There is disagreement within the FOMC. How will it be resolved?

Yesterday the Wall Street Journal described an internal FOMC debate between those wanting more stimulus and those anxious about the Fed’s already bloated balance sheet. The Journal reports that the decision at the last FOMC meeting to replace retiring MBS with long-term Treasuries represented a compromise between the two factions.

That helps explain Federal Reserve Bank of Minneapolis President Narayana Kocherlakota’s odd suggestion that markets misinterpreted the Fed’s ever-so-slight monetary easing as a signal that the FOMC had big concerns about real economic activity going forward. I scratched my head when I first read Kocherlakota’s remarks, since I had thought any surprise in the FOMC actions was that the FOMC seemed to be less worried than many private analysts. But if you believed, as Kocherlakota seems to, that the Fed has already done too much, his remarks might make more sense.

Another interesting aspect of the WSJ report is the process by which it got into the Journal in the first place: someone on the FOMC wants more of the internal FOMC debate out in public. And why might you want to do that, if you were on the inside? One objective might be to try to change the dynamics of the debate in hopes of hastening a resolution. Another would be to help the public understand the FOMC’s recent minutes and communications like Kocherlakota’s. And a third objective could be to begin the process of communicating that a change is in the works.

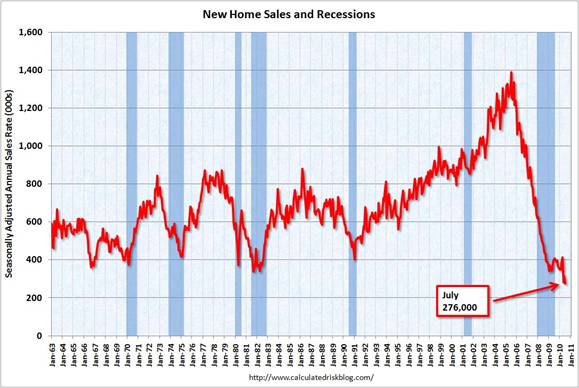

I have suggested that ongoing deterioration of economic conditions will be the critical factor that triggers the Fed’s next move. On this, Exhibit A might be today’s report that new Home sales set an all-time low in July. The good news, such as it is, would be that residential fixed investment was already so low that it accounted for only 2.5% of total second-quarter GDP.

|

But in addition to the direct effect on GDP, there may also be financial ramifications of the new downturn in real estate. Today the Wall Street Journal reported:

Of the $1.4 trillion of commercial-real-estate debt coming due by the end of 2014, roughly 52% is attached to properties that are underwater, according to debt-analysis company Trepp LLC.

Add to these yesterday’s report that existing home sales fell 27% in July from the downward-revised June numbers, with single-family home sales at the lowest level in 15 years. As usual, that’s just what Bill McBride had told us was going to happen.

|

Which is one of the reasons I pay attention to

Bill’s interpretation of the WSJ story on the FOMC debate: he reads it as paving the way for Quantitative Easing 2.

Totally agree with JDH.

The Fedsters are heavily influenced by the most recent economic data and stock market sentiment, and those have all turned decidedly negative since the August 10 meeting.

If the next few months are as poor as I expect, the Fed will be telegraphing QE2 before the election and starting QE2 shortly after the election.

re reading the Fed:

Soon we’ll be measuring how long each member of the Fed applauds when the Chairman enters the room.

“There is disagreement within the FOMC. How will it be resolved?”

It is 10 against 2 and it will be resolved with a vote as always. Little tougher to exactly numerate the vote. Could be 8 yeahs, and two nays. But Hoenig is the only one that knows why he is a nay. Kocherlakota doesn’t seem to really know why he would be a nay, and may just abstain to hedge his bets.

But the really hard part is yeah or nay on what?

Cut interest rates? Nope.

Inject money vi QE2 T-Bill version? Wafo? The world is swimming in money. (not us personally of course)

QE2 T note and Bond version w/sterilization? Wafo? Everybody is buying those.

Buy MBS? Wafo? 4.5% not low enough?

Keep some powder dry to put out the next wildfire in toxic assets? CMBS maybe? Euro bailouts? Something else we don’t know about?

Getting warm here I think.

“The good news, such as it is, would be that residential fixed investment was already so low that it accounted for only 2.5% of total second-quarter GDP.”

That’s the kind of logic that cuased people like Ed Leamer and Ben Bernanke to miss calling the recession back in 2007-2008. It is the destruction of wealth (rather, the destruction of foolish misperceptions of actual wealth) that weighs on the economy more than the effects on housing construction.

The Fed had better try for opacity now more than ever, if not to conceal the fact that the emperor has no clothes, at least to muddy the waters enough so that the fools will respond with a nice jump in the DOW when Ben speaks.

I find the reasoning that QE2 will alleviate further falls in real estate to be pretty opaque.

It still isn’t clear to me that the loss in savings income isn’t as significant, if not more so, as the fall in borrowing costs when we are in a deleveraging environment.

And if the Fed announces tomorrow that they will be buying $1T in Treasuries, or as some advise, they set a ceiling for Treasury yields, won’t it entice people to buy Treasuries? Basically, they’d be saying the price of Treasuries will only go up.

What is left for the Fed to do? An interesting article by Hamid Baghestani in the J Econ Finan (2008) 32:4757

DOI 10.1007/s12197-007-9002-6, “Predicting capacity utilization: Federal Reserve

vs time-series models”, seems to show that reducing the Federal Funds Rate is not stimulating manufacturing capacity utilization as has been the case in the past.

Cedric, Don, Bob, AS,

We’re all on the same page. The Dirty Fed is pushing on a string trying to fix a problem created by the bursting of the biggest asset bubble in the history of the world, a bubble deliberately created by that same Dirty Fed.

How the collapse will play out is anyone’s guess. My bet is panicked oversized QE2, QE3, QE4, resulting in a complete dollar collapse.

Sure would have been a good idea to stay on the gold standard back in the Nixon era, eh?

W.C. Varones said: “We’re all on the same page. The Dirty Fed is pushing on a string trying to fix a problem created by the bursting of the biggest asset bubble in the history of the world, a bubble deliberately created by that same Dirty Fed.”

How about … the biggest credit/debt bubble in the history of the world that has been showing up as various asset bubbles deliberately created by that same Dirty Fed.”?

Get Rid of the Fed:

Exactly. That’s what I was trying to express but you put it more precisely.

Agree with you professor. What drove my attentions is the last part of the article, where it introduced the history of Ben fighting deflation, and how much he hate deflation and will take what is nesscery to make it under control. To me, it seems that Fed now is more concerning about deflation which quantitative easing won’t do too much about. With so much money already sitting on the sideline, the most important thing is to find a way to let those money properly spent. This is kind of out of Fed’s reach.

August 26th

Is the exercise aiming at contradicting or interpreting the Fed?

As testified by the last Fed press Release Date: August 10, 2010

“To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal Reserve’s holdings of Treasury securities as they mature.”

“It still isn’t clear to me that the loss in savings income isn’t as significant, if not more so, as the fall in borrowing costs when we are in a deleveraging environment.”

Bob_in_MA

Yes, I think that’s the crux of the argument against it’s effectiveness and I generally agree with that. What if it took different forms? Wouldn’t it be more effective if the Fed could pay an interest subsidy (say 3%) on demand deposits held by the public? I think it would have more potential effect on demand than having it sit at the Fed as excess bank reserves and pay the BANKS interest on it.

Sadly, no matter what the FED does it won’t make much difference. We are not in a monetary deflation but in a fiscal deleveraging constraction. The FED already has so much money out there that the excess reserves are the largest in history. Any more QE will simply expand the reserves. But even if the FED were to raise interest rates and begin to draw down on the expanded money supply it would have virtually no impact on the economy. It would simply reduce the money sitting in reserves.

Until we focus on the real problem, congress and the executive and their continued creation of uncertainty in the markets we are debating how many angels can dance on the head of a pin.

The FED will do something because it doesn’t want people to know that it is irrelevant, but the FED is essentially an impotent blow-hard, much ado about nothing.

W.C. Varones I assume that if you wanted the US to stay on the gold standard back in the 1970’s you also believe that the price of gold should have remained at $35. If so, why not go back to the $21 price that prevailed before FDR raised it to $35?

Great information. I do not know why wingnuts like WCV and GROTF post here to display their ignorance.

Ricardo, sounds like u think Bernanke is the wizard of oz. It’s worse than that, though. He’s the scribbler who developed the financial accelerate model….which, under the cover of inflation targeting is the direct cause of Depression 2.0. He is the madman that Keynes so eloquently described. Now we all have 2 pay the price.

Imho, Edmund Phelps had it right when he gave an

interview to the German press stating that HBO’s

economic team is bad. Only the markets hope for QE,deflation is fought by raising interest rates, the Hoenig-line

FT has a good off-paywall piece about it: ‘An assessment of the case against QE’

http://blogs.ft.com/gavyndavies/2010/08/26/an-assessment-of-the-case-against-more-quantitative-easing/

“My bet is panicked oversized QE2, QE3, QE4, resulting in a complete dollar collapse.”

If the Fed buys Treasuries with newly-created money, it won’t collapse the dollar. There’s already more money out there than people need for their transactions — the yield on short-term risk-free T-bills is essentially zero, meaning the premium that someone has to pay to have transactable money rather than T-bills is essentially zero. Right now, money is being held as savings, and money and bonds are virtually equivalent assets in that respect. So QE just exchanges non-interest-bearing money for interest-bearing bonds (or “securitized money”, as I like to think of bonds).

Let’s try a thought experiment. Suppose that the Fed purchased all outstanding Treasuries. All $9 trillion worth. What would happen?

Rates on Treasuries fall to zero. Current holders of Treasuries get a windfall profit, as they realize the full face value in the present rather than spaced out as an income stream, so there might be a stimulatory wealth effect. Then again, the biggest holders of Treasuries are foreign central banks, followed by state/local govts and pension/insurance funds, and these don’t seem likely to go on consumption binges.

What would happen to non-risk-free interest rates? Here I’m less sure. One line of thought is that the risk-based markup over a Treasury of comparable duration should remain constant, so long-term borrowing rates would fall considerably. But my other thought is that banks compare the rate they can get to their borrowing costs, projected over the life of the loan, when deciding whether to make a loan. Banks borrow short, so their predicted borrowing costs are based on their predictions about future short-term rates. (This is, as I understand it, the basis of calls for raising inflation expectations — it’s really a promise to banks that short-term rates will be kept low longer than past policy would suggest, so that they can expect loans made at lower rates to still be profitable.) It’s not clear to me that bringing down long-term Treasury rates leads banks to conclude that their future borrowing costs will be low.

And if long-term Treasury rates plunge, maybe the stock market rises — if investors are valuing stocks according to P/E ratios as compared to current bond yields, rather than to historical P/E ratios. So maybe another wealth effect there.

Nowhere in this do I see a collapse of the dollar, either relative to “stuff” (inflation) or to other currencies. People who are holding govt bonds as savings will be about as happy holding cash as savings, they won’t suddenly decide to increase their spending. From a Quantity Theory of Money perspective, the velocity of money will drop about in proportion to the increase in its quantity.

So QE buying Treasuries would not be disastrous, might be a bit helpful, but I’m actually skeptical that it would affect aggregate demand enough to matter.

There is another thing that the Fed could do, however, that might be more interesting. Buying foreign currency. What if the Fed announced their intention to buy $50 billion worth of foreign currency per month for a sustained period? Of course, this is simply currency devaluation, and might provoke retaliation and/or WTO suits. But it should be effective at creating some inflation and/or weakening the dollar vs. our trading partners, if those are our goals.

W.C. Varones, I don’t think we’re on the same page. Staying on the gold standard would have been a futile and expensive gesture. And I don’t have the disdain for the Fed you do.

But I am skeptical that they fully understand the forces at work and how to deal with them. What would give me more confidence is if they would acknowledge that there is a problem with an economy that needs debt levels that rise twice the rate of GDP, and that problem isn’t solved by steadily falling interest rates to keep debt service affordable.

ZIRP and QE simply seem to be efforts to restart what was unsustainable. I’m not sure that what Krugnman refers to as liquidationism wouldn’t be preferable. Just give the whole country generous income support for two years and allow all the markets to clear on their own terms.

Insulate people, but not banks, firms, asset prices, etc. People’s wealth would suffer, but mainly for the rich who can afford it. And after the bottom, we’d have 8% growth, not the .8% we’re headed for.

lilnev,

Sure, this is what I call the Star Trek scenario. We don’t need money anymore and all goods and services just appear for our consumption.

Not so sure that would work, tho. But the Fed and Treasury may try and become a duopoly in debt and currency markets. The treasury says I got all the zero interst debt you want and the Fed says I got all the dollar electrons you want…sure…could happen.

stephen,

FDR’s devaluation of the dollar by 40% looks like sound money in comparison to the Federal Reserve’s 97% devaluation since 1971.

There seriously needs to be a brief “Are You A Madman?” quiz before people are allowed to post comments.

Groucho,

Bernanke and company are like the alcoholics wife. They are enablers, but those actually causing the problems are getting a total pass as the FED gets all the heat.

I will grant you that the congress could not have gotten away with what they did had the FED not facilitated it, had they not financed the largess, but the congress appropriated the funds and the executive and his minions in the thoudands of agencies are the ones who flushed the money down the toilet.

If consumers will not borrow and lenders will not lend then all the money the FED throws at the problem will just flow into reserves. Bernanke knows this but he has to do something. They will probably come up with some way of buying commercial loans from banks essentially pumping in more base money while putting the trash loans on the FEDs balance sheet: FED=”bad bank,” but that money will also flow into reserves and do virtually nothing to the economy.

Keynes was right about a liquidity crisis, but he was wrong about what it really means. The government cannot spend us out of a liquidity crisis. Government spending simply makes it worse because the real liquidity crisis is the loss of confidence of entrepreneurs and investors and no amount of added liquidity will make them invest when the government might destroy it before nightfall.

Money is not a veil; money is a smoke screen that congress and the executive hide behind.

@lilnev

“Current holders of Treasuries get a windfall profit, as they realize the full face value in the present rather than spaced out as an income stream, so there might be a stimulatory wealth effect. ”

Riddle me this: how is it that treasury owners get a windfall profit. The only treasuries that are issued as discount instruments are bills and E/EE savings bonds. Treasury notes and bonds are issued at par. With ZIRP, even the bills trade close to par. C’mon, you can do better than this. I don’t even know where to begin with your conclusion that long rates would dip to zero.

Further, I hope that you don’t really believe that we could simply print up $9B and deliver it to our trade partners who have been financing our over-consumption. Heck, why don’t we just print up $50B and take care of social security and healthcare for everyone. People seem to think that printing is such an easy way out.

sorry, meant to say $9T and $50T in the previous post

Jim: While I think your assessments of what the Fed is likely to be signaling are sensible and reasoned, they still share the assumption that the Fed governors are cooperating and that the signals are coordinated. Is it possible that things are actually somewhat inharmonious behind the scenes and that substantive policy differences are spilling out in an uncoordinated way?

I ask this because of a very clever (if cynical) quip that Arnold Kling made the other day. (last sentence of numbered paragraph 2 here)

http://econlog.econlib.org/archives/2010/08/brink_lindsey_w.html

Of course the Fed could buy all outstanding Treasuries. For discounted bonds, they simply bid up to the face value, and only a fool wouldn’t sell. For coupon bonds, they bid up to the face value plus all remaining interest payments. These bids are higher than current market prices, thus when the current holders sell them they would receive a boost in wealth. The Fed clearly has the authority to engage in such open market operations. And since the only “cost” to the Fed is crediting reserves, they aren’t financially constrained. You may think it’s a bad idea, but it could be done.

And why would it be a bad idea? Inflation? If the private/foreign sectors hold $11T in cash and reserves, instead of $2T cash/reserves plus $9T in bonds, will that change the balance of how much they desire to save vs. spend? The first doubling of cash/reserves hasn’t done much to slow disinflation, do you expect the second or third doubling to be qualitatively different?

My point is that inflation is driven by aggregate demand vs. supply constraints, and aggregate demand results from decisions about whether to spend or save. If you want to change aggregate demand, you have to find a way to shift those preferences. Most of the money in the world is being saved; and most of it is currently in the form of bonds. I’m arguing that if you turned all those bonds into cash, it wouldn’t do much to change people’s spending/saving preferences– they would simply save in the form of cash instead of bonds.

Incidentally, I’m not advocating this as policy. Just as a thought experiment. I conclude that the Fed really has very little leverage in this situation. We need to increase the spending power of people who will choose to spend it, rather that just save it — and that means fiscal policy.

“It still isn’t clear to me that the loss in savings income isn’t as significant, if not more so, as the fall in borrowing costs when we are in a deleveraging environment.”

Bob_in_MA

I thought of this in a different context. The spread between short and long term rates is providing income to banks and other financial entities that are holding long-term Treasuries. The reduction in this spread would reduce their income stream, but provide an immediate capital gain. However, in general, the reduction in long term rates must hurt bank income, because it would also reduce the net income from both new loans and existing variable rate loans. Since I sincerely believe they are still in deny and delay mode over their balance sheet losses, this won’t be good for them at all. It seems to me that this has got to be responsible in some part for the stance of some Fed presidents on further quantitative easing.

The main avenue for gain from QE, it seems to me, is from asset valuations – the strategy will delay the appropriate reduction in still-overvalued assets.

“There is another thing that the Fed could do, however, that might be more interesting. Buying foreign currency.”

lilnev

It’s my understanding that, although the Fed makes the currency purchases (or sales), they do so at the orders of the U.S. Treasury. I think this is a non-starter, because it would hurt only those trade partners who are playing by the rules, whereas it is against the currency peggers in Asia that the dollar must be allowed to depreciate.

I agree that QE will probably not do much in the current environment and that trying to spark moderate inflation now will be nearly impossible without taking measures so drastic that they risk a conflagration by causing the perceived value of the currency to plummet.