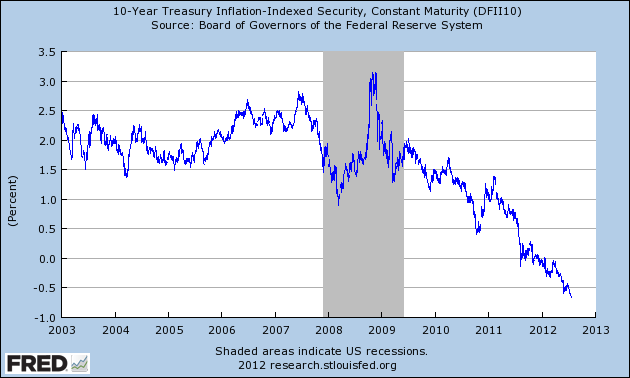

As feared by Representative Ryan, in March 2011, crowding out due to deficits: The ten year inflation adjusted constant maturity rate as of 7/20 was -0.67%

Source: St. Louis Fed FRED accessed 7/24 11am Pacific.

10-Year 1-3/8% Treasury Inflation-Indexed Note, Due 7/15/2018 (DTP10L18) on 7/23 is at -1.135%.

Today I was able to borrow money from myself at -5% APR.

Whoever claims that negative interest rate in free market is impossible is plain wrong.

Professor,

I am not sure why you turned to the TIPs bond to make your point. In this instance you should use the rate on the nominal bond rather than the inflation adjusted instrument. You would arrive at same conclusion.

Separately, I do not get your point. It appears that you were seeking some way to take a gratuitous shot at Congressman Ryan.

The fact is, in my opinion, that US rates are inordinately low and will stay that way as long as the US is viewed as a financial safe sanctuary. When the perception develops that all is well, then you should lock your children in the root cellar because the unwind of this trade will be an epic financial catastrophe. Rates will back up sharply and quite quickly.

In the meantime I think that if you are going to beat up on Ryan you should take better placed stategic shots rrather than this drive by shooting.

John Jansen: Nominal yields are relevant in terms of the impact of government bond supply versus overall demand for such securities. But real interest rates are relevant for real (physical) capital investment, in standard user cost of capital models, as well as hybrid accelerator/neoclassical models.

We were warned about low real interest rates dissipating suddenly in 2004, when Bush Administration officials were saying that was an optimal time to borrow. Now those same people are saying (when real rates are about 3 ppts lower) now is not an optimal time to borrow — because those low rates might dissipate. Go figure.

So, you might turn out to be right – and eventually, some time before the sun burns out, I’m sure real rates will rise.

ECRI: “Recession Here”

http://www.businesscycle.com/#

I think I’m inclined to agree with Achuthan here. It feels to me a bit like the leading edge of a recession.

If so, Obama’s toast.

John,

Please understand that when a government can borrow (freshly printed) money from itself at a negative rate, it is surely a sound argument that

* Ryan is being economically unenlightened (at best…).

* Government should borrow a lot more to take advantage of excellent interest rate.

* Apparently it is also Bush’s fault.

B Turnbull

Ryan is being economically unenlightened

That goes without saying. Ryan picked up a gentleman’s B.A. in economics from a lower tier school but he likes to think he’s a policy wonk. Oh, and he likes to hang out with Chicago econ profs at expensive restaurants as long as they are buying the $120/bottle wine.

Government should borrow a lot more to take advantage of excellent interest rate.

You seem to have missed Menzie’s point. The public is lining up at the door fighting over the chance to invest at negative real rates. That should tell you something about the opportunity cost of the marginal investment in the private sector. There is no crowding out. That was Menzie’s point. Now is the ideal time for the government to take advantage of low interest rates because government projects (even at negative rates) are earning the highest social return. Apparently you think we should hold offo on investing in infrastucture rebuilding until interest rates are high and there is ample crowding out. B Turnbull‘s investment strategy: Buy High, Sell Low. Did you learn your economics at the same school as Rep. Paul Ryan? As an aside, Rep. Eric Cantor made the mistake of believing Ryan’s predictions back in 2009 and Cantor ended up losing $40K by betting inflation would return.

Apparently it is also Bush’s fault.

That’s silly. Bush hasn’t been out of office since Jan 2009. It’s mainly the fault of the Tea Party Republicans. The economy was at least headed in the right direction up until the knownothings in the Tea Party took control of the House.

Others mentioned in Menzie’s link:

Bloomberg noted that former Fed Chairman Alan Greenspan and former Bush Treasury official John Taylor have made similar claims.

Looks like Ryan is in good company, and as Menzie admits above he could be right. Now Menzie does believe that in the long-run we will all be dead so to him it doesn’t matter, but it might to your children and grandchildren.

Consider the children of Detroit in the booming 1950s living in 60 years of socialism from Democrat governments now unable to unload their property for $500. But don’t worry, they will all soon be dead.

John Jansen: if as I suspect you’re the acrossthecurve.com guy you’re still sorely missed.

What’s interesting about the TIPS curve is that it’s been both inverted and humped for a couple of months now (Menzie Chinn: you mislabelled 5-yr TIPS). It suggests that the market considers inflation retargeting to be the table after the election. (Term structure signals in nominal rates are swamped by policy interventions, but currently are consistent with Byron Wien’s call for a lower achievable growth rate in developed economies: see weekend WSJ.) This configuration could migrate to nominal rates (my call 3 years ago for 4 years thence, but FED unwind may take longer); last time that happened was Germany spring ’94 (between reunification and Euro).

nnyhav: Sorry, where have I mislabeled the 5 year TIPS? In this post? Or another?

Surely, when a government owns a printing press, it can borrow from it at any interest rate even negative. Look — negative interest rate! Wouldn’t we be “idiot(s) of elephantine proportions” not to borrow/print even more to save us all some money on worthy social projects?

Of course, Ryan and most of other people in the world are just plain uneducated/unintelligent for you 2slugbaits, that’s why they need mighty educated economists like yourself to show them the light.

Yes, it’s my bad, it is either Bush’s fault or Tea Party’s fault; it may even be California self-serving senior folks’ fault who just don’t die as quickly as you 2slugbaits desires.

Anyway, thank you 2slugbaits for your wisdom and your altruism with other people’s money. Long live liberal progressive economic wisdom.

MC: end of this post:

“10-Year 1-3/8% Treasury Inflation-Indexed Note, Due 7/15/2018 (DTP10L18) on 7/23 is at -1.135%.”

nnyhav: I beg to differ. If you go to the FRED site, you’ll see this is correct (or you can ask yourself how can that be a five year TIPS when 2018 is more than five years from today?)

When the financial crisis struck full-on in late 2008, I was skeptical about more stimulus checks. But, now I wonder if they would have worked if we done them quarterly targeting the 10-year Treasury at 4%. The best idea that I’ve ever read by Brad DeLong (the desired result anyhow-can’t remember how he wanted to go about doing that).

Get it right, 2slug. Ryan likes to throw down $350 bottles of wine at Bistro Bis.

Otherwise, you pretty much have Pink Slip Paulie correct. To paraphrase Krugman “Paul Ryan is what a stupid person thinks what someone who knows economics sounds like.”

MC: OK, 6 yrs, initially issued as 10yr, 4 yrs ago (the current 5yr is 0.125 of April ’17, trading at a similar yield). No market participant would refer to it as a 10yr now.

(All sort of beside the point, like Paul Ryan…but while I’m here, I might mention that rate levels reflect, among other things, issuing capacity, as determined by the debt ceiling.)

All this reminds me of the interview of George Will of Bob Shiller, who had warned early on of an equity bubble…so Will says something like “Admit it you were wrong” since it took a few years (like 3 or 4 more) for the dotcom bubble to burst big time. This is recounted in Taleb’s book sorry I don’t have the exact cite handy.

Like a lone voice crying in the wilderness…..

This is somewhat of a limits to arbitrage argument. That is, negative real interest rates cannot persist forever…but how do we know when will they reverse course.

Hold off on the celebrations for now…negative real rates are nothing to cheer about.

B Turnbull that’s why they need mighty educated economists like yourself

I am not an economist.

when a government owns a printing press, it can borrow from it at any interest rate even negative.

What does this have to with today’s negative 10 yr TIPS? TIPS bonds are held by the public. Isn’t it more likely that the reason 10 year TIPS are negative is because investors see very bad economic growth prospects over the near and mid-term? If investors really believed we were on the cusp of turning into Zimbabwe then shouldn’t we see upward pressure on nominal interest rates? As it is the Fed is struggling to stave off deflation and will have to resort to extraordinary measures just to get inflation up to 3%.

it may even be California self-serving senior folks’ fault who just don’t die as quickly as you 2slugbaits desires.

I don’t think we need to go that far. Let’s compromise and agree that next time you will vote with your head. Deal?

nnyhav: Apparently nobody refers to it as I have, except the St. Louis Fed, as I copied the text from the website.

Yes, I realize the rate reflects other factors, as discussed here, here, here….

Stephen Kopits: You wrote, “I think I’m inclined to agree with Achuthan here.” How did you feel about this call by Achuthan last September?

http://www.businesscycle.com/reports_indexes/reportsummarydetails/1091

Has there been an objective look at the ECRI’s record of false positive?

Looking at the Federal Reserve ownership of the yield curve (source: Global macro monitor Feb 16 2012)

The long maturities starting as of 2018 and farther along the time curve are not a crowded investment in relation to the total amount 7.7 trillion USD outstanding in Bonds and TB.With an average amount of 500 billion USD where the Federal Reserve ownership is the most predominant 41% as of 2018, 43% as of 2019 and lesser percentage with very small amount of bonds outstanding as of 2022. The required amount of debts retired for a drop in yield are infinitesimal and the outcome consistent with the hereafter conclusion.

The Effectiveness of Alternative Monetary Policy Tools in a Zero Lower Bound Environment. J Hamilton S. Wu

“The historical correlations are consistent with the claim that if in December of 2006, the Fed were to have sold off all its Treasury holdings of less than one-year maturity (about $400 billion) and use the proceeds to retire Treasury debt from the long end, this might have resulted in a 14-basis-point drop in the 10-year rate and an 11-basis-point increase in the 6-month rate.”

Dealing with the primary assets Bonds and TB and not with the Tips may not change much the conclusion for now.

no reflection on many commenters here

past and even present

but in general

prof-chinn deserves better comments

insistent off base ankle bites

and the hollow barks

of flea infested old dogmatics

give this fine fellow his due

you witless curs !!

The marginal buyer of TIPS or treasuries, and hence the rate setter, is NOT holding the security until maturity. They buy today, wait for the price to go up and sell before maturity. In other words, their expected return at purchase exceeds the yield to maturity.

Think of it this way, I don’t care what the nominal (or real) yield to maturity is if I am confident the FED is going to come in as a buyer. I buy before the FED, then the FED activity in the market forces the price higher, then I sell for a return that exceeds the yield to maturity.

It seems misleading to claim that buyers of government securities are somehow eager to lock in a negative real return. Rates are set by buyers who sell prior to maturity, so their return is not determined by the stated yield at purchase.

“John Jansen: Nominal yields are relevant in terms of the impact of government bond supply versus overall demand for such securities. But real interest rates are relevant for real (physical) capital investment, in standard user cost of capital models, as well as hybrid accelerator / neoclassical models.”

I think John’s point is that the change in nominal rates is approximately equal to the change in real rates as there has not been an appreciable change in expected inflation. But let’s go back 30 years when nominal rates fell but expected inflation fell more. The Reagan fiscal stimulus – which was offset by an aggressive monetary contraction – did raise real rates even as nominal rates fell a bit.

Next week, August 1st, QE3.

There is “crowding out” but it’s not because of government. Banks are awash in cash – as are corporations. Banks aren’t lending it out because, having just blown their money through their own loose ways, they now don’t trust what will happen and so demand a degree of credit worthiness that excludes many willing borrowers. The “crowding out” is caused by market reaction to events. A different form but with a similar effect on investment.

Ricardo and the others, it would be delightful in long term rates would return to more common (“normal”, but what and why is it normal?”) levels because that would mean a growing economy and falling unemployment with the excess slack being worked off. And that would be the time to reduce Government spending so as to prevent crowding out and paying down the debt, at least the debt to GDP ratio. Right now the Titanic that is known our economy, after bouncing off of one ice berg, is heading for another, with deflationary forces rushing in my the bow to taker her down. What are those forces:

1. The post-cold war globalization of the economy, with the spread of the internet, created an investment boom in China and the rest of Asia, Russia, Eastern Europe, and Latin America. Billions of more educated workers have entered the capitalist system, competing in wages with 1st world workers in U.S., Europe, and Japan. The cost of labor is falling, the production of stuff has expanded, but the population that can buy all that stuff has not been expanding near enough, and contracting in 1st world. Big deflationary force.

2. Debts created by asset bubbles, particularly real estate asset bubbles, are no longer supported as asset prices decline. Unemployment caused by the worker glut causes underwater asset holders to default, further driving down asset prices held as collateral, rending the institutions and individuals who loaned on that collateral essentially insolvent except for “extend and pretend.” Very, very , big deflationary force.

3. The EUROZONE created its very own paper gold standard in the EURO, reducing member states to the status of provinces or even firms, who depend on the kindness of the bond market to finance their activities. The bond market is not feeling very kind. Hence Europe is spiraling down to situations where perhaps a 1/3 of its workforce will be unemployed within a year. Very, very, very, very deflationary.

4. Finally, lets assume Menzie’s and my nightmare is realized and Mitt Romney is President, Paul Ryan is VP, a Republican Senate and Republican House enact pseudo-Reagan and appoint John Cochrane in Ben Bernanke’s place on the Federal Reserve. Tax cuts fro the “producers,” tax increases on the “moochers,” immediate substantial cuts in transfer payments to the “moochers,” a raise in short term rates to 2% to stop ZIRP and start reducing the Fed balance sheet to unwind QE. Romney has already said he expects 2013 will be bad and should not count against him until these “wonderful” policies and his “confident manner” kick in. This severe U.S. austerity will cause even more slack in demand, and therefore a reduced supply. Very, very, very, deflationary.

5. So who is right rational based on the above, the Market with its low long term rates predicting a decade of depression or Ricardo and Ryan, that “hyperinflation” is right around the corner.

Why is US Breakeven 10 Year inflation rate only 2%? Probably, for the same reason 10 yr treasure yield is only 1.4%. Who cares about 5 straight years of over trillion dollars deficits, with a lot more deficits to come–there are always QE1, QE2, QE3, QE…. With all these massive buyers of treasuries taking only one side of the trade, the price and yield can be absolutely anything.

Again, if a government controls its own currency, it can print and borrow from itself at any rate it desires, even negative. It saves money in the manner similar to Mr. Smith who first appropriates Mr. Brown’s automobile, and then returns him a spare tire to save him some money. Printing/spending already takes purchasing power from many private people and businesses and then redirects it to government favored projects. What rate of interest a government charges itself hardly matters.

What about lower interest payments incurring to other countries and to general public? Surely, these savings are real. But paying previously borrowed money with freshly printed ones is simply executing a partial default. Any government that controls its own currency can execute partial default at any time.

Anyhow, advocating continuous or temporary partial default vs. abrupt one is quite different from arguing “we can print and borrow from ourselves at a negative real interest rate — great! Let’s hurry up and print a lot more.”

Menzie: I find it ironic that you pull this graph to show that some else is wrong when it also shows that your way of thinking is also wrong. Leave the graph and change the title to “Interest Rate Induced Stimulus Watch” and you have the same point.

You seem to be suggesting that rates are artificially low due to QE, which doesn’t hold water since yields have fallen much further since the end of QE. Didn’t we already see Bill Gross get this wrong last year?

The fact that the market is on one side of the trade is just reflective of the fact that the market doesn’t see inflation coming, but if anything, deflation.

And why do you suggest that somehow borrowing is limited to borrowing from itself? The government is now essentially charging people to borrower their money, so why is this bad for taxpayers? To be sure, I think things could change in a hurry, but there is no reason to suspect as much right now. MC’s analogy to the weather is a good one: I can predict all day that it will rain and will always be right eventually, but that doesn’t make my prediction relevant today.

In any event, the point was that rates reflect a lack of private investment, which suggests that the typical argument against government spending, namely that it’s not stimulative because it reduces private spending, doens’t seem to apply right now since there is no private spending to crowd out. Not sure why a debt burden should scare us from borrowing a negative rates or from stimulating the economy, which would do more to reduce the deficit than anything else by increasing revenues and reducing safety-net spending.

@B Turnbull

You seem to be saying that the Fed is dictating the rates on US treasuries through QE. But this statement fails to cohere with reality. Just check the FRED data.

First, Why has the 30 year T-bill moved with the 10 year even though the majority of Fed purchases are for treasuries of 10 years and shorter? If your story were right and the Fed were forcing the rate by QE, then the 30 year bill which hasn’t seen much QE should have diverged heavily since its price was largely determined by private buyers. Yet it hasn’t.

See this graph:

http://research.stlouisfed.org/fredgraph.png?g=90l

Second, why did the rate on T-bills decline even after QE2 ended and why did the rate decline after QE1 ended? If your story was correct, the rate would have soared as the Fed got out of the market and private buyers demanded higher rates.

Compare the previous graph, to this graph of Fed purchases:

http://research.stlouisfed.org/fredgraph.png?g=90k

Third,

Note from the second graph that the Fed changed its composition of holdings to favor longer term securities, yet from the first graph, we can see that it caused virtually no change in the relative prices of the 5,10 & 30 year treasuries. If the fed were dictating rates, why didn’t the change in composition of fed holdings change the relative prices of these securities?

If the Fed were picking the rate at which the government borrowed money, the data would be completely different from what we are seeing. From this we can conclude that the fed is, at best, making very small tweaks to rates at which the government borrows.

Patrick

So you are saying the FED does not have an impact (or very little) on market rates?

Then why does the FED bother with the QE’s?

Patrick,

Bernanke himself does not deny that the Fed does affect long term interest rates in large part by buying and holding treasuries.

Anyway, check out the following document:

http://www.newyorkfed.org/markets/opolicy/operating_policy_120620.html

To quote:

“Purchases of Treasury securities for the maturity extension program will be distributed across five sectors using the same approximate weights that have been used in the purchases to date:”

20 – 30 Years get 29%.

Here is another article you may find interesting discussing liquidity of treasury market:

http://www.bloomberg.com/news/2012-07-23/bernanke-considers-how-much-treasury-buying-is-too-much-economy.html

Also, here are few things to consider:

* The yield on shorter maturity treasuries must be dominated by arbitrage principle. Banks can borrow money next to nothing pledging treasuries as collateral, and with the Fed’s promise to keep short term interest rate extremely low for many years to come there appears to be only limited duration risk.

* Where do foreign central banks park their excess USD which they must acquire to keep their currencies from appreciation?

* It’s not just the Fed, many financial institution are either required to keep some treasuries or need them to conduct daily operations or just want to make an easy profit by buying shorter term treasures and borrowing against them at next to nothing.

* How about anticipation factor and “never bet against the Fed” rule? How many are really expected to take a significant short treasury position against the Fed? Or how many would take a long position in anticipation of more Fed’s buying?

* Large, persistent one sided trades are likely to remove those that have any doubts about the direction of future treasury yield. Remember the price of aol after many months of going up? Who cares about fundamentals, if the next guy will pay even more?

* See liquidity concern above.

“The fact is, in my opinion…”

Welcome to the blogosphere.

Menzie,

This is a rather late post, but Rep. Ryan has been warning about the threat of imminent hyperinflation for over four years. His own site has a very efficient search system which delivers up an article Ryan penned on May 1, 2008, decrying the actions of the Fed and predicting that the Dogs of Hyperinflation would soon be loosed upon the nation. Always a game one though, Rep. Ryan hasn’t let up and has put forth a continual series of press releases, newspapers articles and white papers (one co-authored with John Cochrane) all predicting the same gruesome interest rate spiral. The media, however, in a display of collective amnesia seem unable to bring themselves to ask Rep. Ryan just when his prediction might manifest itself.

@TJ

I’m saying that the Fed doesn’t get to pick whatever rate it wants. It can push the overall economy, but it can’t actually pick prices on individual assets like B Turnbull was suggesting.(For example, by deciding that it wants the USFG to pay less to issue debt) The fed is operating in a market that is heavily structured by private interests. For example, it can’t change the relative prices of long and short term bonds by buying short term bonds because private buyers will arbitrage the difference away. Furthermore, you see little change in the prices of treasuries when the fed gets involved because #1 private buyers anticipate and smooth fed actions after announcement and #2 private buyers end up shifting and spreading(transmitting) the effects of fed policy out into other asset classes. If you look at broader macroeconomic measures, however, the actions of the fed are obvious. (For example, compare the fed asset purchases to the change in the GDP deflator)

@B Turnbull:

Your quote from the Fed is after operation twist. I already addressed this and you can see Operation Twist at work clearly in the graphs that I already provided. Operation twist was a shift from short term asset purchases to long term asset purchases without changing the total quantity of held assets. What is interesting is that, despite this change in policy, the relative pricing of the assets did not change. This is inconsistent with your stated worldview. (That the fed can pick the price on US debt, thus lowering/obscuring the true cost of US borrowing)

But it is good that you bring up arbitrage, because that is exactly my point. If arbitrages can happen between 10 and 30 year bonds(and, of course, they can) then the fed doesn’t get to pick the price on government debt. Because that means that arbitrages can happen between 30 years and MBS. Or Spanish debt and US debt. Or any class of assets with any other class of assets.

Thus the fed can’t pick the rate because they don’t change the underlying value or maturity of the assets that they’re buying. USFG policy will affect the prices of US debt with respect to other assets(because their policy determines the ultimate value of the debt), but Fed buys will just be arbitraged away; pushing hard on the global economy, but pushing treasuries only ever so slightly, and little more than they push the price of any other asset.

“The fact is, in my opinion, that US rates are inordinately low and will stay that way as long as the US is viewed as a financial safe sanctuary.”

Yes, it has nothing to do with QE1+2, or Operation Twist, or the fact that the Fed bought 69-77% of all Treasury issuances in 2011.

DERR!