When I discuss Lost Decades I always stress the fact that the “s” denotes the plural. Figure 1 shows that a decade and a half in, the trajectory of output has been noticeably depressed since 2001Q1.

Figure 1: Log GDP (dark blue), OECD forecasted (light blue), potential GDP (gray), and nearest neighbor fit against time, local weighting, bandwidth=0.3 (red). Source: BEA, 2011Q3 2nd release, OECD November 28 forecast, CBO Budget and Economic Outlook (August 2011), and author’s calculations.

The downtrend post-2001Q1 is more pronounced in per capita terms (extends only to 2011Q3, since I don’t have population post November 2011, and didn’t have the patience to hunt up projections to interpolate to quarterly frequency).

Figure 2: Log per capita GDP (dark blue), potential GDP (gray), and nearest neighbor fit against time, local weighting, bandwidth=0.3 (red). Source: BEA, 2011Q3 2nd release, mid-month population from FRED, CBO Budget and Economic Outlook (August 2011), and author’s calculations.

In Lost Decades, we make clear that we can avoid two complete lost decades, if we implemented reasonable policies. But we also recognized the obstacles (p.221):

… Financial interests resist regulations that shift the burden of risky behavior back onto them and off of taxpayers. Beneficiaries of government programs fight against attempts to curb their benefits. Taxpayers refuse to pay the taxes needed to pay for the programs they want. Partisan politicians block reasoned discussion, suggesting absurd pseudo-solutions instead of realistic alternatives. …

And so we see today the blocking of a head for the Consumer Financial Protection Board [1], on top of attempts to repeal Dodd-Frank (no secret why); the wealthiest fighting hard to retain their tax expenditures [2], and others suggesting that cutting taxes and benefits can spur massive supply side responses never before witnessed [3]. (At least no one has argued that eliminating child labor laws would immediately boost potential GDP, so one should be thankful for small blessings.) At the same time, we see the dispiriting spectacle of the failure thus far to extend the payroll tax cut and unemployment benefits, despite the evidence that these are effective, job-creating measures (and the former was first advocated by Republicans).

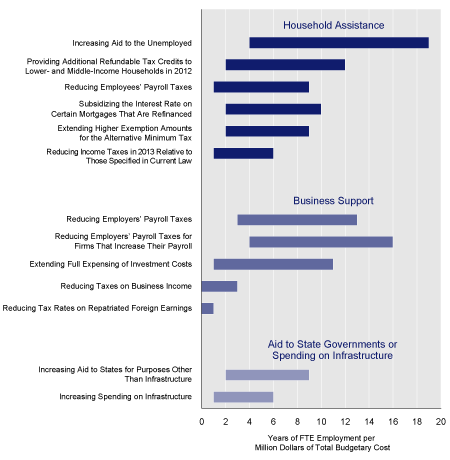

Estimates from CBO suggest that both types of measures would have a substantial impact on employment (and hence output).

Figure from Elmendorf (2011).

Jeffry Frieden on New Hampshire Public Radio a couple days ago, here, and on Euronews auf Deutsch.

Update: 12/10, 4:30pm Pacific. Jeff Myers has kindly provided population estimates from Census/Moody’s. I have generated a combined actual/projected series 1967-2011, and applied the LOESS regression (against time) to that series.

Figure 4: Log per capita GDP (dark blue) and projected, using OECD forecast and Census/Moody’s population projection (light blue), log per capita potential GDP (gray), and nearest neighbor fit (red). Source: BEA, 2011Q3 2nd release, FRED, CBO, Jeff Myers, author’s calculations.

Detail: PAC contributions to FIRE:

Source: Open Secrets.

A ten fingers ten toes socialist economist came up with some socialist answers. Big surprise.

It’s really amazing how the dim right wing has redefined socialism. I gotta hand it to them, they’ve taken what would once have a small-c conservative position and shifted it to the left, in the process lending legitimacy to the crazies like Ron Paul and the mendacious like Ryan. Really amazing.

Was the inclusion of PAC contributions a decision to quit making strictly political posts, but to instead hide them in within economic posts? Or is it just an admission that this type of economics is really just politics?

One more thing, what pikers these finance, insurance, and real estate types are compared to the big boys. And down right bipartisan compared to most of the biggies.

Menzie,

The problem with the CFPB and Dodd-Frank are not that they increase the level of regulation over the financial sector. The problem is that the regulations have been written in a way that gives government and government agencies too much power.

There is no reason why we can’t have a set of regulations that are aimed at solving specifc problems rather than a set of regulations that create a new layer of federal beauracracy and create more problems than they solve.

It should be obvious to everyone that a goal of these massive pieces of legislaiton that have been introduced/passed in the last few years is to create a regulatory environment in which the federal agencies themselves are unregulated/under-regulated.

A goal is to centralize power in the executive branch. History suggests that centralization is unsustainable, makes the majority worse off economically, inevitably leads to more corruption and has a poor record regarding human rights.

We need effective regulation, not a more centralized economic system in which the state determines winners and losers.

Uncle George on the fate of the Eurozone. http://www.wilsoncenter.org/article/the-fate-the-eurozone-hanging-together-or-falling-apart

I thought the part about “unsterilized ECB intervention” (second to last video) was the interesting bit. I interpret his view as suggesting that the ECB (and implicitly, Franco-German leadership) would rather see the Euro debased rather that destroyed, if that’s the only alternatives they face.

…overeducated elites resist the notion that they don’t know as much about things as they think that they do…

Buzzcut

It isn’t just the know=it-all syndrome. A lot of us think we know more than we do, but the elites in power don’t just resist but refuse the truth that they can never know enough.

Whee! Isn’t this fun; the team is off again!

Since there isn’t a shred of evidence that Dodd-Frank, as just one example, will achieve anything beyond creating legal fees, it is hard to know what the fuss is about. It’s nice that someone cares, I suppose.

c thomson: Given your (incredibly racist) comment on 9/26/2011:

is remarkably free of evidence, I think I will disregard your remark.

Interesting to see how the US lost decade is tracking Japan over same time length in the depression. It would reveal the path going forward for the economy.

It looks like Japan post bubble,when starving for yields,equities linked bonds were feeding and flying over the capital markets desks.Equities markets did not thrive and neither did the equities linked bonds.

Next time,we may look forward to the bell bottoms and Lucy in the Sky with Diamonds.

Bloomberg

Goldman Said to Plan CDs Tied to Equities

By Matt Robinson – Dec 9, 2011 7:22 PM GMT+0300

This interesting chart may be useful to support my comments on

Goldman Said to Plan CDs Tied to Equities

By Matt Robinson – Dec 9, 2011 7:22 PM GMT+0300

Chart of the day

http://www.chartoftheday.com/20111209.htm?T

Racist? Ah, that good Madison leftie method of trashing anyone who laughs at the pompous.

Incidentally, ‘towelhead’ is tasteless or an example of religious bigotry – not racist. Like the difference between the terrible ‘n’ word that no white mouth can utter and ‘mulatto’ that Obama uses in his own book.

‘Evidence’ that Dodd-Frank is just posturing and Washington makework? That will have to await the next financial meltdown.

tj Sorry, but your post is downright incoherent.

The problem is that the regulations have been written in a way that gives government and government agencies too much power.

What does this mean? What is “too much power?” If anything the regulations don’t have enough power. The law was passed and then the Executive agencies worked with (some would say worked too closely with) the financial industry. I didn’t see a lot of consumer groups being invited to assist in writing the implementing regulations. So your comment just sounds like another anti-government rant that I could hear on AM radio any given afternoon.

And then you said this:

It should be obvious to everyone that a goal of these massive pieces of legislaiton that have been introduced/passed in the last few years is to create a regulatory environment in which the federal agencies themselves are unregulated/under-regulated.

Followed immediately with this:

A goal is to centralize power in the executive branch.

Huh??? A little lesson in constitutional law. The legislative branch writes the laws and the executive branch implements legislation through regulations. How is it that the goal of legislators is to centralize power in the executive??? This borders on Glenn Beck stuff.

Look, Dodd-Frank is already the law of the land. What the GOP is doing is to decapitate some of the agencies in order to prevent those agencies from enforcing the law. The GOP is doing the bidding of the same financial crooks who caused the Great Recession. Apparently Jamie Dimon wants another crack at wrecking the economy and the GOP is only too happy to oblige. Let’s turn this around and ask what would be the response of bankers if the Democrats tried to decapitate and defund agencies in charge of protecting banks from bank robbers and cheats. They would be outraged, and justifiably so. But yet those same bankers and same GOP politicians are perfectly comfortable with decapitating and defunding agencies that are supposed to protect consumers and the public from fraudulent and deceptive banking practices. Why is the GOP willing to decapitate the Dodd-Frank agencies but horrified at the thought of decapitating the FBI or CIA or DoD? All of those agencies have missions enacted in law. All of those agencies have implementing regulations written by the permanent bureaucracy. So what is the rationale for only wanting to enforce some of those laws and not others? Answer: look at the PAC contributions…the rationale is big money.

2slugs,

The legislation (obamacare, CFPB, the failed cap and trade which has been retrofitted to the EPA, etc) is written in a way that leaves the final details of the policy up to a federal agency, which in turn, is run by an executive branch appointee. True the laws are passed by the legislative branch, but recently they have been ceding much of the rules-making to the agency that oversees the policy. It didn’t start with Obama, but he has taken the practice to a new level. This is what I mean by “centralizing power in the executive branch.” I thought it was obvious to most people, but I guess not.

tj All laws are written in such a way that most of the details are fleshed out until regulations are written by the executive. And since the total body of law tends accrete, it is also always and everywhere true that the number of rules and regulations will rise to a new level with each administration. You could have made that same complaint at the time of the John Adams administration relative to George Washington’s administration.

Your view of how government bureaucacies work is a cartoon version of reality. I’m pretty sure that you have zero realworld experience, so I’ll try and help you out. First, sometimes you portray government bureaucrats as shiftless, lazy and barely worth minimum wage. And then in the next breath you will complain about overambitious and downright diabolical bureaucrats scheming 25 hours a day, 8 days a week to centralize power and put down the poor, productive private sector Job Creator. Well, neither cartoon is accurate. I’ve sat through more sessions trying to write regulations to implement new legislation than I care to remember. It’s a grind. I don’t feel any sense of craving more power through an ever greater number of regulations. I don’t go to bed at night dreaming of new ways to expand executive power. If anything the temptation is to turn the whole mess over to industry lobbyists so I can enjoy a weekend. But the reason we have complicated regulations is not because we have power crazed bureaucrats with time on their hands; it’s because corporations have very expensive legal and accounting staffs whose main job is to find loopholes in regulations. If you want to simplify regulations, then ask corporations to fire their accountants and lawyers.

But I see that you demured on the issue of the GOP trying to decapitate and defund agencies that they don’t like even though those agencies’ mission is public law. So do you think the GOP is right to ignore the law just because they don’t like it?

I have always found Chinn less political than, say, Krugman or DeLong, so I am quite amazed at the right wingers here dissing him so energetically. I am also amazed at how little they seem to know about reality.

2slugs,

Not sure where most of that rant came from. Lots of straw men. No I don’t have the experience you claim. My information comes from a ‘left as you can get’ in law who worked inside the federal government for his entire career until he retired a few years ago. Every time I bring up czars, agency over-reach, etc, he reminds me that it really began in earnest with Reagan. However, even he admits that Obama’s style of governing seems to leverage the practice like no other.

tj If he retired a few years ago, then how would he know? But FWIW, by far the biggest overreach was under Bush 43. By a mile.

Obama’s style of governing seems to be one of begging the GOP to be nonpartisan and then wondering why McConnell and Boehner kick him in the teeth. It’s the “Charlie Brown trusts Lucy with the football” style of governing.

tj

A point of interest, articles on czars at Wikipedia are interesting in presentation. Take it for what it is worth, but the articles trace the Presidential “czars” back to FDR for WWII contingencies. Reagan per the articles had just one position, the Drug czar.

President’s czars

The political term

yes, among the reasonable policies you forgot to mention is the FOMC more aggresively stimulating AD though more agressive policy. The FOMC has been way behind the curve since late 2007 with monetary policy, even now failing to lean against fiscal contraction. And while I agree with many of your points about regulation, few people have the appetite for more regulation when AD is falling (look at what happened to cap and trade). The instict is that regulations are taxing, and who wants more taxes or costs when AD is falling. The proximate cause of the lost decade is the FOMC policy failure. Successful FOMC policy would raise AD and smooth the way to implement other policy initiatives you mention.

In particular, when it comes to bank bailouts, the economy as a whole cannot diversify away from certain sectors, like housing and real estate. So whether its 2-3 big banks, or 2000 savings and loans, an economy-wide severe recession will cost major $$$. It’s a fallacy of composition to think that regulations alone will solve the issue. Bank capital is a function of trend growth and income volatility. When income growth is lower and more volatile, bank capital needs to be higher. The best way to support bank capital is for the FOMC to ensure a nominal income floor . While many authors argue for a small positive rate of inflation to prevent debt-deflation, the more direct and beneficial avenue is to prevent nominal income from falling. The FOMC already targets a small positive rate of inflation – but this is not enough, maybe someday the FOMC will realize this. When nominal income drops, the economy as a whole cannot escape bank failures if that drop is sufficiently severe. If the banks hold 9% capital but the FOMC allows nominal income to drop 15%, then we will see 200 savings and loans or 2-3 big banks fail. Regulations will not solve this. The best preventative medicine to prevent debt deflation and optimize bank capital is not targeting a small positive rate of inflation, but putting a floor under nominal income. And government-benefit seekers will not seek them when there are better opportunities in the private sector. People will feel a lot more comfortable paying taxes (income and carbon) when their incomes are going up.

So yeah, I hear you that more regulations are needed. But step 0 is to correct the horrifying FOMC policy failure. It has not even achieved its legal mandate(s), with inflation too low over the last several years, and every person needs to be fired IMO.

Don’t you just love those financial regulations, SarbOx and Dodd-Frank. They just nipped that con-man John Corzine in the bud, didn’t they? No? You mean he signed the balance sheets even though he had no idea where the money was? But the regulations….?

Oh well, I am sure that Nancy Pelosi has enough from her insider trading to bail him out. Sure he is a Democrat but don’t the laws apply to Democrats too…. Oh, I forgot, they don’t apply to the smartest people in the room, only to the peons who foot the bills. Never mind!!

I’ve studied lost decades for many years and have a website devoted to my ramblings on the subject.

One thing I have noticed is that people are quick to blame government for letting asset bubbles get out of hand. But that’s like asking a person with diarrhea to control his bowels.

Another item of note: as the lost decade progresses, finance as percentage of national income wanes. We have yet to see this unfold fully.

A nasty us vs them mentality is also expected. Perhaps it has already started.