Here I briefly survey some recent developments.

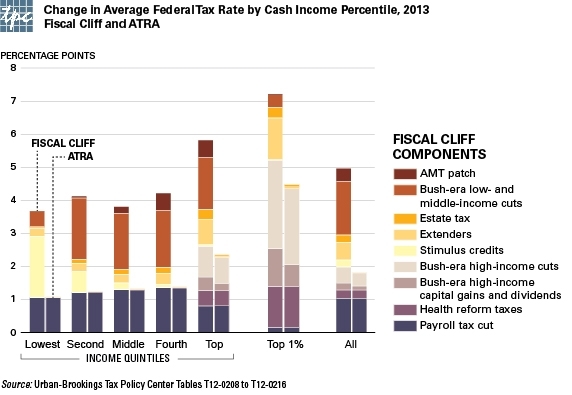

Forbes had this graphic of the consequences of the recent fiscal-cliff deal (named by its Congressional sponsors the American Taxpayer Relief Act, or ATRA) for various income quintiles. The left bars show how much your after-tax cash income would have gone down in percentage points as a result of the tax increases had there been no deal, broken down by specific contributing factors. The right bars show how much your after-tax income actually fell as a result of the deal.

|

Megan McArdle has some concerns about the outcome:

Consider the fiscal cliff deal that we just passed. Virtually every economist agreed on what needed to happen: Congress should extend all the tax cuts and spending hikes temporarily, because any fiscal tightening would also reduce economic growth and raise unemployment. But because our current trillion dollar deficits are entirely unsustainable, Congress should also set a deadline to have all or most of these temporary measures expire….

In a month-long round of backroom bargaining interspersed with public name calling, our politicians essentially managed to craft the opposite of this deal. We raised taxes immediately, which will put pressure on a still-weak economy. On the other hand, we also made the overwhelming majority of the Bush tax cuts permanent, at a cost of trillions over the next ten years.

Next political cliff-hanger to gawk at: negotiations over raising the debt ceiling. We learned this weekend that this won’t be side-stepped with the trillion dollar platinum coin trick. Ezra Klein quotes Treasury Department spokesman Anthony Coley as stating:

Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit.

So what will happen? Here is Bill McBride’s assessment:

The House will raise the debt ceiling before the deadline, and the U.S. will pay the bills. The House majority has no leverage on the “debt ceiling”; as I’ve noted before, the House majority holds a losing hand and everyone knows it. The sooner they fold (and raise the debt ceiling) the better for everyone.

Also from the indispensible McBride, a couple of favorable developments on the longer-term outlook. Goldman Sachs Chief Economist Jan Hatzius is predicting that the U.S. federal deficit will be down to 3% of GDP by 2015. And the state of California is now projecting a budget surplus for the current year.

Another small bit of good news for the budget– the extraordinary measures that the Federal Reserve has been adopting the last three years have generated extraordinary windfalls for the federal budget. The Fed announced on Thursday that it earned a record $89 B in profits returned to the U.S. Treasury in 2012.

|

Now somebody else just needs to find another $900 B or so and we’re all set.

If you are looking for ways to reduce the current cyclical deficit, the U.S. mint coins roughly 18.5 billion individual coins per year. Changing the mix away from money-losing pennies and toward “money-making” platinum might have a salubrious effect.

The debt problem could be fixed painlessly for a few years if Congress authorized the Social Security Trust Administration to print the money required to pay benefits, then cancelled the federal debt the Trust owns, which amounts to about $2,000,000,000,000. This would also solve the mistaken perception that Social Security system is going bust at any particular time.

The payroll tax hikes and hit to PCE from higher taxes on the top 1% already results in real final sales per capita turning negative as early as Q1-Q2 along with S&P 500 reported earnings contracting yoy.

Whether we ever again have a reported “recession” is a moot point, as real private GDP per capita since ’08 is contracting and will likely continue to do so along with gov’t spending per capita for years to come.

In this context, the S&P 500 is overvalued by 65-160% vs. the 10-year avg. P/E, long-term avg. and cyclical trough reported earnings, and the dividend. Of course, the banksters and the Fed know this, which is why the banksters have directed Bubble Ben Shalom Zimbabwe’s Fed to print $1 trillion more for ’13 for the banks’ balance sheets.

Why doesnt the govt sell a few billion dollars worth of gold to the Indians and Chinese?

@Bruce Carman

“Bubble Ben Shalom Zimbabwe’s Fed”

That nearly had me in hysterics.

What are you going to do when growth is over 3% this year, Brucie?

I have been thinking over the weekend about fiscal stimulus… I heard that the fiscal stimulus since the crisis has actually favored capital income over labor income. I don’t have any figures on that though…

My question is this… Take an $800 billion fiscal stimulus package… What would the effect on the economy be if the income generated from that package was 70% capital income to 30% labor income? My research would say that the effect would be to push the economy into a contraction.

What if the split was 20% capital income and 80% labor income? The effect would be to expand available factor capacity and move the economy away from a contraction.

Does anyone know the general % split between capital and labor income generated by the fiscal stimulus since the crisis?

I am still waiting for someone to tell me where the $89billion the FED made came from. Could it actually be that the FED created the $89billion and paid itself interest to give to the Treasury? Really?

Ricardo: The Fed has interest-bearing assets and interest-bearing liabilities. The Fed’s profit is the interest it earns on assets minus the interest it pays on liabilities plus net realized capital gains. The Fed’s holdings of long-term Treasuries and mortgage-backed securities earn a lot more interest than the 25 basis points the Fed pays on reserves. This is why the Fed earns a big profit.

Gee, let’s just have the Federal Reserve buy up all the Treasury bonds issued and we’ll make even more money! This, of course, would eventually lead to the question of why the Treasury issues debt in the first place. . .

The Fed could shuffle around the books and show am 89B profit as easy as you could buy a friend a cup of coffee. It’s pocket change to them. They can just print it or even easier just create it. It’s a freaking magic show.

Your answer is a circle. What increased production allowed the FED to earn a return?

Certainly the FED earned off of Treasuries but the Treasury essentially pays that interest by money received from – wait for it – the FED. Now granted the Treasury sells securities first to the banks, but then the FED buys Treasury securities from the banks. Then the Treasury pays the FED interest on those securities and the FED then gives that interest back to the Treasury.

Now on the MBS the FED bought most of this from the GSEs. Now granted the FED earns some interest from that portion of MBS debt that is actually being serviced, but what about all that not being serviced? Perhaps we can say that the return from the MBS is interest earned on real estate mortgages.

As an aside, I wish I could write a $billion check and buy MBS and earn interest without having any money in the bank.

Explain the payroll tax portion of the bar in the top chart.

I understand why the bar is below 2% for those in the higher income levels…the tax is only applicable to the first $113k or so of income.

But, why does this graph only show a 1% impact on the lowest income levels?

Are they assuming some write down of FICA applicable wages for those making under the $113K level?

Kevin K: Please specify exactly what you refer to by “shuffle around the books”.

Ricardo at January 14, 2013 01:14 PM: The interest that the Fed receives on Treasury securities is indeed paid by the Treasury and then returned to the Treasury, which you might describe as a circle. However, if these same securities were held by the public instead of being held by the Fed, the money would flow out from the Treasury and not come back in via the Fed. Thus the fact that these securities are held by the Fed means a lower fiscal deficit than if they were held by the public. And interest on MBS is being paid to the Fed by the households who borrowed mortgages from private banks. The MBS is a security that packages groups of these mortgages into an asset whose owner receives the interest payments– that owner is now the Fed.

Rob: The tax increase is reported in the chart not as a percentage of payroll income but instead as a percentage of total cash income. The

Tax Policy Center

defines cash income as follows:

JDH wrote:

Ricardo at January 14, 2013 01:14 PM: The interest that the Fed receives on Treasury securities is indeed paid by the Treasury and then returned to the Treasury, which you might describe as a circle. However, if these same securities were held by the public instead of being held by the Fed, the money would flow out from the Treasury and not come back in via the Fed. Thus the fact that these securities are held by the Fed means a lower fiscal deficit than if they were held by the public. And interest on MBS is being paid to the Fed by the households who borrowed mortgages from private banks. The MBS is a security that packages groups of these mortgages into an asset whose owner receives the interest payments– that owner is now the Fed.

Thanks professor. I do not want to belabor the point. I think what you wrote is what I said.

Do you know how much of the $90billion was interest paid to the FED by the Treasury on Treasury securities?

On the issue of Treasury interest my point was not the mechanism but the fact that the $90billion is in large part “funny money,” essentially the government paying itself interest (since only the FED creates money essentially the FED paying itself interest).

You are right that the interest paid on the MBS is from mortgages but much of this is being subsidized by government. Additionally that portion of the MBS that is in default is simply being held on the FED’s books without recognizing a loss.

To pretend that the $90billion is anywhere closely comparable to earnings in the free economy is a joke.

JDH:

Thank you for the explanation. I understand.

Forbes is using a very interesting way of looking at the payroll tax holiday.

I doubt there is a single individual in the country in the bottom 75% who will view it in that light! All they know is that their paychecks dropped by the full 2 percentage points.