Macroeconomic Advisers estimates second quarter growth at around 0.6% SAAR. [0] Is it because of the sequester and the ending of the payroll tax rate reduction? In part, Jeff Frankel thinks so; see also [1]. Macroeconomic Advisers had predicted something over a 1% reduction in growth rate (SAAR) relative to baseline in the second quarter [2]

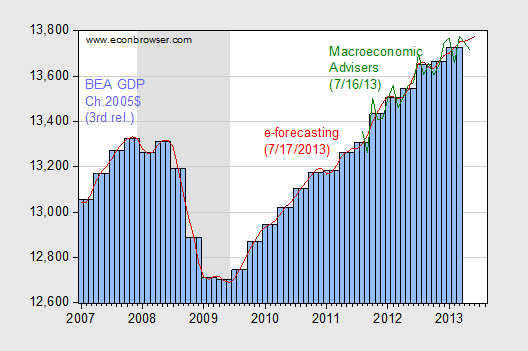

Figure 1 depicts the stakes. Nowcasted GDP growth has slowed dramatically:

Figure 1: GDP (blue bars), e-forecasting 7/17 estimate (red), Macroeconomic Advisers 7/16 estimate (green), all in billions of Ch.05$, SAAR. NBER defined recession dates shaded gray. Source: BEA, 3rd release, e-forecasting, Macroeconomic Advisers, and NBER.

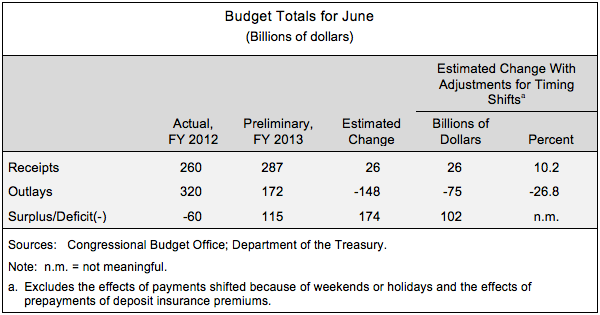

Three quarters of the MA estimated 0.6% growth in Q2 June is associated with personal consumption expenditures and net exports. What is the impact of reductions in government outlays and increases in receipts? CBO reports monthly data on the Federal series. In its June 2013 Monthly Budget Review, it’s noted that through the first nine months of the fiscal year, the deficit is $392 billion smaller than the corresponding time period in FY 2012. In principle, one would want to know what happened to the structural budget deficit, but this number is still informative.

In fact, the Federal government ran a surplus in June 2013; adjusting for timing, the June 2013 balance was $102 billion less than recorded in June 2012. Of this, $75 billion was accounted for by reduced outlays.

Source: CBO, Monthly Budget Review, June 2013.

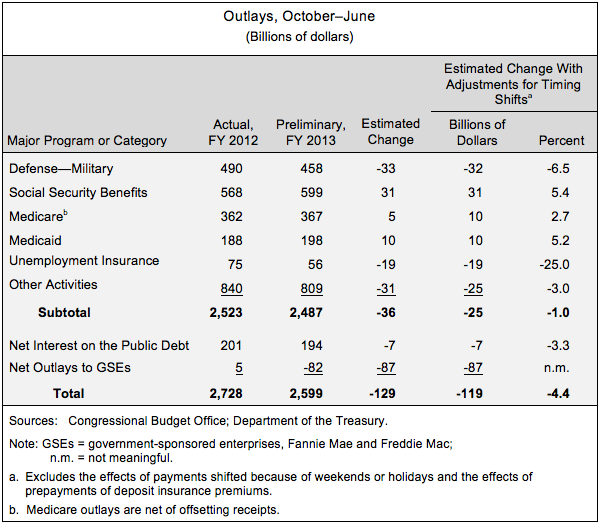

For the first three quarters of FY2012, big contributors to the decline in outlays are defense and unemployment insurance. Note these numbers are not at annual rates (AR).

Source: CBO, Monthly Budget Review, June 2013.

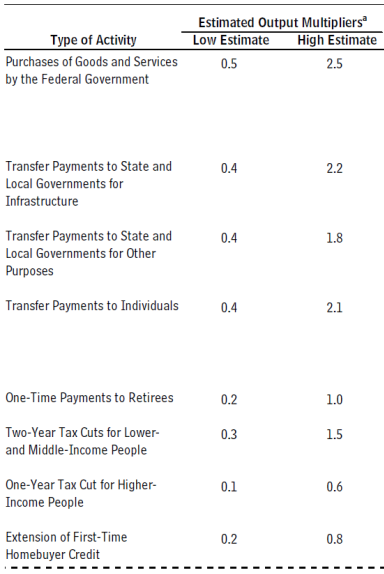

Both types of spending should have relatively large multipliers: the first because defense is largely devoted to expenditures on goods and services, the second because the marginal propensity to consume of households receiving UI payments is likely to be close to unity. CBO estimates are presented below:

Table 2 from CBO (2012).

In other words, no time for either contractionary fiscal or monetary policy.

Side note: These numbers indicate that for the first three quarters of FY2013, nominal Federal spending is decreasing, contra W.C. Varones (who hangs on to his innumeracy proudly) and Ricardo/RicardoZ/DickF/Dick.

Update, 6PM: See also Rampell/Economix on employment effects of the sequester.

Most of the reduced defense spending is due to reductions in contracted services (Have you seen how long the grass is at most Army bases? The Army actually has a slideshow that is supposed to help you identify different kinds of snakes in the high grasses…that’s the sequester solution). The really big cuts just started the week of 8 July and won’t show up in the GDP numbers for awhile.

Slugs: You can bet that lots of petty annoyances are being imposed on the rank and file in the name of budget cuts, primarily as a form of lobbying the troops. I still remember enlisted folks telling me that during the early ’90’s defense cuts toilet paper was eliminated on their base due to ‘Clinton’s dislike of the military.’

Published “outlays” numbers are net of “applicable receipts”, which in June included large GSE dividends, resulting from the accounting policy change that JDH covered. In other words the June numbers were a blip.

But anyway there’s been some 3% of GDP of consolidation and drag over the course of q1 & q2, which the economy sustained better than even most fiscal conservatives expected, not to mention the fiscal cliff scaremongers. Still to come is the drag from the end of the mortgage refinancing boom.

To borrow from Paul Krugman and Menzie, the only reason sequestration has not produced a booming economy is because it is not big enough. We need bigger, bigger, bigger cuts.

Isn’t that the mantra about flooding the markets with money – more, more, more, and when that doesn’t work, even more.

We ran a surplus in June.

Hooray!

It annihilated growth and kept people from getting jobs like the experts warned.

Boo!

When are we going to stop listening to the deficit hawks???

So the federal sequester is shaving 1% off GDP. Moody’s model has 2Q GDP at 0.5% Add 1% and you’re still only at a 1.5% rate.

Yes, the sequester is slowing growth. But 1.5% is still nothing at all to cheer about. Blaming the entirety of the slowdown on the evil Republicans and their budget cuts doesn’t pass muster.

Brian: I didn’t blame it all on the Republicans; in fact that word doesn’t appear in the post at all. Rather, it is the sequester, the end of the payroll tax rate reduction, the fiscal consolidation built-in even before the sequester, and general global economic conditions.

This article makes me cringe.

1. The army buys a bomb and blows it up. At the end of the day we have the same amout of money and fewer bombs. We’re less wealthy for this, so don’t try to say military spending has a huge miltiplier. Just because it adds to our accounting function of GDP does not mean we are actually better off.

2. The sequestration probably had a positive effect. The money was not borrowed by the govt, but it went somewhere. It was invested in something else and spent elsewhere, it’s not like if the govt doesn’t spend it, that it gets shoved under a mattress.

3. Those multipliers have awefully large ranges, but assume they are over 1.0. The govt should just borrow and spend infinity and we’d all be rich.

4. Why take anything from the CBO? They have never been right about ANYTHING EVER.

Menzie, I don’t think you’re using the right report to make the case you’re arguing.

You’re linking fiscal contraction to GDP numbers, but the CBO report is difficult to interpret in this light. I’d like to see Q2 13 versus Q2 12 and Q1 13 vs Q1 12. I was confused why we’re seeing nine month and only June data–and then I checked the CBO site, and that’s what they have. It’s a monthly, not quarterly, review. It’s difficult to see the quarterly impacts with this type of presentation.

As for employment, weekly initial claims were quite good: http://www.calculatedriskblog.com/2013/07/weekly-initial-unemployment-claims_18.html

Here’s a bit on austerity and employment in the UK:

http://uneconomical.wordpress.com/2013/07/12/les-shameless-cherry-picking-of-macro-data/

Finally, I’d add that, for the first time, I believe, global expenditures on oil and gas exploration and production will be greater than the entire US military budget.

I’ve been running my own relatively simple nowcasts based on the currently available data and have been coming up with rather more optimistic estimates in the second quarter (1.4%-2.0% real growth depending on the model). (Incidentally my estimates are more consistent with the respectable employment numbers.) I’m sure that the major modelers have access to better data than me, and their models are more sophisticated, but it will be very interesting to see the final results and where who has been wrong and why.

“Three quarters of the MA estimated 0.6% growth in Q2 is associated with personal consumption expenditures and net exports.”

Actually this is incorrect. That is true of June, not of the second quarter as a whole.

Macroeconomic Advisers:

“Implicit in our latest tracking estimate of 0.6% annualized growth of GDP in the second quarter is a 0.6% increase (not annualized) in June. Roughly ¾ of the assumed rise in June is accounted for by PCE and net exports.”

The only reason why that caught my eye is I’ve been wrestling with the data myelf. In particular net exports were a drag on growth in April and May when taken in aggregate, so I gather the June numbers must show a significant improvement.

P.S. Also I’m really curious about the June real PCE figure since nominal retail sales were up strongly but CPI soared. In fact this quarter’s nowcasts are facing far more than the usual uncertainties.

Mark A. Sadowski: Thanks for flagging the error. Now corrected in text.

Brian,

Menzie is correct. Sequester is not a Republican idea but was an Obama administration plan. The Republicans, as the stupid party, simply signed on.

THANKS OBAMA FOR THE SEQUESTER THAT HE THREATENED TO VETO IF ANYONE WANTED TO AVOID IT.

Ricardo: I don’t know where you got the quote where I said the sequester was President Obama’s idea. But I have a question that is somewhat personal. If you asked your partner to marry you, the fact that he/she did means that it was your idea and he/she was stupid enough to agree to it? This seems like the logical implication of what you’re saying.

If you’re looking for someone to blame for the sequester then blame all of Washington. It does not fall solely on Obama, nor Republicans or Democrats. The blame falls on all of them. Talking about how the sequester is a bad idea is not a partisan debate because it’s passage was not partisan either. To be more specific it passed with half of the house Democratics support and about three quarters of Republican house support. In the Senate 45 Democrats supported the measure and 2/3rds of Republicans supported the measure. Boehner said of the sequester that he got 98% of what he wanted, and Obama signed it into law. It’s not reasonable to blame this on either party alone.

Menzie,

I have never said that spending was not decreasing. We have a sequester and we have a Republican House and we are seeing the strongest signs of recovery since 2006. Coincidence?

Once again Keynesian policies are shown to be a failure. All of the money pumping of 4 years ago left us gasping for air. Making the Bush tax cuts permanent on most of Americans, allowing the sequester, a Republican House that is holding down spending, a relative stabilization of the FED balance sheet, and the Obama administration postponing the horrors of Obamacare all have contributed to a slow recovery in business.

But we are not out of the woods. President Obama and the Democrat Senate are still whining and crying to increase Keynesian policies to pull us back down, and central planning Fascists like Paul Krugman are spewing just as much propaganda as always.

Menzie,

I didn’t say that you said sequester was Obama’s idea, I think you have actually said the opposite. I was noting the fact that it was Obama’s idea regardless of what you believe or have said. His people brought it to the table in the debt ceiling debate and the Republicans signed on.

Concerning your personal question, I have no idea what your point is or what you are asking. Is it a legitimate question to make a point, or are you attempting an awakward insult?