Last week’s new economics data were a mixed bag. But on balance I’d have to say I’m more discouraged than when the week began.

|

July auto sales weren’t so bad, edging up a bit (on a seasonally unadjusted basis) from both the previous month as well as July of 2009. The latter is not a trivial accomplishment, since the beginning of the cash for clunkers stimulus had been one factor in the sales a year ago. For the last 5 months we’ve held about 15% above the values of the previous year, but nevertheless still 30% below the corresponding 5 months of 2006.

|

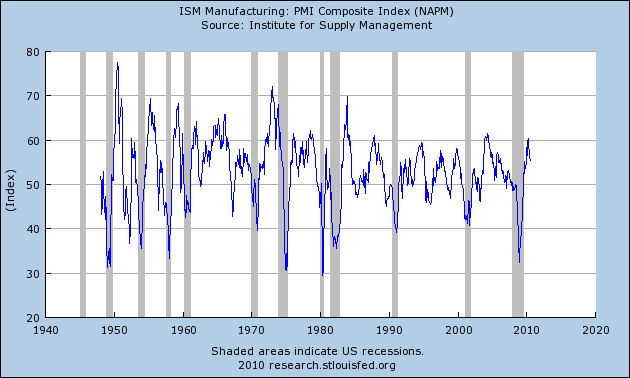

The ISM manufacturing PMI index slid for the fifth consecutive month, standing at 55.5 for July. But as I keep reminding people, the consistent string of observations above 50 means that a plurality of managers have been reporting that each month this year was better than the previous month. To give myself some reassurance about that, I looked at a regression of quarterly real GDP growth (at an annual rate) on the quarter’s average PMI reading from 1948:Q1 to 2010:Q2. The regression has an R2 of 0.43, and says that we might usually expect a PMI of 55 to be associated with about 4% real GDP growth. In other words, if everything else in the economy were doing as well as the last ISM manufacturing report suggests, our Little Econ Watcher would be smiling away.

|

But unfortunately, ‘taint so. New home sales may have taken a turn for the worse, and pending home sales also look foreboding:

|

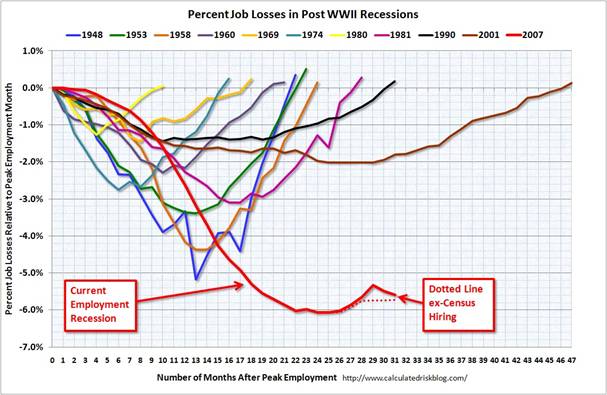

But the biggest worry remains the 131,000 fewer Americans working in July. Even if you add back in the 143,000 lost temporary Census jobs, employment was only up by 12,000 jobs, very far below what is needed to keep up with growing population, let alone to make any progress in bringing the millions of unemployed Americans back to work. Menzie takes some comfort in the fact that hours worked are still going up, and that an important factor in the drag– the loss in state and local government employment– is something that policy can address. But I would still describe the lack of progress made on employment at this point as pretty discouraging.

|

The Aruoba-Diebold-Scotti Business Conditions Index, which does not use hours, and does not adjust the monthly employment changes for the effects of temporary Census hiring, is certainly discouraged. In fact, the combined effect of last week’s increase in new claims for unemployment insurance plus the weak employment report pushed the ADS dangerously close to the -0.8 value that historically would often mean that a new recession could be starting. The most recent inference of that series, however, can be heavily influenced by the latest data, and it would be a mistake to make too much out of the most very recent values.

But it would also be a mistake to say that everything is going just fine.

|

This morning on CNN we have Robert Rubin saying “A ‘major second stimulus’ might create uncertainty and undermine confidence.”

If Rubin were a doctor he would withhold medicine from a sick patient because giving him medicine might demoralize him and destroy his will to live.

Unfortunately, Rubin’s acolytes, Summers and Geithner, seem to agree. With Romer’s resignation, things are looking especially grim. Obama’s embrace of Rubinomics and disregard of dissenting voices could turn out to be his greatest failure.

I’m not sure that the little Econ Watcher’s neutral mouth is the part of his countenance we should be looking at. Maybe we should be looking at nervous eyes? Or scarier yet, hands over his eyes.

Since most leading indicator indices are misled by the steep yield curve caused by the ZIRP, Albert Edwards plotted the Conference Board leading index leaving out the yield curve:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/trichet/AE3_0.jpg

Has someone done the same with the Aruoba-Diebold-Scotti Index? The people publishing it must be aware their data is being skewed.

Bob in MA: ADS makes no use of the yield spread.

I’m sorry, I was sure I had read that they did use it. But I see I was wrong.

When breaking down the most relevant components of the economies,it is hard to see where improvment through monetary policies could improve solvency

The history of mergers and acquisitions is a leading indicator of financial crisis as the scripts are recurrently the same.

Equities prices manipulations.mergers and acquisitions mania are always preceeding Markets crashes

A testimony of above ” Is Debt Overhang Causing Firms to Underinvest?” Filippo Occhino

There are corporates savings but they are debts as well:

http://www.clevelandfed.org/research/commentary/2010/2010-7.cfm

Other components are easily available with Fred (consumers debts,banks assets exceeding non performing loans..)

Even this bright side,may be construed against a quick recovery.

Household Financial Obligations as a percent of Disposable Personal Income

http://research.stlouisfed.org/fred2/series/FODSP

When assets prices will be compatible to incomes and revenues hopes may arise.

Oil prices are not particularly helpful, either. NYMEX at $81 this morning; $82 is the historical 4% recession threshold. I personally doubt the US can add oil consumption much above $77, so it looks to me like we’re constrained on the transportation fuels side.

Looking at the ADS, Unemployment and the WLI, in my opinion we are certainly at the door steps of another recession in GDP.

http://dshort.com/articles/ECRI-Weekly-Leading-Index.html

I have always found the definition of a recession to be fascinating. For me, while GDP did improve, I feel like we never got out. Massive stimulus dollars hyper inflated the GDP and simply kicked the can down the road. Unlike many on this site, I am not an economist. I love the study of economics and wish that I had taken a different route in life, perhaps even becoming an economist. However, I am a banker in the Southeast, and from my perspective, the recession never ended it was just glossed over.

So what would you recommend the government do going forward?

I blame Greenland ice claving.

The ISM Manufacturing does not take account of destroyed output. It creates a false sense of optimism. If 20 % of businesses go bankrupt then the remaining ones will likely see an increase in business. This is not net good news.

Just like the census hires were and weren’t important, their loss is and isn’t important. Isn’t as a long-term factor, is as a short-term factor.

The flattening back to zero of consumer spending is also a key sign.

All the leading indexes are looking ominous, so are typical leading indicators like Baltic Dry. There’s a lot more trouble in China than just frothy downtown Beijing/Shanghai apt prices.

Stick a fork in us. We are done! Horrible economic policy, driven by seriously deluded followers of command control economy, have destroyed the entrepreneur and 70% of job creation. No money flowing, everyone stuffing the mattress. No one is taking risk, because there is no reward to be had. Until Janauary 2013, this Country will flounder and may collapse. It took Reagan’s team almost 8 years to clean up the LBJ, Nixon, Ford and Carter mess. We are talking a generation this time and maybe a very big war to boot, before, or if, we climb out of this hole.