Interpreting Monetary Policy’s Impact on Exchange Rates (and Economic Activity)

Over a week ago, Bundesbank President Jen Weidmann warned against the politicization of Japanese monetary policy, as the BoJ was pressured for more expansionary policy. [1] Nouriel Roubini warned that a currency war could be self-defeating as each country’s laxer monetary policy merely resulted in higher commodity prices. [2] I have been wondering exactly how expansionary monetary policy can influence exchange rates in an era of unconventional monetary policy. And even if it can’t affect exchange rates, is that a reason for not pursuing expansionary policy.

Figure 1: Nominal value of US dollar (blue, left axis), and Fed funds rate (%) (red, right axis). NBER defined recession dates shaded gray. Source: Fed via FRED, NBER.

Exchange Rate Determination in a New Era

Several months ago, the Economist noted that the usual determinants of (advanced country) exchange rates no longer seemed to affect currency values in the traditional fashion ( Currencies: The weak shall inherit the earth, October 6, 2012):

…Other things being equal, the increase in money supply that a bout of quantitative easing brings should make that currency worth less to other people, and thus lower the exchange rate.

Ripple gets a raspberry

Other things, though, are not always or even often equal, as the history of currencies and unconventional monetary policy over the past few years makes clear. In Japan’s case, a drop in the value of the yen in response to the new round of QE would be against the run of play. Japan has conducted QE programmes at various times since 2001 and the yen is much stronger now than when it started.

Nor has QE’s effect on other currencies been what traders might at first have expected. The first American round was in late 2008; at the time the dollar was rising sharply (see chart). The dollar is regarded as the “safe haven” currency; investors flock to it when they are worried about the outlook for the global economy. Fears were at their greatest in late 2008 and early 2009 after the collapse of Lehman Brothers, an investment bank, in September 2008. The dollar then fell again once the worst of the crisis had passed.…

David Bloom, a currency strategist at HSBC, a bank, draws a clear lesson from all this. “The implications of QE on currency are not uniform and are based on market perceptions rather than some mechanistic link.”

As the article points out, the most robust determinant of exchange rates has typically been short term interest differentials (in my view, it’s actually real interest differentials, as in the Dornbusch-Frankel model — see this survey). Now, it is asserted, it’s long term real bond yields. For more, see this recent WSJ article. (Also, it’s clear that risk is important, as discussed in this IMF working paper).

I think part of the confusion that some have over what should determine exchange rates (as well as inflation rates) arises from a misapprehension of what current unconventional measures are doing. In the pre-2007 period, lowering interest rates, ceteris paribus, implied faster money creation and hence faster inflation. Post-2008 (and payment of interest on reserves), that linkage is not so straightforward. Credit easing is altering some interest rates, but leaving yet others unchanged. Quantitative easing that results in large increases in bank reserves but leaves the money supply unchanged means that inflation expectations are largely unchanged. Extended policy rate guidance (committing to keeping rates low for a certain period, or made conditional on activity measures) does seem to alter the expected rate of inflation, but to the extent that these measures together induce higher output in the future relative to the no-unconventional policy counterfactual (see tables below), more positive expected future output gaps will tend to result in appreciated currency values in the future.

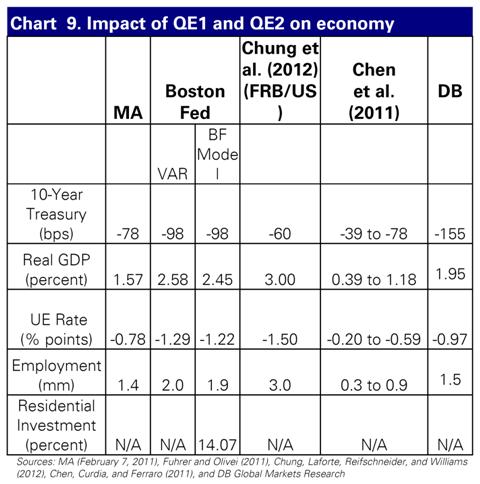

Chart 9 from Deutsche Bank, “QE3 to Boost Asset Values and Growth,” Global Economic Perspectives (Sep. 27, 2012) [not online]

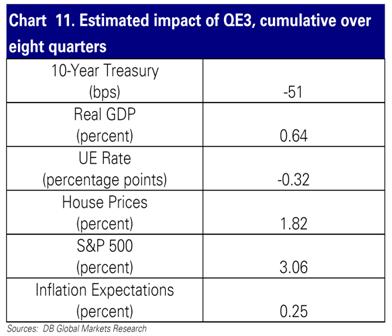

Chart 11 from Deutsche Bank, “QE3 to Boost Asset Values and Growth,” Global Economic Perspectives (Sep. 27, 2012) [not online]

To the extent that expected future exchange rate values affect current exchange rates, it’s not surprising that one could get differing effects due to the implementation of these unconventional measures. The direction of effect depends on how the different measures affect output and inflation expectations at different horizons, among other things.

For instance, other estimates indicate US large scale asset purchase should depreciate the dollar. Christopher Neely notes that the announcement effect (depreciation) is consistent with a portfolio balance approach, but output is held fixed in his exposition, and asset demand does not depend on output, ruling out the mechanism I outline above. (See also Jim’s post on QE.)

Would One Still Want to Conduct Unconventional Measures Even If Exchange Rates Are Not Affected?

I think the answer is yes. Suppose Country A conducts expansionary monetary policy that (for the sake of argument) would result in a weaker exchange rate and a higher price level (say by 10%). Now suppose Country B seeks to prevent an appreciation of its own currency against Currency A; it could undertake a commensurate expansionary monetary expansion (that would result in a 10% price increase). In the end, the nominal exchange rate is unchanged, but the price level in both countries is higher. This might seem like a zero sum game – but I would say that in fact the world benefits if the price level is too low. That is, as Jeff Frieden and I have argued, higher inflation is going to be helpful in shrinking debt ratios and facilitating real wage adjustment. (That being said, the current measures (aside from extended guidance) do not seem likely to have large impact on inflation, except to the extent that output is increased and prices rise via the Phillips curve.)

Of course, if a central bank were to purchase foreign exchange (let’s say BoJ purchases US Treasurys), then there will be downward pressure on the currency’s value (in the old days, we would say if unsterilized, but I think these days, even if sterilized). Other countries might be forced to follow suit.

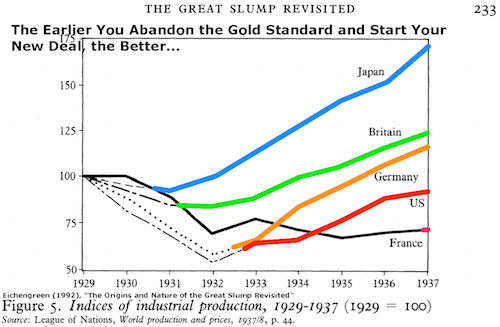

Then, one has to ask if countries, in an era of slack aggregate demand and high debt, might benefit from loosening monetary policy even further. Here’s one possible answer, from the experience of the Great Depression (courtesy of Barry Eichengreen).

Figure 5 from Eichengreen (1992).

Update, 11:45am Pacific, 1/29: Beate Reszat clarifies the degree to which recent government statements infringe upon BoJ independence, in the context of current legal and institutional arrangements.

Just a note on the write up in “The Economist” – it misses a great deal of what happened. It is, I think, very widely understood that the sharp run-up in the dollar right after the collapse of Lehman was driven largely by forced payments. Many accounts (European banks, in particular) borrowed in the US market on a very short-term basis, and when US banks ran into funding troubles, they passed those troubles on to their borrower-clients. In the case of overseas borrowers, repayment of borrowed dollars showed up as demand for dollars in the FX market. There was certainly a safe-haven bid, as well, but anyone who leaves out the cut-off of credit while pretending to explain that chart simply fails in their effort. They’ve left out what made that episode so bad.

We didn’t really leave the gold standard until 1971.

Doesn’t this run counter to what happened in Japan in the last month. The government’s policy to devalue the yen has clearly worked, and it has done this in a deflationary environment. What’s different in my opinion, and has proved far more effective than previous attempts to ‘silently’ devalue currencies, is the power of communication. The Fed’s pledge to commit to QE until unemployment falls to an ‘acceptable level’ rather than the QE itself is what drove USD lower. Draghi’s comments pledging to ‘do whatever it takes to save the Euro’ worked to bring yields down in the EZ, without the printing of a single banknote. Likewise, Japan’s open commitment to lower the yen has been the driving force behind the yen. In this new phase of the currency war ‘words speak louder than action’ as this infographic nicely demonstrates. http://uk.saxomarkets.com/fx-debates/currency-wars-infographic

So what happens here if housing prices take off?

An other existential problem, when did the currencies wars started and when will they end?

Geologists are modest when it comes to the real duration and time scales of the geological cycles. They have to deal with long time cycles.

When the foreign exchanges rates balances are fitting the respective countries aims but the currencies are misaligned everything is implicitly balanced. When the aims are contradictory it is called a war and yet the belligerents clamour should have been heard since long.

The empirical data and reality are consigned in the hereunder figures and data.

BIS statistical survey on foreign exchanges http://www.bis.org/publ/rpfx10.pdf

IMF COFER

http://www.imf.org/external/np/sta/cofer/eng/cofer.pdf

No claims on the GBP, very few on the yen and a large unallocated share of claims on the USD. That takes care of the volume related to the underlying supply and demand.

Econbrowser

Currency Wars and (Macro) Competitiveness

Exchange Rates: Two Stylized Facts and Yet Another (Consequent) Puzzle

There’s a typo in the first sentence, it’s Jens, not Jen Weidman.

The last time I looked at data provided by the Economists magazine, Japan’s Current Account Balance was a plus 1% of GDP while the U.S., Canada and Great Britain all showed a NEGATIVE balance of 3% or more.

Since the end of WW II, Japan has exhibited a phobia against the possibility of not having enough money coming in from exports to pay for the imports it needs to feed its population and operate its economy. A 1% surplus is not enough. But Hey, we are all irrational sometimes. And Japan is a sovereign nation. The U.S., Canada and Great Britain should not expect Japan to cease being Japan.

The U.S., Canada, Great Britain and any other nation that tolerates a long standing trade deficit are sovereign nations also but they don’t seem to recognize that they MUST defend themselves against the actions of Japan, China and Germany.

The proper defensive actions for all trade deficit nations is tariffs applied to all imports manufactured in Japan, Germany and China until such time as their share of all goods imports is equal to their share of all goods exports. Currency wars are a mistake. Go for the jugular. But seek balanced trade, not a trade surplus.

So, GDP fell in Q4.

Well, Professor Hamilton, what does it mean?

Steven Kopits: I’ll have some comments up later today, but first have to teach my class and meet with some students.

You know, that’s really harsh, Jim. We’re third in line after teaching and students?

ReformerRay:

I’m in total agreement that tariffs are the rational way to balance persistent trade deficits. Unfortunately we have accumulated long experience of how industries lobby government to erect protectionist legislation that ultimately weakens a nation’s international competitiveness.

The industrial world has entered a new paradigm – Globalization and Free Trade. From a theoretical perspective, decreased bureaucratic overhead should result in increased trade and greater overall wealth. As promoted by Multinational Corporations and International Banking, the objective of the new regime is the minimization of taxation and operational costs, as well as the maximization of securitization to pay for any trade imbalance. The results: Chronic government deficits (weakened government), the reduction in labor’s share of profits (increased Gini coefficient), and a fragile, unregulated and over-leveraged international banking system (financial crisis).

Our problem is essentially one of competency. Without institutional knowledge of past mistakes and the discipline to correct problems before they become insurmountable, our culture will continue to operate from crisis to crisis, with resources hogged by the most powerful.

ReformerRay wrote “The U.S., Canada, Great Britain and any other nation that tolerates a long standing trade deficit are sovereign nations also but they don’t seem to recognize that they MUST defend themselves against the actions of Japan, China and Germany.”

Dear Sir, you would have made a much deeper intellectual impression if you had replaced “Japan, China and Germany” with “countries running a positive trade balance”.

Or have I to interprete you contribution in the sense that countries which provide the USA and UK with commodities are allowed to run huge absolute and per capita surplusses?

A slightly confused scientist from central Europe.

I mention China, Japan and Germany for several reasons:1. Collectively, their goods trade surplus with the U.S. comprises 55% of our total goods trade deficit in 2011. No other nation comes close to their record. 2. Each of them uses their governmental power to enhance their positive trade balance with the U.S. 3. When their numbers are removed from our trade deficit, the remaining nations provide almost balanced trade with the U.S. (79% of our goods imports from the rest of the world are paid for by the value of the goods exports we sell to them). 4. Each of those nations has many other customers – they will adjust easily to a reduction in our trade deficit.

Finally, Mr. ulenspiegel1965 is right with regard to imports of oil and other commodities. We need trade, especially commodities we lack. And it is the manufactured goods produced elsewhere, not commodities, that has reduced manufacturing activities in the U.S.

Japan, China and Germany are the proper targets.

“And it is the manufactured goods produced elsewhere, not commodities, that has reduced manufacturing activities in the U.S.”

That is extremely weak, your (US) reliance on high commodity imports in combination with your inefficient use of your own resources, contributes as much as the good imports to your trade balance. Your chance to provide competive products in future (again) will be destroyed by your approach, without higher prices for (imported) energy you are in a real disadvantage when it comes to technological developement, as this is usually a result of limited resources.

Yes, there are many reasons why goods are manufactured elsewhere and sold in the U.S. One of the reason that leads to my recommendations is the effective use of governmental resources in the three nations to create an effective exporting economy. I respect their right to do so. I would ask the leaders of these nations to respect the right of the U.S. to use governmental power to reduce our trade deficit in goods.

Each nation should look to its own interests first. The satisfying aspect of recommending that the U.S. act unilaterally to REDUCEE (not eliminate) our trade deficit is that we can recommend that all nations also act to reduce any trade deficit that they find onerous.

If we agree that balanced trade will spread the benefits of trade among more nations and will act to sustain international trade, that goal alone is sufficient to justify nations acting to reduce their own trade deficit.

This new goal (Balanced Trade) should displace Free Trade for all nations – for a variety of reasons. If this new goal is accepted, the WTO must be reconstituted.

“Unfortunately we have accumulated long experience of how industries lobby government to erect protectionist legislation that ultimately weakens a nation’s international competiteveness.”

Correct. That is why we need a new way to establish tariffs, along with a new goal (Balanced Trade). Tariffs have to have a justification (to reduce the trade deficit). Biggest bang for the buck is to limit tariffs to the nations that have the largest numeric surplus with the home country. Since our goal is numeric sum of all trades, tariff rates should be equal among all products. That simplifies life. It also prevents logrolling by legislators. It also enhances competition. Those countries that have a trade balance near zero will escape all tariffs. More competition.

It is possible to construct a tariff system that does not have the deficiencies of the past. Just ask yourself “What is the most efficient way to move trade towards balance?”