Weak U.S. economic growth continues to be discouraging. But it’s worth taking a look at a few places where things going well for America.

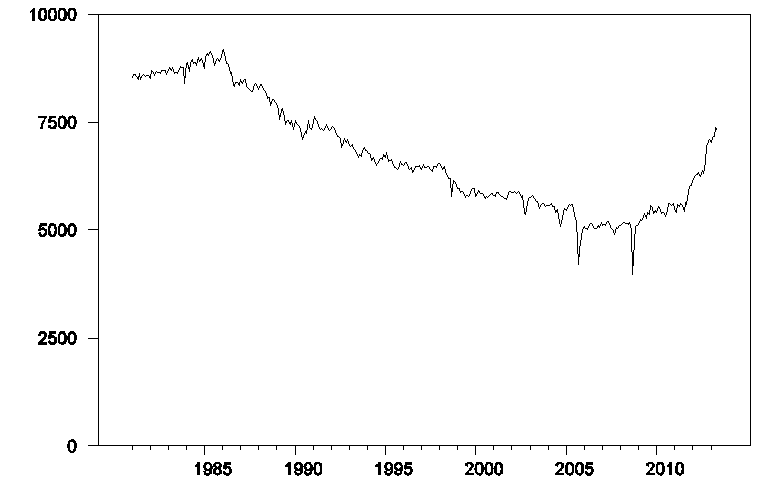

There has been a remarkable resurgence in U.S. oil production over the last few years, with levels now back up to where they were in 1992, though still 28% below the peak reached in 1970.

|

Interestingly, two states– Texas and North Dakota– account for more than 100% of the increase in U.S. production since 2009. While some other states, such as Oklahoma, New Mexico, and Colorado saw modest gains, declines in production from the Gulf of Mexico, Alaska and California were bigger than the combined gains from the states outside of Texas and North Dakota.

| Region | Change in production |

|---|---|

| US | 2041 |

| Texas | 1454 |

| North Dakota | 595 |

| US (excluding TX and ND) | -8 |

| Oklahoma | 123 |

| New Mexico | 117 |

| Colorado | 75 |

| California | -41 |

| Alaska | -56 |

| Federal Offshore–Gulf of Mexico | -348 |

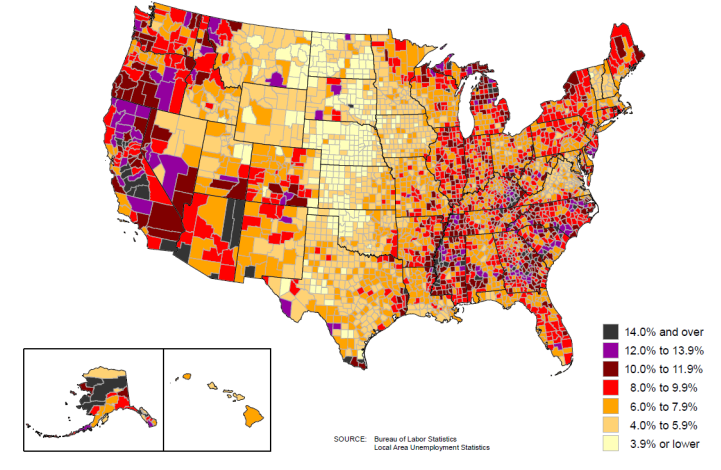

It’s also interesting, and in my opinion not entirely a coincidence, that it is the region in a central swath through the middle of the United States that has been most successful in terms of connecting workers with jobs.

|

Texas and North Dakota accounted for only 8% of all U.S. jobs in 2009, but between them produced 18% of the increase in employment between 2009 and 2013. And the energy boom in these states has clearly benefited their neighbors as well. For example, on a visit to St. Cloud Minnesota last year, I was told that many of the local carpenters and plumbers were commuting to perform work in North Dakota.

Two years ago, I proposed that supply-side policies could be key for future U.S. economic growth. The response of many people was that our economic problem was one of inadequate demand for workers and products rather than inability to produce more on the supply side. But I think the record of the last two years has shown that I was right. Demand for workers and products derives fundamentally from an opportunity for mutually advantageous production and exchange. Finding new ways to produce energy at prices consumers are able to pay is itself an effective program for getting people back to work.

Of course, it helps to have rich hydrocarbon deposits inside your borders, and most states don’t have that. But the declines in production from Alaska, California, and offshore were all the results of deliberate policy choices. Permit delays are one reason Shell’s $5 B investment in Alaska has yet to produce oil, and developing the potential of ANWR has yet to be approved. Some analysts think that California’s Monterey Shale has even more potential than Texas’s Eagle Ford or North Dakota’s Bakken, though the political challenges are daunting. The big losses in offshore U.S. production were another deliberate policy decision.

I continue to urge that those who want to help more Americans find jobs should begin with the basic question, what could America be good at?

Of course, the Mid-continent also correlates with a large food producing area, and in general food and fuel producing areas are doing pretty well in the US.

My premise for a while has been that we are transitioning from an economy focused on meeting “wants” to one more focused on meeting “needs,” as forced oil conservation moves up the food chain–as developing countries, led by China, have (so far at least) consumed an increasing share of a post-2005 declining volume of Global Net Exports of oil.

And here was my advice from six years ago, which can be summarized as “Cut thy spending and get thee to the non-discretionary side of the economy.”

http://www.resilience.org/stories/2011-08-08/elp-plan-economize-localize-produce

Job growth in many third world countries has been excellent from 2009-2013. I would not suggest emulating their business climates.

In the U.S. as a whole, occupational fatalities declined by 6.6% from 2011 to 2012. In Texas they increased by 22.6%. In North Dakota they increased by 45.4%. Absent these two states the national rate fell by 10.2%. Texas does not require provision of worker’s comp benefits, alone among U.S. states, and roughly 1 in 5 Texas workers lack this coverage.

In Texas, there are still 69% more people unemployed than 6 years previously. The median wage is lower than nationally, and workers are significantly less likely to have health insurance. State leaders have opted out of expanding Medicaid under the ACA, despite the lack of healthcare coverage in the state and the fiscal drawbacks of declining federal funds.

The state of North Dakota has a population about half that of the city of San Diego and the number of jobs added in support of the large oil boom in that state is trivial in terms of total national employment. An employment boom of similar size in California would have roughly 2% of the relative employment effect. To achieve proportional results CA would need to have several Saudi Arabias hiding beneath the surface.

Texas was among the states that did not have a real estate bubble (less than 20% appreciation 1998-2006). This means foreclosures and negative equity did not affect the economy there to the same degree as nationally. This is chiefly due to state mortgage regulations which were MUCH more stringent than most of the rest of the country. That is something we would be wise to emulate.

For thoughts on what America could do well (NATIONALLY and AT SCALE) see my comments on your post 2 years ago.

benamery21 at August 25, 2013 02:05 PM: You’re right that North Dakota only accounted for 0.3% of national employment in 2009, but it accounted for 1.4% of the growth since then all by itself. For this reason, I think it provides an excellent illustration of my point– it was a supply-side development, not demand-side policies, that produced North Dakota’s boom.

“[I]t was a supply-side development, not demand-side policies, that produced North Dakota’s boom.”

Peak Oil.

Net energy, i.e., EROEI.

“Seneca effect/cliff”.

US firms’ FDI to China-Asia for 20 years.

China and India’s unsustainable growth.

The US has doubled extraction of crude oil and substitutes since ’08 coincident with a tripling of the average price of crude oil since ’05. Look at the extraction rate since ’08 vs. known reserves and the implicit profitable cost of extraction AND the necessary rate of extraction hereafter.

Then look at the decline in crude and substitutes extraction per capita since ’70 and ’85.

These metrics are textbook characteristics of Peak Oil, falling net energy per capita, and the “Seneca effect/cliff”.

It is absolutely taboo and fatal to one’s career, academic or otherwise, to state the obvious about Peak Oil, net energy decline per capita, and the implicit implications of civilizational decline from the “Seneca cliff”.

The US is extracting as fast and at the highest price possible existing crude and substitutes at a price that is unaffordable in terms of growth per capita hereafter.

The great tragic irony with respect to Fossil Fuel civilization is that we are applying every financial and technological innovation conceivable to date to extract crude and substitutes as quickly as possible what we cannot afford as a society to consume per capita in the future, and we are referring to it as an economic, financial, technological, and political success. No doubt, the more clever technologists and imperial intellectuals among the Egyptians, Minoans, Romans, Maya, Inca, Anasazi, and Easter Islanders similarly congratulated themselves for their ability to accelerate resource consumption in the early stages of the “Seneca cliff”.

It costs the US no, or negative, growth of real GDP per capita to sustain the grossly inefficient system of resource, income, wealth, and tax receipt distribution to the top 0.1-1% to 10% of households at the cost to the bottom 90-99%. All empires and their civilizations have collapsed under remarkably similar circumstances, and the imperial elite and their sycophantic ministerial courtiers were rationalizing conditions all the way down.

Apart from the worsening Fukushima disaster, the Canadian tar sands extraction project has resulted in the largest toxic waste dump on the planet to date, whereas fracking is resulting in the drawdown and contamination of aquifers on an unprecedented scale.

One could not desire a better example of pi@@ing and sh&@ing in one’s own well than what we have witnessed since the onset of Peak Oil in ’05.

And when the self-destructive boom goes bust and centuries’ worth of deep, tight, and tar liquid fossil fuel reserves remain in the ground because they are too costly to extract and for the bottom 90% to afford to burn, rather than blame the unsustainable system that assumes perpetual growth on a finite planet, we will blame politicians, regulators, treehuggers, China, terrorists, Iran, the Fed, and who knows who else.

The bottom 90-99% cannot afford the energy system required to support the unsustainable global hierarchical upward flows to the top 0.1-1%; but to admit this challenges the basis of the credibility and legitimacy of the assumptions of the neo-liberal, imperial system of “globalization” on which world civilization relies. That few, if any, politicians, CEOs, Wall Streeters, academic scientists, or eCONomists can publicly concede this strongly suggests that forthcoming “solutions” will only add to the costs of future “solutions” and associated complexity.

No sensible person will dispute that micro supply-side measures can help here and there (supply-side me and I’ll contribute to your economy) but you fail to address the real question: could these and similar measures help the macro? Nope, because well because fallacy of composition, Keynes and all that.

pat toche: Are you saying that North Dakota’s gain was somebody else’s loss? Whose, and how?

Mr. Hamilton,

I am curious as to the specific supply side policies you see in contributing to the spectacular oil boom in North Dakota. ND has some of the highest oil production and extraction taxes in the country (combined they are 11.5%). ND also has major supply side issues, such as a lack of affordable housing, damaged roads, etc. Counties have often forced oil companies to put bonds on the roads they use, placed moratoriums on building man camps used to house workers, etc. In addition, a large number of wells in ND are on the Fort Berthold Indian Reservation, and are thus subject to the laws of the federal government (bia) and that of the affiliated tribes. On the rez there are an incredible amount of regulations and some of the highest royalties in the country (I have heard 18%+).

As a side note, other things have happened in North Dakota: The installed wind generation capacity in North Dakota increased from 714MW at the beginning of 2009Q3 to 1680MW at the end of 2012, or 235% of the starting level. North Dakota now has the highest per capita installation of wind power of any state in the country. The current installations supply about 15% of the state’s kwh generation (this is only 3rd in the country, due to the large power sector in ND supported by power exports to Minnesota). Interestingly, the next states in order by per capita installations are: Wyoming, Iowa, South Dakota, Kansas, and Oklahoma.

According to the 2012 Ag Outlook from ND State, Farmland values (based on returns) in North Dakota increased 44% to $1414/ac from 2008 to 2012 on the back of ag commodity prices. This is 289% of the 2004 value. Prices have outpaced these increases. That’s about $50K per state resident in land appreciation, which is based on actual ag sales. I may be mistaken, but I believe North Dakota has more cropland per capita than any other state due to the small population.

Counting from the beginning of 2010, instead of the beginning of 2009 makes a huge difference in the relative job performance of ND and the nation. It looks to me as if the number of workers employed in ND from Jan 2010 to now increased at ~0.45% of the national rate. The big difference is that employment was headed down nationally in 2009 (over 4 million fewer employed in Jan 2010 than Jan 2009), while growing much more rapidly (albeit not as fast as desired) since (employment rose more than 6M). Using the sum of these two numbers as your divisor for job growth in North Dakota masks the actual relative rate of job growth during the recovery.

Author, an excellent read! Thank you most kindly.

Professor,

I am stunned – not by your post but by the ignorance of those who cannot grasp what you are saying. Now I don’t actually mean those posting here. I mean the real policy makers who seem to be doing all that they can to prevent prosperity. How many do not understand that if the Progressives could they would shut down the oil boom in a heart beat?

I will say that one thing monetary expansion did is raise the price of oil to such a point that it was profitable even in the face of such opposition. Sadly, the monetary expansion has drained the rest of the economy to fund the commodity boom.

I find it interesting that Prof. Hamilton attributes the oil boom in Texas and ND to supply side policies. Obviously, the increase in production has been spurred by higher oil prices due to an increase in worldwide DEMAND coupled with a decrease in production over the last few years due to Peak Oil and the recession. Energy is an industry where DEMAND has driven job growth, not supply side policies.

I agree with Jeffrey Brown that what we are witnessing is an economic shift focused more on ‘needs’ than ‘wants’. This demand for basic commodities is forcing prices up in all of these markets (energy, food, lumber). As the population grows and resources are more constrained, more income will be spent on commodities (needs) to feed, clothe, house and power the world’s people. As people shift their income to cover the cost of these basics, there will be less left to pay for more discretionary items. One way to offset this trend would be to find a way to increase wages so that more money would be left for discretionary purchases. Then we would see job growth, especially in America, which employs more people as a producer of many discretionary products and services (mostly services)than it does in commodity production. (see http://www.bls.gov/cps/cpsaat09.htm )

This is a good post, as many others of yours, and I think that you are right. And I agree with Bill McBride that the next couple of years are going to be “bright”.

Frac Jesus and Gridlock: I apologize if I was unclear. I attribute North Dakota’s and Texas’s economic growth not to “supply-side policies”, but rather to the good fortune of having rich hydrocarbon deposits within their borders. However, it is a policy decision whether these are allowed to be developed. Some states have chosen to do so, others have not.

My point in calling attention to the supply side is to emphasize that those who maintain that only aggregate demand stimulus could help our current situation are mistaken.

Now, correlate the unemployment rates you show with changes in population over the last 20 years. A large number of the counties in that central swath of the country with low unemployment have also experienced shrinking populations. The Great Plains in particular are “dying” in the sense that the population is leaving (although many other rural areas are seeing the same pattern). The ND oil boom may have given Williston a temporary boost; but it’s temporary, an aberration in rather than the reversal of a trend that’s been going on for most of 75 years.

Professor,

There is not need ot apologize about your discussion of supply side driving recovery in the oil states. It is true.

As you note the boom has not been in California even though they have huge untapped reserves. Also New York has prevented increased supplies of oil production while surrounding states are beginning to see recovery because of increased oil production.

If Frac Jesus and Gridlock understood supply side they would understand why the oil growth is happening where it is. They simply parrot the confusion of the MSM that supply side is only about taxes.

JDH –

If you want to talk about the geography of success, why not look at Silicon Valley? Pumping hydrocarbons out of the ground isn’t something the US has some unique competitive advantage at. How about looking at the wealth and success generated by Google, Apple, and Facebook?

Additionally, if you want to attribute unemployment rates to hydrocarbon extraction policies, shouldn’t you show the difference in employment rates since 2005 or so? That swath of the midwest always has low unemployment because no one lives there.

The lack a commercially successful well in the Monteray Shale has nothing to do with supply side policies.

But would any of these supply-side discoveries have occurred if it weren’t for the constantly rising demand for energy?

http://en.wikipedia.org/wiki/File:World_primary_energy_consumption_in_quadrillion_Btu_by_region.svg

http://www.worldoil.com/Oil_supply_demand_by_quarter_Graph_March_2013.html

And exactly when did these discoveries make oil more affordable. Oil hasn’t gone below $70 for several years now and the price of gas is now permanently above $3.00 a gallon when it used to be below $2 with some regularity only a decade ago.

In fact, these new techniques of Shale oil drilling, as I understand it, are only profitable at $70 a barrel or above. If demand were not high enough to support that price, no one would be drilling that oil or using the tar sands oil from Canada.

Re: “Texas does not provide worker’s comp benefits” Funny, I went to a couple TX worker’s comp lawyers websites and here is what they said:

The Texas Labor Code provides that if a Texas worker is injured in Texas or while working outside of Texas, they are entitled to Texas Workers’ Compensation benefits.

Maybe TX doesn’t require that employers purchase workers comp insurance – in other words, they can self insure. So long as the tort system in common law remains in effect an employer can’t get out of responsibility for his employee’s injury if he was at all negligent. Besides TX law requires it.

The desperation of find something, anything to ‘prove’ that TX is really an evil, nasty BushHilter kind of place would be funny if it weren’t so pathetic.

Perhaps instead of poo pooing TX, you might learn from them? Just a thought.

it is a good post to follow the famous saying ‘think positive, be positive.But this time it will be wrong for US.

JDH finds hope in “… Finding new ways to produce energy at prices consumers are able to pay …”

Bruce Carmen says “…rather than blame the unsustainable system that assumes perpetual growth on a finite planet…”

Who is right?

As far as I can see carbon based energy is a limited source of energy almost by definition. What comes after we cannot extract sufficient energy to keep us in the style to which we have become accustomed?

Is JDH just doing some short term thinking and ignoring the long term?

Texas does not require employer provision of workers comp benefits. This is clearly stated on the state website linked below. In practice this means that roughly 1 in 5 Texas workers are not covered if their non-subscribing employer is not solvent or, if the employer does not act in good faith, will be required to use the courts, under burden of proof of employer negligence, to ATTEMPT to obtain recompense AFTER having needed it. There’s a reason EVERY OTHER STATE requires the worker’s comp no-fault system.

http://www.tdi.texas.gov/consumer/wc.html

I learn from Texas regularly. It’s usually how NOT to do it. However, if you read my comments upthread you will see a hat tip to Texas on mortgage regulation.

Ricardo –

The Monterey shales in California are indeed large and extensive. However, they lack the gas drive found in the Eagle Ford and the Bakken, and therefore current fracking techniques have not been successful there. This is not, however, a failure of California policy as I understand it–the shales lie under existing conventional fields. I don’t believe there’s an access issue.

DMS – As you state, high oil prices matter. It’s not entirely clear that shale oil production is, in fact, broadly profitable on a full cycle cost basis.

Uber – Apple’s sales are large enough to move the GDP needle on an order of magnitude similar to Texas and ND shale oil extraction.

Professor, you say:

“I continue to urge that those who want to help more Americans find jobs should begin with the basic question, what could America be good at?”

One has to be careful, when asking that question, that we do not fall into some kind of dirigiste French Industrial Policy, that is directed by some politically appointed bureaucrat.

Let the market decide what America could be good at. Let the market decide, without the heavy-handed way of the administrative and regulatory state (federal and state), and the jobs for all Americans will follow suit and fast.

Steven Kopits,

You are much more knowledgable about oil production than I am so I would not contradict you. It seems from what I have read that the Monterey shales have not been exploited primarily because until recently the state has prevented pressure pumping to fracture the rock formations.

Of couse the California Democrats are licking their chops at the money they might be able to tax away from a booming oil industry so environmentalists are not as welcome as they once were. Three bills presented to the legislature to restrict fracking failed to pass.

But Monterey is not the only source. Kern Country is also looking at increasing permits.

Who knows, out of desperation, California may in fact institute supply side policies as it applies to oil production.

…what could America be good at?

Well, we’re pretty good at keeping the sea lanes open. Pax Americana. That should count for something. We have first rate universities that grab the lion’s share of Nobel prizes in physics, so we ought to be good at research into Gen-IV breeder reactors. We are blessed with a lot of wind, even outside of the Beltway, so wind energy is an advantage. Lots of empty spaces that can collect solar energy. We also have a big advantage in controlling what is by far the biggest share of the world’s fresh water; which is something that North Dakota carbon products threaten. We also have (or at least had) an advantage in Gulf shellfish. Thank you BP for all those reassuring commercials. I would hope that the US could do better than pulling oil and gas out of the ground, which is something that any 7th century tribal warlord in the desert could do.

I’m not convinced that low unemployment in the central swath of the country is connected to oil & gas extraction in North Dakota and Texas. A more likely answer would be massive crop failures in other parts of the world. US corn production this year could break the 100 million acre threshold, with so much marginal land being brought under the till that per acre yields are expected to fall significantly despite favorable weather. John Deere hasn’t been reporting quarter after quarter of record profits because North Dakota is pulling up oil.

Michigan opened up its shale to development just like North Dakota did.

Does it bother you, as a highly honored and successful academic, to be a shill for the tea party?

I challenge you, Professor Hamilton:

How does the policy of North Dakota differ from that of Michigan, when it comes to petroleum exploration?

Do you know?

Have you ever investigated it?

I bet not.

If I am wrong, I will be happy to suffer the consequences.

But I would think that an esteemed academic such as yourself would have researched the difference between Michigan and North Dakota mineral development policies before attributing a causal relationship to such policies.

Steve Mann

Associate Professor of Finance

TCU

http://oilshalegas.com/antrimshale.html

If as few as a second-order Pareto distribution, i.e., ~4%, of readers, regular participants, and lurkers of this blog were fully informed about Peak Oil, net energy (EROEI), oil exports per capita, exergy, and the power law, log-linear Pareto Seneca effect, we could have an informed discussion and at least have the opportunity to frame properly the conditions facing Fossil Fuel Era civilization at the onset of the Seneca cliff, as Steven and Jeffrey have to date contributed significantly; otherwise, we’re like the tar sands and shale field hard hats pi@@ing cheap beer into the whirlwind we’re reaping.

Like the hard hats after a long night of overconsumption of Coors, Pabst, Strohs, and Miller, we’re staring down with bleary eyes a new day accompanied by some serious hangover pain for which no over-the-counter remedy exists. The hair of the oily dog that bit us ain’t the cure for the post-Fossil Fuel Era hangover.

Weird Steve Mann: I have nowhere suggested that North Dakota’s mineral policy is superior to that of Michigan. (1) Why do you think I have made such a claim? (2) Why are you so angry about something that you made up? (3) Why do (1) and (2) make you feel so self-righteous?

“I have nowhere suggested that North Dakota’s mineral policy is superior to that of Michigan.”

“It’s also interesting, and in my opinion not entirely a coincidence, that it is the region in a central swath through the middle of the United States that has been most successful in terms of connecting workers with jobs.”

I am sorry you find me angry, Professor Hamilton.

You certainly implied (i.e., “in my opinion, not entirely a coincidence”) that energy development policies were associated with unemployment.

I provided you an example of a state that has enthusiastically opened its borders to energy development, but has horrible unemployment nonetheless, and, if you look at the two maps (comparing Antrim shale to unemployment), the area of shale development appears to be the area of highest unemployment in Michigan.

Have you analyzed the number of wells drilled in New Mexico?

Michigan?

I assure you, they have drilled a LOT of wells in New Mexico, yet it continues to have high unemployment.

What analysis, based on facts, support your opinion that “it is not entirely a coincidence”?

If I appear angry, prof, it is because I expect more from my role models.

weirdness: No, I did not imply that energy development policies were associated with unemployment.

You have simply misread and misunderstood what I wrote.

I invite you to reread it on the assumption that every word was written by someone reasonable, rather than with whatever strange filter you applied.

And if you find something that you think could not be given a reasonable interpretation, let me invite you to pose your question as, “did you mean to say or imply x?” rather than jump immediately into name-calling.

Is there any truth to the quote below? If so does a similar process exist on earth that may generate petroleum deep in the earth without the need for decaying biological organisms?

We estimate that Titan “contains more hydrocarbon liquid than the entire known oil and gas reserves on Earth,” says Ralph Lorenz of Johns Hopkins University’s Applied Physics Laboratory.

http://iceagenow.info/2011/10/lakes-oil-saturns-moon-titan/

After going back through and reading some of Mr. Hamilton’s linked articles I better understand his point. The US needs to do things smarter and better than the rest of the world to have a bright future, and he thinks that oil and gas specifically is where the US can excel.

I can’t help but agree with that point. Why?

1. US current account deficit is large, to re-balance we need exports. Oil happens to be the #1 reason why the deficit is so large. Seems a natural choice.

2. The US has some of the most experienced oil and gas workers in the world.

2. The US needs a well educated work force to remain competitive at the international level. Anyone working in the E&P industry has hopefully started to see the trend towards oil companys hiring young college grads when I believe not too long ago this simply was not the case.

Thanks for this, especially the reiteration of the question: “What could America be good at?”

It’s a very easy and yet very tough question to answer. The peculiar problem we have is that we are so good at some things it raises costs across the economy and makes many kinds of activities here cost-prohibitive. That’s the ultimate problem.

Treating that problem as a demand-side problem means a policy of redistribution, which is arguably more fair, but increases costs further and squeezes marginally viable businesses. And you won’t build a strong welfare state on a weak economy. You’re likely to instead provoke a backlash and end up poorer and less fair than you started.

So thinking about the supply side is critically important.

What we don’t need though is more so-called “supply side economics” a la Reagan and Dubya, that focuses on reducing taxes on the wealthy. Our very wealthy are already paying low effective tax rates, forcing too much of the tax burden on small business and upper middle class professionals.

As for fracking, it has been a bigger boon to the US economy than most people realize. Our fracking technology is amazing, a productivity frontier, the absolute opposite of what slug said. We have, luckily, been given a bit of a reprieve in global warning for the last 15 years or so – no one’s really sure why – so I don’t see the environmentalists winning the war to stop fracking anytime soon.

What we need to watch out for is the likelihood that the fracking boom will end as suddenly as it started. The depletion rates of frack wells are very rapid. Combined with a lack of new conventional and deep offshore wells, a sudden decline in frack well output would produce a shockingly sharp production decline. I don’t think any of us know how much better the technology will get or what exactly the difficulties in Monterey are, so we can’t know how long the fracking boom will last. But it seems very unlikely advances will be so great that frack wells will last anywhere near as long as conventional.

Professor Mann, despite the drilling in New Mexico production is lagging that of North Dakota and Texas which is reflected in the employment numbers…

JDH-How about some facts rather than your coincidental opinions?

http://www.deptofnumbers.com/unemployment/north-dakota/

The unemployment rate in North Dakota has been below 4% for the last 20 years, with the exception of a brief period in 2008-2009 during the recession. It is about the same as it has been.

How about Texas then?

http://www.deptofnumbers.com/unemployment/texas/

Nope, the fracking boom in Texas doesn’t seem to correlate with unemployment rates at all, either.

Well maybe they did better than other Midwest states without much oil and gas. How about Nebraska as our counterfactual?

http://www.deptofnumbers.com/unemployment/nebraska/

Well, Nebraska has less of a cycle than Texas, but isn’t as flat as Nebraska. And unemployment is maybe a little higher than it was in 2005 in Nebraska, but a little lower in North Dakota.

Certainly nothing conclusive.

How many jobs? Well, the direct number of jobs in mining and logging in North Dakota went from 15,500 in December 2007 to 21,000 in March 2012. That’s 5500 direct jobs over 4+ years, or a whopping 1400 jobs a year.

In contrast, Google went from 16,000 employees in 2007 to 32,000 in 2011.

Great post! James is of course correct. There is good evidence to suggest that anti-industriy and pro-financial services policies have hurt certain states. The good news is that the general high unemployment among the poor in these states (even if the elite are much richer) will hopefully open doors to a new industrial cycle that can put people back to work. The question is when will the elite’s control of MSM and the to-big-to-fail financial scams and environmental scams/scares end?

Surely at some point the poor are going to wake up and smell the roses and elect those who encourage supply side economics and jobs -those who approve big infrastructure projects like pipelines rather than throw trillions to support their financial friends. How long before a pipeline is appreciated for the true economic benefits it brings? How long before a financial vampire squid is recognized as an economic parasite sucking the life blood out of true economic activity!

To the extent we increase domestic oil production and substitute it for imports, we do shift “demand” into the United States from the Oil Exporting countries per the National Account equations and identities of U.S. and its oil trading partners.

I do question Professor Hamilton’s adoption of the fossil fuel production and transportation industries hostility and propaganda regarding environmental regulation (the chief reason Gulf of Mexico exploration has slowed the last 4 years is perhaps due to BP’s prioritizing cost control over safety and environmental protection in its operations) and the economic externalities that allow these companies to shift costs (both in lives, dollars, and natural world) to others when spills and damages occur (for instance, there has been three major pipeline spills over the last 4 years, the most recent in Arkansas – the homeowners in area have all seen a major drop in the value of their properties, but except for the few houses actually inundated with oil, both the pipeline operator and Exxon-Mobil hard line about paying any claims and costs). Further, fracking uses a great deal of water, and particularly in the Western U.S., including California, water used for fracking will be lost to other purposes such as agriculture and drinking. Finally, it seems that experiments with Austerity in Europe and the U.S. now, and Japan in the 1990s, show that when interest rates are near the zero lower bound and private demand is weak due to “deleveraging” (paying down or defaulting on debt), reducing Government expenditures will slow economic growth as demand contracts until devaluation (internal by decline in real wages or external in terms of foreign exchange) causes a rise in net exports and thereby “import” demand into the economy (and we are back to how U.S. oil production “steals” demand Nigeria or Mexico to boost employment in Texas and North Dakota).

A grade of A+ on this quote, Professor Hamilton!

“But the declines in production from Alaska, California, and offshore were all the results of deliberate policy choices.”

As I have so often stated with the “declining” Peakers, that around 80% of the world’s crude reserve is controlled by government.

Even Socialist Mexico is suggesting the end of state control (monopoly) of it’s goo production and reverses.

What is government GOOD at, gumming up the works..

Hans,

It’s certainly a relief to know that absent government interference, there is no problem maintaining an infinite rate of increase of our consumption of a finite fossil fuel resource base.

uber_snotling at August 26, 2013 07:55 PM: The average unemployment rate in North Dakota between Jan 1976 and Dec 2007 was 4.1%, compared with 3.0% today. The national unemployment rate averaged 6.2% over 1976-2007, compared with 7.4% today.

I’d also be interested to hear your interpretation of the following numbers, which have been provided above but on which you have so far not commented. In July 2009, North Dakota accounted for only 0.3% of all U.S. unemployment, but the state accounts for 1.4% of the national increase in employment since then. Texas and North Dakota together accounted for 8% of all employment in 2009 but 18% of all the employment gains since then.

Ricardo: Frac’ing has been going on in CA since the 50’s with almost no regulation, efforts to regulate it are very recent (Texas and Louisiana have had significantly more stringent regulations, whether or not they are stringent enough). There have been about 20 times as many wells drilled in CA as in ND. There are, last I checked (take a look at DOGGR if you don’t believe me, it may have changed), still typically more wells drilled annually in CA than in ND.

Within the last two weeks I have reviewed (as an electric utility senior engineer) several multi-megawatt oilfield electrical services. Three of these involve 1750HP injection pumps for waterflooding, and numerous VFD driven 50HP submersible oil pumps for new individual wells. Another (20 MW or so), as I understand it, involves separating oil, water, gas, and liquids from a wide area collection system and providing small storage and takeoff for truck collection. Another was a repower at an existing wellfield (once owned by Stocker Resources, but no longer) that I’ve been involved with off and on for 15 years. All of these were in heavily builtup areas of urban LA county with significantly more population than the entire state of North Dakota. In the not too distant past my company was part owner of a LARGE (100’s of MW’s) gas-fired co-generation facility in Kern county (more rural but still with more population than ND)which was sited to provide steam as part of EOR for injection to produce heavy oil (my involvement in the facility was limited to touring it, and a few meetings on transmission impacts, as that part of the county is outside our service territory and I’m a “wires” guy).

California is currently (last year, and last EIA reported month) producing more oil than Alaska despite having older fields than Texas; serving as port of entry to much of PADD V’s oil, and refining and trnsporting product to AZ, NV(until recently the only source), and OR.

Does CA set some sites offlimits to new drilling? You bet. Do oil companies have to jump thru hoops to work in a densely populated, seismically active, and ecologically fragile state? You bet. Do I have my own frustrations with sometimes inept regulators, clueless citizens, and politically spineless politicians? Sure. Is CA anti-oil? Not even close. You may not be aware, but CA doesn’t even have a severance tax!

The U.S. has about 5% of the population, 10% of the oil production, and 20% of the oil consumption on the planet.

One of the things we could do well, and would do well to do, is to invest in reducing that last number via investment in conservation, not curtailment. Note that less than half of our consumption is personal auto use. There are benefits to conservation beyond the direct financial benefit to the end-user.

P.S. Yes I know those numbers aren’t exact.

Bena –

For the three months ended July 2005, the US represented 25.3% of global oil consumption (EIA STEO data).

For the same period 2013, the share was 21.0%. That’s a decline of about 0.5% share per year. We should anticipate such a pace to continue. Thus by 2020, the US share is likely to be around 18%.

If this is progress for you, well, congratulations. Personally, I believe that this will cause the US economy to continue to struggle. JP Morgan recently announced that they think the US potential growth rate is now only 1.75%, a finding entirely consistent with the likely path of US oil consumption.

Regarding the jobs in the Dakotas and Texas, I think much of this is only indirectly related to the energy development industry as most of is probably residential construction. And both states were not greatly affected by the housing bubble, and hence did not suffer as much from the housing bust that occurred from 2006-2012 as documented by Bill McBride at Calculated Risk. So in a sense energy development and consequential construction serves as a demand “multiplier” in those states. California, “socialist” it may be, is creating 38,000 jobs a month now, and besides oil, it has entertainment and tech development as two things America does very well.

The depletion rates of frack wells are very rapid.

http://ftalphaville.ft.com/2013/08/21/1594492/is-the-shale-forecast-curve-hyperbolic-or-exponential/ – “we’ve spent a lot of time in the last two years scouring for the next Eagle Ford, for the next Bakken… to date we’ve been disappointed by the emerging shales we’ve encountered.”

Kopits: As I have been clear about here in the past I see investment to reduce structural dependence on oil and thus reduce usage at a faster pace without reducing utility as very different from curtailment caused by pricing the poor out of the energy market. As an example I support federal funding of heating oil furnace replacement with non-oil heat sources. If you don’t see reducing our trade deficit, putting money in Americans’ pockets, and putting Americans back to work as progress, then I don’t know what to tell you. There are very few good reasons to still be using heating oil in the U.S. in 2013. Upfront cost with no credit is one of those reasons we can solve for people while helping everybody else simultaneously.

Hans,

It’s certainly a relief to know that absent government interference, there is no problem maintaining an infinite rate of increase of our consumption of a finite fossil fuel resource base.

Posted by: Jeffrey J. Brown at August 27, 2013 06:51 AM

Mr Brown, you should be pleased to known, that man left the Stone Age with a plenty of supply left behind.

BTW, could you give me a single mineral that mankind has exhausted? Please take your time!

Bena –

Let me make a broader case.

We can posit the Oil Efficiency Law (OEL), which states that oil efficiency gains exceeding 2% per year are likely to reduce social welfare. The historical record suggests this is probable.

Assuming a flat oil supply and targeting 3% GDP growth, we would have to increase oil consumption by 1% per year, or about 190 kbpd, to be consistent with the OEL. If we believe oil consumption will fall by 1.5% per year, then we need to find another 285 kbpd. Thus, achieving 3% GDP growth would require finding alternatives equal to nearly 0.5 mbpd / year, and that’s just for the US.

How much is 0.5 mbpd? Well, the average car consumes about 500 gallons of fuel per year, say, 9 barrels for round numbers, and let’s assume transportation represents 70% of oil consumption. As such, 500 kbpd equals the consumption of 13 million vehicles. In turn, this would split into 5 million new, non-oil fueled vehicles per year; and the conversion of 8 million vehicles currently in service to alternative fuels. As new car sales are about 15 m per year; roughly a third of new car sales would have to be non-oil based. (Actual vehicle sales would be higher, probably around 18 m units.) If you’re trying to solve the whole problem with new car sales, then about 2/3 of all new car sales would have to be non-oil based.

That’s a very, very big change from where we are today. And of course, we’d have to be making analogous adjustments for other oil uses, including oil heating.

Now, the question arises as to whether such a pace of adaptation is possible. Can we come up with a new type of vehicle that can take a 60% market share, unsubsidized, against gasoline and diesel-powered vehicles? And do so in the next, say, 5 years? I think that’s very big challenge, and a reason why we’re seeing the adjustment occur primarily on the demand—GDP growth—side.

So, Bena, it’s not that I disagree with you. But I am concerned that you may be under-estimating the size of the challenge by as much as two orders of magnitude. This is not fiddling at the margins; it’s about fundamentally re-organizing society’s energy usage.

Hans –

The Stone Age ended because i) the supply of stones was much greater than the demand for stones; and ii) technological innovation. (On the other hand, I imagine Stone Age people didn’t heat their dwellings with stone.)

In the oil age, the first condition is clearly not met. Annual oil consumption totals about 30 bn barrels, on an endowment of about 2 trillion barrels. Thus, more than 10% of the endowment will be consumed in a decade, and therefore a century is a very long time in terms of oil resources.

As for the second condition, can we find a better fuel than oil? If you work with oil, over time you will come to appreciate its unique properties; it is virtually the penicillin of energy. It’s cheap, relatively easy to produce and refine, has high energy content, is liquid at room temperature, burns but does not explode, is portable, and is suitable for internal combustion engines. It’s a miracle fuel.

We don’t know of anything else that comes close. Perhaps CNG, maybe methanol (from natural gas). But we don’t have a substitute nearly as good, and precisely why the overwhelming majority of the world’s vehicles run on oil-based fuels. Its monopoly on transportation fuel is a testament to the real superiority of oil compared to any large scale alternative.

Thus, the oil age is in fact likely to end—or more precisely, wind down—due to a lack of affordable oil. We are already in the transition. The US vehicle fleet is 1 car in every 6 off trend; US commercial airline departures are 1 in every 3 off trend. The days when oil could power the growth of the advanced economies is already over, something we can see clearly in the weak GDP growth numbers from the OECD.

Hans,

Perhaps you could lead an effort to repeal the Second Law of Thermodynamics:

http://en.wikipedia.org/wiki/Second_law_of_thermodynamics

Let’s assume that the Peak Oil “Theory” states that the finite sum of discrete sources of oil that peak and decline will also peak and decline.

What puzzles me about the Peak Oil “Theory” is dead stories is the following: If the “Theory” is wrong, what’s the alternative theory? That the finite sum of discrete sources of oil that peak and decline will show a perpetual rate of increase?

It’s particularly ironic that a (so far) post-peak region, the US, is used as an example to claim that the Peak Oil “Theory” is dead.

While currently increasing US crude oil (crude + condensate) production is very helpful on a number of fronts, it is very likely that we will continue to show the post-1970 “Undulating Decline” pattern that we have seen in US crude oil production, as new sources of oil have come on line, and then inevitably peaked and declined (US crude oil production, which will probably average about 7.5 mbpd in 2013, is currently about 25% below the 1970 peak rate of 9.6 mbpd).

For example, EIA data show that crude oil production from Alaska increased at 26%/year from 1976 to 1985, which contributed to a secondary, but lower, post-1970 US crude oil production peak of 9.0 mbpd in 1985 (up from a low of 8.1 mbpd in 1976), versus the 1970 peak rate of 9.6 mbpd. Because of the strong rate of increase in Alaskan crude oil production from 1976 to 1985, the US was actually on track, in the mid-Eighties, to become crude oil self-sufficient in about 10 years, but then the inevitable happened, and the rate of increase in Alaskan crude oil production slowed, and then started declining in 1989, resulting in a post-1970 “Undulating Decline” pattern. Note that the 1976 to 1985 rate of increase in annual Alaskan crude oil production (26%/year) exceeded the estimated 2008 to 2013 rate of increase in combined annual crude oil production from Texas + North Dakota (20%/year).

The very slow increase in global crude oil production since 2005 (with average annual post-2005 global crude oil production falling below the 2005 annual rate for seven straight years), combined with a material post-2005 decline in Global net oil exports, have resulted in high crude oil prices that have provided considerable incentives for US oil companies to make money in tight/shale plays. But I think that the assertion by many in the Cornucopian camp that shale plays will result in a virtually infinite rate of increase in global crude oil production is wildly unrealistic.

We are facing high–and increasing–overall decline rates from existing oil wells in the US. At a 10%/year overall decline rate, which in my opinion is conservative, the US oil industry, in order to just maintain the 2013 crude oil production rate, would have to put online the productive equivalent of the current production from every oil field in the United States of America over the next 10 years, from the Gulf of Mexico to the Eagle Ford, to the Permian Basin, to the Bakken to Alaska. Or, at a 10%/year decline rate from existing wells, we would need the current productive equivalent of 10 Bakken Plays over the next 10 years, just to maintain current production.

On the natural gas side, a recent Citi Research report (estimating a 24%/year decline rate in US natural gas production from existing wells), implies that the industry has to replace virtually 100% of current US gas production in four years, just to maintain a dry natural gas production rate of 66 BCF/day. Or, at a 24%/year decline rate, we would need the productive equivalent of the peak production rate of 30 Barnett Shale Plays over the next 10 years, just to maintain current production.

The dominant pattern that we have seen globally, at least through 2012, is that developed net oil importing countries like the US were gradually being forced out of the market for exported oil, via price rationing, as the developing countries, led by China, consumed an increasing share of a declining post-2005 volume of global oil exports.

For more information on net oil exports, you can search for: ASPO + Export Capacity Index.

bena,

You may have missed what I wrote: “Of couse the California Democrats are licking their chops at the money they might be able to tax away from a booming oil industry so environmentalists are not as welcome as they once were. Three bills presented to the legislature to restrict fracking failed to pass.”

The only thing more important to a California politician than controlling entire California production and money is their love of money – but then I guess that is really the same thing. Of course California loves oil production. If I left any other impression it was not intentional. But California also love enviro-nuts and so they have been restricted in the exploitation of their oil resources for a number of years. Over the past few years necessity has cause them to once again allow the oil companies a measure of freedom.

Ricardo: Your understanding needs adjustment to fit reality, including the difference in severance taxes between the #3 and #4 oil states. Are greedy Dems just waiting to pounce on the ‘infant’ CA oil industry?

Kopits:oil for personal autos is less than 50% of U.S. consumption (motor gasoline is about 45 percent). The difference from the commonly quoted 70 percent is planes, trains, and trucks, etc. Most of the non-auto consumption would be easier to quickly reduce/displace than auto consumption.

Talking head on CNBC this morning (Simon Hobbs at 10:31 AM Eastern time) had the following question for his two oil experts, John Kildauf and Addison Armstrong:

I didn’t hear anyone correct him (the US is dependent on imports for about half of the crude oil that we process in US refineries).

And so it goes. No wonder there is so much confusion about what is actually going on in global oil markets.

Interesting post, and even some occassionally interesting comments. Some observations: (1) the claim about declining populations in the Great Plains is true–it’s been going on for a number of decades. This would be one reason why there is so little infrastructure in North Dakota to support the recent job surge, if that’s what it is. Once the resource is depleted, those folks will clear out, and the long term trend will likely kick back in; (2) How good an idea is it, really, to go back to an extraction economy? (Warren Buffett may or may not think it’s a good idea, but he sees it happening–in an extraction economy, you want to own the railroads.) Especially when externalities still aren’t being factored into what one would hope would be reasonable economic analyses–like this one. Low unemployment is a good thing, to be sure–what sort of environmental costs are being racked up to be picked up by taxpayers later on? (3) “Deliberate policy choices”–this tends to obscure the range of rationales behind this, doesn’t it? And, frankly, it implies that the thinking underlying these choices is somewhat arbitrary, and can be reversed on a whim. Yes, these are deliberate policy choices–which means there are multiple objectives, as is often the case. And the citizens of those states may be perfectly content with this state of affairs.

Bena –

You are correct. (Also, there are 42 gallons in a barrel of oil, not 55.)

With those adjustments, we’d need a bit more than 7 million non-oil fueled passenger vehicles annually, about 40% of total new car sales, I would guess (assuming that vehicle sales would be above current levels).

And a similar number for aircraft, trucks, trains, industrial and residential uses. It’s a big number, either way.

JDH: “weirdness: No, I did not imply that energy development policies were associated with unemployment.

You have simply misread and misunderstood what I wrote

…”

Dear Prof Hamilton,

Apologies for calling your point a teabagger point. Apparently, I failed to understand your point.

I understood your point to be that restrictions on drilling in the high unemployment areas were associated with the high unemployment.

ASltenrativel;y, I undrstood your point to be that states that encouraged drilling had, as a consequence, lower unemployment.

As yuou may recall, that has been a popular refrain among the Palin faction of the tea party: “Drill, Baby, drill” as the solution to unemployment.

But as you say, I apparently read your post with a jaundiced eye, and unfairly and inaccurately interpreted your post as suggesting that energy development policies and unemployment were related.

For that I apologize.

As you say:

“weirdness: No, I did not imply that energy development policies were associated with unemployment.”

What is rather oddd to me is that I appear not to be alone in reading your post that way, based on the reacdtions of the other commenters, who seem to be rather united in discussing energy development policies and employment.

My puzzlement grew even stronger when I read your reply to another comment by “uber snotling”:

“I’d also be interested to hear your interpretation of the following numbers, which have been provided above but on which you have so far not commented. In July 2009, North Dakota accounted for only 0.3% of all U.S. unemployment, but the state accounts for 1.4% of the national increase in employment since then. Texas and North Dakota together accounted for 8% of all employment in 2009 but 18% of all the employment gains since then.”

I’m curious what YOU think those numbers mean, and why they are interesting, if you “did not imply that energy development policies were associated with unemployment.”

apologetically, and respectfully, but quite curiously yours,

scm

weirdness at August 28, 2013 11:25 AM: I think those numbers tell us that it can be helpful to have rich hydrocarbon deposits inside your borders and policies that allow them to be exploited. And they further tell us that such supply-side factors can be helpful despite the belief of many analysts (myself included) that a key economic problem is inadequate demand for goods and workers.

Dear Prof Hamilton,

you’ve been quite generous with my use of your bandwidth, so I apologize for wasting more bandwidth and time.

The reason I was unhappy with the point that you did NOT make, the one relating energy development policies and unemployment, was that neither Texas nor North Dakota had a housing bubble, so the number of unemployed homebuilders is rather low there compared to many places.

I agree 100% with you that “…it can be helpful to have rich hydrocarbon deposits inside your borders…”.

But I remain quite curious as to what you mean by “helpful” and “policies” in the full quote of your latest response:

“I think those numbers tell us that it can be helpful to have rich hydrocarbon deposits inside your borders and policies that allow them to be exploited.”

I understand that = as you have implied – my reading comprehension skills are possibly inadequate.

But, given that your original post provided a map of unemployment, and that your response quoted above was in the context of employment, would it be a reasonable inference that by “helpful” you mean “improve employment” and/or “reduce unemployment”?

(If not, I apologize and respectfully ask what you mean by “helpful”?)

Similarly, given the caveats about my reading comprehension skills, I am curious what you mean by “policies” when you write “…rich hydrocarbon deposits inside your borders and policies that allow them to be exploited.”

When I read about “helpful” “polices that allow [hydrocarbons] to be exploited”, I tend to think that you are implying that energy development policies are associated with unemployment”.

But you assure me that that was not the meaning of your post:

“weirdness: No, I did not imply that energy development policies were associated with unemployment.”

At any rate, I thank you for your years of increasing knowledge by teaching and posting, and I apologize for intruding into your area of expertise with what, in retrospect, appears to be inadequately developed reading skills.

Sincerely,

scm

weirdness at August 28, 2013 12:43 PM: I claim that the existence of rich hydrocarbon deposits inside their borders and policies that allow those resources to be exploited have helped bring the unemployment rate down and number of people working up in North Dakota and Texas.

Such a claim does not imply that Michigan could accomplish the same thing simply by changing its mineral development policies.

Several commenters have mentioned the “emptying out” of the Great Plains. I wanted to note that all of the lightly populated Plains states currently have higher population than at any time in the past (this is true of both Dakotas, Montana, Wyoming, Nebraska, and Kansas). North Dakota had been the exception to this until in 2011 the population passed the prior (1930) peak. However, emptying out is a real phenomenon. What is meant by this is that because a higher fraction of the state population is concentrated in urban areas, vast rural areas of these states have significantly lower population density than since they ‘filled up’ 100 years ago. This is mostly about farm mechanization and farm family demographics, not a lower level of land utilization. It is also true that these states have had much lower relative population growth than the country as a whole for many years. Thus, for instance, each of the Dakotas had 3 congressional seats from 1910 to 1930. Today North Dakota’s population is less than that of the average single congressional district. It is, however, higher than ever before in its history.

The census publishes an interesting annual table

http://www.census.gov/popest/data/state/totals/2012/tables/NST-EST2012-06.xls

which describes components of state population growth. In its most recent iteration it is interesting to note that the annual rate of population growth in Texas due to domestic migration, although high (0.55%), is similar to many other southern and western states (10 states are over 0.5%, where the average rate, by definition, is zero). Texas’ rate of international migration is now very near, albeit slightly below, the national average of 0.28%. Where Texas stands out is in the rate of natural increase, which is 3rd in the nation, behind only Utah and Alaska at 0.83%.

Dear Mr Kipits:

The point I was attempting to make was that man left the stone age because of innovation.

Ships were first powered by muscles (oars), then replaced by sail (green energy – what would be our fate if the EPA existed then), replaced by coal; replaced by oil; and now power nuclear energy.

Whatever the conditions, oil will in due time be supplanted but in the meanwhile Kernal Drake’s revolution lives on 150 years later.

My Dear Mr Brown:

A most cognizant narrative and much if not all not subject to dispute.

You have properly recorded the natural decline of fields and their production.

Although, understanding historical perspective often offers a guide into the future the ability of man to project forward production and costs is invariably subject to failure, because of varies factors beyond one’s control.

The effects of goo production decline in America, has it’s roots in unnatural events created not by either supply or demand but by anti-market forces,

namely governmental units, CONgress, and a coalitions of non-profit, anti-capitalist agencies.

The decline in activity in Alaska, California, the west and east continental shelf all resulted due to anti-carbon, anti-pollution elements whom have vilified the industry for over a half of century.

Let us not forget, that 75% of all goo reserves are governmental controlled and that America is one of the few nations wherein mineral rights is beholden as private property.

The question I have ax numerous times and that has never even been answered is: name a single mineral that man has depleted?

>>>Such a claim does not imply that Michigan could accomplish the same thing simply by changing its mineral development policies.

Thanks again for your patience.

I fully understand that you did not claim that unemployment could be fully explained by differences in mineral development policies.

Perhaps I’ve been unclear on the point I’ve been trying to get across:

What evidence is there that mineral development policies – particularly for shale drilling – in Michigan (or New Mexico, or even California, for that matter) are different than in North Dakota or Texas?

It is my understanding that the economics of the Bakken & Eagle Ford plays are different than the economics of the Antrim and Monterey shale plays.

E.g:

http://www.oilshalegas.com/montereyshale.html

http://oilshalegas.com/antrimshale.html

Isn’t it possible that mineral development policies have nothing to do with the different level of activity in the different shale plays?

Respectfully,

scm

Weird –

Policies will affect the level of activity. For example, NY bans fracking and PA doesn’t. One has made a lot of money from fracking, the other hasn’t.

Here’s a federal versus private lands comparison:

http://www.instituteforenergyresearch.org/2013/06/10/fossil-fuel-production-on-federal-lands-at-a-ten-year-low/

Kopits: At some point we’ll have to fully develop this colloquy. I continue to maintain that reasonable and aggressive conservation policy would not only allow growth, but actually create it, given our current oil trade deficit and existing supply and demand conditions for oil. I’m going to hit and run, again, however, with the observation that you aren’t counting improving auto fleet mpg in your example, or flex-fuel vehicles (which allow for future switching without initial consumer changes), or utility improvements lowering vmt demand (such as telecommuting, postal delivery of non-mail items, mature networks of smartphone connected carpooling and carsharing, etc.) I will also note that, as I mentioned, the personal auto part of this is harder than overall crude consumption. If policies were put in place and sustained, personal auto would catch up after easier potential reductions in other sectors met your targets over earlier years.

Several years worth of your 0.5mbpd could be met by simply passing the laws and writing the checks to eliminate petroleum consumption for primary space heating. Another year could be cheaply met by improving EPA Smartway guidelines for semi trailers, making them mandatory outside California, and paying for the retrofits. Requiring dual-fuel (LNG/diesel) for newly sold semi tractors, and then gradually raising the road tax on diesel after the LNG distribution network catches up gets you another 3 years over about a 10 year period (this could be pushed harder, but it’s not necessary to meet the pace you demand). Over time, freight will shift to rail as energy costs continue to rise.

Hans,

Following is a link to a graph showing the combined actual and forecast production from 14 oil field units on the North Slope of Alaska:

http://netldev.netl.doe.gov/Image%20Library/technologies/oil-gas/petroleum/projects/ep/Fig41817-RDS_1.jpg

Could you identify what anti-market forces caused the combined production from these 14 fields to sharply decline?

Hans,

Incidentally, Cornucopians like to claim that the Peak Oil “Theory*” means that we are “Running out” on some specific date.

What it means is that we hit a peak flow rate, and so far, for the US, the peak crude oil flow rate was 9.6 mbpd in 1970 (defining crude oil as crude + condensate). Since 1970, we have seen, so far at least, an “Undulating Decline” pattern in US crude oil production as new sources of oil have come on line and then declined, e.g., the North Slope of Alaska.

It’s one of life’s little ironies that the Cornucopian Crowd is using the example of what is, so far at least, a post-peak region, the US, to claim that the Peak Oil “Theory” has been refuted.

In any case, the reality facing developed net oil importing countries like the US is that we were gradually being forced out via price rationing, at least through 2012, of the global market for exported oil, as developing countries, led by China, consumed an increasing share of a declining post-2005 volume of Global Net Exports of oil. A link to more discussion of this topic:

http://www.theoildrum.com/node/10213#comment-976162

*The Peak Oil “Theory” I think is best expressed as the premise that the finite sum of a discrete sources of oil that peak and decline will also peak and decline.

My interpretation was that the documented supply-side effect operates on relative prices and that we are observing a relative supply shift, so that if North Dakota’s supply has shifted up, someone else’s must have shifted down relatively (which could be up or down). Analogy: tax competition. Other analogy: competitive devaluations.

Bena –

The equation looks like this:

(1+dO) * (1+dGDP/dO) = (1+dGDP)

where,

dO is the change in oil consumption

dGDP/dO is the rate of productivity gain,

dGDP is the change in GDP

We can state the dO is likely to be -1.5%

What can be the pace of efficiency gain? (dO/dGDP, call it dE, the reciprocal of the productivity gain)

Historically, without price pressure, dE averages 1.2%, and 2.0% with modest price pressure.

Jim has estimated max sustainable dE (he’ll correct me if I’m wrong) at 2.5%. In the last two years, it has been as high as 3.8%. I personally think it’s 2.5-3.5%, probably not more than 3%. So let’s work with that.

Then,

(1-.015) * (1+0.03) = 1.015, and dGDP = 1.5%.

This efficiency number (dE) includes everything, by construction. That’s vehicles, and trains, and iPads, and telecommuting. It’s an aggregate number.

Can this be speeded up by administrative actions? I think doing so against the market is quite difficult. For example, you’ll recall the CAFE standards from the 1980s. With the collapse of oil prices in 1985, the market circumvented these standards by creating the SUV, that is, by creating a class of passenger vehicles which qualified as trucks for CAFE purposes. So, the market responds primarily to price signals, not regulations. (http://www.pewenvironment.org/uploadedFiles/PEG/Publications/Fact_Sheet/History%20of%20Fuel%20Economy%20Clean%20Energy%20Factsheet.pdf) And for that reason, new car mileage was increasing in the US faster than required by CAFE standards in recent years.

Now, we can measure the scale of adaptation of necessary to meet the challenge. For vehicles, that implies that 40% or more of new car sales have to be non-oil based. Clearly, this is not a minor issue, it’s really something quite big.

Consequently, if you’re going to make proposals, make them big. You mentioned converting residential heating from oil. This has, in fact, been happening at a rapid pace. Residential distillate fuel deliveries (primarily heating oil, I would think) have fallen by nearly half since their 2003 peak, averaging -8% per annum, from 450 kbpd in 2003 to a mere 237 kbpd in 2011.

But the annual falls average 10-30 kbpd, and about 20 kpbd is typical. Given that we need to find 500 kbpd per year, that’s not a terribly material contribution, even though the rate of decline in heating oil consumption is hardly less than stunning.

I’m all for speeding up adaptation. I am on the record as saying that T. Boone Pickens was right in 2008, and he’s still right. CNG is more valuable as a transportation fuel than as a power source. And I have written about the importance of self-driving cars. (Which are coming along, by the way: http://www.businessweek.com/news/2013-08-29/mercedes-piloting-itself-in-jams-heralds-driverless-future-cars)

But let’s not treat the issue as something fuzzy or amorphous. It’s entirely quantifiable. We know what we have to do and the conditions for success. That’s what we have to focus on.

Mr Brown, I would like to suggest that the reason for production declines is not that the O&G firms have no interest but because of conditions produced by the anti-carbons forces and other factors.

1) The production costs and taxes are extremely high. The inability to export oil, especially to Japan reduces the value of the crude and lowers margins.

2) More pipeline capacity would be needed and most of the state is own by the Federal government.

3) There is a great deal of opposition by varies governmental units, EPA, US Fish and Wildlife and of course special interest groups SC, Wildlife Defense Fund and other Enviro fronts.

4) Since cost of production and maintenance are higher than your average play, it requires elevated goo prices to sustain growing levels of production.

5) Ax the Gold, Silver, and copper miners what length they have to go through for permitting and mandated environment studies. Federal permitting can take anywhere from one to two years, compared to N Dakota or Texas where that process if completed within sixty days.

The Peakers have been with us since Col Drake and for the past 150 years – have been wrong.

What the Peakers have done in the last decade was to redefine the meaning, which we all knew in grade school was ever declining production…

Now it is being marketed as when oil becomes expensive. So the Peakers model has gone from being objective to subjective…

America is not being force out of the goo markets via the “price rationing” as we are not a second nor third world nation. This is just more non-sense from the now defunct OilDumb.

Mr Kopits, the argument of declining production (aging) is true, especially with shale plays, however, in the Bankken only about 10 to 15% of all crude is lifted, so the time will come when new and improved technology will make it possible to replay these fields.

Hans –

The gross contribution of shale oils to the oil supply is around 2 mbpd in total, on a production base of 90 mbpd. Thus, for all the hype, shales have added all of 2% to the oil supply in the last seven years. That’s nice, but nothing spectacular.

The US is being priced out of global oil markets. You can see the effect on i) US crude oil consumption, ii) US vehicle miles traveled, iii) US commercial airline departures, and, per benamery, iv) US residential heating oil consumption, among others. There is absolutely no question of this–and you can see the effect beginning in 2005.

As for peak oil, BP reports the oil supply increased by 4.1 mbpd from 2005 to 2012. All of the increase can be accounted for by NGLs (not oil); US shale oil production; and Canadian oil sands production. Thus, the legacy oil system which existed in 2005 in fact peaked in 2005, and even increasing Iraqi (conventional) production was not sufficient to offset the decline.

This implies that the growth of the global oil supply is fully leveraged to shales and oil sands. Oil sands might be expected to increase by 150 kbpd / year, and we see US shales increasing by 1.5-2.0 mbpd to 2016/2017 and peaking about there.

What do we do after that? That’s the question.

“Mr Brown, I would like to suggest that the reason for production declines is not that the O&G firms have no interest but because of conditions produced by the anti-carbons forces and other factors.”

Hans,

Just to clarify, you are stating that Anti-carbon forces and “other factors” caused the decline in the 14 oil fields on the North Slope of Alaska?

Here’s the data table for the crude oil production from 14 Alaskan North Slope oil fields (as shown graphically at the above link):

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=manfpak1&f=a

Combined production fell from about 2.0 mbpd in 1988 to about 0.5 mbpd in 2012, a rate of decline of 5.8%/year.

The fields were virtually fully developed a long time ago, oil prices have quadrupled since 2002, and North Slope operators desperately need more production, in order to keep the Trans Alaskan pipeline operational.

So, how did “Anti-Carbon” forces cause the production from these 14 fields to decline by 75%?

My point is that our global crude oil supply base consists of discrete sources of oil like the combined output from 14 fields, and the Peak Oil “Theory” is that the finite sum of the output of discrete sources of oil, like these 14 fields, that peak and decline, will also peak and decline.

I’m just baffled that anyone can believe that the finite sum of discrete sources of oil that peak and decline will show a perpetual rate of increase in production.

Mr Kopits, yes shale is a very klein part of global production but it is also quite new. World wide, I suspect there are several hundreds of these fields. It is quite possible, they will and can account for a greater percent of goo output. (the anti-fracking forces have been placed on alert and field operational)

Would you agree, Mr Kopits, that there is a general relationship (nexus) between the standard of living and crude oil consumption? Then, if what you are suggesting is, America will see a decline in per capital growth in GNP. The govcession and market driven energy efficiencies is what is reducing the GNP per capital crude oil use.

Your opinion that conventional oil production has peaked, will undoubtedly be proven wong. There are still vast tracks of land and oceans with will produce enormous volume of crude.

Your estimate on shale (hail shale) production is already incorrect and outdated, as between the Bakken and Eagle Ford plays total output reached 1.5 mbpd, in the latest reports! I am guessing that by 2020, these two play alone will furnish America with 3 to 3.3 million bpd, not withstanding anti-market activities.

Mr Brown, declining Alaska production is more than just aging fields of dreams…Alaska, holds a massive amount of crude, but the that greens wish to continue the Great American Culture Revolution, of which clean air and water are more important than economic liberties.

Do you really think the energy companies just gave up on Alaska?

And my answer, sir, to your question is in the main no, however, new production by all means yes…A good example for all to wittiness would be the state of California and its collapsing crude oil production…The principal cause, yes, anti-carbon forces, allowing no new refineries and no new crude production, despite vast tracks of oil reverses…

We have had, for quite some time, a federal government, rather bias to Enviro forces and subjects, irrespective of economic costs. The non-profit industry (many funded by your tax dollars) and governmental units, do not have the ability to weight the consequences of their actions…

Kopits: You appear, from my perspective, to be assuming your answer to some extent. If you assume policy can’t increase efficiency gains, you can’t use that to argue that policy can’t increase efficiency gains.

http://www.forbes.com/sites/alexepstein/2013/08/28/universities-must-reject-environmentalist-calls-to-divest-from-the-fossil-fuel-industry/

This is just a small example of the anti-market activities by anti-carbon agencies.

How mankind has benefited from crude oil both from the point of health and welfare and a standard of living unforeseen several hundred years ago is unparalleled..

To my green friends, the offer still stands, I will purchase all the gasoline you need, in exchange for wind and solar energy…No takers so far…