In the excitement over the debt ceiling debate, the increasing extent of fiscal drag, and anxiety about an economic slowdown, I have neglected discussion of the dollar. I still think that continued dollar depreciation is necessary to effect global rebalancing. I’d prefer it to happen by way of expansionary monetary policy, but we might get dollar depreciation as intransigent policymakers work hard to destroy the safe-haven role of US Treasury securities. [0] So, while all eyes are on Jackson Hole, here’s a quick, stream of consciousness review of some dollar-related issues.

Competitiveness

In Figure 1, I present the long history of the real value of the dollar, to provide perspective. Notice that the dollar has been declining in value since early 2002.

Figure 1: Log real value of USD against a broad basket of currencies (blue), against a basket of major currencies (red), both March 1973=0. Source: Federal Reserve Board.

The dollar index against other major currencies in July (last observation plotted) is only 2.6% lower than it was three years earlier. The index against a broad basket of currency is 4.9%.

I’d say we need more depreciation of the broad index (which includes China, and the other East Asian economies), rather than less. I know there are some people who argue that the Fed shouldn’t be debasing the dollar (where were these people in 2002?); of course, if one believes in a neoclassical model (which is consistent with fiscal policy ineffectiveness), monetary policy can’t affect real magnitudes in systematic fashion, so why care what the Fed does?

For those of us operating in reality, I think it’s useful to recall that there are many real exchange rates.[pdf] The commonly cited one is the CPI-deflated real exchange rate, which approximates the rate at which bundles of US consumption goods trade off for other bundles of foreign consumption goods. As long as consumer prices approximate costs of production, the CPI deflated real rate is a good measure of “competitiveness” defined by macroeconomists. Figure 2 presents the diverging paths of the IMF’s CPI deflated and unit labor cost deflated real exchange rates.

Figure 2: Log value of USD against a broad basket of currencies, CPI deflated (dark blue), against a basket of industrial currencies, unit labor cost deflated (dark red), both 2005=0. Source: IMF, International Financial Statistics.

Figure 2 shows that once one takes into account the wage restraint exhibited in the US, along with fairly rapid labor productivity growth, US competiveness has increased substantially since 2002. There is a problem in making direct comparisons since the CPI deflated rate is computed against a broad set of trading partner countries, while the unit labor cost deflated series is computed against the other industrial countries the US trades with. Hence, an important omission is China. Presumably, if China were included, the downward trend would be less pronounced. How much less is difficult to say, given that it is hard to determine what unit labor costs are in China (for an example of the impact on the Chinese effective real exchange rate, see this post).

A Dollar Turning Point?

I’m a believer that continued low policy rates in the US, combined with macro weakness, will result in persistent dollar weakness. Dollar weakening is a view shared by the CBO, for this and other reasons, as related in its updated Budget and Economic Outlook (pp. 44-45), as well as Martin Feldstein. Currency market forecasters (here as surveyed by FX4casts.com) appear to have a different view (although there is considerable uncertainty), as shown in Figure 3.

Figure 3: Log nominal value of USD against a broad basket of currencies (dark blue), and geometric mean forecast from July 28 survey of currency forecasters (dark blue squares), and 95% confidence bands (gray +). Source: Federal Reserve Board and FX4casts.com.

In a recent paper, Catherine Mann at Brandeis University has outlined reasons why she believes the dollar is at turning point. From “Dollar Risk: Inflection Point or Continued Trend?”

…the double-digit depreciation of the dollar since February 2002 was

narrowing the external deficit (even before the Great Trade Collapse and rebound). Thus,

the need to sell dollar assets to finance external borrowing has been, on balance, smaller,

putting less depreciation pressure on the dollar. Yet, at the same time as the external

deficit has narrowed the fiscal budget deficit is much larger, implying a need to sell more

US Treasury securities to some investor, domestic or global.

Thinking about these factors follows generally the relationships and framework (albeit in

‘reverse’ ) from the last time the issue of dollar risk arose. That is, in 2000 the dollar was

still appreciating, but many thought that the trend was unsustainable because of the

magnitude of the US current account deficit and stock of international obligations, and

the narrowing budget deficit (into surplus) reducing the availability of US Treasury

securities, among other factors.

Applying the framework and analysis from 2000 to current data suggest an inflection

point for the dollar. First, based on an asset allocation view, there is plenty of head-room

for adding dollar investments into the global investor’s portfolio. Second, key global

players have not de-coupled, and in fact continue to depend on growth in US and Europe

to support economic activity at home. This habit of export-led growth, which has been

supported by the policy of under-valued exchange rates, remains entrenched, thus making

it difficult for these important players to allow own-currency appreciation even in the face of potential further capital losses on their increasing holdings of dollar-based

international reserves. Even countries that, on balance, do not heavily manage their

exchange rates are finding that their currency appreciations to date exact a toll on the

global competitiveness of their producers (witness the yen and Swiss franc interventions

in August 2011). Finally, with regard to holdings of US Treasury securities in

international reserves, despite some rhetoric toward diversification, purchases continue apace.

The sum of these factors, as well as a long-run chartist view, suggest that the trend

dollar depreciation has reached an end.

My take on what determines the value of floating exchange rates, from a primarily macro asset-based approach, here: [pdf], [1], [2], [3], [4]; and from a portfolio balance approach [5].

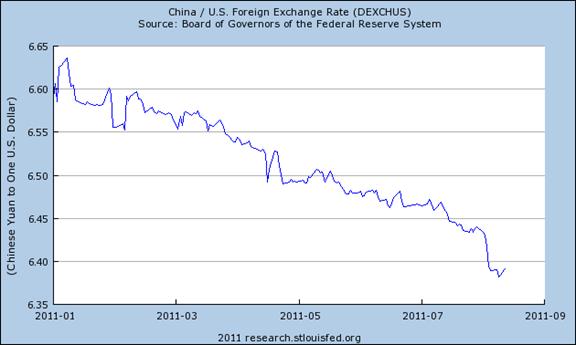

Personally, given the Chinese de facto crawling dollar peg, I think a lot hinges on China, and I have more hope that faster CNY appreciation will occur (where China leads, the rest-of-East Asia will, I believe, follow [6]). Figure 4 is a plot of the CNY/USD exchange rate over 2011.

Figure 4: CNY/USD exchange rate, daily (down is CNY appreciation). Source: St. Louis Fed FREDII.

China has moved from resumed CNY appreciation to accelerated appreciation of late. Martin Feldstein has argued that this move might be durable exactly because China needs to stifle inflation, and CNY appreciation is a key way to achieve that goal. So if the need for internal rebalancing (see today’s NYT for background) is not sufficient to induce Chinese policymakers to allow faster revaluation, the fear of inflation might be. (See a Mundell-Fleming interpretation here; you can see I’ve been recommending accelerated CNY appreciation for a long time).

Official Holdings of Dollar Assets

How have movements in the dollar’s value, and policy measures at home and abroad, affected dollar holdings by the official sector? Figure 5 presents data from the most recently released IMF Composition of Foreign Exchange Reserve (COFER) report.

Figure 5: Central bank holdings of foreign exchange reserves, in millions of US dollars. US is USD, UK is British pounds, GY is Deutschemark, FR is French francs, JP is Japanese yen, SW is Swiss francs, NE is Dutch guilder, EC is ECUs, EU is euros, OTH is other, and UNALLOC is unallocated. Source: IMF, COFER, June 30 release.

One can see that reserve accumulation has definitely resumed since the 2008-09 global recession. Of that, a large share is “unallocated”, that is of unknown composition. It’s assumed that a large share is in US dollars. How is the dollar holding up as the key reserve currency? Figure 6 presents some estimates.

Figure 6: US dollar share of central bank holdings of foreign exchange reserves (blue), US dollar share from Chinn and Frankel (2008) (dark blue triangles), and US dollar share assuming 60% of unallocated reserves are in USD. Source: IMF, COFER, June 30 release, Chinn and Frankel (2008), and author’s calculations.

The dollar share appears to be declining rapidly if one looks at only reported dollar holdings. However, as is well known, most of the reserves that are not identified in terms of currency denomination are likely dollars. Assuming that 60% of those “unallocated” holdings are dollars yields a much less pronounced downward trend.

There are two important observations. These shares incorporate valuation changes, and so when the dollar loses value against other currencies, that shows up in the shares. Ted Truman at the Peterson Institute for International Economics has argued that one should also look at the constant value, or “quantity”, shares. In a recent Real Time Economic Issues Watch post, Allie Bagnall has tabulated the quantity shares for the dollar and the euro at 2010Q4, and the respective shares are higher and lower than the shares calculated using COFER data (although the changes are actually larger using quantities).

Bagnall (2011) documents my second observation: some of the recent movements in shares are being noticeably driven by Swiss National Bank intervention.

Sovereign Wealth Funds

Accumulation of dollar assets is not only undertaken by central banks. Increasingly in East Asia, sovereign wealth funds have become important players.

Chart 9 from “Sovereign Wealth Funds: New Challenges from a Changing Landscape,” Testimony of Brad Setser Before the

Subcommittee on Domestic and International Monetary Policy, Trade and Technology of the Financial Services Committee U.S. House of Representatives (September 10, 2008).

Unfortunately, there isn’t much of an update on the time series estimates of sovereign wealth fund holdings; they now exceed $3.3 trillion [Truman, (2011)]. And we don’t know exactly what they’re up to. That point is documented by a recent Policy Brief by Bagnall and Truman at PIIE.

In short, even when the COFER data comes out at the end of the year, and we get data of the 3rd quarter on foreign exchange reserves, we still not know how much damage the display of political hostage taking Republican intransigence with respect to raising desperately needed tax revenue over the medium term horizon has inflicted on the dollar’s role as a reserve currency, and as an international currency. So, we might get that “dollar debasement” (against other currencies) — just not through monetary policy but by other means.

Do we overestimate the degree of control China has over it’s currency value? They’re trying to maintain an artificial situation, not vary value that’s in genuine equilibrium.

Jonathan: I think due to capital controls, they can control the nominal, and to a lesser extent, real value of the CNY. See my discussion of the monetary approach to the balance of payments incorporated in the 2007 Economic Report of the President, here.

There are two kinds of money cranks. Those who believe that flooding the economy with money will generate economic well-being, and those who believe that flooding the economy with money will always generate hyper-inflation. When you consider money illusion consider that a mirage is only dangerous to a man dying of thirst.

To put things in perspective, figure 4 shows a yuan apreciation of about 3%, a rather pathetic adjustment given the starting imbalance.

I don’t think talking about ‘the value of the dollar’ as a single metric is useful. The euro, at more than $1.43, is greatly overvalued, and at a time when the member economies are in bad straits. Ben should not try to do anything to exchange rates, because reducing the overall value of the dollar in the face of Asian currency pegs may have dire results, but that’s really all he can accomplish with more QE. Only Timmy can do anything about the needed exchange rate adjustments, and he is not so inclined.

Menzie Could you explain the intuition behind the idea of deflated CPI being a measure of “competitiveness as defined by macroeconomists? I think I get the intuition if the CPI is composed of primarily domestically produced goods, but are time series comparisons valid if a growing share of the CPI basket is made up of a foreign value added component?

2slugbaits: Given distribution costs, and the heavy presence of services in the CPI, the foreign component doesn’t show up much at the business cycle frequencies or higher for the US. It can show up in small, open economies that are subject to big devaluations.

But that doesn’t mean that CPI deflated is appropriate — exactly because it incorporates a lot of nontradables. So one could use PPI for only domestically produced goods, or — as I suggest — unit labor cost deflated.

I have a question :

If money is ‘printed’ as a form of easing, then that money eventually circulates across the entire world.

Thus, beyond the immediate short term, it does not matter which country printed it. Whether the printing was done in the US, EU, or China, that money, over time, circulates all the same.

Is this correct.

In the foreign exchange,it may sometimes be worth to have 10 cm of statistics rather than 10 kms of theories,unless one can make the statistics look like the theories.

CPI deflated rates is a late correlation in the dollar histogram,should the CPI deflated rate be the new standard,the pound should show a lower gravity against not only the usd but euro.It does not seem to be the case.BIS trienal Banks survey may assist:

http://www.bis.org/publ/rpfx10.htm

Global exchange rate turnover is up and running at usd 4 trillion (less than 10% of the world GDP) a day and cumulatively dwarfing any single country forex reserves.Spot transactions have been an the upwards (presumably not showing much of a long term view in the fundamental analysis) Interesting to notice that Banks have taken a lesser participation in the forex markets and Hedge funds,insurance companies are “hedging” counterparts.

”The percentage share of the US dollar in the daily forex market has shown a slow decline as witnessed since the April 2001 survey,pound sterling following the same path”. (http://www.bis.org/publ/rpfx10.pdf) but correlation is not causation.

The statistics (occ derivatives,http://www.occ.treas.gov/topics/capital-markets/financial-markets/trading/derivatives/dq111.pdf ) are to be included in the 10 cm statistics,”five large commercial banks represent 96% of the total banking industry notional amounts and 83% of industry net current credit exposure”.

Foreign exchange is not a source of revenues, 35 million usd only for 1Q 2011.

As for the fundamental analysis following Econbrowser posts are missing:

Currency Wars and (Macro) Competitiveness,The BIS on Global Forex Trends,Exchange Rates: Two Stylized Facts and Yet Another (Consequent) Puzzle,China’s Currency and Trade Balance: Two Pictures,”Effects of Abandoning Fixed Exchange Rates for Greater Flexibility”,”Renminbi Going Global”

Thanks for the link. I relied on Brad S to go through Chinese and sovereign fund dollar purchases but without his blog that info is barely talked about (and I don’t have the time to dig through the stuff).

I have assumed they are continuing purchases but I don’t know the levels.

My concern is more about the balance between managing inflation, pumping vast amounts of money into the domestic economy and the external value. If I understand the amount of money pushed into the Chinese system – for everything from massive infrastructure on through – then the scale of control needed, etc. gets out of hand.

GK,

You raise an interesting thought. Since the transmission mechanisms that move dollars from the FED to the economy are broken as can be seen in the low inflation rates perhaps we need a new policy. Why not just make counterfeiting legal (I mean other than at the Federal Reserve)? The dollars would almost immediately enter the active economy and consumption would shoot up rapidly. If the inflationists were consistent with their proposals they would embrace such a policy.

Menzie, I would be curious as to your take on why we should not make counterfeiting legal to stimulate consumption?

More specifically, I was thinking that since printing money in the US and EU is not politically possible, they both make a deal with China where China does all the printing.

China prints $3 Trillion and that circulates across the world. It does not stay in China so does not cause incremental inflation in China.

The point is, when money is being printed, it matters little which country is printing it.

Good post.

In all of this let us remember that we have to use vivid words like hostage and terrorist to tar one side so that it is clear who is to blame. THere can be no principled disagreement as demonstrated by the will of the voters in the last election.

Sarcasm off:

Partisans will always disagree on the policies that are to be implemented and nothing will persuade them to change their minds. This is why we have elections. The people get the final say over the experts and the people end up having to bear the responsibility for their choice. All of the vivid words that the experts use don’t hold a candle to the shout of the voters that will occur on the first Tuesday in November 2012.

One consequence of a weaker dollar will be higher-than-otherwise domestic oil and diesel prices. Those are posted in bright red or green on about every fifth street corner, and they represent a drain from other spending. And with most of the feedstock imported, hiding the problem with Nixon-style price controls will be an exercise in futility – pay out ever more of the depreciated dollars, or else be paralyzed by shortages.

So if we continue to pursue dollar depreciation, will the psychological and cash-flow implications of rising oil-product prices ensure that the recession never truly ends?

Aside from the ‘hostage taking’ crap, thanks for an interesting post.

Could you do a bit about the strengths and weaknesses of DSGE models, what they do well, etc.

Do they capture turning points in the economy? How so or not, what do you think they need to improve to be better?

Almost got through a whole post without angry partisan rhetoric. Almost.

Yeah, W.C. Few partisans comments, but relatively few comments.

I was wondering, if I were Menzie, whether I wouldn’t close the post with “And it was all Bush’s fault”, just to make sure people were paying attention.

Personally, I like “lite” technical posts like these. I’m well-versed in ideology; I’m more interested in learning a bit more about economics in terms of practice, theory, and world of economists (eg, self-selection in the profession, issues in pedagogy, a math-bias as a constraint on openness, principal-agent issues in forecasting, communicating within and without the profession, group think, institutional bias, taboo subjects, influence of ideology on analysis and forecasting, etc.).

Bryce and W.C. Varones: I have a more explicit description now.

THE ZERO LOWER BOUND IS ONLY A SOCIAL CONVENTION. Nothing stops the Fed from charging interest on reserves and pushing effective fed funds to negative territory. In fact, its been done by Sweden and Switzerland (well one was on deposits but same idea). Treasuries, TIPS, all have or have had negatie yields during the crisis.

QE has been a failure – far too political. Conversely, a negative fed funds rate is consistent with IR policy and parsimonius: a taylor rule type policy calls for negative rates given the size of the output gap.

Now why would a negative fed funds rate push banks to riskier assets better than “operation twist”?

1. banks (backward looking) credit models for loans say they will lose money given lending criteria. Its better to make nothing (8-9 bps) on reserves than loosen credit. negative rates promotes loan demand and looser lending criteria.

2. at the margin, its the risker loans (i.e. small business without no access to credit) that fuel growth. these are the companies that want to hire but cannot expand fast enough due to tight credit. Large corporations are already flush with cash, buying more or these to lower rates does nothing, they already have all the cash they need.

3. treasuries are yielding *less* than fed funds, further incenting banks to hold reserves.

4. its effectively a tax on savings. ooooh that also hits a sizeable portion of people who earn more than 250k/yr if it bleeds into deposit rates.

5. yes, the rich might move their deposits out of the country to Europe or the UK where rates are >=0. Probably they already did that, because they can to Europe where rates are higher, but to the extend it escalates, the dollar declines boosting exports. &*^ the dollar! go dollar debasement!

sure, low loan demand is a problem. But tight lending standards are compounding that (why ask when the answer is no?), and a lot of small businesses and riskier credits are resorting to hedge fund lending.

I fail to see the benefit of more QE vs negative fed funds rates. maybe someone smarter can provide an argument. Taylor-type rule calls for minus 2% ish, but i would settle for negative fed funds in the minus 25-50 bps range.

It is still amazing to me that people are whining about selective inflation….

Mortgaged homes are leveraged, which means that many homes in America still have negative equity. Negative equity is estimated at $750B (mostly in California).

Printing money to increase inflation to a less-than-terrifying 3-4% would get people out of negative equity, which is a far bigger problem than gasoline rising another 10%.

Ask anyone with a home equity albatross of -$100K whether they would like to get back in the black if the cost would be another incremental $120/year in gasoline expense…

Or in other words, how many people would agree to carpool for 1 year if they can get their -$100K home equity back in the black? A net improvement of $100K in your net worth?

The cognitive dissonance present in America is amazing.

____________________________

Oh, and before people get all hysterical about increasing ‘food’ prices, note that the increase is mostly in processed junk food that Americans need to eat less of anyway. Go to the farmer’s market and note that prices have not increased as much as ‘quasi-food’ products with fancy packages and high-fructose corn syrup has.

Price action in food items is wonderfully consistent with the secondary outcome of pushing people out of processed junk and into healthier fruits and vegetables, which Americans need some tough love on anyway.

___________________________

So yes, I think a QE3 of about $1.2 Trillion is a must.

I still want someone to answer my question :

If money is ‘printed’ as a form of easing, then that money eventually circulates across the entire world, right?

Thus, beyond the immediate short term, it does not matter which country printed it. Whether the printing was done in the US, EU, or China, that money, over time, circulates all the same.

Is this correct?

And if so, the political difficulties of printing in the US or EU means China should be the one to print $3 Trillion, dissipating it across the world.

dwb,

So you are saying that the Fed should ‘keep it simple’ and push the FF rate down to -1%?

I would agree. The stock market crashed precisely because QE2 ended.

A FF rate down to -1% could be very stimulative. I am sure they considered it before doing QE1 and QE2, and rejected it for some reason.

Another thing I would like to point out is that the debasement of all Western currencies has caused major tectonic shifts in the distribution of world GDP.

Since the start of 2008, in nominal dollar terms, the US has growth just 7%, while China has grown 87% and India 55%.

The EU and Japan have also lost similar ground in relation to China and India.

Even now, in nominal US$ terms, China and India are both growing at >15%/year. In 4 years, China has added an entire Germany to nominal US$ GDP.

_______________________________

During the Great Depression, US GDP shrank by 25%. Today, the massive easing has kept this from happening, but the rate at which China and India are gaining ground, in such a short time, due to dollar debasement, is a deviation from the trendline that is almost as large as the US saw during the GD.

Think about it. If China can grow 87% in relation to the US in just 4 years, is that not a GDP event of similar magnitude to the GD dislocation?

Started reading, got halfway through argument that Dollar holdings and value relative to baskets of other exploding currencies is increasing.

Back to top.

ctrl-f “gold” zero found.

Navigate away. If it didn’t get a cursory mention in a discussion of the value of money then … ?

I’ll come back later and search for a WC Varones retort.

gold is not money theres your cursory mention.

Its not even a measure of inflation or a safe haven. Gold is purely a referendum on the popularity/acceptance of Hayek-ian economics and “expansionary fiscal contractions.” Promoted by Germany, Tea Partiers, Fox News, and WSJ oped-page, and bizzarely by some well-known economists who ought to know better (refund your PhD please).

Theres been no hyper inflation, no widespread sovereign defaults. Not even the radical right GOP candidates will sign on the the Gold standard, lol. What paltry inflation has arisen (mainly in commodities) is predictibly due to underalued Yuan (which china looks to be correcting albeit slowly, to tame inflation). It’s very simple: large output gaps (e.g. 9% unemployment) cause deficits. Full Employment cures them (70% at least). Confidence fairies dont create jobs.

Like other zombie ideas, Hayek-ian goldbuggery will die once again, as the predictions fail to materialize and are (yet again) proven wrong. Gold will peak with the popularity of Hayek-ian economics and Ron Paul’s Tea Party… which may indeed be now. Even the ECB is about to U-turn as Germany slows (heavens! German recession! can you say German fiscal stimulus?! that oughta open the floodgates!).

GK 1:30,

Don’t forget that inflation affects different people differently. Specifically, it makes asset owners wealthier and food and energy consumers poorer. i.e. bankers and millionaires and billionaires get richer, while the guy living paycheck-to-paycheck gets poorer. It’s ironic that those who complain most loudly about the wealth gap also tend to be Fed inflation cheerleaders.

Yes, homedebtors are probably on balance better off with rising home prices and rising food and gas prices… but as we’ve noted (and predicted), the Fed has so far been able to produce only the latter and not the former.

If the Fed could engineer wage and broad price inflation in the 3% – 4% range for a number of years without causing other disastrous unintended consequences, it would probably be helpful. But that’s a big if.

Anonymous 3:14,

Unfortunately I don’t have a very vehement retort. Given the disastrous debt crisis the Fed’s easy money has gotten us into, I don’t see any way out other than default or inflation. And inflation is probably the lesser of those two evils.

GK-

Of course it matters who issues the dollars… The whole object is to collect rent on the currency by spawning credit… In earlier times, or in Islamic culture, renting currency would be considered socially unacceptable because of its eventual parasitic effects on the real economy. In modern western culture, credit expansion has been the holy grail for 60 years. The banking oligarchs will never give up their main line feeding tubes without a fight!

WC Varones,

Inflation is the path of least resistance but definitely not the lesser of the 2 evils.

Default is much more honest, quick, & comes closer to inducing the relatively guilty to pay the costs. Inflation spreads the default out over years, distorts the language of the economy horribly–making efficient allocation of resources impossible–& inflicts terrible costs on the most innocent. It will in the fullness of time probably produce a greater crisis than straight default.

WC Varones,

the Fed has so far been able to produce only the latter and not the former.

Why is that?

If the Fed could engineer wage and broad price inflation in the 3% – 4% range for a number of years without causing other disastrous unintended consequences

Yep. Note that until 1999 or so, that much inflation was considered pretty benign…

Perhaps the only real solution to housing is to increase (skilled) immigration, and hope the uptick in consumer spending + increase in housing demand creates more jobs than the immigrants themselves occupy.

Specifically, skilled immigration from BRIC countries. A special immigration category.

dwb,

“gold is not money”

Funny how the people who keep saying this are the people who don’t have any.

If you want to store your wealth in infinitely printable Zimbabwe Ben notes or negative real yield Timmy the Tax Cheat Treasury bonds, be my guest. I’ll take gold, thank you very much.

And how odd that central banks around the world have turned net buyers of gold after decades of selling. Are the central banks run by “Hayek-ian goldbugs?” Perhaps they see something you don’t?

And I posed this challenge to Barkley here. I don’t believe he took it up, but some of the other gold haters might find it worth investigating:

I know you have had a little exposure to portfolio theory. Look at gold’s returns, volatility, and correlation with other asset classes during fiat currency regimes, and I think you’ll discover that a small allocation to gold is an essential part of any balanced portfolio.

GK,

Why is that?

Largely because the easy money is being given to the banks and not getting down to the struggling working and middle classes who need it. If the Fed is going to print money, they ought to give it back to the people via a big tax refund rather than give it to the banks who will only use it to buy Treasuries and earn free money on the spread.

Perhaps the only real solution to housing is to increase (skilled) immigration

Yep, I completely agree. Our current policy is to allow millions of unskilled illegal aliens who consume far more value in social services (schools, health care, prisons, food stamps, etc.) than they provide in labor. Meanwhile we make it very difficult for highly skilled workers to come and contribute.

Mass skilled- and/or moneyed- immigration could go a long way toward solving the housing crisis. Buy a house or start a business, you get a green card.

Bryce,

You’re right with respect to the corrupting rot that inflation encourages, but mass default at both the consumer and sovereign level would probably cause an immediate Mad Max scenario.

Bryce,

making efficient allocation of resources impossible–& inflicts terrible costs on the most innocent.

That happens with very high inflation. 3-4% CPI inflation is not high.

WC Varones,

Largely because the easy money is being given to the banks and not getting down to the struggling working and middle classes who need it.

So then the easy solution would be to make all Federal payments (SS, Govt. salaries) from printed money, so that it circulates among the mainstream immediately. Why didn’t they do something so simple?

Buy a house or start a business, you get a green card.

The sad thing is, the time when it would have been best to do this has already passed.

To offset retiring Boomers, the Indian/Chinese skilled immigrants coming in should ideally have been born in the 70s and early 80s. That generation has now settled and would not come here.

The next generation of 22-year-olds is now too young to offset boomers, and also less interested in America, as the quality of life in their home countries has risen even as life in America has declined.

Since California is the state that would benefit the most from skilled India/China immigration, I am surprised they have not lobbied Washington for it..

WC Varones,

I submit diffidently that default would not yield a Mad Max scenario: Nothing would be wiped out but paper capital. We would still have all the physical & human capital after the default as we did the day before. And it would be in the hands of more prudent owners.

GK,

Resources were grossly misallocated in the Dotcom bubble & the housing bubbles well before CPI heated up because relative prices are distorted. Remember, the new money/credit doesn’t enter the system broadly, but is spent 1st on capital/investment goods.

So now that we have gotten clearer on what Prof. Chinn thinks is the problem, perhaps we can also ask him to work on commentary like this, “as intransigent policymakers work hard to destroy the safe-haven role of US Treasury securities…”

This is a way of framing the issue that completely ignores what the 2010 election was about. Clearly it is about size and direction of government. If the new class of freshman Republicans had given in, they would have been removed by the voters in their districts. On the other hand, we see the unions, whose continued survival depends upon high levels of fortunes are tied to the size of government, trying to remove Republicans at the state level. This battle is being waged by advocates for one side or the other in academia as well. It will only be resolved with decisive victories at the polls so that the other side modifies its stance to recoup its fortunes.