occured despite a lack of non recourse lending in these markets or securitisation of mortgages. So in themselves these U.S. specific explantions do not explain the whole picture.

In summary, the booms don’t happen in all places in a particular country because unless the “fundamentals” in a “housing market” are strong enough to get prices going up in the first place the boom never gets going strongly enough to induce much speculation. In some regions the fundamentals weren’t strong enough to get the boom going, in others they were strong enough and we had the boom and the bust. In still others, as a number of posters have pointed out, economic conditions were so poor that prices were weak when other regions were booming and as economic conditions have weakened further prices fell. e.g. Rust Belt.

Falling house prices, driven by excessive purchases and purchasing price forming a balloon, collapse drives ecomony toward celler, affecting incomes everywhere!

Falling income of governmental entities requires new taxes.

New taxes on top of falling income, decreases amount available for living expense, being more important than housing costs, forces need for lesser payments for housing, forcing demand for house towards the celler in all areas.

Cylical progression of demand and supply stagnates and demand trend is negative.

will not recover until incomes increase suffiiently to supply taxes and living expenses and then increasing available funds for housing needs.

It will be necessary for consumers to limit spending for non-necessities for a significantly long period of time.

I expect no change for the next 5 years!

JackO

Don’t forget rising oil prices. On top unexpected declines and flat incomes, people had higher living expenses requiring more savings and liquidity.

Land use restrictions play a role in many housing booms, and I believe is the reason that CA has 12 yr boom and bust cycles.

Your study confirms what is intuitive to most of us: the bigger the boom, the bigger the bust.

My San Diego housing reports are published monthly, so stop by my website and have a look.

Cedric claimed :

“We have to fix global warming.” No, I don’t think so.

Global warming has been shown to be a scam. There is nothing to ‘fix’ other than the need to step up our efforts to ridicule Al Gore.

Furthermore, note how Marxists always want to raise taxes, but NEVER talk about cutting spending. What failures in life they must be.