From Bloomberg:

The biggest Keynesian stimulus in U.S. history was a bust.

Incredibly, some Keynesians who supported Barack Obama’s $862 billion stimulus now claim it fell short of their goals not because the idea was flawed, but because the spending package was too small.

Dr. Hassett continues by citing a 2002 study.

A 2002 study by economists Richard Hemming, Selma Mahfouz and Axel Schimmelpfennig of recessions in 27 developed economies from 1971 to 1998 found that increased spending by government had, in almost all cases, a barely noticeable impact, and sometimes a negative one. Heavily indebted countries that spent more in recessions grew about 0.5 percent less, relative to trend, than countries that didn’t, the study found.

I wish Dr. Hassett had quoted additional parts of the paper because a lot of subtleties were omitted in his “summary” of the paper. In any case, I’ll quote some additional passages from the same study (it’s also an IMF working paper, by the way) to heighten the reader’s awareness of exactly how relevant — or irrelevant — Dr. Hassett’s quote is to the current episode:

Fiscal policy is Keynesian during recessions in closed economies, but

the fiscal multiplier is quite small (i.e., it is unlikely to exceed unity).

…

However, these conclusions do not preclude the possibility that, where

the circumstances are right, fiscal expansions can be an effective

response to a recession. The right circumstances would feature some or

all of: excess capacity; a closed economy or an open economy with a

fixed exchange rate; big government; expenditure-based fiscal policy;

and an accompanying monetary expansion.

Gee, well, I’d say there’s slack in the U.S. economy. [1] I’d also conjecture that the US economy is pretty closed relative to the majority of other observations in the study. I think I heard there was an expenditure (as opposed to tax reduction) component in the ARRA. [2] And finally, I believe I have heard that current monetary policy is quite expansionary. [3] Apparently, Dr. Hassett was unaware that any of these conditions applied to the United States in 2009-10.

In addition, I do wonder why Dr. Hassett had to go back to 2002 to find a study (well, actually, an out-of-context quote from a specific study). In the intervening time, the IMF has conducted many large scale, cross country analyses of fiscal policy in advanced economies. [4] [5] [6] In addition, a number of surveys of the size of multipliers have been conducted and published. [7] [8]

I believe that think tank economists provide a useful purpose in providing diverse views in ongoing policy debates. However, in this case, I think I will forego Dr. Hassett’s assessment, and put my faith in the assessments from private sector economists who do not have an ideological axe to grind. Below is Deutsche Bank’s recent assessment of the impact of various fiscal stimulus measures on the level of GDP.

Figure 1: Dobridge, Hooper, Slok, Sufian, “The growing risk of fiscal drag in the US,” Global Economic Perspectives, New York: Deutsche Bank, July 28, 2010.

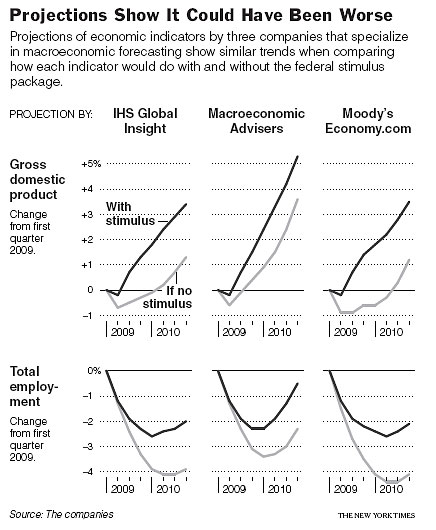

And below is a graphic from an earlier post that describes private sector assessments of the impact on GDP relative to counterfactual.

Source: J. Calmes and M. Cooper, “New Consensus Sees Stimulus Package as Worthy Step,” NYT (Nov. 21, 2009).

* For those who are not aware of the reference, this is the title of: James K. Glassman, Kevin A. Hassett, Dow 36,000: The New Strategy for Profiting From the Coming Rise in the Stock Market (1999). For context, the Dow closed today at 10,040.45.

Believing in Keynesianism is like believing in Santa Claus.

It’s a nice fantasy, but only a fantasy.

Show me where politicians with a fiat currency run surpluses in the good years, and I’ll show you a jolly old elf.

You can’t be a one-way Keynesian, running deficits in the good years and monster deficits in the bad years.

It is best to avoid ridiculing those with whom you disagree. Here you point out Hassett’s previous bad prediction, and also suggest he is motivated by ideology in his views. Everyone knows he works for a think tank, and what that think tank’s views are, so this is gratuitous.

You are an academic economist. It is well known that certain conformist points of view are de rigeur in your circles. Should the reader dismiss your work out of hand for no other reason?

As for the supposed objectivity of the private sector economic advisors quoted, aren’t they all working with the same Keynesian assumptions, more or less, so that their projections simply embody their presuppositions?

I suggest you read Calculated Risk blog for a top notch economic commentator who keeps snark out of his work.

That said, you make many useful contributions and I appreciate your blogging efforts. But I think you would do well to set aside your political partisanship.

Satire or sense, alas! can Hassett feel?

Who breaks a butterfly upon a wheel?

Okay, I’ll admit that I read his piece too.

Guilty pleasures.

uhhhmmm…do you know who also doesn’t have an ax to grind…the market…how do the homebuyer tax credit work out or cash for clunkers or the extend and pretend housing policy.

you can’t stop a debt/deflation cycle by just adding stimulus…you can create one however.

as far as private economist…all of them overpredicted today’s housing numbers and all of them over predicted the philly index.

It is funny how Keynesianism is now a euphemism for socialism; socialism itself being a euphemism for the forcible and tyrannical seizure of wealth from the productive.

Socialists always say that when socialism doesn’t work, the answer was because there was not enough socialism. Heh. They never show a place where there was enough socialism to work, unless it had solid white Protestant values.

Thucydides,

But I think you would do well to set aside your political partisanship.

A leftist can no more put his religion aside than a radical Muslim can put his religion aside, or an extremely fanatical evangelical Christian can put his religion aside.

Politics offers a place in the psyche of leftists that others would occupy with religion.

It is worth noting that about 18 months after Reagan’s tax cuts, there wasn’t much sign that the economy was turning around. As a matter of fact, disaggregating the effect of massive monetary easing from the tax cuts is difficult, but I would suspect that one would find that the tax cuts had a much smaller effect than Volcker’s easing of credit on bringing about recovery.

Bring it a couple decades later and I think you would also find that Bush’s tax cuts didn’t exactly bring about a robust recovery by mid-2002. Blame 9/11 all you like because it’s incorrect to do so. In fact, even by 2005-2006, I would exactly call the growth we had anything spectacular even though we had one of the largest private credit bubbles in history backing it up.

Shall I count the ways this post is very, very bad?

1. Hazlett’s authorship of “Dow 36,000”, however idiotic, is irrelevant to the argument he puts forward. Chinn refutation rests in part on the implication that Hazlett is such an obvious idiot at making predictions that everything he does must be crassly wrong.

2. The “however” paragraph of the Hemming et. al. paper is quintessential two-handed economics. After spending words and data on a thesis, they add possible exceptions, to make referees, and potential citers of the opposite persuasion happy.

3. Are *private sector economists* all anti-Keynesian? By association with their capitalist masters, they must be. Hence, if even they defend the stimulus, it surely must be effective! I don’t know if this part of the post is lazy or just intellectually dishonest and I don’t care. But, as in point #1, DB’s analysis should be evaluated on its own intellectual merit. I should add that Economy.com and Mark Zandi (source of the employment graph) have made plenty of totally wrong predictions all the way leading to the recession. I was at the Moody’s annual conference when Zandi predicted we would not have had a recession. That was on Sept. 14 2008. If Chinn ridicules the record of those he criticizes, he should do some homework to review the record of those he calls for succor.

W.C.Varones,

You are right. Bill Clinton is kind of a Jolly Old Elf.

gappy,

Indeed. We wouldn’t discount everything Menzie says based on one idiotic thing he wrote in the past.

I’m actually pulling for Menzie, hoping he can turn away from the path to Krugmanesque partisanship. He has some potential as an economist if he chooses to be one.

Thucydides: I would have thought given your namesake’s disdain for demagogues, you would applaud my critique of Dr. Hassett’s analysis. In fact, is it political partisanship if I critique bad analysis and quoting out of context? If so, I had best re-arrange my syllabi.

I disagree that there are certain views that are de rigeur in academic economic circles. That you should say so indicates that you are either unfamiliar with such environments, or have very specific experience. I can speak as one who has either been trained at or taught at four different universities that there definitely is not comformity in views. In fact, I would guess my views with respect to macro modeling are in a minority at my institution. So, please, survey a few more faculty at different institutions in different states before making broad generalizations.

I also have experience with multiple think tanks (and indeed worked for one once). I disagree that you would know exactly what one thinks by knowing the think tank that they are associated with. In fact, I would very strongly disagree with that assertion, and if you would like to pursue the basis for my assertion, I would be glad to oblige.

gappy: Who’s Hazlett? Also, “et al.” I believe is the proper spelling.

More substantively, the additional paragraphs were not mere boilerplate; take a look at the tables in the paper. Or, you can take a look at the Ilzetzki et al. paper, discussed in this post, which replicates and extends the Hemming et al. finding.

Finally, Zandi/Economy.com is source for only one of the graphs in the second graphic. Please read carefully. Now, if you don’t like the “capitalist masters”‘s distortion of the incentives of the forecasting firms, then you can take a look at CBO’s most recent assessment of the ARRA (which I have previously linked to in this weblog [a] [b]).

DS,

Come on. Clinton’s “surplus” was a myth caused by raiding the fake “Social Security Trust Fund.”

Even ignoring that, it was the exception that proves the rule.

Through Econbrowser posts in reference proofs, were given that large evaporation was taking place in the government expenditures, the end result being a multiplier

Last post is mine. sorry preview and post are close to each other.

I don’t think it’s that Hassett didn’t read far enough, Menzie. It’s more likely that he’s lying from the very first word.

The first word of the quoted passage is “Incredibly”. There is nothing “incredible” about Keynesians “now” saying that the stimulus was too small, even among those “Keynesians who supported Barack Obama’s $862 billion stimulus”. In early 2009, Pimco’s Bill Gross among those saying it would be inadequate, not just Paul Krugman et al. Some might have “supported” it not as a high-enough amount, but rather as the best that was politically achievable under the circumstances. Can Hassett name any economists who supported it *as adequate stimulus*, saying that they were sure it was enough? If so, how curious that he doesn’t. Could it be that he doesn’t want to embarrass those people? Not too likely.

If you want to analyze error in the various *predictions* that the stimulus would be insufficient, back then, go ahead. But don’t accuse unnamed economists of reversing themselves on that count when all the economists people might think of have, in fact, been pretty consistent the beginning. Name names, if you can. It appears Hassett can’t.

W.C. Varones, I give you … Australia.

Conservative psychopaths are easily identifiable by the incoherence of their “arguments”; there are clearly a few posting here. Their claim to objectivity is hilarious, given the demented nature of their thought processes.

P.S dear Heterosexual: methinks thou dost protest too much.

Obama’s stimulus cost more than the Iraq war.

And it was less beneficial than the Iraq War too.

“And finally, I believe I have heard that current monetary policy is quite expansionary. [3]”

Ha-ha. Really? Can I somehow block Prof Chinn’s posts and get only Prof Hamilton’s in my feed?

Obama’s stimulus cost more than the Iraq war.

http://www.washingtonexaminer.com/opinion/blogs/beltway-confidential/Little-known-fact-Obamas-failed-stimulus-program-cost-more-than-the-Iraq-war-101302919.html

And it was less beneficial than the Iraq War too.

I hate these kinds of declarations from the talking heads. The war cost lives and you cannot put a dollar amount on a life.

That said, we know we’ve reached the Keynesian end game when debt servicing exceeds revenues.

That day is fast approaching for the sovereigns regardless of the news put forth (for some slight of hand see Spain’s bond sale to finance debt).

Just to plug holes in existing fiscal deficits the world has to issue 4.5 Trillion dollars in new sovereign debt. The governments of the developed world governments ‘printed’ 12% of Gross Domestic Product (GDP), or 40% of government expenditures.

BTW, don’t believe the 53% debt to GDP ratio for the US; don’t forget about the problems with Social Security and our favorite “off-book” GSEs.

Bob the Wombat:

Pretty good counter-example, but they are in the rather enviable situation of having huge natural resources and a relatively small population. I’ll admit they’re still doing an impressive job (as is Canada).

I overstated my case. Some countries in special situations run small enough structural deficits that Keynesianism is worth discussing and probably works very well. The U.S. hasn’t been anywhere near that point for decades.

Wow, this is interesting. Here we have Varones saying belief in Keynes is like belief in Santa, followed by Thucydides saying that ridicule is best avoided, and they both appear to be on the same side of this issue.

OK, let me take the middle ground on rhetoric, though not on this issue. If you are going to ridicule the other side, you ought to at least avoid seeming ridiculous in the process.

There is no reason that Keynesian stimulus in times of below-trend economic performance requires a surplus in normal times. None. Zero. Holding that up as a standard reveals ignorance of the subject matter. We can speculate that Varones is substituting his own preference for fact, but that would only be speculation.

Is “Dow 36,000” irrelevant? To the facts, yes. However, since Hassett is being picked out as a authority by Bloomberg, he is “speaking from authority” as well as from the facts – facts which he abuses. So it is, in fact, relevant that Hassett is an intellecutal lightweight. Readers have every reason to want to know who it is that is being offered up as an “authority”. Get yer arguments right, kiddies.

Thucydides,

You have had a lot to say about generalities, and about some of substance of the post, while avoiding other bits of substance. The bits of substance you avoided are the bits that directly address the weakness of Hassett’s argument. The weakness is mostly what looks like willful omissions in his selection of quotes from other people’s work. One can be as dry as dust in calling Hassett out for dishonesty, or one can have a little fun. The point remains that Hassett was dishonest.

Finally, this is Menzie’s blog. It is not clear why you should have any pretension toward editorial authority here. Get your own blog.

By this post’s own numbers, ARRA took on permanent debt equal to 6% of GDP and created a temporary boost of 2% of GDP.

How is that a success by any measure?

Professor Chinn,

I’m not sure how the U.S. is a closed economy. Isn’t it obvious from recent trade data that a lot of the demand gained by the stimulus leaked to other countries?

Personally, I think the “Dow 36,000” was deserving of note. If for no other reason than it’s humor value.

Why is it “Socialism” means “The Government” can’t do risk management, in an excellent fashion, but, companies can, but extremely badly?

Shouldn’t we be throwing all the Insurance Industry CEO’s in JAIL for being “Socialists”, or does RESCISSION, clearly evil illegal Contract Breaking of Paying Customers, get them off the hook?

In other words is Risk Management Only Legal, when the CEO does it in an illegal way?

ppcm:

As an answer to Rogoff and Reinhardt I have another question:

Who says why and when public and private debt, in aggregate, has to be fully amortized? As it has been done for decades it is enough to recycle it. You can reduce debt burden at will when de moment comes to do it. The magic of economic growth and inflation works.

There are several examples of governments that reduced debt during economic expansion.

Menzie, may I suggest to you that you improve your style.

Pointing at someone previous bad prediction ? Better you avoid ridiculing those with whom you disagree, my dear Menzie.

Or, as a chinese saying goes : “People, who are not gentle, will feel the sword.”

Cheers.

You know what’s kind of funny? “Dow 36,000” was based on an economic model (nothing as sophisticated as Menzie is into, but a model nonetheless). I believe it was comparing the risk and returns of bonds to stocks, if I’m not mistaken, and extrapolating what stocks SHOULD be valued at based on a much lower risk shown in recent historical data (pre-crash, of course).

Or something like that.

Anyway, Keynsian estimates of the efficacy of the stimulus are based on nothing more than their own economic models, right?

So it’s one modeler vs. the other.

Back in the real world, other than the unionized trades that can only get the government to pay for their outrageous “prevailing wages”, no one really thinks that MORE stimulus is called for. I see trillion dollar deficits, and I’m scared. We need to spend less, not more. There are already enough automatic stabilizers in the budget, we don’t need to spend more discretionarily.

As for “easy money” at the Fed…, well, one of my other favorite blogs is “The Monetary Illusion”.

Buzzcut: Yes, it’s based on a model, but not a model we teach — or at least I don’t teach it. For me, the closest one can come to validating the Glassman-Hassett approach is a stock price is the present discounted value of future dividends, assuming constant growth rate of dividends and a constant rate of discount, where G-H have assumed a lower rate of equity discount than typically used. Here’s the handout I use for my lower division undergraduate course on money and banking. But as Krugman pointed out long ago, G-H used earnings instead of dividends. If you know of a “model” that justifies this approach, well, then I’d like to be apprised of it. So in my mind, the Glassman-Hassett book is not so bad because of the prediction aspect, but rather the economic error (although the prediction error follows from the economic error).

Ignacio

Point well taken,the same goes for the relationships:

corporates,private and banks.When everything is going well,debts are not repaid or rolled over.

Any major structural slowdown and then:

Series: LLRNPT, Assets at Banks whose ALLL exceeds their Nonperforming Loans

http://research.stlouisfed.org/fred2/series/LLRNPT?cid=93

Rogoff and Reinhardt are introducing the notion of threshold,a critical point of rupture.

Indeed Russian bonds 1917 were repaid around the 21st century.

China railways never yet (to my knowledge).

Since Keynes multiplier is the topic,let us give him the final word:

In the long run we all are dead and let us have the speculators to say In between everything is possible.

Way to put the ad hominem right there in the title.

I’ll add another group not to listen to, and that would be banks and any economists employed by banks.

It’s true that we didn’t nationalize the banks, and they are a “very special class” of private sector, but the banks nationalized the country. (I’m still waiting for the news report on that.) It worked in Germany too.

I’ve also noticed that the stock and bond market have become devout Keynesians. If the Green Helicopter isn’t flying directly overhead, you can do wealth transfer with the taxpayer and some greater fool in the markets eventually.

The only private sector people we have left are the few making decisions on company capital spending.

The financial sector was just recently invited to the North Pole, er…, I mean Washington DC, to tell our leaders how to fix the housing problem. If we are not careful we will end up with nationalized housing but no one will know where their house is.

We are up to the stratosphere in Keynesians. Beyond the stratosphere if you add in NASA Keynesians.

“projections show it COULD have been worse”….. the title says it all.

anyone who believes that they can engineer better economic conditions by temporarily or permanently making decisions for others is arrogant to the extent of being dangerous.

ever read what Nassim Nicholas Taleb has to say about “economists”? if not, then check it out.

am a long time reader, and this is my first (and last) time commenting. goodbye.

Menzie,

I see lots of criticism of you but not one solution. This is like the NRC response attack team.

They had their way with all their tax cuts for the rich and the stock market after Bush is where is was in 1997. Employment is less than in 2000. And what do we hear from the carping gallery that couldn’t read an academic paper, more of the same. War, tax cuts.

Well, war’s good business, invest YOUR son. Iraq was good? It is a basket case, far worse for the Iraqis than when Sammam was in charge, whether you go by displaced people, murdered civilians, electricity per day, oil output, security. We ruined Iraq and turned Iran loose.

And yes the AEI is not serious economic think tank. Scholars? Paul Wolfowitz? John Yoo??

I am not sure that direct money transfer of taxpayer funds to the financial oligarchy can be classified as Keynesian stimulus. Bush-Obama administration mainly saved big banks.

Roosevelt administration was not afraid directly created jobs and directly attacked financial oligarchy. Those steps are taboo for Obama. You need to have personal courage to attack those guys. It looks like he does not want to rock the boat and just wait to join the looters are soon as his term expires. The most telling sign here is the absence of criminal prosecutions of those who were responsible for the peddling sub-prime loans.

So it is not surprising that the courage confront the problems and propose the path out of the crisis is nowhere to be found in present day politicians. Obama with his Rubin’s right of the center economic team was just trying to play it nice with financial oligarchy.

Another problem is that a lot of Republicans became real nuts, kind of brainwashed Right wing Bolsheviks (extremes meet). You can see this from some of the postings here. So politically the USA is deep deadlock at the time when action is needed. If republicans wins seats in November (which is plausible in the country where 40% of population believe that Saddam was directly responsible for 9/11)

So the problem here is that economic crisis is simultaneously is a deep political crisis. Previous ideology of casino capitalism that was dominant for 30 years or more is dead for good and new is nowhere to be found. Peak oil is another constrain that make kicking the can down the road impossible.

kharris – right on! Thank ylu for cutting thru th BS from the wingnuts

Just because the model was wrong, or unjustified, doesn’t mean that it wasn’t a model.

Menzie,

Not sure what you don’t like about this..

“But as Krugman pointed out long ago, G-H used earnings instead of dividends. If you know of a “model” that justifies this approach, well, then I’d like to be apprised of it.”

I don’t know of a model, but the capitalists I worked for explained it to me long ago when I was a budding capitalist. There are two kinds of companies. Growth companies and value companies. If a company can be a growth company, shareholders prefer the company to retain and reinvested earnings in growing the business. If they don’t have good growth opportunities, investors prefer earnings to paid out in dividends. In stock market lingo, this is known as a value stock or company.

The common denominator is earnings, so that would be my preferred metric to look at.

Not defending G-H n general. Anyone that thought the stock market was going to 36000 needs psychiatric care.

“Believing in Keynesianism is like believing in Santa Claus.”

Believing in the invisible hand is like believing in the tooth fairie.

In real world economies market power, externalities, asymmetric information, and missing markets are the rule, not the exception. As a result, real world economies only have an invisible paw, not an invisible hand. It works reasonably well a good deal of the time, but it can fail very badly at times, and then the government has to intervene.

Keynes said that a surplus is for the economy in good times (low unemployment, etc) and it is the political economy of legislators that dismisses Keynes with the expected result that the USA has experienced. Keynes was NOT wrong. Citizens and legislators have failed. We must not forget that it has been GOP administrations that have increased the deficits and debt, like it or not. Get over it America.

The term “slack” was invented by Keneysians to obscure REAL capital destruction.

@ Full Employment Hawk “Believing in the invisible hand is like believing in the tooth fairie.”

Ha I really like that. Do you have one for “free markets”?

Menzie: You are talking out of both sides of your mouth. One one hand you are saying “mission accomplished” on the ARRA, while on the other hand you have argued that we need more stimulus. Which is it? If your response is that we didn’t know the depth of this recession at the time, then would it be fair to say that your econometric models failed us a few years ago? Just how fallable are your “forecasting” techniques and why should beleive them this time around?

Chinn: When I realized the name was Hassett I already pressed “Publish”. On the other side, forgetting the period in et al. completely invalidates my criticisms. Oh, well.

I am perfectly aware that Economy.com’s provided only part of the evidence. I happen to know first-hand how sloppy economy.com, Zandi, and Moody’s analyses can be, so I pointed that out. I suspect that, if I looked carefully into the other assessments, I would find plenty of arbitrary assumptions.

My main objection to the original post and the reply in comments is that both rely on supporting documents without evaluating their intrinsic merit. To which one could reply by invoking documents supporting the opposite thesis, and so on ad infinitum. It’s debating by invoking authority. This blog can do better than that.

When someone mentions Reagan tax cuts, they ALWAYS ignore these additional facts:

1. Tax receipts went down dramatically. You can even look this up in Wikipedia of all places. This was despite the claims that the Laffer Curve said tax receipts would go up.

2. The 1981 ERTA tax cuts were followed in 1982 by the TEFRA tax increase, the largest tax increase in US history. That law also enacted arguably the single largest intrusion into private life by government, the requirement that all family transactions – like loans – bear interest at a rate set by the government. You can’t lend money to a child legally without interest, despite family bonds, because Ronald Wilson Reagan signed TEFRA into law. Note: the GOP also controlled the Senate at the time.

3. The TEFRA tax increase was followed by tax increases in 1983, 1984, 1985, 1986, 1987, 1988. These tightened up AMT rules – actually turning it into a real tax with bite, a process begun largely under TEFRA.

This history strongly suggests that cutting taxes isn’t meaningful to spur growth, although that does raise havoc with the budget, and that raising taxes does little to crimp growth, because 7 straight years of tax increases can be completely ignored by the entire GOP as though they never happened.

I think a good case can be made for a model based on earnings rather than dividends, but you then have to make calculations appropriate to that model. How much growth is due to the assumed reinvestment of those earnings, for example?

One reason earnings are the preferable measure is that changes in tax treatment of capital gains have led to smaller and smaller shares of earnings being distributed as dividends, and an increasing popularity of share buybacks as an alternative. From the point of view of the individual investor, share buybacks are really not very different from a reinvestment of earnings.

A good example of a very simple (nonetheless reasonably useful) use of earnings as a valuation measure is the old Benjamin Graham concept of “earnings yield”. Essentially, 1/PE, the “earnings yield”, was compared to the yield of long term bonds in order to judge the relative attractiveness of current stock vs. bond valuations. By that measure, in the example Krugman cites, with interest rates at 6%, you would have expected a PE of about 17.

Of course this doesn’t account for earnings growth, but the underlying assumption is that the potential for earnings growth with stocks is offset by the increased risk.

The real flaw in the G&H logic was in minimizing (ignoring really) the risks. A better understanding of the reality that most companies will fail over a period of 100 years, rather than continue to provide steady earnings growth, would lead to more of an emphasis on minimizing those risks, such as through a Graham/Dodd approach of emphasizing strong balance sheets.

wcv “By this post’s own numbers, ARRA took on permanent debt equal to 6% of GDP and created a temporary boost of 2% of GDP.”

You do know that you are confusing stocks and flows, don’t you? GDP is a flow variable; debt is a stock variable. Do you understand why this makes your comment meaningless?

2slugbaits

Oh noes! Don’t tell Paul Krugman! He’s confusing stocks and flows by discussing debt and GDP!

http://krugman.blogs.nytimes.com/2010/08/11/debt-in-the-30s/

You do know you’re confusing who’s confused, right? Discussing stocks and flows in the same sentence is not the same thing as confusing stocks and flows.

gappy: I think nobody who has been reading this weblog can say that I have been derelict in my duty of citing many, many, many different estimates of multipliers, and hence impacts upon GDP. I’ve cited John Taylor’s estimates as well, which were at the low end of impact. And then I’ve cited the range of impacts, as used by the CBO; that’s kind of like a meta-analysis. Heck, there’s a Econbrowser category devoted to just multipliers. Rather, I suspect some Econbrowser readers think I focus on multipliers ad nauseum. Hence, forgive me if I’d assumed that I was not just “invoking authority”, and hoping readers had remembered those previous posts. (By the way, what is it with folks and the charge of “invoking authority”; for sure I will invoke authority if it’s an engineer talking about bridge integrity).

T-Dub: I have never used the term “mission accomplished” in reference to the stimulus package; and I do not believe I have ever used that term to characterize any endeavor I had pushed for. Hence, I believe you have me confused with someone else.

The war cost lives and you cannot put a dollar amount on a life.

It also saved lives. Oil for food alone was killing 50,000 children a year. Ending that saved lives. Iraqi life expectancy in 2010 is actually higher than in 2002.

One can argue that Obamacare will cost a lot of lives too….

So we have to keep this discussion strictly based on dollars. Obama’s stimulus cost more than the US invasion of Iraq from 2003-10. Period.

KKK wrote :

Conservative psychopaths are easily identifiable by the incoherence of their “arguments”; there are clearly a few posting here. Their claim to objectivity is hilarious, given the demented nature of their thought processes.

Projection of the purest sort. Everything you wrote is precisely true of leftists, and your own hysterical inability to realize politics is a religion substitute for you is evidenced by your comment.

Plus, the KKK was tied to the Democratic Party, not the GOP. George Wallace, Robert Byrd, etc. are Democrats, as was Strom Thurmond at the time of his segregationist platform. Being a leftist means being ultra-ignorant about history, of course.

Hitler was left-wing too, BTW.

You can thank me for schooling you, at your convenience.

wcv Go back and reread what you posted. You are looking at the change in the GDP growth rate for the first year and trying to match that against an entire debt stock of 6 percent for the entire stimulus, which is spread out over several years. You’re simply confused about flow variables and stock variables. And you are completely confused about what Krugman is saying.

T-Dub The failure was not in the modeling of what kind of stimulus package was needed; the failure was in rounding up the political muscle to do what was needed. Romer’s own calculations showed that the stimulus needed to be ~$1.3T, and that was based on how the economy looked in Dec 2008. We now know that the economy was actually much worse off than we thought in Dec 2008, so that suggests a $1.3T stimulus would have been a minimum. The models said $1.3T, but Rahm Emmanuel and Larry Summers folded up the numbers, put them in their pockets, and told Obama a number that was about half of what was needed. Why? Because, as Rahm Emmanuel said, getting 60 votes for a big stimulus bill meant finding a way to get Al Franken seated in the Senate in March. So they lowballed the stimulus thinking that they would get a second bite at the apple. They didn’t count of Tea Party foolishness and the GOP’s willingness to blow up the economy all for the sake of Mitch McConnell’s ambition.

gappy There’s a big difference between forecasts going awry due to regime changes, exogenous shocks or random errors versus plain old-fashioned incompetence and model specification issues. “Dow 36,000” was amateurish cheerleading of such an order that even Larry Kudlow had to blush. There are lots of fake economists with Ph.D’s all over cable news. Stephen Moore of the Club for Growth comes to mind. And even Ben Stein calls himself an economist on Fox News just because Fox News viewers are too dense to know better. The “Dow 36,000” thesis was not built on any kind of standard model. Now I’m fine with heterodox economics, but even heterodox economists have to submit to some kind of intellectual discipline. When Hassett writes a book it’s fair to ask if he’s appealing to an actual economic model or if he’s just following a tried-and-true huckstering model to sell books and self-promotion. It’s disappointing that Bloomberg would choose to print such nonsense. Perhaps they are feeling the heat from Rupert Murdoch’s Wall Street Journal. The economic lesson here is to remember Gresham’s Law.

GK aka Heterosexual: If you deflate into constant FY2010 dollars, then you find that Iraq expenditures through FY2010 (excluding likely future VA costs associated with injuries, etc.) will be $809 billion. Adding in FY2011 expenditures (under CBO’s rapid withdrawal scenario) will yield a total of 858 billion. In contrast, ARRA according to original scoring will be 789 billion in constant FY2010 dollars; CBO increased its estimate of total costs to $816 billion (current dollars), implying the total cost of ARRA in constant FY2010 dollars at 818 billion. So, you truncated the sample to make your numbers work. Unless you assume zero US expenditures in FY2011, your assertion is wrong, in real terms.

“Plus, the KKK was tied to the Democratic Party, not the GOP. George Wallace, Robert Byrd, etc. are Democrats, as was Strom Thurmond at the time of his segregationist platform. Being a leftist means being ultra-ignorant about history, of course.”

This “ultra-ignorant about history” thing is actually a hallmark of repugs:

1. You conveniently forget that a lot of electorate from South changed their party affiliation after Johnson’s desegregation reforms.

Please compare states that are voted Republican now and in 1950th.

2. And neither Hitler himself, nor national socialism as a political movement can be classified as left-wing. It was a political reaction against left-wing parties sucesses. The ralling cry was defence against the Jewish-Marxist plot to conquer the world, and the betrayal of Germany in the Versailles treaty.

Hasset made a simple, stupid mistake, basically double-counting dividends (as pointed out by Jeremy S. and acknowldged by Hasset). It is just as silly to imply that anyone who makes a mistake shouldn’t be listened to anymore.

The biggest problem with simple stimulus now is that the trade deficit will respond more than in proportion, because the amount of the stimulus taken through foreign currency mercantilism grows with the stimulus – Asian pegged rates require greater intervention when U.S. import demand grows. I think this effect is big enough to gut the gain from a poorly crafted stimulus (such as we should expect from Congress) and leave us worse off.

Arguing against short-term Keynesian effects of fiscal spending is like arguing against global warming. The result is apparent from the simple science, at least in direction, although the actual magnitude can be debated.

don All the more reason that the stimulus should have concentrated more on direct government infrastructure spending rather than tax cuts. The first order effect of direct government spending is largely insulated from import leakages, and most government spending has to be on domestically produced goods.

This commentary has just gone nutso. If there was a problem with our national debt, wouldn’t investors demand a better interest rate before buying short and long term bonds?

The rate on 10 year treasuries is 2.5%. Challenge me and tell me when it was lower. Short-term treasuries are hovering around 1%.

When will a better time to borrow money arrive? Higher interest rates just mean more loss from the Treasury, and the “invisible bond vigilantes” are scaring people almost as much as the “vampire squid” should scare people.

We need to return to the tax regime that Carter-Reagan enacted. Simply average the two. The deficit would shrink, as would the national debt.

We also need to impose tariffs on imported goods, and payroll taxes on offshored jobs. We have adopted a “free trade” regime where only we play by the rules, and the multinationals profit from them by moving as much as they can offshore. YOU WANT TO MAKE $5 PER DAY LIKE MANY CHINESE?

If not, you should support policies that punish China and India as much as their policies are punishing the middle class (what little there is left of it).

Just disgusts me to see this incredible job loss, wage shrinkage, corporate profits without U.S. job creation, and people freaking out about a deficit when we have record low borrowing costs.

don: If Dr. Hassett has publicly acknowledged the error in print, I would be happy to desist from further remarking on this error. I would be obliged if you would provide a URL or other information regarding how to access the relevant comment/article.

1. You conveniently forget that a lot of electorate from South changed their party affiliation after Johnson’s desegregation reforms.

That is more than superceded by the fact that George Wallace ran as a Democrat in 1976. The Democrat party was the one he found hospitable well after Nixon’s resignation.

Leftists NEVER want that to be brought up.

You stand corrected.

The ralling cry was defence against the Jewish-Marxist plot to conquer the world

er…… Nazi Germany was still left wing. Leftists will fight each other (Hitler vs. Stalin, USSR vs. PRC, etc.).

Ever since his Dow 36,000 fantasy Hassett has been good mainly for laughs. He is funny.

“Critics of the book continue to claim that there is a double-counting of dividends and earnings, although the authors go to great lengths to refute this with fact. Critics have a bad habit of reading other critics to avoid working through a book!”

From a review of the book.

Here’s another comment to the book, from 2001:

“Stocks are amply priced now. Using the authors’ dividend-yield-plus-growth-rate formula, the universe of American stocks should return seven percent to eight percent over the next generation — only one percent or so more than Treasury bonds, and no more than corporate bonds. I would be willing to bet Glassman and Hassett that even ten years from now, when earnings and dividends should have nearly doubled, the Dow Jones Industrial Average will still be closer to its current level of 11,000 than to their hyperbolic projection of 36,000.”

This prediction seems to have come true. 🙁

“Nazi Germany was still left wing” – mein Gott, that might be the single most absurd statement I’ve ever read.

Your black is white, up is down, left is right world-view bespeaks the lie of your handle.

You have every right to believe in fantasies and falsehoods, but you should be aware that your strident postulation of this balderdash makes you look like a kook.

Keynes idea was not meant to address an economy with a structural problem but only to smooth out a cyclical problem. We are trying to recreate an economy that was off track. Growth was only coming from increases in debt. We were consuming more, importing more and not exporting enough. Both sides (debt and trade deficit) of this are unsustainable. Income growth has been stagnant for years but consumption increased due to housing equity from 2001-2007 and other borrowing.

Japan has spent 20 years trying what they think is a Keynesian approach and it has failed. In fact it has destroyed the wealth of the country and the government borrowing is destroying the savings of a very frugal people. When the next credit downgrade occurs, you are likely to see a realization that the bonds have little real value and the government is broke. It is worse that the Japanese own 95% of the debt because they will have lost their money in stocks, real estate and then their savings. This is the largest wipeout of wealth in history.

alex sinclair Japan has spent 20 years trying what they think is a Keynesian approach and it has failed.

Huh? Japan’s problem was (and still is) that policymakers would tip their toe in Keynesian water for one year and then pull it out the next year just as fiscal stimulus was starting to kick in. You can see it in Japan’s stuttering growth throughout the 90s. Look at the data…up, down, up, down, spike, plunge, up, down….

There may or may not be long term structural problems with the US economy, but that’s not today’s problem. Today’s problem is weak aggregate demand. End of story. The fix is fiscal stimulus. I wish the Fed well in any further experiments in Quantitative Easing, but I wouldn’t bet the farm on it working. The best we can hope for from the Fed is that they don’t get in the way of a recovery by getting spooked about inflation and fretting over fiscal policy adding a few more tenths of a percent to the debt/GDP ratio.

that might be the single most absurd statement I’ve ever read.

Nazi Germany was, in fact, leftist. They were called the Nazi Socialist party.

They nationalized all industries, and had little free enterprise. They also practiced genocide (a typical leftist tactic, as evidenced by Stalin, Mao, Pol Pot, Kim Il Sung, Saddam Hussein, etc.)

Nazi Germany was left wing. Get over it, and get some basic education.

To deny this is like leftists accuse the Tea Party of being violence, while the left happily beats up innocent black people like Kenneth Gladney.

I see you avoided the point brought up about George Wallace being a Democrat in 1976. I think he was right that Democrats ‘never want that brought up’. Hmmmm….. perhaps that deserves some exposure….

GK, Heterosexual and David: While there is no explicit rule against posting under different names, I think it would be intellectually honest to use just one pseudonym.

Heterosexual: That is more than superseded by the fact that George Wallace ran as a Democrat in 1976. The Democrat party was the one he found hospitable well after Nixon’s resignation.

Leftists NEVER want that to be brought up.

It you think that Democratic Party was a left wing party, you are up to a ride awakening. Both Democratic and Republican Parties in European sense are two wings of the same party. Yes, now due to economic distress Democratic Party is slowly migrating left, but it is still a party of “fringe rich”, a political alliance between the Southern segment of the upper class and the Northern “ethnic rich” including Jewish bankers. Attending a sociology class in nearby community college might help. Here is a common textbook explanation from http://sociology.ucsc.edu/whorulesamerica/power/class_domination.html

Sorry it’s a little bit long.

Chinn: I read every post of this blog exactly because it reports and comments on empirical data. I am aware of the many, many posts on multiplier estimates and effectiveness of the stimulus. Even more so, presenting NYT charts by pretty lousy private forecasters seems to me just a lazy way to score a point. I would also add that one should not ask too much of meta-analyses, and that sometime the term is used a bit loosely. Meta-analysis sounds more serious than a survey, and that is the case when they are conducted properly.

Regarding “invoking autority”, you can’t be serious. First, because even sticking to the engineering analogy, no commissioner of a bridge would take any engineering estimate at face value. Second, because the domains of a bridge integrity study and fiscal stimulus effectiveness evaluation are quite different. Which is why we don’t have Galloping Gerties anymore, but we are still discussing Keynesianism, even though they happened around the same time.

gappy: Just to make sure I have you right, you are saying Global Insight and Macroeconomic Advisers are “pretty lousy forecasters”? If so, I would like to know your metrics for making the judgement (RMSE, ME, MAE, turning points), and what your comparator group is (ARIMA, Markov-Switching), and what is the comparison method (out-of-sample forecasting over what period; evaluated in levels, in changes; at what horizon), and what is the variable of interest (advance release, final release, latest vintage). You seem to have made a deep investigation of these issues, and I think the Econbrowser readers would appreciate your insights here; a link to a URL would be very helpful in this regard.

Hmm. Originally being from the Seattle area, I am of course aware of “Galloping Gertie”. Have you visited London recently? There is a “Millennium Bridge” there; it was briefly called “Wobbly Bridge”…

The funniest thing about the “the stimulus didn’t work” crowd is that they have the opposite opinion about austerity, as seen in Ireland and so on. For them, the continuing failure of austerity to cause recovery is a sign that the public simply hasn’t suffered enough…

The Keynesian theology was exposed as a fraud a long time ago. It is time to move on to sound economic thinking that explains how the economy works and can be used to make accurate predictions.

As noted above, Keynes never supported deficit spending during times between recessions- depressions. His thinking also did not envision a large trade deficit.

A proper stimulus program, today, would including reducing the trade deficit in addition to providing funds for infrastructure improvements. The money placed in circulation must stay in this country to produce its magic.

Simple minded transfer of funds from government to the private sector is not necessarily effective if the surrounding conditions are not favorable. That does not mean that Keynes’ thinking is irrelevant.

2slugbaits – I agree. One of the best federal programs I can see is subsidies to the local governments to keep up their services, especially education. Second best would be for the government to employ people directly (rather than such stupid and wasteful programs as cash for clunkers and the homebuyer’s tax credit). And guess who agrees? None other than Kevin (“Find the unemployed and hire them”) Hasset.

Menzie, I couldn’t find a public admission by Hasset, but is it really necessary to grovel publicly over one’s errors? Isn’t it enough to let go unchallenged what appear to have been some very concise and accurate criticisms?

Some fool called the Iraq war BENEFICIAL.

How ?

Thousands of dead American’s.

Thousands of permanently disabled Americans

Hundreds of thousands of dead Iraqi’s.

The power grid in Iraq is still NOT FUNCTIONING AS WELL AS UNDER SADAAM !!!

No real gov in Iraq.

Much of the oil contracts went to China, ect.

This guy who called the Iraq war beneficial needs to learn how to read.

“Fascism” is the merger of corporation and state. That Hitler called it “National Socialism” doesn’t negate this; he could have called his program “The Howdy Doody Show,” but it would still be fascism.

Look, I’m a left-winger. I could call myself a conservative. Would that make me one?

The gleeful, cackling embrace of illogic by the conservatives is Exhibit A in the destruction of America.

Which begs the questions:

Why do conservatives hate America?

Why are conservatives terrorists?

don: Sorry, I have nothing but your word for it that Dr. Hassett has accepted that he has made an error. Groveling is not necessary (nor asked for), but once one publishes something, one is responsible. I think that is the something that is expected of scholars (I can’t speak to other spheres of activity — perhaps different norms pertain there, and you might be subscribing to those norms).

Moreover, as long as Dr. Hassett continues to deliberately and misleadingly misquote, then I think it fair to remind readers of his previous analytical errors.

The notion that Nazis were a left-wing phenomena is a new assertion perpetrated by intellectual hucksters with a political axe to grind. I’m looking at you, Jonah Goldberg. The party sprang from the Freikorp movement which fought communists in the streets. They stood opposite the likes of Kurt Eisner, Ernst Toller, Eugen Levine, Karl Liebknecht and Rosa Luxemburg.

The NSDAP drew its support from the military, industry and right wing paramilitary units. Early supporters included Erich Ludendorff, Hermann Goering, Fritz Thyssen, Hugo Stinnes, Alfried Krupp, Hjalmar Schacht and I.G. Farben. that’s hardly a who’s who of left wing interests.

Operationally, the Nazis were xenophobic, hierarchial, and militaristic. Their social policies were best summarized with the three Ks, “Kinder, Kueche, Kirche”, a notion familiar to English advocates for “barefoot and pregnant.” These are not left wing tendencies but they are certainly familiar to those on the right.

As an adjunct to JoeDog and Two Beers history lesson for the cognitively challenged conservatives, there is substantial evidence that American companies supported the rise of the Nazi Party. Hitler was a great fan of Henry Ford, whose anti-Semitic writings were widely known and whose business tendencies were perhaps less mad than most conservatives (e.g. people who work at a car factory should be able to afford to buy a car), his politics would be unacceptable now. Union Bank’s Prescott Bush funded Germany after the war started, and Ford, GM, Standard Oil, and many other corporations continued to produce and ship war materiel to Germany for profit. Nationalist Socialism was a moderate socialism for workers of the German race as defined by the party; like American capitalism, there is socialism for the chosen ones and misery for millions. See the following texts:

Industry and Ideology

They Thought They Were Free

The Rise and Fall of the Third Reich

Throw Jonah Goldberg from the train, for your own mental and emotional health.

Chinn: I have read with sufficient depth only reports from Moody’s and Economy.com, as well as forecasts produced by a number of investment banks (e.g., Goldman, Nomura). I don’t have access to other reports, e.g., Global Insights. The reports I have read usually a) are very “parsimonious” on the methodology they follow; b) don’t publish data in a form that can be easily extracted and verified ex post. Usually, both the authors and their readers are content to get at most the first significant digit right. All I can say is that, whenever I have looked at past reports, the predictions have been grossly wrong. I know the metrics you mention (disclosure: M.S. in theoretical Physics, M.S. in Statistics from Stanford, M.S. and Ph.D. in Operations Research from Stanford, and I do Statistics for a living); but I suspect that you are a bit too demanding on me. So, let me turn the table on you: is there any systematic, quantitative study of the forecasts produced by companies like Global Insights? After all, there are large-scale studies on the calibration of weather forecasts and on recommendations of financial analysts; and this class of forecasters seem as important. You approvingly quote them, so I am sure you know of at least one. And since you approvingly quote them in support of your argument, the burden of the proof is on you to prove that your estimates are reliable, not on me. Putting aside this playful polemic in which I don’t care much about being right, I’d really love to see such a study, even restricted to a narrow class of predictions or verifiable estimates.

Oh, regarding the Millennium Bridge: a bit of resonance was obviously “engineered in”, to inject a modicum of excitement in the boring lives of them Londoners.

gappy: To my knowledge, the macroeconometric forecasting firms do not publish forecasting evaluations. However, the firms that do participate in Blue Chip or WSJ surveys are sometimes evaluated by outside researchers. For the latter, see Eisenbeis et al. (2002); for the former, see Bauer et al. (2003). Note that in the Bauer et al. study, Moody’s and Macroeconomic Advisers do pretty well — of course, the general finding that “averages” or “consensus” do better over time still holds. If you are interested in how organizations like Congressional Budget Office do, as compared to Blue Chip, see here. Since you are trained in statistics, you might find the following papers of interest: [a] [b] [c]

Thanks a lot for the pointers. Greatly appreciated!