That’s the title of a blogpost by Roosevelt Bowman and Jan J.J. Groen at the New York Fed. The write:

…we examine the role of market uncertainty and currency risk premia in the pace and size of episodes of dollar weakness since 1991. We find that the most recent bout of U.S. dollar declines largely can be attributed to the recovery in global economic activity from the most recent recession.

The unique aspect of the approach is the use of lots of data, and balance sheet variables. Citing a paper entitled Financial Amplification of Foreign Exchange Risk Premia by Tobias Adrian, Erkko Etula and Jan J. J. Groen, they describe the approach thus:

…The risk premium measure represents the aggregation of investors’ expected dollar appreciation in excess of one-month forward rates across a multitude of U.S.-dollar-based currency pairs, and we link it to a few determining factors.

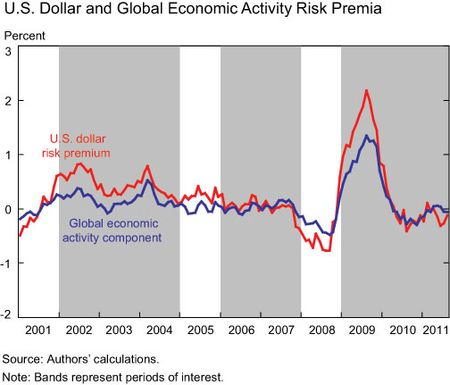

The chart below presents the U.S. dollar risk premium estimate since 2001 as well as the component of the premium associated with global economic activity. At times, there is a wedge between the overall risk premium and the global economic activity component, which represents the risk premium component associated with the funding conditions of U.S.-based financial institutions. This latter risk premium component measures the degree to which these institutions are able to expand their asset holdings (including foreign assets) beyond the level implied by their capital and deposit base by borrowing extra funds.

Figure from Bowman and Groen (2011).

For more discussion of the foreign exchange risk premium, see [1] [2]

The linked post is well worth reading. (Hint: it isn’t the Fed cheapening the dollar, but keep on believin’, hold on to that feel in’)

Dumb question (if allowed):

1) Shouldn’t arbitrage make this graph identically zero? What causes the deviations from zero? Lack of funds on the part of investors?

Something Menzie should contemplate :

http://pjmedia.com/instapundit/130785/

“How come so many journalists and professors fervently believe things that they cannot possibly verify on their own”.

Heh.

GK: Do you actually burn brain cells reading that stuff? Talk about pseudo-sociology (as well as a non-standard non-economics definition of class).

Menzie Chinn wrote: GK: Do you actually burn brain cells reading that stuff? Talk about pseudo-sociology (as well as a non-standard non-economics definition of class).

Truth no longer matters to the Right. They’re purely a faith-based politic now.

So less the usd risk premium the less the world economic activities , both back to pre recession level 2002-2008 & next may remain stable having ranging around the area .Good recovery of usd premuim recovery & the world economy to readjust & adapt within this low & recovery without further usd risk premium to increase ,

nice read & topic .